Highlights of High-Grade Intercepts Include:

Turmalina Mine

19.65 g/t Au over an estimated true width of 5.35m (Orebody A)

9.03 g/t Au over an estimated true width of 9.62m (Orebody A)

22.05 g/t Au over an estimated true width of 8.81m (Orebody C - Central)

Pilar Mine

16.60 g/t Au over an estimated true width of 4.00m (BA Orebody)

17.90 g/t Au over an estimated true width of 3.50m (BF2 Orebody)

7.54 g/t Au over an estimated true width of 8.43m (LFW Orebody)

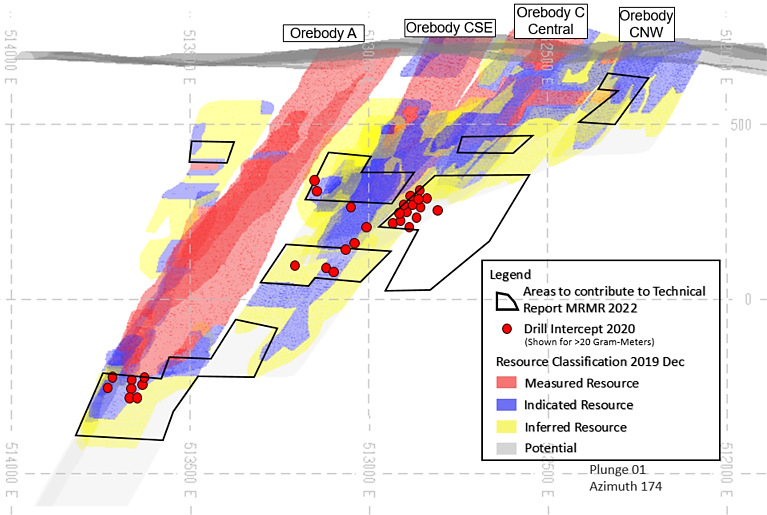

TORONTO, ON / ACCESSWIRE / May 25, 2021 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) is pleased to announce updated, in-mine diamond drilling results completed at its Turmalina Gold Mine and Pilar Gold Mine, both located in Minas Gerais. Results are subsequent to the most recent published Mineral Resources and Mineral Reserves ("MRMR") statements (31, December 2019 and 30, May 2020 for Turmalina and Pilar respectively). Drilling results reported in this release and from on-going and planned 2021 exploration programs will be included in Jaguar's next National Instrument 43-101 Technical Report MRMR update planned for early 2022.

Consolidated Jaguar Proven and Probable Reserves as at 31, December 2020 (net of 2020 mined depletion) totalled 478 koz's of gold (3.64Mt at an average weighted grade of 4.08 g/t Au).

In-fill diamond drilling competed in 2020 from ongoing programs at both mines, within and beyond the current published Mineral Resource and Mineral Reserve limits, continue to confirm lateral and depth extensions to the known, currently exploited mineralization at grades and thicknesses consistent with current and historical levels.

(Detailed MRMR tabulations for both Turmalina and Pilar Mines to 31, December 2020 may be found in the company's Annual Information Form (AIF) published on SEDAR and dated 15, March 2021 and on the Company's website at www.jaguarmining.com.)

Vern Baker, CEO, Jaguar Mining commented; "Our geology team has done an outstanding job providing the sustainable resources our mines need to grow and prosper. Diamond drilling success within our mines continues to build the resources that provide both sustainability and potential for growth. Jaguar has increased its in-mine diamond drilling metres over the last 18 months to provide increasing our MRMR and delivering a foundation for sustainability and long-term growth. I am very pleased to see results at higher levels in the mine, such as the Turmalina intercept of 22 g/t over 8.8m, located at C-Central near level five. This strong zone extension bodes well for sustaining our performance going forward.

Jaguar is committed to generating cash flow, that will allow us to invest in the future of our company and provide strong returns to shareholders. We applaud the exploration and geology teams' dedication to ensure the foundation of our success continues to support our future performance. As previously stated, we will not be completing a full technical report to update the MRMR in 2021, however, we will continue to support exploration programs for resources within our mines. We expect to fully update the MRMR in early 2022 which may include additional mineral resources from other exploration properties in the Iron Quadrangle where we have ongoing exploration programs."

Turmalina and Pilar Mine Drilling Results - 2020 / 2021

At Turmalina and Pilar, infill diamond drilling progressed throughout 2020 and is currently continuing. To date, drilling has been aimed at Mineral Resource to Mineral Reserve conversion across all production areas.

