- Mace branded bear spray sales up 769% over 3Q 2020 and 416% over first nine months 2020

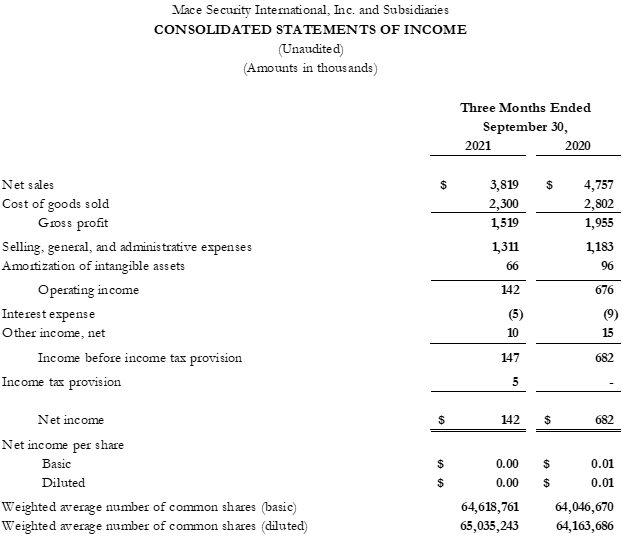

- 3Q 2021 net sales were $3,819,000, down $938,000, or 20%, versus same period prior year which was bolstered by social unrest events

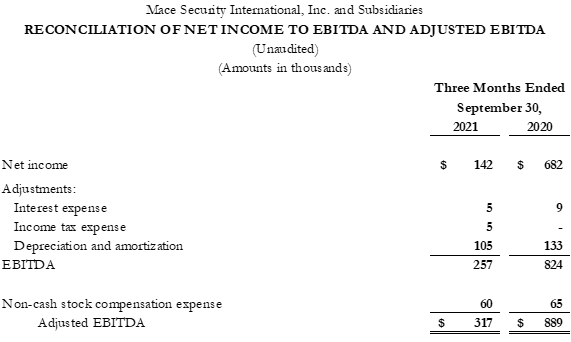

- EBITDA for the quarter was $257,000, or 7% of net sales, a decrease of $567,000 versus $824,000 EBITDA, or 17% of net sales, in the third quarter of 2020

