Splash Beverage Group (NYSE: SBEV) stock's move lower last week may have spooked some, but for seasoned investors, it exposed an opportunity. And they seized it on Monday, sending shares higher by over 13% to close at $1.58. For many, the move higher was expected, noting there was nothing SBEV-specific on the wires last week to cause the decline. On the contrary, SBEV is growing at its fastest rate in company history, is striking impressive distribution deals across the country with tier-one distributorships, has retail product placements in Walmart (NYSE: WMT), Target (NYSE: TGT), 7-Eleven Stores (OTCMKTS: SVNDY), and many Sam's Club locations, and is positioning to exploit value from its interests in some of the most Eco-friendly packaging invented. Notably, the packaging and technology related to CartoCan and Copa Di Vino could become billion-dollar revenue-generating assets on their own.

Moreover, unlike most stocks trading at SBEV levels, this company is managed by a Who's Who list of experts in the beverage sector, several responsible for taking Red Bull energy drink from development stages to billions in sales. History repeating is likely, and SBEV has at least four shots at reaching appreciably higher sales numbers for its brands. And it could happen faster than it did for Red Bull, noting that SBEV brands, SALT, Copa Di Vino, Pulpoloco, and TapouT, while each innovative and able to develop new market segments, also have market traction and accelerating growth, something Red Bull didn't have from the start.

That leaves a question for investors to ask about which brand could match the incredible growth of Red Bull. The answer- any of them. That optimism stems from each brand is more than a flavor profile; they are innovators in their respective markets. Distributors and retailers are paying attention.

Video Link: https://www.youtube.com/embed/Xajh4HAtrPs

A Tremendous List Of Revenue-Generating Agreements

Even more, are signing deals. SBEV has already executed distribution and retail placement agreements with many of the world's largest wholesalers and retailers, including several of the biggest Anheuser-Busch (NYSE: BUD) product distributorships. That's the tip of the iceberg regarding expanding brand presence. As noted, retail giants Walmart, Target, and many Walmart- owned Sam's Club locations are clearing shelf space for SBEV products. That's not all.

Additional distribution and retail agreements leverage the strength of market-dominant broad-line partners, which could do more than facilitate a pathway for Splash to penetrate other national and regional chains; it could expedite it. If so, tapping into those channels through a management team understanding every facet of the beverage industry can do more than accelerate SBEV's growth; it can allow SBEV to leverage a competitive edge and get its products on significantly more store shelves across the country that can then aggressively target segment opportunities from a beverage market expected to eclipse $1.8 trillion in 2024.

Here's an exciting thing about SBEV's opportunities. They are historically recession-proof, especially true for companies and brands offering better products that are competitively positioned to maintain and build share. Splash Beverage Group checks that requisite with its TapouT performance hydration and recovery drink, SALT flavored tequila, Copa Di Vino single-serve wine, and Pulpoloco, authentic made-in Spain, Sangria, offering more than premium quality; they are also produced, packaged, priced, and marketed in an eco-friendly way. In some respects, the packaging is so inventive that its scalable applications can cross industry lines and independently become enormous value drivers.

An Award Winning Product Portfolio

That's in addition to the value created from an all-star beverages and spirits product lineup. Single-serve Copa Di Vino wine earned national attention by being the only product featured twice on the popular investment show Shark Tank. A testament to Copa's taste, position, and potential, every "shark" wanted a piece of that deal. Notably, it was more than just the great taste they were after; its value as a leader in package sealing technology was also individually recognized for its potential to open near-limitless monetization opportunities for SBEV. Its eco-friendly specifications are so revolutionary that Copa Di Vino can remain fresh for up to a year, compared to competing brands having a sell-by date of months or even days.

Pulpoloco, SBEV's made in Madrid, Spain, sangria, is another. It, too, is earning an increasing share of attention and segment sales. On Monday, SBEV announced that select 7-Eleven Stores will be adding Pulpoloco to their store shelves. That follows the chain previously awarding Pulpoloco its Brands With Heart designation, which facilitated SBEV showcasing the brand to 7-Eleven and Speedway stores. But more than great taste, there's a potentially massive and inherent value kicker. This best-in-class sangria is packaged in innovative and marketable packaging technology that many have called the most socially conscious and eco-friendly packaging on the market: CartoCan. SBEV holds exclusive rights to the unique packaging technology, and with CartoCan having the potential to be a sought-after packaging type in the beverage industry, it can significantly steepen the revenue curve at SBEV.

That's not an overly ambitious assumption. In addition to being 100% biodegradable, the innovative packaging technology is 30% more eco-friendly than aluminum or PET, uses 30% less total raw materials to create, and the raw materials that are used come entirely from renewable sources. That includes using only wood fibers from forests managed in an exemplary fashion, which has led to CartoCan packaging earning the exclusive right to bear the Forest Stewardship Council (FSC) label. And like Copa, the CartoCan keeps Pulpoloco shelf-stable for at least a year, keeping the vibrant character of its taste profile well-protected during that time.