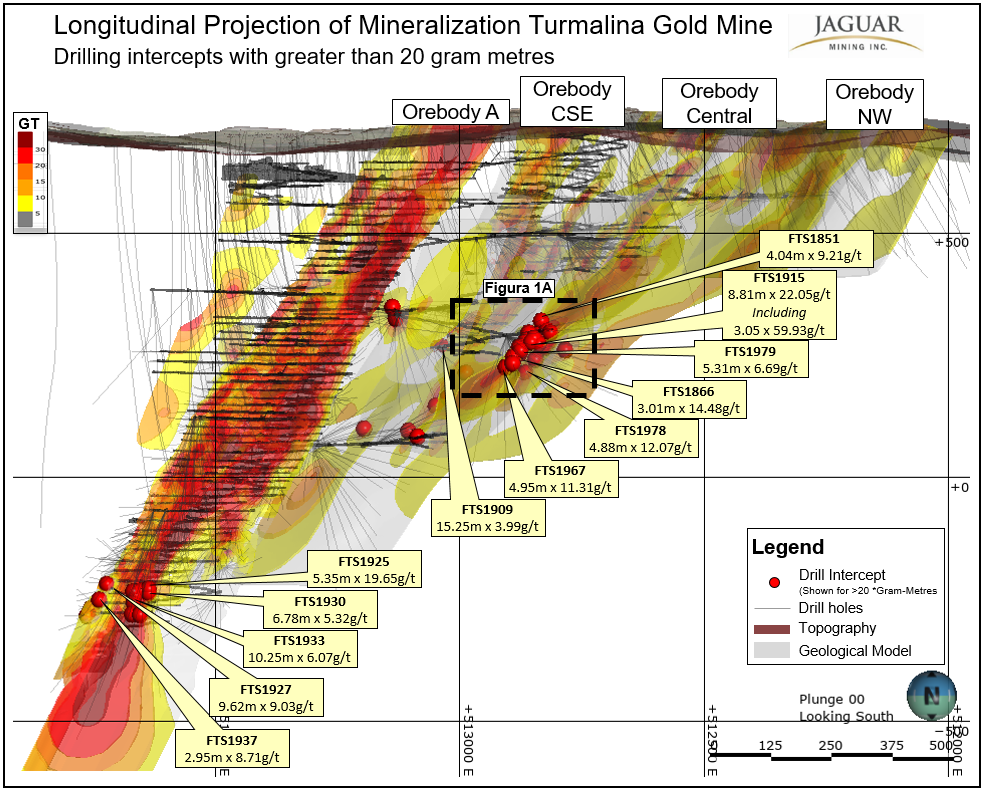

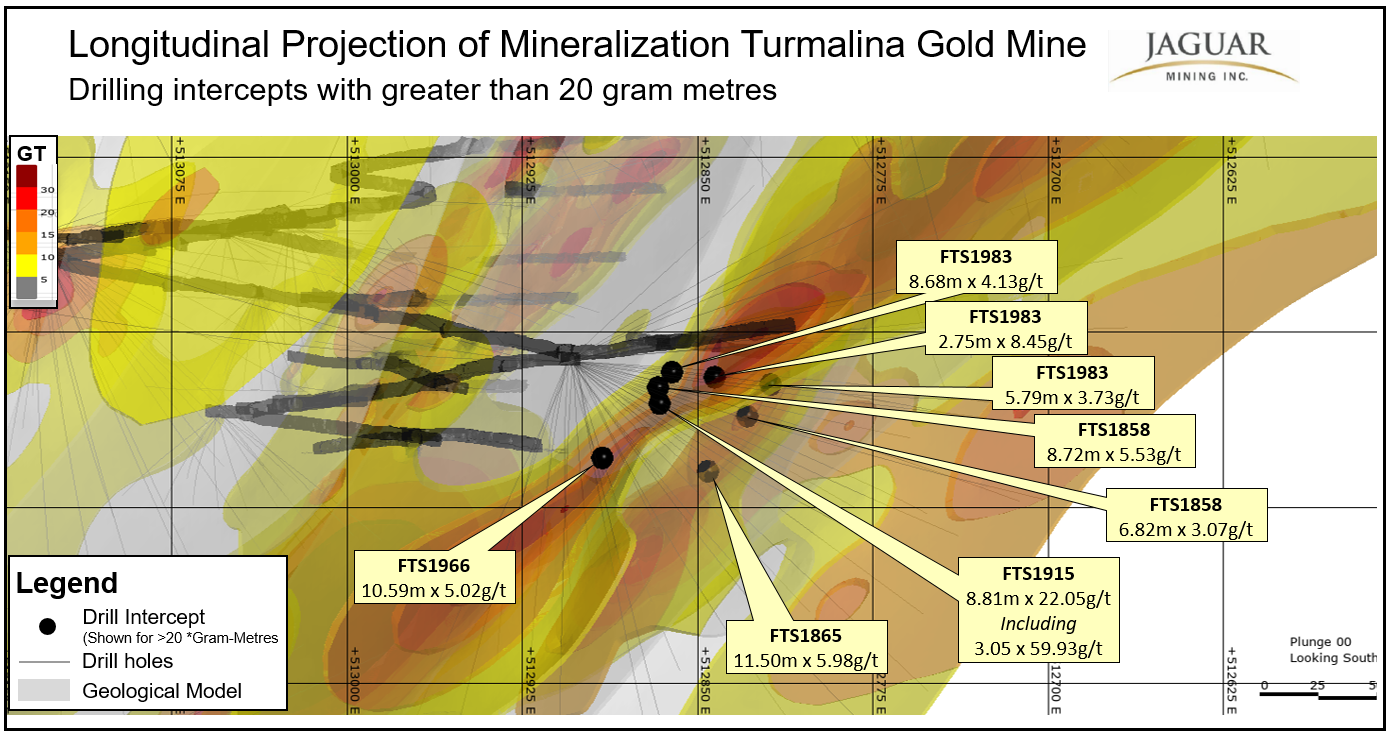

At Turmalina, growth exploration drilling has focused on new resource additions at shallow levels in the mine, primarily targeting the C-Orebody structure from C-Central towards the C-NW area (Figures 1 and 3). In 2021 growth exploration drilling will be aimed at extending the A-Orebody to a depth well beyond the current level 12-level production panel.

Results continue to reflect grades and thickness consistent with current and historical mine resources. Drilling which reported grade thickness (GT) values greater than 20 g/t completed at Turmalina during 2020 are included in Table 1 below and presented in Figures 1. and 1A (All results reported from 2020 drilling are tabulated within the latest AIF Report (15, March 2021, on SEDAR).