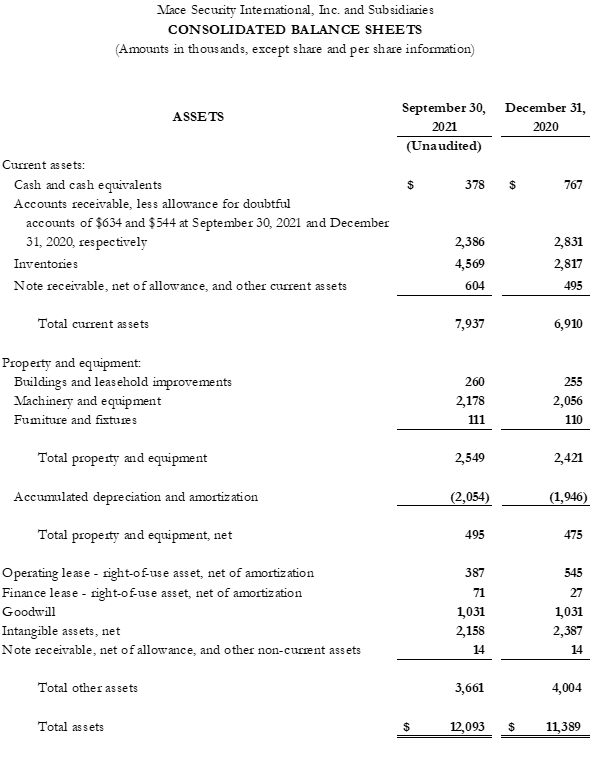

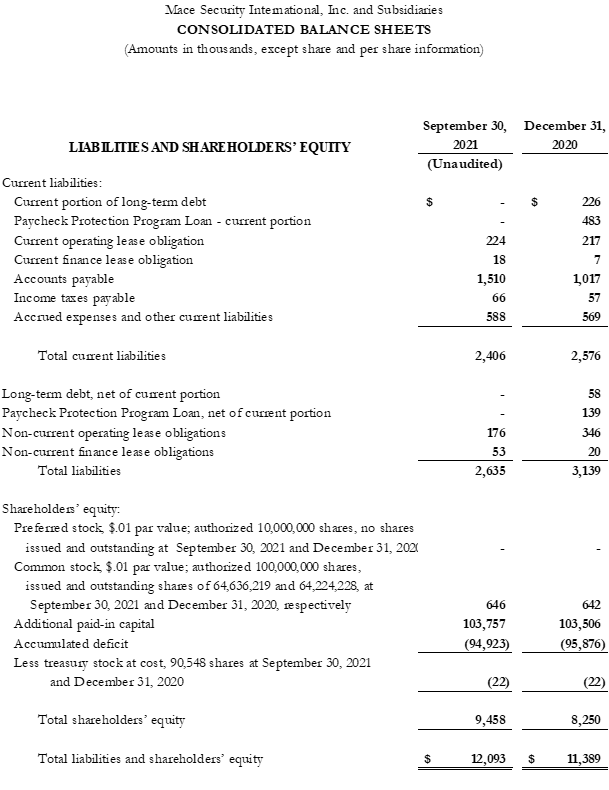

- The company remains debt free as of September 30, 2021

CLEVELAND, OH / ACCESSWIRE / November 1, 2021 / Mace Security International (OTCQX:MACE) today announced its third quarter and year-to-date 2021 financial results for the periods ended September 30, 2021.

Mace reported net sales for the third quarter of $3,819,000, down 20% versus the same period in 2020. The decrease is due to several factors including robust retail sales in the prior year comparable period due to social unrest that did not recur in 2021, along with a significant private label fill customer insourcing. This was partially mitigated with a 64% growth in Mace's online channels, including a 769% increase in its Mace branded Guard Alaska bear spray. Net sales across its retail and e-commerce channels were up $1,648,000, or 23%, for the year over the same nine months of 2020.

Mace reported a gross margin rate for the third quarter of 40% vs 41% for the same quarter last year. SG&A expenses were $1,311,000, or 34% of net sales, compared with $1,183,000, or 25% of net sales, in the like quarter of 2020. The increase in SG&A expenses was predominantly attributed to the Company's sustained commitment to increase its direct-to-consumer revenues through digital advertising and branding, along with its investment in new product development. These increases were somewhat offset by a reduction in incentive pay provision.

Sanjay Singh, Executive Chairman, commented, "We knew that the comparison against the exceptional third quarter of 2020 would be difficult. Our execution on generating revenues from new customers in the quarter, which we expected to exceed the loss of private label revenues since the beginning of the year, was slower than expected. Design changes caused delays in new product introductions thus adding more headwinds. We restructured our manufacturing costs mid-quarter which are now lower by thirty percent vs. prior year and eighteen percent vs. the second quarter this year. The company delivered a positive EBITDA in the quarter despite lower revenues and has no debt despite an inventory build that will help combat longer than usual lead times from its suppliers. Mace has superior brand recognition, and we are now making impactful progress on reaching our consumers. Our YTD POS sales on the Amazon platform are up 359% vs. 2019 while 2020 was up 176% over 2019. We expect revenue comparisons in the fourth quarter to continue to be challenging due to social unrest revenues in the prior year."

President and CEO Gary Medved commented, "We remain committed to expanding our retail reach, adding three new retailers to our customer portfolio in the third quarter, and developing new products, of which we expect to launch two of them in early 1Q22. We continue to invest in our digital efforts to grow our online presence, and our focus on manufacturing automation is producing higher efficiencies."

Third Quarter 2021 Financial Highlights

- Net sales were $3,819,000, up 12% over the second quarter of 2021 and down 20% versus the same period in the prior year. The quarter-to-quarter increase was driven by double-digit growth in both online and international sales with a 123% increase in overall bear spray sales driven entirely by the 2021 launch of its Mace branded Guard Alaska product. The decline to prior year was primarily due to a more than 70% decline in non-Mace brand, private label sales along with declines from the robust retail sales that occurred in the Company's record third quarter sales of 2020 influenced by the social unrest in the U.S.

- Gross profit rate of 40% was down 1% from the same period in 2020 as the lower sales volume led to deleveraging of the fixed manufacturing costs coupled with increased freight costs. Product margins improved both quarter-to-quarter over second quarter 2021 and quarter-over-quarter to last year. The Company continued to reduce its manufacturing cost structure to improve its leverage on a go-forward basis.