SALT Tequila is another asset fueling SBEV's growth. It is also accruing national deals allowing it to target a significant niche in the tequila market, flavored, a segment expected to push the overall tequila market to become an over $18.5 billion market by 2028. SBEV's SALT can be a factor in that increase. SALT is a 100% agave, 80-proof tequila brand building a substantial consumer base in a flavored spirits market experiencing double-digit growth. Offering premium chocolate, berry, and citrus-flavored tequila, SALT Tequila is ideally and uniquely positioned to do more than exploit that potential; it can dominate the category. Incidentally, it's on that path. A 42-store deal with Walmart's wholly-owned Sam's Club, among others, is expanding the brand's presence on a regional scale that could quickly become national.

A fourth brand asset is also earning significant marketing traction: TapouT performance, hydration, and recovery drink.

TapouT Is A True Hydration And Recovery Beverage

TapouT is scoring important deals, resulting from its recognition as a true performance beverage focusing on active hydration that encompasses activation, electrolyte restoration during exercise, and complete recovery following a workout. Different than other marketed sports drinks, TapouT's formulation provides an optimized mix of the vitamins, minerals, antioxidants, electrolytes, and sugars necessary to drive cellular hydration in the muscles and other body parts requiring fluids, fueling them during the activity and facilitating their replenishment during the body's recovery process. Similar to SBEV's other products, its differences are advantages.

The biggest is that TapouT performance drinks aren't formulated as protein drinks to help people bulk up or as caffeinated energy beverages giving a false boost at the start of a workout. Instead, TapouT performance drinks are consciously balanced to provide the optimal nutrients and hydration for peak performance and recovery. The more excellent news is that TapouT has crossover segment potential while staying true to its marketing as a balanced performance beverage that boosts hydration, performance, and recovery from one drink source. In other words, while different, it can still earn a sizable share from a multi-billion-dollar market segment that expands its reach beyond the general water, fortified water beverages, protein drinks, and energy drinks categories.

Still, while gaining popularity in that segment, it is performing exceptionally well in its primary target market, focusing on earning business from the active consumer looking for a balanced blend of nutrients, electrolytes, and vitamins that can optimize performance and speed up recovery after intense physical exertion. SBEV has noted its belief that TapouT can help redefine the performance drink category by marketing a better, more genuine product that provides beneficial results without gimmicky caffeine-induced side effects. The pace of brand marketing and increasing consumer recognition and engagement indicates SBEV is on the path to succeeding in that mission.

Still, all the missions in the beverage world only matter if the company driving them is seeing the results of their groundwork laid. SBEV is, and it's been an excellent run so far.

Growing Revenues, Accretive Deals Position SBEV For A 2023 Breakout

From a revenue perspective, SBEV is booming. Revenues in 2021 were over 2000% higher than those posted the prior year. While the percentages slowed in 2022, growth was still impressive, with SBEV posting record sales in Q2 and then besting them again in Q3 with a 73% increase over the same period in the prior year. As investors wait for final year-end 2022 results, the SBEV bulls argue that the deals signed throughout 2022 and the ones added this year support the thesis that revenue growth will again be record-setting. Investors won't need to wait long to find out. Fourth-quarter and full-year 2022 financials are expected at the end of March.

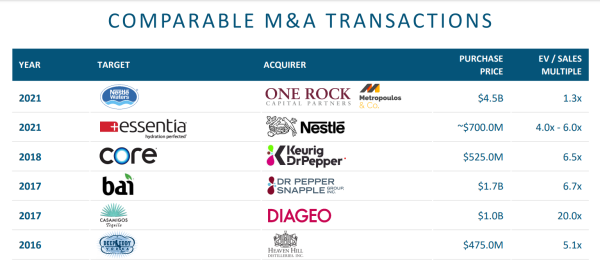

Keep this in mind when evaluating the results. Revenue growth is important from more than an income report standpoint. In the beverage industry, brands sell for appreciable revenue multiples, historically up to 20X income. The chart below shows an average of 7X revenues for brands acquired. Thus, besides appraising the financials, investors should listen closely to management commentary, primarily any related to potentially acquiring new profitable brands and the sales potential inherent to distribution agreements.

Know this. In challenging markets, sector behemoths play a different role than brand incubators. If they want growth, they'll buy it through products already penetrating valuable markets. SBEV has four products meeting that criteria, and perhaps more are coming into the pipeline soon. Regardless, the SBEV retail footprint is getting larger. And the more they step on the toes of Big Beverage, the greater the likelihood of SBEV monetizing a brand at one of those elevated multiples.

The cycle then continues, this time with Splash Beverage well-capitalized to fuel growth and having proved the rise of Red Bull under members of its team management was no fluke; history can repeat itself. And if it does, buying into SBEV's product excellence and market potential likely won't come cheap.

Disclaimers: Shore Thing Media, LLC. (STM, Llc.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to ten-thousand-dollars cash via wire transfer by a third party to produce and syndicate content for Splash Beverage Group, Inc. for a period of one month ending on 4/15/23. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Phone: 917-773-0072

Country: United States

Website: https://primetimeprofiles.com/