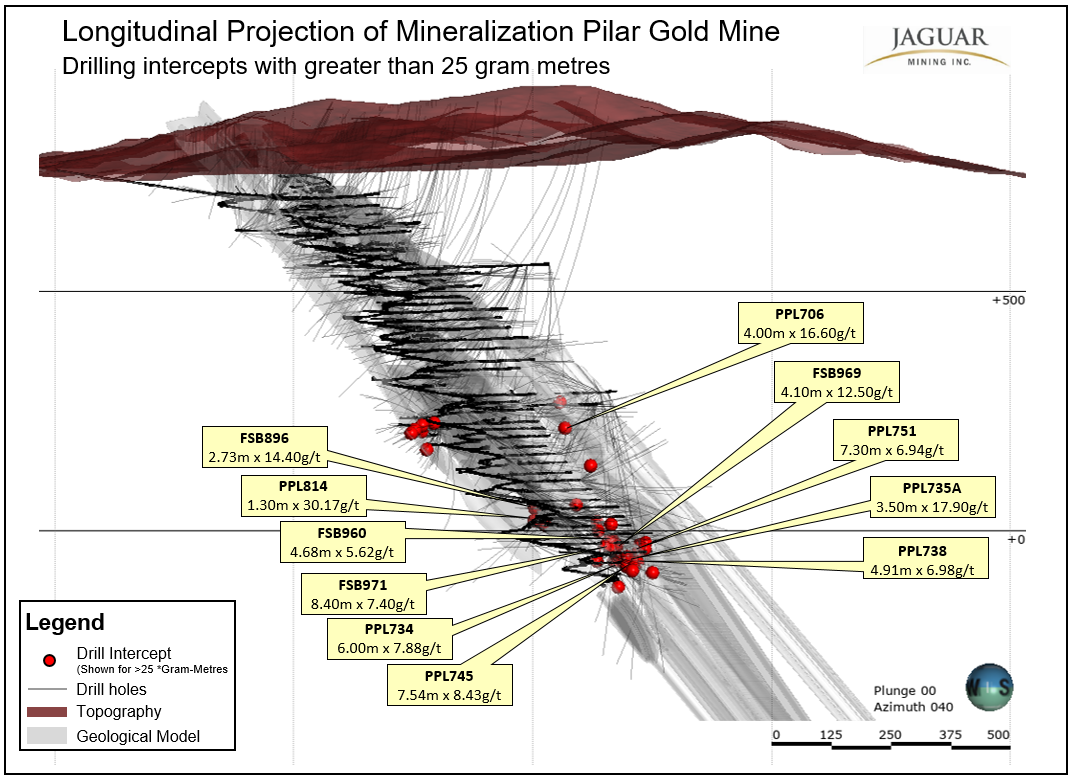

At Pilar, growth exploration drilling has focused on new resource additions at shallower levels in the mine, primarily targeting the SW - Orebody. In 2021 growth exploration drilling will target additions to Pilar's life of mine by drilling both the lateral extensions of mineralization close to existing infrastructure throughout the mine, in order to add productivity, while extending the high-grade structurally controlled Banded Iron Formation hosted mineralization to depths well beyond the current level 12- level and 14 production levels (Figures 2 and 4).

Results continue to reflect grades and thickness consistent with current and historical mine resources. Drilling which reported grade thickness values greater than 25 g/t, completed at Pilar since June 2020 are included in Table 2 and are presented in Figure 2. (All results reported from 2020 drilling are tabulated within the latest AIF Report (15, March 2021 on SEDAR).

Table 1 - Turmalina Mine - Drill Results showing intersections reporting greater than 20 g/t metres (GT) Orebody A and Orebody C.

