EDMONTON, AB / ACCESSWIRE / November 10, 2021 / OneSoft Solutions Inc. (the "Company" or "OneSoft") (TSXV:OSS)(OTCQB:OSSIF), a North American developer of cloud-based business solutions, is pleased to announce its financial results for the quarter ended September 30, 2021 (" Q3 2021 "). Please refer to the interim unaudited condensed Consolidated Financial Statements and Management's Discussion and Analysis (" MD&A ") for the three and nine months ended September 30, 2021 filed on SEDAR at www.sedar.com for more information.

FINANCIAL SUMMARY FOR Q3 ENDED SEPTEMBER 30, 2021

The following table summarizes the third quarter ended September 30, 2021, compared to September 30, 2020:

| Three months ended | Nine months ended | |||||||||||||||

(in C$,000, per share in C$) | September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | ||||||||||||

| $ | $ | $ | $ | |||||||||||||

Revenue | 1,233 | 795 | 3,240 | 3,090 | ||||||||||||

Gross profit | 937 | 589 | 2,437 | 2,359 | ||||||||||||

Net loss | (705 | ) | (999 | ) | (2,830 | ) | (2,317 | ) | ||||||||

Exchange (loss) gain on translation of foreign operations | (39 | ) | 3 | 13 | (18 | ) | ||||||||||

Comprehensive loss | (744 | ) | (996 | ) | (2,817 | ) | (2,335 | ) | ||||||||

Weighted average common shares outstanding - basic and fully diluted (000)'s | 117,187 | 114,975 | 116,436 | 114,246 | ||||||||||||

Net loss per share | (0.01 | ) | (0.01 | ) | (0.02 | ) | (0.02 | ) | ||||||||

OPERATIONAL HIGHLIGHTS FOR Q3 2021

- Total and recurring revenue for Q3 2021 increased by 55% and 56%, respectively, over Q3 2020, due to the addition of new customers and higher levels of activity by almost all customers. A decrease in the effective quarterly average U.S. foreign exchange rate negatively affected revenue by approximately $43,029. Recurring revenue comprised 95% of the revenue for this quarter.

- Revenue for the nine months ended September 30, 2021, increased by 5% year over year. While the Company has added seven new customers this year, the year over year increase in revenue was muted by a new client having loaded a very large number of data logs in its initial CIM software implementation in Q1 2020 and a decrease in the average effective U.S. foreign exchange rate that negatively affected revenue by approximately $223,296.

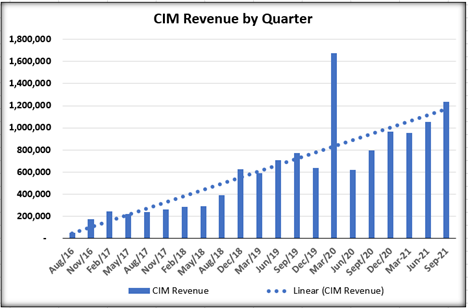

- The Company's five year compounded annual revenue growth rate is approximately 83% as illustrated in the chart below, which summarizes CIM revenue for the past twenty-one quarters. The dotted line confirms the growing CIM adoption and revenue growth.

Financial Metrics

| Three months ended: | Nine months ended: | |||||||||||||||

OneSoft SaaS Metrics | Q3 2021 | Q3 2020 | Q3 2021 | Q3 2020 | ||||||||||||

Revenue as reported in the Financial Statements | $ | 1,232,900 | $ | 794,998 | $ | 3,240,482 | $ | 3,089,955 | ||||||||

Revenue categorization: | ||||||||||||||||

Annual Recurring Revenue ("ARR") | $ | 1,171,920 | $ | 751,707 | $ | 3,019,129 | $ | 2,954,801 | ||||||||

Other Revenue | $ | 60,980 | $ | 43,291 | $ | 221,353 | $ | 135,154 | ||||||||

Total Revenue | $ | 1,232,900 | $ | 794,998 | $ | 3,240,482 | $ | 3,089,955 | ||||||||

Direct Costs | $ | 296,061 | $ | 205,612 | $ | 803,749 | $ | 730,912 | ||||||||

Gross profit | $ | 936,839 | $ | 589,386 | $ | 2,436,733 | $ | 2,359,043 | ||||||||

Direct Costs as % of ARR and Other Revenue | 24 | % | 26 | % | 25 | % | 24 | % | ||||||||

Gross profit as % of ARR and Other Revenue | 76 | % | 74 | % | 75 | % | 76 | % | ||||||||

ARR as % of Total Revenue | 95 | % | 95 | % | 93 | % | 96 | % | ||||||||

ARR Growth (Qtr / Qtr, YTD / YTD) | 56 | % | 19 | % | 2 | % | 60 | % | ||||||||

- Clients estimate their CIM consumption for the upcoming year and typically pay for it at the start of that period, which the Company records as Deferred Revenue until it is earned. Deferred Revenue at the end of Q3 2021 totaled $1,937,757 versus $413,546 at Fiscal 2020 year-end.

- Cash flow used in operating activities for the nine months ended September 30, 2021 was $920,791 versus cash use of $2,463,924 in the comparative period, with the biggest difference being the generation of $2,159,116 more cash from deferred revenue this year.

