JPMorgan has observed that retail traders have been cashing in on some of the most popular AI stocks recently. Even though retail traders invested almost $450 million into individual stocks last week, with a notable preference for technology stocks, there has been a significant shift in their investment choices. Stocks like Nvidia, Advanced Micro Devices, and Super Micro Computer have experienced the largest net outflows, suggesting that investors are possibly securing profits after these AI-related stocks have experienced substantial gains in the past months, and there is uncertainty about their future growth potential.

While the artificial intelligence sector has recently seen profit-taking by everyday investors, this pivot in the market presents an opportune moment to turn our attention to the biotech sector. Companies in this space, particularly those in cutting-edge fields like radiopharmaceuticals, offer a fresh landscape for investment. With dynamic advancements and strategic acquisitions shaping the industry, biotech stocks may provide a new frontier for growth-oriented portfolios.

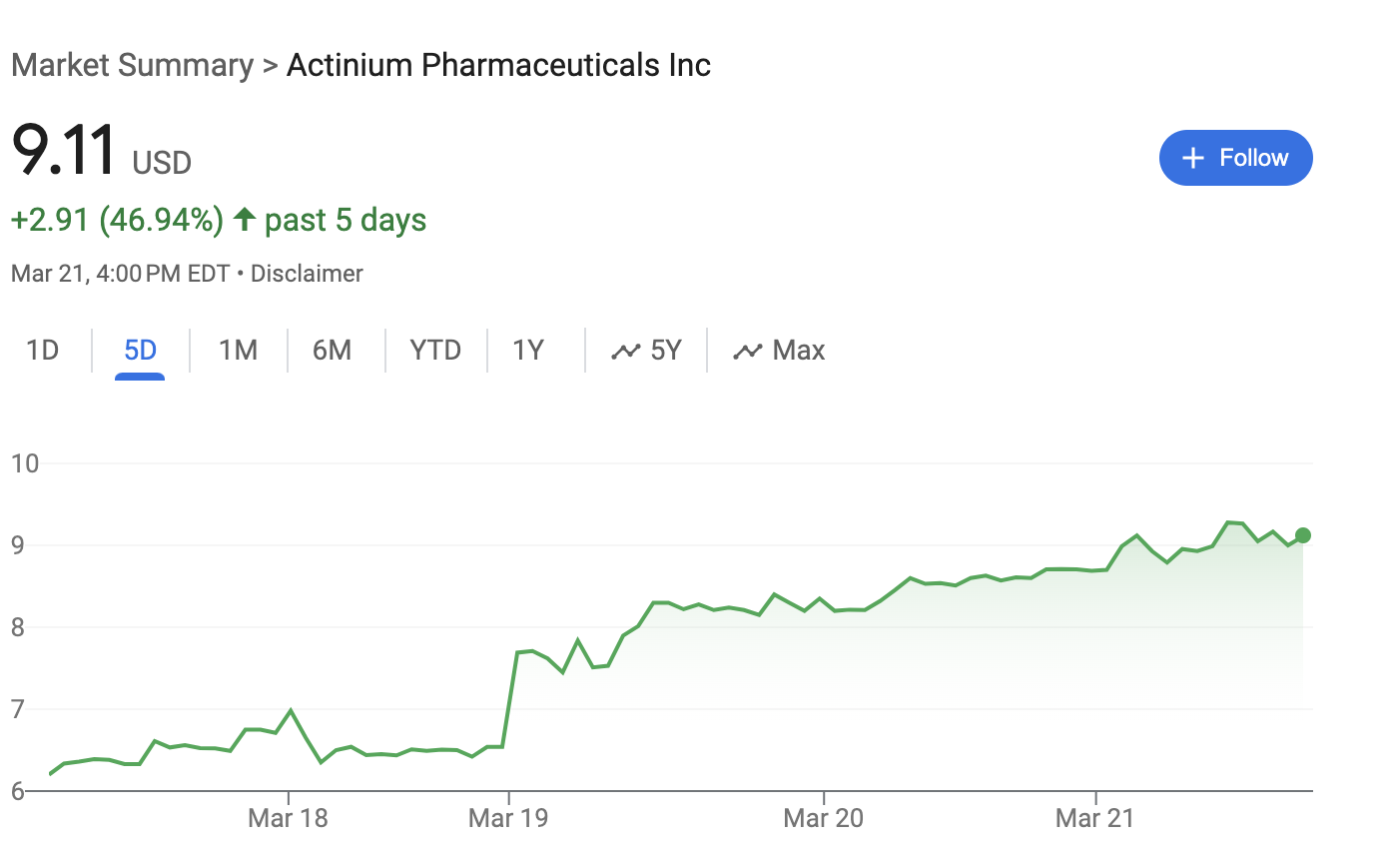

One biotech stock that warrants attention is Actinium Pharmaceuticals Inc (NYSE:ATNM). ATNM is exhibiting a substantial gain over a 5-day period, with the price escalating from about $6.20 to $9.01, marking a 45.32% increase.

Actinium (NYSE:ATNM) develops targeted radiotherapies to meaningfully improve survival for people who have failed existing oncology therapies. Advanced pipeline candidates Iomab-B (pre-BLA & MAA (EU)), an induction and conditioning agent prior to bone marrow transplant, and Actimab-A (National Cancer Institute CRADA pivotal development path), a therapeutic agent, have demonstrated potential to extend survival outcomes for people with relapsed and refractory acute myeloid leukemia. Actinium plans to advance Iomab-B for other blood cancers and next generation conditioning candidate Iomab-ACT to improve cell and gene therapy outcomes. Actinium holds more than 220 patents and patent applications including several patents related to the manufacture of the isotope Ac-225 in a cyclotron.