|

Jaguar Mining Inc. - Turmalina Mine |

||||||||||

|

Hole ID |

From (m) |

To (m) |

Down Hole |

Estimated |

Gold |

GT |

Date |

Orebody |

Laboratory |

Drilling |

|

FTS1805 |

58.31 |

61.75 |

3.44 |

3.22 |

6.52 |

20.99 |

January 6, 2020 |

CSE |

RG |

JAGUAR |

|

FTS1891 |

70.26 |

75.21 |

4.95 |

4.75 |

4.82 |

22.90 |

March 19, 2020 |

CSE |

RG |

JAGUAR |

|

FTS1900 |

54.10 |

58.41 |

4.31 |

4.26 |

6.04 |

25.73 |

March 30, 2020 |

CSE |

RG |

JAGUAR |

|

FTS1927 |

80.60 |

90.38 |

9.78 |

9.62 |

9.03 |

86.87 |

April 22, 2020 |

ASE |

RG |

JAGUAR |

|

FTS1921 |

104.86 |

113.67 |

8.81 |

8.10 |

5.58 |

45.20 |

April 24, 2020 |

ASE |

RG |

JAGUAR |

|

FTS1923 |

99.41 |

111.08 |

11.67 |

8.25 |

5.13 |

42.32 |

May 6, 2020 |

ASE |

RG |

JAGUAR |

|

FTS1925 |

110.64 |

117.34 |

6.70 |

5.35 |

19.65 |

105.13 |

RG |

JAGUAR |

||

|

FTS1951 |

134.19 |

148.07 |

13.88 |

11.75 |

6.25 |

73.44 |

June 8, 2020 |

ASE |

RG |

JAGUAR |

|

FTS1952 |

144.81 |

156.06 |

11.25 |

9.99 |

7.54 |

75.32 |

RG |

JAGUAR |

||

|

FTS1897 |

56.51 |

62.32 |

5.81 |

3.96 |

12.56 |

49.74 |

June 8, 2020 |

CSE |

RG |

JAGUAR |

|

FTS1900 |

46.43 |

58.41 |

11.98 |

9.35 |

2.89 |

27.02 |

June 3, 2020 |

CSE |

RG |

JAGUAR |

|

FTS1907 |

67.93 |

71.89 |

3.96 |

2.71 |

10.49 |

28.43 |

August 24, 2020 |

C - Central |

RG |

JAGUAR |

|

FTS1908 |

60.02 |

65.12 |

5.10 |

4.91 |

4.55 |

22.34 |

August 27, 2020 |

C - Central |

RG |

JAGUAR |

|

FTS1929 |

100.59 |

118.45 |

17.86 |

14.25 |

4.86 |

69.26 |

August 12, 2020 |

ASE |

RG |

JAGUAR |

|

FTS1822 |

205.80 |

207.60 |

1.80 |

1.70 |

13.46 |

22.88 |

January 7, 2020 |

CSE |

ALS |

MAJOR |

|

FTS1837 |

81.40 |

83.15 |

1.75 |

1.20 |

20.72 |

24.86 |

April 28, 2020 |

CSE |

ALS |

MAJOR |

|

FTS1840 |

92.74 |

95.50 |

2.76 |

2.55 |

10.36 |

26.42 |

April 22, 2020 |

CSE |

ALS |

MAJOR |

|

FTS1847 |

154.91 |

158.73 |

3.82 |

2.10 |

10.77 |

22.62 |

May 19, 2020 |

CSE |

ALS |

MAJOR |

|

FTS1849 |

175.40 |

190.69 |

15.29 |

4.94 |

9.22 |

45.55 |

May 26, 2020 |

CSE |

ALS |

MAJOR |

|

FTS1851 |

161.30 |

168.36 |

7.06 |

4.04 |

9.21 |

37.21 |

June 1, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1855 |

45.75 |

54.50 |

8.75 |

6.18 |

6.08 |

37.57 |

June 24, 2020 |

C - Central |

ALS |

MAJOR |

|

78.80 |

80.40 |

1.60 |

1.54 |

39.85 |

61.37 |

C - Central |

ALS |

MAJOR |

||

|

FTS1856 |

82.85 |

87.10 |

4.25 |

4.12 |

10.55 |

43.47 |

June 29, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1857 |

84.45 |

90.85 |

6.40 |

5.95 |

5.38 |

32.01 |

July 3, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1858 |

33.75 |

44.40 |

10.65 |

8.72 |

5.53 |

48.22 |

July 3, 2020 |

C - Central |

ALS |

MAJOR |

|

77.20 |

86.85 |

9.65 |

6.82 |

3.07 |

20.94 |

C - Central |

ALS |

MAJOR |

||

|

FTS1859 |

43.40 |

54.05 |

10.65 |

8.39 |

3.95 |

33.14 |

July 7, 2020 |

C - Central |

ALS |

MAJOR |

|

61.85 |

66.80 |

4.95 |

3.50 |

7.82 |

27.37 |

C - Central |

ALS |

MAJOR |

||

|

118.15 |

123.90 |

5.75 |

4.40 |

5.60 |

24.64 |

C - Central |

ALS |

MAJOR |

||

|

FTS1865 |

27.25 |

39.35 |

12.10 |

11.50 |

5.98 |

68.77 |

August 3, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1865 |

71.90 |

79.95 |

8.05 |

7.97 |

2.61 |

20.80 |

August 3, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1866 |

48.65 |

51.75 |

3.10 |

3.01 |

14.48 |

43.58 |

August 3, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1909 |

50.41 |

66.48 |

16.07 |

15.25 |

3.99 |

60.85 |

September 22, 2020 |

C - Central |

RG |

JAGUAR |

|

FTS1930 |

109.12 |

116.44 |

7.32 |

6.78 |

5.32 |

36.07 |

September 8, 2020 |

A - SE |

RG |

JAGUAR |

|

FTS1933 |

116.46 |

127.88 |

11.42 |

10.25 |

6.07 |

62.22 |

September 4, 2020 |

A - SE |

RG |

JAGUAR |

|

FTS1937 |

121.60 |

125.04 |

3.44 |

2.95 |

8.71 |

25.69 |

October 13, 2020 |

A - SE |

RG |

JAGUAR |

|

FTS1944 |

23.92 |

27.87 |

3.95 |

2.91 |

7.32 |

21.30 |

November 20, 2020 |

A - SE |

RG |

JAGUAR |

|

FTS1960 |

36.35 |

37.60 |

1.25 |

1.11 |

24.93 |

27.68 |

December 27, 2020 |

A - SE |

RG |

JAGUAR |

|

FTS1887 |

83.30 |

90.50 |

7.20 |

6.55 |

4.30 |

28.16 |

December 27, 2020 |

C - Central |

RG |

JAGUAR |

|

FTS1966 |

36.45 |

50.50 |

14.05 |

10.59 |

5.02 |

53.16 |

September 9, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1967 |

62.80 |

68.10 |

5.30 |

4.95 |

11.31 |

55.98 |

September 19, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1971 |

40.40 |

63.20 |

22.80 |

13.30 |

1.81 |

24.07 |

October 6, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1978 |

83.25 |

88.95 |

5.70 |

4.88 |

12.07 |

58.90 |

November 27, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1979 |

35.00 |

40.60 |

5.60 |

5.31 |

6.69 |

35.52 |

November 28, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1983 |

38.95 |

51.00 |

12.05 |

8.68 |

4.13 |

35.85 |

December 11, 2020 |

C - Central |

ALS |

MAJOR |

|

62.80 |

66.50 |

3.70 |

2.75 |

8.45 |

23.24 |

C - Central |

ALS |

MAJOR |

||

|

86.65 |

93.90 |

7.25 |

5.79 |

3.73 |

21.60 |

C - Central |

ALS |

MAJOR |

||

|

FTS1984 |

68.80 |

70.70 |

1.90 |

1.75 |

12.38 |

21.67 |

December 30, 2020 |

C - Central |

ALS |

MAJOR |

|

FTS1915 |

36.60 |

46.40 |

9.80 |

8.81 |

22.05 |

194.26 |

March 16, 2021 |

C - Central |

ALS |

MAJOR |

|

Including |

43.00 |

46.40 |

3.40 |

3.05 |

59.93 |

182.79 |

March 16, 2021 |

C - Central |

ALS |

MAJOR |

Figure 1 - Turmalina Mine - Location of Drilling Intersections on Orebody A, Orebody C-SE and C-Central showing intersections reporting greater than 20 g/t metres (GT) overlain on the Grade X Thickness image.

At Orebody C-Central, infill and growth exploration drilling continues to confirm the down plunge extension of high grades from current mining areas on levels 3 and 4 to below level 6. (See figure 1A). The best intersection to date is from hole FTS1915 which reported an intercept of 22.05gt Au over an estimated true width of 8.81m.

Figure 1 A - Turmalina Mine - Location of Drilling Intersections on Orebody C-Central showing intersections reporting greater than 20 g/t metres (GT) overlain on the Grade X Thickness image.

Table 2 - Pilar Mine drill intercepts - with Grade x Thickness (GT) greater than 25 g/t metres