- Gross profit for the third quarter decreased by $436,000, or 22%, from the third quarter of 2020, primarily resulting from the decline in sales volume.

- SG&A expenses increased by $128,000 to $1,311,000 for the quarter, or 34% of net sales, driven by Mace's commitment to increase its penetration in the direct-to-consumer market and the related advertising expense, an increase in its provision for loss on trade accounts receivable, and research and development costs for upcoming new product introductions. These expense increases were partially offset by a decrease in personnel related expense predominantly from a reduction in incentive pay provisions.

- Net income of $142,000 for the quarter decreased by $540,000 when compared to the Company's record third quarter 2020 net income due to the lower sales volume and expenses associated with the Company's commitment to growth.

- Cash and cash equivalents decreased to $378,000 as of September 30, 2021, a decline of $389,000 from the $767,000 on hand on December 31, 2020, while completely paying off $284,000 of outstanding debt during 2021, associated with a prior acquisition.

- Working capital increased by $1,197,000 compared to December 31, 2020, with an increase of $1,752,000 in inventory of which $1,110,00, or 63% of the increase, was in raw materials or component goods. Supply chain reliability, uncertainty and delays has expanded lead times and the need to increase component part quantities. The Company sold down 20% of its finished goods inventory from the end of the second quarter. The increase in inventory was partially offset by a decrease of $445,000 in net accounts receivable.

- Adjusted EBITDA for the quarter was $317,000 compared to Mace's third quarter record $889,000 for the third quarter of 2020.

Third Quarter 2021 Operational Highlights

- Mace further reduced its manufacturing costs partially due to capital investments in manufacturing automation elevated the Company's manufacturing efficiency rate by 900 bp over the third quarter in 2020. The Company believes that there are still efficiencies to be gained as it continues to operate with its modified cost structure.

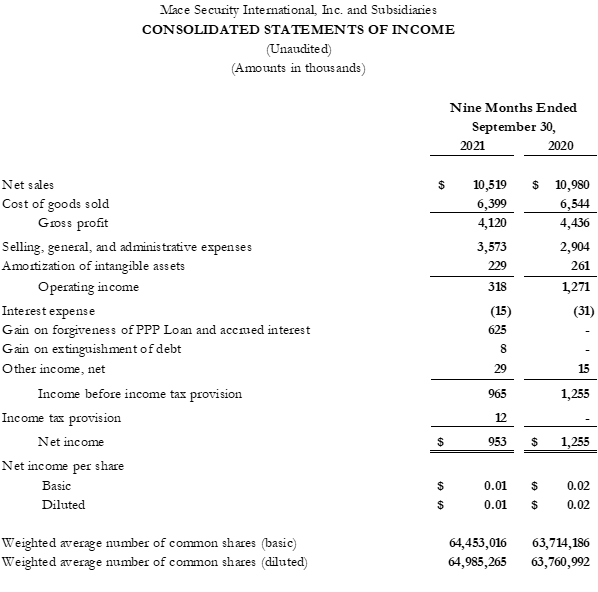

Year-to-Date September 2021 Financial Highlights

- Net Sales of $10,519,000 decreased by $461,000, or 4%, versus the first nine months of 2020 driven down by a 65% decline in private label sales, which was mostly offset by a 23% increase in online and retail sales.

- Gross profit rate declined to 39% for 2021 compared to 40% for the same period in 2020 due to lower profit margins for certain customers, which the Company is addressing, along with increased freight costs.

- Gross Profit decreased by $316,000, or 7%, when compared to the first nine months results of 2020 due predominantly to the lower sales volume.

- SG&A increased by $669,000, or 23%, mostly from advertising to increase the Company's penetration in the direct-to-consumer market, increase in insurance premiums related to market conditions, increase in provision for loss on trade accounts receivable, and research and development costs for new product introductions.

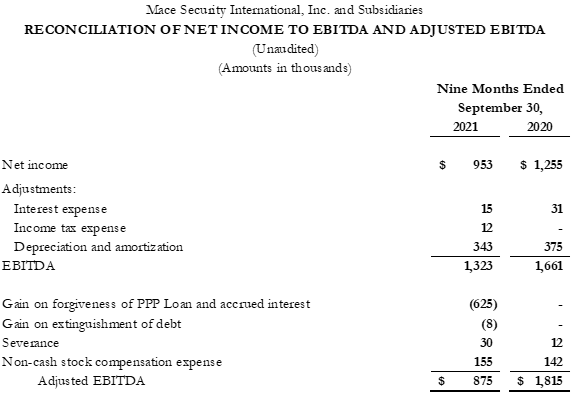

- Net Income was $953,000, or 9% of net sales, a decline of $302,000 from net income of $1,255,000 in the first nine months of 2020. The 2021 net income was enhanced by a $625,000 gain from PPP Loan forgiveness obtained in the first half of 2021.