Earlier this week, Maxim raised the firm’s price target on Actinium Pharmaceuticals (ATNM) to $30 from $20 and kept a Buy rating on the shares following another Ac-225 acquisition with AstraZeneca (NASDAQ:AZN) to acquire Fusion Pharma (FUSN). The firm noted that the acquisition comes amidst building momentum in the radiopharma space, in particular among alpha emitters, including the December acquisition of RayzeBio (RYZB) by Bristol Meyers (NYSE:BMY) for $4.1B for its Ac-225 pipeline. Maxim also highlights Lilly (LLY) acquiring POINT Biopharma in October 2023 for $1.4B, which was centered around its pipeline of targeted beta – Lu-177 – and alpha – Ac-225 – emitting radio-pharmaceuticals. The Ac-225 focused M&A activity, which given the small number of companies in the space, places a potential “scarcity value” on Actinium, the firm argues.

In conclusion, as JPMorgan's analysis points to a shift in retail investor sentiment within the AI sector, Actinium Pharmaceuticals Inc (ATNM) stands out as a promising prospect in the biotech field. This company is making impressive strides with a significant 45.32% increase in stock price over just five days. With Actinium's robust patent portfolio and promising pipeline candidates like Iomab-B and Actimab-A aimed at revolutionizing treatment for acute myeloid leukemia, it exemplifies the kind of innovation and potential that investors are increasingly drawn to. The recent bullish outlook from Maxim, along with strategic acquisitions in the alpha-emitting radiopharmaceutical space, underscores a burgeoning interest in this niche yet increasingly pivotal area of biotech. Actinium's growth and the "scarcity value" attributed to its specialized offerings put it on the radar as a compelling investment option, signaling a timely shift for those looking to diversify and capitalize on the next wave of medical advancements.