|

Summary of Significant Intersections with greater than 25 g/t metres |

||||||||||

|

Hole ID |

From (m) |

To (m) |

Down Hole |

Estimated |

Gold |

GT (ETW) |

Date |

Orebody |

Laboratory |

Drilling |

|

PPL689 |

104.95 |

115.90 |

10.95 |

10.10 |

7.05 |

71.21 |

June 1, 2020 |

SW |

RG |

JAGUAR |

|

PPL629 |

13.20 |

19.00 |

5.80 |

5.44 |

7.42 |

40.36 |

June 1, 2020 |

BA |

RG |

JAGUAR |

|

PPL672A |

47.00 |

49.35 |

2.35 |

2.10 |

12.51 |

26.27 |

June 12, 2020 |

BFII |

RG |

JAGUAR |

|

PPL581 |

46.00 |

55.00 |

9.00 |

6.94 |

4.74 |

32.90 |

June 22, 2020 |

BA |

RG |

MAJOR |

|

PPL669 |

76.80 |

85.90 |

9.10 |

8.95 |

3.77 |

33.74 |

July 7, 2020 |

SW |

RG |

JAGUAR |

|

PPL728 |

4.00 |

7.20 |

3.20 |

2.20 |

27.98 |

61.56 |

July 11, 2020 |

SW |

RG |

JAGUAR |

|

PPL728 |

22.17 |

32.96 |

10.79 |

5.50 |

8.45 |

46.48 |

July 11, 2020 |

SW |

RG |

JAGUAR |

|

PPL719 |

62.30 |

75.90 |

13.60 |

9.00 |

3.60 |

32.40 |

July 11, 2020 |

SW |

RG |

JAGUAR |

|

PPL703 |

37.10 |

70.45 |

33.35 |

9.03 |

6.88 |

62.13 |

July 11, 2020 |

BF |

RG |

JAGUAR |

|

PPL705 |

28.40 |

34.40 |

6.00 |

1.81 |

15.38 |

27.84 |

July 11, 2020 |

BFII |

RG |

JAGUAR |

|

PPL701 |

44.50 |

56.65 |

12.15 |

5.41 |

5.51 |

29.81 |

July 11, 2020 |

BFII |

RG |

JAGUAR |

|

PPL726 |

231.00 |

241.00 |

10.00 |

4.20 |

7.33 |

30.79 |

August 15, 2020 |

LPA |

RG |

MAJOR |

|

FSB892 |

18.00 |

30.80 |

12.80 |

4.90 |

5.80 |

28.42 |

August 23, 2020 |

BF |

RG |

JAGUAR |

|

PPL750 |

128.40 |

138.45 |

10.05 |

3.24 |

7.70 |

24.95 |

August 28, 2020 |

LFW |

RG |

MAJOR |

|

FSB896 |

10.75 |

14.78 |

4.03 |

2.73 |

14.40 |

39.31 |

September 11, 2020 |

BFII? |

RG |

JAGUAR |

|

PPL706 |

79.00 |

83.00 |

4.00 |

4.00 |

16.60 |

66.40 |

September 23, 2020 |

BA |

RG |

JAGUAR |

|

FSB918 |

21.80 |

29.80 |

8.00 |

7.15 |

5.69 |

40.68 |

September 24, 2020 |

BFII |

RG |

JAGUAR |

|

PPL735A |

152.00 |

155.65 |

3.65 |

3.50 |

17.90 |

62.65 |

September 28, 2020 |

BFII |

RG |

MAJOR |

|

PPL745 |

105.00 |

115.00 |

10.00 |

7.54 |

8.43 |

63.56 |

October 1, 2020 |

LFW |

RG |

MAJOR |

|

128.32 |

145.00 |

16.68 |

11.00 |

5.26 |

57.86 |

BF |

RG |

MAJOR |

||

|

157.68 |

168.00 |

10.32 |

6.91 |

4.43 |

30.61 |

BF |

RG |

MAJOR |

||

|

175.30 |

181.00 |

5.70 |

4.04 |

8.79 |

35.51 |

LPA |

RG |

MAJOR |

||

|

PPL734 |

139.40 |

158.00 |

18.60 |

6.00 |

7.88 |

47.28 |

October 13, 2020 |

BFII |

RG |

MAJOR |

|

PPL751 |

99.75 |

108.00 |

8.25 |

7.30 |

6.94 |

50.66 |

October 19, 2020 |

BF |

RG |

MAJOR |

|

143.50 |

149.90 |

6.40 |

5.62 |

7.09 |

39.85 |

BF |

RG |

MAJOR |

||

|

159.20 |

164.55 |

5.35 |

4.80 |

17.36 |

83.33 |

LPA |

RG |

MAJOR |

||

|

166.80 |

170.00 |

3.20 |

2.95 |

16.75 |

49.41 |

LPA |

RG |

MAJOR |

||

|

PPL738 |

106.30 |

125.55 |

19.25 |

4.91 |

6.98 |

34.27 |

October 22, 2020 |

BF |

RG |

MAJOR |

|

FSB965A |

35.40 |

43.50 |

8.10 |

2.45 |

10.50 |

25.73 |

October 30, 2020 |

BF |

RG |

JAGUAR |

|

PPL732A |

112.00 |

114.00 |

2.00 |

1.08 |

37.95 |

40.99 |

November 3, 2020 |

BFIII |

RG |

MAJOR |

|

FSB952 |

4.00 |

13.00 |

9.00 |

3.40 |

9.75 |

33.15 |

December 1, 2020 |

BF |

RG |

JAGUAR |

|

21.00 |

26.00 |

5.00 |

1.78 |

17.48 |

31.11 |

LPA |

RG |

JAGUAR |

||

|

FSB944 |

11.15 |

14.30 |

3.15 |

2.50 |

10.47 |

26.18 |

December 1, 2020 |

LPA |

RG |

JAGUAR |

|

FSB960 |

2.00 |

16.90 |

14.90 |

4.68 |

5.62 |

26.30 |

December 1, 2020 |

BFII |

RG |

JAGUAR |

|

FSB968 |

0.00 |

21.00 |

21.00 |

4.00 |

7.50 |

29.70 |

December 16, 2020 |

BF |

RG |

JAGUAR |

|

FSB969 |

18.00 |

34.00 |

16.00 |

4.10 |

12.50 |

50.90 |

December 16, 2020 |

BF |

RG |

JAGUAR |

|

PPL762 |

112.50 |

127.00 |

14.50 |

7.20 |

4.44 |

31.97 |

December 17, 2020 |

BFII |

ALS |

MAJOR |

|

PPL814 |

79.80 |

81.50 |

1.70 |

1.30 |

30.17 |

39.22 |

December 28, 2020 |

LFW? |

RG |

JAGUAR |

|

FSB971 |

15.00 |

34.00 |

19.00 |

8.40 |

7.40 |

61.80 |

December 28, 2020 |

BFII |

RG |

JAGUAR |

Figure 2 - Pilar Mine - Location of intersections from diamond drill holes reported since the last MRMR report at Pilar Mine (May 31, 2020).

2020 / 2021 Drilling Programmes relative to published Mineral Resource and Mineral Reserve limits.