- At September 30, 2021, cash totaled $6.5 million ($7.2 million at December 31, 2020). Working capital (current assets less current liabilities) was $5.0 million ($6.2 million at December 31, 2020), and the Company has no debt. Assuming no significant changes in current business strategies and cash consumption, Management believes the Company has sufficient cash on hand to fund its business and growth strategies as envisioned.

BUSINESS OUTLOOK

The Company's sales and marketing strategies continued to increase recurring revenues and advance our technology and solutions, market presence and business development opportunities. The Company added seven new clients since the beginning of 2021, including its largest mileage client to date (approximately 41,000 piggable miles) in Q3 2021.

The Company now has more than 150,000 miles of pipeline under contract (approximately 100,000 miles piggable) with operators that have implemented CIM as the cornerstone of their integrity management processes. These clients range from small to very large operators, which attests to the scalability of our solutions. Although the mileage under contracts may be ingested into CIM over the course of several years, this serves as a strong foundation to build incremental recurring revenue upon in future periods, augmented by the Consumption Economics revenue model that enables clients to increase their use of CIM on a fee-for-use basis as new software functionality is added to the platform.

We believe that our first-mover advantage resulting from the use of machine learning and advanced data science technologies represents high intrinsic value for all Company stakeholders. Management believes that OneBridge now has access to more aggregated pipeline data to which machine learning can be applied than any other company world-wide. This factor not only serves to further accelerate our first-mover advantage, but also inhibits traction of future competitors. Furthermore, we expect our client relationships will remain intact for years into the future, providing we continue to deliver technologically advanced solutions that assist operators to reduce pipeline failures and realize cost savings. The long sales cycles that are typical of the industry and Fortune 500/100 companies, as challenging as they have been for the Company to date, present a significant barrier to entry for potential competitors who will need to navigate through all the evolutionary steps that OneSoft has encountered during the past six years. Additionally, new features and functionality under development are expected to continue to advance the Company's strategic position and increase future recurring revenues.

We believe the Company is approaching a tipping point wherein prospective customers will more readily accept the validity of CIM because of the increasing number of peer companies that have adopted CIM as their next generation solution for pipeline integrity management. Industry players' knowledge of the high value that CIM contributes to operations is increasing through word-of-mouth referrals from highly credible clients, technical publications and on-line product presentations, all of which are assisting the Company to gain market traction.

Sales activities are currently underway in the U.S.A., Canada, Australia, Belgium, Brazil, Argentina and Chile with numerous CIM Production Trials planned or in various stages of completion, which we anticipate will result in completed sales and recurring revenue in future periods. Lab and business development initiatives are also underway, including recruiting CIM resellers, investigating joint venture arrangements with synergistic companies and pursuing new potential markets and revenue sources where CIM technology and products can be applied.

Given the Company's strong balance sheet with $6.5 million of cash at quarter end, no debt, current cash burn rate, and anticipated revenue going forward, Management believes the Company is sufficiently funded to execute current business plans as envisioned without requirement to raise additional capital.

ON BEHALF OF THE BOARD OF DIRECTORS

ONESOFT SOLUTIONS INC.

Douglas Thomson

Chair

For more information, please contact

| Dwayne Kushniruk, CEO dkushniruk@onesoft.ca 780-437-4950 | Sean Peasgood, Investor Relations Sean@SophicCapital.com 647-494-7710 |

Forward-looking Statements

This news release contains forward-looking statements relating to the future operations and profitability of the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "expects", "believe", "will", "intends", "plans" and similar expressions. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Such forward-looking information is provided to deliver information about management's current expectations and plans relating to the future. Investors are cautioned that reliance on such information may not be appropriate for other purposes, such as making investment decisions.

In respect of the forward-looking information and statements the Company has placed reliance on certain assumptions that it believes are reasonable at this time, including expectations and assumptions concerning, among other things: the impact of Covid-19 on the business operations of the Company and its current and prospective customers, the availability and cost of labor and services; the efficacy of its software; our interpretation based on various industry information sources regarding the total miles of pipeline in the USA and globally, which segments are piggable; our understanding of metrics, activities and costs regarding evaluation, inspection and maintenance is in alignment with various industry information sources and is reasonably accurate; that counterparties to material agreements will continue to perform in a timely manner; that there are no unforeseen events preventing the performance of contracts; that there are no unforeseen material development or other costs related to current growth projects or current operations; the success of growth projects; future operating costs; interest and foreign exchange rates; planned synergies, capital efficiencies and cost-savings; the sufficiency of budgeted capital expenditures in carrying out planned activities; and no changes in applicable tax laws. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Since forward-looking information addresses future events and conditions, such information by its very nature involves inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to many factors and risks. These include but are not limited to the risks associated with the industries in which the Company operates in general such as: costs and expenses; interest rate and exchange rate fluctuations; competition; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws.

Readers are cautioned that the foregoing list of factors is not exhaustive. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether because of new information, future events or otherwise, except as expressly required by Canadian securities law.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

SOURCE: OneSoft Solutions Inc.

View source version on accesswire.com:

https://www.accesswire.com/672051/OneSoft-Solutions-Inc-Reports-Financial-and-Operational-Results-for-Q3-2021-Q3-2021-Total-Revenue-up-55-over-Q3-2020