In the realm of pharmaceuticals and biotechnology, several key players are exhibiting notable market activity. Novo Nordisk A/S (NYSE:NVO), with a share price of $129.83, has seen a slight decrease of $0.53, translating to a -0.41% change, on a volume of 6.352 million against an average of 5.085 million, boasting a market capitalization of $583.871 billion and a PE ratio (TTM) of 47.91. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) stands at a price of $415.71, up by $3.60, reflecting a +0.87% change, with a trading volume of 750,718, somewhat below its 3-month average volume of 1.31 million, and a market cap of $107.381 billion with a PE ratio (TTM) of 29.93.

Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) is trading at $968.01, having a marginal gain of $1.05, or +0.11%, with a volume of 408,860 against a 532,156 average, and a market cap of $106.251 billion complemented by a PE ratio (TTM) of 27.88. Moderna, Inc. (MRNA) shows an increase of $1.01 to $104.09, amounting to a +0.98% change, with a higher volume of 2.136 million compared to its 3-month average of 4.565 million, and a market cap of $39.77 billion. Lastly, argenx SE (NASDAQ:ARGX) has seen a significant uptick of $39.93 to $396.88, which is an +11.19% change, on a trading volume of 739,471, which is double its average of 365,068, and holds a market cap of $23.886 billion.

https://finance.yahoo.com/industry/biotechnology

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice or an endorsement of ATNM or its strategies. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Please ensure to fully read and comprehend our disclaimer found at https://investorbrandmedia.com/disclaimer/. InvestorBrandMedia.com has been compensated a total of three thousand dollars by a 3rd party Bullzeyemedia LLC for content distribution services on ATNM from March 20th to March 25th, 2024. We own zero shares of ATNM. InvestorBrandMedia.com is neither an investment advisor nor a registered broker. No current owner, employee, or independent contractor of InvestorBrandMedia.com is registered as a securities broker-dealer, broker, investment advisor, or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. This article may contain forward-looking statements as defined under Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. These statements, often incorporating terms like “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or similar expressions about future performance or conduct, are based on present expectations, estimates, and projections, and are not historical facts. They carry various risks and uncertainties that may result in significant deviation from the anticipated results or events. Past performance does not guarantee future results.InvestorBrandMedia.com does not commit to updating forward-looking statements based on new information or future events. Readers are encouraged to review all public SEC filings made by the profiled companies at https://www.sec.gov/edgar/searchedgar/companysearch. It is always important to conduct thorough due diligence and exercise caution in trading.InvestorBrandMedia.com is not managed by a licensed broker, a dealer, or a registered investment adviser. The content here is purely informational and should not be taken as investment advice. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor regarding forward-looking statements. Any statement that projects, foresees, expects, anticipates, estimates, believes, or understands certain actions to possibly occur are not historical facts and may be forward-looking statements. These statements are based on expectations, estimates, and projections that could cause actual results to differ greatly from those anticipated. Investing in micro-cap and growth securities is speculative and entails a high degree of risk, potentially leading to a total or substantial loss of investment. Please note that no content published here constitutes a recommendation to buy or sell a security. It is solely informational, and you should not construe it as legal, tax, investment, financial, or other advice. No content in this article constitutes an offer or solicitation by InvestorBrandMedia.com or any third-party service provider to buy or sell securities or other financial instruments. The content in this article does not address the circumstances of any specific individual or entity and does not constitute professional and/or financial advice. InvestorBrandMedia.com is not a fiduciary by virtue of any person’s use of or access to this content.

Source: https://finance.yahoo.com/quote/ATNM/

https://www.tipranks.com/news/the-fly/actinium-pharmaceuticals-price-target-raised-to-30-from-20-at-maxim

https://seekingalpha.com/news/4081208-actinium-stock-spikes-astra-fusion-deal

https://www.cnbc.com/2024/03/21/retail-traders-are-bailing-on-3-of-the-hottest-ai-plays-in-the-market-today.html

Media Contact

Company Name: Investor Brand Media

Contact Person: Ash K

Email: investorbrandmedia@gmail.com

Phone: (954) 593-5597

Country: United States

Website: https://investorbrandmedia.com/