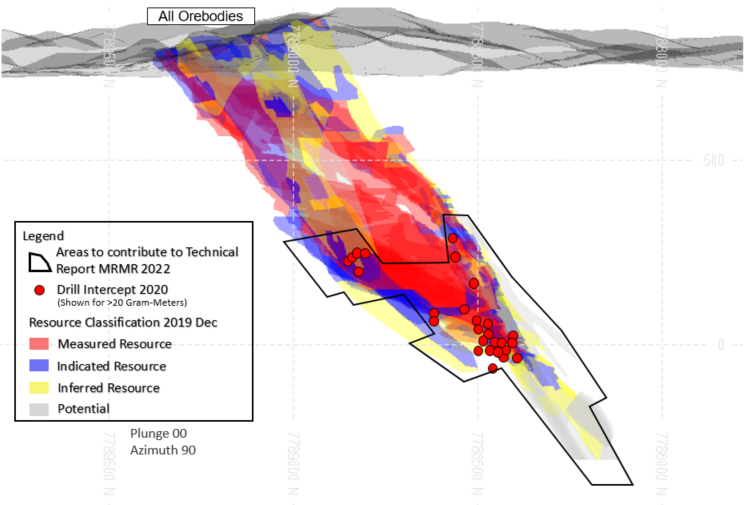

Figures 3 and 4 below show the location of current in-fill and growth drilling that will inform the next NI-43-101 Technical Report and MRMR estimates for Jaguar planned for release in 2022.

Figure 3 - Turmalina Mine

Figure 4 - Pilar Mine

Qualified Person

Scientific and technical information contained in this press release has been reviewed and approved by Jonathan Victor Hill, BSc (Hons) (Economic Geology - UCT), FAUSIMM, Vice President Geology and Exploration, who is also an employee of Jaguar Mining Inc., and is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Quality Control

All sampling and samples utilized at Jaguar for Mineral Resource and or Mineral Reserves estimation uses a quality-control program that includes insertion of blanks and commercial standards in order to ensure best practice in sampling and analysis.

HQ, NQ, and BQ size drill core is sawn in half with a diamond saw. Samples are selected for analysis in standard intervals according to geological characteristics such as lithology and hydrothermal alteration. Rock channel sampling of the underground development follows the same standard intervals as for the drill core.

Half of the sawed sample is forwarded to the analytical laboratory for analysis while the remaining half of the core is stored in a secure location. The drill core and rock chip samples for resource-reserve conversion and grade control samples are transported for physical preparation and analysis in securely sealed bags to the Jaguar in-house laboratory located at the company´s Caeté Complex, Caeté, Minas Gerais. Growth exploration samples are sent to the independent ALS Brazil (subsidiary of ALS Global) laboratory located in Vespasiano, Minas Gerais, Brazil. The analysis of these exploration samples is conducted at ALS Global's respective facilities (fire assay is conducted by ALS Global in Lima, Peru, and multi-elementary analysis is conducted by ALS Global in Vancouver, Canada). ALS has accreditation in a global management system that meets all requirements of international standards ISO/IEC 17025:2005 and ISO 9001:2015. All major ALS geochemistry analytical laboratories are accredited to ISO/IEC 17025:2005 for specific analytical procedures.

For a complete description of Jaguar's sample preparation, analytical methods and QA/QC procedures, please refer to "Technical Report on the Roça Grande and Pilar Operations, Minas Gerais State, Brazil", a copy of which is available on the Company's SEDAR profile at www.sedar.com.

The drilling results presented on this news release are from drill holes completed by contractors Major Drilling and Jaguars own fleet of underground diamond drilling rigs.

For a complete description of Jaguar's sample preparation, analytical methods and QA/QC procedures, please refer to the "Technical Report on the Roça Grande and Pilar Operations, Minas Gerais State, Brazil", dated August 17th 2020, a copy of which is available on the Company's SEDAR profile at www.sedar.com.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with two gold mining complexes and a large land package with significant upside exploration potential from mineral claims covering an area of approximately 102,000 hectares. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex and Caeté Mining Complex (Pilar Mine and Caeté Plant). The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. The Roça Grande Mine has been on care and maintenance since April 2018. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

|

Vernon Baker |

Hashim Ahmed |

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, expected sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the estimated timeline for the development of its mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). In addition, the Company's principal operations and mineral properties are located in Brazil and there are additional business and financial risks inherent in doing business in Brazil as compared to the United States or Canada. In Brazil, corruption represents a challenge requiring extra attention by those who conduct business there. Corruption does not only occur with the misuse of public, government or regulatory powers, it also can occur in a business's supplies, inputs and procurement functions (such as illicit rebates, kickbacks and dubious vendor relationships) as well as the inventory and product sales functions (such as inventory shrinkage or skimming). Employees as well as external parties (such as suppliers, distributors and contractors) have opportunities to commit theft, procurement fraud and other wrongs against the Company. While corruption, bribery and fraud and theft risks can never be fully eliminated, the Company reviews and implements controls to reduce the likelihood of these events occurring. The Company's present and future business operations face these risks. Accordingly, for all of the reasons above, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR at www.sedar.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