- Adjusted EBITDA for the first nine months, which excludes the $625,000 gain from PPP Loan forgiveness, was $875,000 compared to the Company's record $1,815,000 for the same period in 2020.

Conference Call

Mace® will conduct a conference call on Tuesday, November 2, 2021, at 11:00 AM EDT, 8:00 AM PDT to discuss its financial and operational performance for the third quarter and first nine months of 2021. The call can be accessed by telephone within the US at (833) 360-0862. Please use the conference identification number 1092552.

A digital recording of the conference call will be available for replay after the call's completion. It will be available two hours after the call and will expire on November 16, 2021, at 11:59 PM. To access the recording, use the dial in numbers listed below and the conference ID 1092552.

Encore dial-in number: (855) 859-2056 or internationally on (404) 537-3406.

The full set of financial statements and an accompanying slide presentation is available on Mace's website www.corp.mace.com under the subheading "Newsroom."

About Mace Security International, Inc.

Mace® Security International, Inc. (MACE) is a globally recognized leader in personal safety and security. Based in Cleveland, Ohio, the company has spent more than 40 years designing and manufacturing consumer and tactical products for personal defense and security under its world-renowned Mace® Brand - the original trusted brand of defense spray products. The company also offers aerosol defense sprays and tactical products for law enforcement and security professionals worldwide through its Mace® Take Down® brand, KUROS!® Brand personal safety products, Vigilant® Brand alarms, and Tornado® Brand pepper spray and stun guns. MACE® distributes and supports Mace® Brand products through mass market retailers, wholesale distributors, independent dealers, Amazon.com, Mace.com, and other channels. For more information, visit www.mace.com.

Mace Security International distributes and supports its products and services through mass-market retailers, wholesale distributors, independent dealers, e-commerce channels and through its website, www.Mace.com. For more information, please visit www.mace.com.

Forward-Looking Statements

Certain statements and information included on this website constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. When used on this site, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "projected," "intend to" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to several known and unknown risks and uncertainties that may cause our actual results, trends, performance or achievements, or industry trends and results, to differ materially from the future results, trends, performance, or achievements expressed or implied by such forward-looking statements. Those risks and uncertainties may include, but are not limited to, (a) general economic and business conditions, including the impact of the COVID-19 pandemic and other possible pandemics and similar outbreaks; (b) competition; (c) potential changes in customer spending; (d) acceptance of our product offerings and designs; (e) the variability of consumer spending resulting from changes in domestic economic activity; (f) a highly promotional retail environment; (g) any significant variations between actual amounts and the amounts estimated for those matters identified as our critical accounting estimates, as well as other significant accounting estimates made in the preparation of our financial statements; (h) the impact of current and potential hostilities in various parts of the world, as well as other geopolitical or public health concerns; (i) the impact of international supply chain disruptions and delays; (j) the impact on the Company of changes in U.S. Federal and State income tax regulations; and (k) the impact of inflation and the Company's inability to pass on rising prices to its customers. You are urged to consider all such factors. Because of the uncertainty inherent in such forward-looking statements, you should not consider their inclusion to be a representation that such forward-looking matters will be achieved. Mace Security International, Inc. assumes no obligation for updating any such forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements.

In this press release, the Company's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. Management believes that presentation of operating results using non-GAAP financial measures provides useful supplemental information to investors and facilitates the analysis of the Company's core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company's business. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached schedules.

CONTACT:

Mike Weisbarth

Chief Financial Officer

mweisbarth@mace.com

SOURCE: Mace Security International

View source version on accesswire.com:

https://www.accesswire.com/670650/MaceR-Security-International-a-Global-Leader-in-Personal-Self-Defense-Sprays-Announces-3Q21-Financial-Results-Launches-Sales-with-New-Retail-Customers-Advance-Auto-and-Carquest-and-Online-Retailers-Lowescom-and-Targetcom