Appendix 1

Drill hole location data for Turmalina holes reported in this Press-Release

|

Hole ID |

Easting |

Northing |

Elevation |

Total Depth |

Collar Dip |

Collar Azimuth |

|

FTS1805 |

513128.83 |

7816978.80 |

332.02 |

79.35 |

-4.64 |

176.34 |

|

FTS1822 |

513301.72 |

7817175.83 |

65.53 |

250.45 |

209.38 |

10.14 |

|

FTS1837 |

513168.92 |

7817155.85 |

69.92 |

178.60 |

268.16 |

10.00 |

|

FTS1840 |

513169.74 |

7817154.04 |

70.19 |

130.85 |

225.99 |

17.96 |

|

FTS1847 |

513169.54 |

7817154.83 |

70.76 |

173.10 |

242.00 |

30.10 |

|

FTS1849 |

513169.51 |

7817155.00 |

70.83 |

242.70 |

245.00 |

31.43 |

|

FTS1851 |

512902.61 |

7817185.71 |

288.83 |

190.10 |

243.08 |

22.99 |

|

FTS1855 |

512902.74 |

7817185.67 |

288.02 |

149.70 |

240.00 |

9.21 |

|

FTS1856 |

512902.07 |

7817186.02 |

288.02 |

185.65 |

251.94 |

7.88 |

|

FTS1857 |

512901.71 |

7817186.49 |

287.98 |

187.20 |

261.99 |

5.99 |

|

FTS1858 |

512902.26 |

7817185.97 |

287.04 |

125.80 |

250.18 |

-15.49 |

|

FTS1859 |

512901.73 |

7817186.65 |

287.07 |

146.75 |

265.01 |

-11.88 |

|

FTS1865 |

512902.44 |

7817186.05 |

286.32 |

105.95 |

251.12 |

-37.70 |

|

FTS1866 |

512903.31 |

7817185.11 |

286.35 |

98.30 |

221.53 |

-41.99 |

|

FTS1887 |

513054.43 |

7817089.68 |

264.61 |

101.89 |

255.35 |

-33.15 |

|

FTS1888 |

513054.73 |

7817089.71 |

264.55 |

95.70 |

228.99 |

-38.03 |

|

FTS1889 |

513055.30 |

7817089.51 |

264.87 |

96.13 |

208.99 |

-36.10 |

|

FTS1890 |

513055.69 |

7817089.38 |

265.01 |

101.17 |

190.00 |

-35.11 |

|

FTS1891 |

513128.98 |

7816978.80 |

332.45 |

105.30 |

171.15 |

15.99 |

|

FTS1897 |

513035.92 |

7817023.78 |

316.08 |

85.35 |

223.90 |

-19.86 |

|

FTS1900 |

513038.81 |

7817022.60 |

316.01 |

75.22 |

215.99 |

-27.10 |

|

FTS1907 |

513038.39 |

7817022.69 |

315.83 |

93.78 |

165.99 |

-49.15 |

|

FTS1908 |

513038.07 |

7817022.88 |

315.77 |

95.39 |

179.95 |

-53.95 |

|

FTS1909 |

513037.41 |

7817023.03 |

315.77 |

80.56 |

197.87 |

-60.73 |

|

FTS1912 |

512902.08 |

7817186.11 |

287.23 |

200.65 |

278.27 |

-13.92 |

|

FTS1913 |

512902.00 |

7817186.63 |

286.64 |

211.20 |

287.20 |

-27.11 |

|

FTS1917 |

512908.06 |

7817190.12 |

287.73 |

222.40 |

24.99 |

1.30 |

|

FTS1918 |

512908.63 |

7817189.38 |

287.72 |

260.80 |

50.10 |

1.46 |

|

FTS1919 |

512909.22 |

7817188.89 |

287.66 |

320.55 |

67.99 |

0.67 |

|

FTS1921 |

513659.55 |

7817303.36 |

-211.81 |

129.90 |

6.26 |

-15.71 |

|

FTS1923 |

513659.32 |

7817303.26 |

-211.75 |

131.20 |

357.99 |

-15.25 |

|

FTS1925 |

513659.08 |

7817302.99 |

-211.67 |

136.06 |

350.00 |

-15.32 |

|

FTS1927 |

513665.11 |

7817303.85 |

-211.28 |

119.43 |

45.99 |

-15.33 |

|

FTS1929 |

513658.79 |

7817302.85 |

-211.99 |

137.10 |

5.00 |

-20.33 |

|

FTS1930 |

513658.51 |

7817302.74 |

-211.88 |

145.69 |

349.90 |

-18.63 |

|

FTS1933 |

513658.77 |

7817302.81 |

-212.21 |

127.88 |

4.25 |

-27.71 |

|

FTS1937 |

513664.79 |

7817303.96 |

-211.72 |

131.54 |

39.02 |

-21.60 |

|

FTS1944 |

513730.87 |

7817346.28 |

-274.13 |

52.90 |

79.95 |

10.62 |

|

FTS1945 |

513729.02 |

7817348.52 |

-275.45 |

125.35 |

357.99 |

-22.64 |

|

FTS1946 |

513729.50 |

7817348.30 |

-275.32 |

135.73 |

11.59 |

-20.62 |

|

FTS1947 |

513730.82 |

7817346.23 |

-274.15 |

151.00 |

25.00 |

-19.88 |

|

FTS1948 |

513730.24 |

7817347.26 |

-275.10 |

136.53 |

44.00 |

-19.22 |

|

FTS1951 |

513659.24 |

7817303.19 |

-212.48 |

170.11 |

7.00 |

-33.70 |

|

FTS1952 |

513659.42 |

7817303.30 |

-212.49 |

173.00 |

0.46 |

-32.78 |

|

FTS1957 |

513729.99 |

7817347.29 |

-275.57 |

100.00 |

38.17 |

-35.50 |

|

FTS1958 |

513729.58 |

7817348.02 |

-275.54 |

146.09 |

16.01 |

-28.80 |

|

FTS1959 |

513729.29 |

7817348.33 |

-275.69 |

145.51 |

6.60 |

-29.80 |

|

FTS1960 |

513730.19 |

7817346.56 |

-274.87 |

50.09 |

66.03 |

-13.97 |

|

FTS1966 |

512903.42 |

7817186.77 |

286.34 |

140.65 |

263.99 |

-74.35 |

|

FTS1967 |

512905.35 |

7817185.37 |

286.41 |

143.55 |

163.69 |

-72.83 |

|

FTS1971 |

512901.42 |

7817190.91 |

286.61 |

202.35 |

316.00 |

-78.92 |

|

FTS1978 |

512902.42 |

7817187.16 |

286.58 |

122.80 |

234.67 |

-59.41 |

|

FTS1979 |

512902.73 |

7817185.64 |

286.30 |

146.35 |

271.48 |

-46.43 |

|

FTS1983 |

512903.28 |

7817185.07 |

287.50 |

145.15 |

250.70 |

-5.12 |

|

FTS1984 |

512902.84 |

7817185.39 |

287.50 |

184.30 |

261.96 |

-2.99 |

|

FTS1985 |

512902.60 |

7817186.82 |

286.35 |

216.60 |

294.98 |

-38.76 |

|

FTS1998 |

513494.27 |

7817353.32 |

-236.24 |

150.70 |

40.44 |

-36.64 |

|

FTS1999 |

513493.68 |

7817353.77 |

-236.16 |

194.18 |

32.17 |

-37.81 |

|

FTS2016 |

513730.26 |

7817347.71 |

-274.72 |

126.91 |

37.12 |

-6.41 |

|

FTS2017 |

513725.03 |

7817346.04 |

-275.47 |

130.05 |

350.00 |

-22.13 |

|

FTS2018 |

513724.84 |

7817345.90 |

-275.33 |

135.95 |

339.99 |

-19.55 |

|

FTS2019 |

513724.70 |

7817345.76 |

-275.30 |

144.72 |

331.87 |

-19.94 |

|

FTS2020 |

513725.46 |

7817346.33 |

-275.86 |

164.45 |

5.19 |

-36.08 |

|

FTS2021 |

513725.26 |

7817346.17 |

-275.50 |

143.56 |

355.99 |

-30.80 |

|

FTS2022 |

513725.43 |

7817346.34 |

-275.63 |

137.66 |

3.99 |

-30.37 |

|

FTS2023 |

513725.08 |

7817346.10 |

-275.65 |

161.44 |

353.00 |

-35.80 |

|

FTS2024 |

513726.94 |

7817347.19 |

-275.87 |

165.29 |

25.00 |

-28.17 |

|

FTS2025 |

513725.12 |

7817346.09 |

-275.99 |

168.74 |

358.99 |

-37.49 |

|

FTS2026 |

513725.94 |

7817346.59 |

-276.04 |

168.74 |

14.05 |

-35.00 |

|

FTS1915 |

512902.60 |

7817185.40 |

286.90 |

136.05 |

263.00 |

-24.65 |

Appendix 2

Drill hole location data for Pilar holes reported in this Press-Release.

|

Hole ID |

Easting |

Northing |

Elevation |

Total Depth |

Collar |

Collar Dip |

|

FSB896 |

662748.22 |

7788582.69 |

46.54 |

41.35 |

349.99 |

0.40 |

|

FSB918 |

662739.50 |

7788473.92 |

46.23 |

48.85 |

185.02 |

13.95 |

|

FSB965A |

662789.67 |

7788345.00 |

-26.07 |

72.90 |

124.88 |

-20.12 |

|

PPL706 |

662838.47 |

7788508.87 |

262.53 |

125.30 |

303.50 |

-35.97 |

|

PPL732A |

662684.06 |

7788279.89 |

-52.10 |

208.40 |

25.15 |

-7.20 |

|

PPL734 |

662684.36 |

7788278.59 |

-51.92 |

220.15 |

42.72 |

-5.43 |

|

PPL735A |

662684.50 |

7788278.33 |

-51.90 |

228.25 |

48.09 |

-5.15 |

|

PPL738 |

662684.91 |

7788277.36 |

-52.01 |

232.10 |

68.71 |

-8.53 |

|

PPL745 |

662683.97 |

7788279.99 |

-52.01 |

225.10 |

59.25 |

-14.61 |

|

PPL751 |

662684.90 |

7788277.82 |

-51.63 |

230.40 |

60.25 |

1.55 |

|

FSB944 |

662841.48 |

7788338.52 |

-24.80 |

93.65 |

249.94 |

-6.52 |

|

FSB960 |

662789.76 |

7788407.22 |

-26.16 |

36.15 |

41.00 |

18.06 |

|

FSB952 |

662800.93 |

7788397.22 |

-27.23 |

46.45 |

59.61 |

-22.75 |

|

PPL661 |

662602.45 |

7788348.75 |

33.04 |

262.05 |

81.62 |

-11.05 |

|

PPL579 |

662602.37 |

7788349.19 |

32.37 |

339.95 |

101.62 |

-36.46 |

|

PPL669 |

662637.45 |

7788785.46 |

219.20 |

180.75 |

255.14 |

-1.30 |

|

PPL665 |

662636.96 |

7788786.51 |

219.50 |

100.15 |

271.77 |

4.03 |

|

FSB887 |

662787.58 |

7788463.86 |

26.08 |

38.00 |

184.07 |

-18.43 |

|

PPL644 |

662637.78 |

7788787.26 |

218.67 |

80.70 |

293.12 |

-18.50 |

|

PPL664 |

662602.46 |

7788348.96 |

33.12 |

257.95 |

76.38 |

-12.65 |

|

PPL687 |

662752.67 |

7788440.74 |

-11.25 |

250.40 |

180.37 |

-26.06 |

|

PPL689 |

662637.76 |

7788785.31 |

219.36 |

182.10 |

249.63 |

2.75 |

|

PPL629 |

662754.26 |

7788542.90 |

264.09 |

120.20 |

94.91 |

12.19 |

|

PPL672A |

662685.50 |

7788560.38 |

-0.63 |

50.80 |

142.28 |

10.21 |

|

PPL581 |

662767.80 |

7788471.71 |

106.88 |

200.50 |

73.11 |

36.16 |

|

PPL728 |

662637.75 |

7788787.33 |

221.16 |

161.10 |

304.94 |

34.49 |

|

PPL719 |

662638.21 |

7788784.59 |

218.11 |

116.95 |

238.42 |

-47.23 |

|

PPL703 |

662754.41 |

7788440.54 |

-11.15 |

141.85 |

130.95 |

-12.64 |

|

PPL705 |

662752.85 |

7788440.69 |

-10.09 |

77.25 |

150.17 |

15.40 |

|

PPL701 |

662753.78 |

7788440.57 |

-11.44 |

94.00 |

160.03 |

-27.30 |

|

PPL726 |

662602.58 |

7788349.66 |

32.68 |

330.95 |

90.39 |

-22.07 |

|

FSB892 |

662780.05 |

7788452.10 |

48.36 |

30.80 |

278.67 |

14.08 |

|

PPL750 |

662683.86 |

7788280.09 |

-51.79 |

221.65 |

54.69 |

-2.83 |

|

FSB968 |

662807.46 |

7788415.23 |

-26.33 |

46.80 |

228.06 |

14.65 |

|

FSB969 |

662823.91 |

7788412.13 |

-26.67 |

65.35 |

229.78 |

-14.74 |

|

PPL762 |

662684.22 |

7788277.87 |

-52.76 |

209.90 |

51.00 |

-35.47 |

|

PPL814 |

662639.02 |

7788497.87 |

-17.11 |

105.70 |

48.19 |

29.85 |

|

FSB971 |

662783.32 |

7788417.29 |

-28.04 |

55.45 |

182.86 |

-27.63 |

SOURCE: Jaguar Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/648658/Jaguar-Mining-Expands-Consolidated-Mineral-Resource-Mineral-Reserve-Growth-Potential