VANCOUVER, BC / ACCESSWIRE / August 26, 2021 / Mawson Gold Limited ("Mawson") or (the "Company") (TSX:MAW) (Frankfurt:MXR) (OTC PINK:MWSNF) is pleased to announce an independently verified update of the third constrained Inferred Mineral Resource estimate at its 100% owned Rajapalot project in Finland.

The estimate was completed by Qualified Persons from AFRY Finland Oy , a European leader in engineering, design, and advisory services. Mineral Resources are calculated using a long-term gold price of US$1,590/oz and a cobalt price of US$23.07/lb and using 0.3 g/t gold equivalent "AuEq" open pit cut-off and 1.1 g/t AuEq underground cut-off (Table 1). AuEq values were calculated using the following formula: AuEq g/t = Au g/t + (Co ppm/1005).

Key Points:

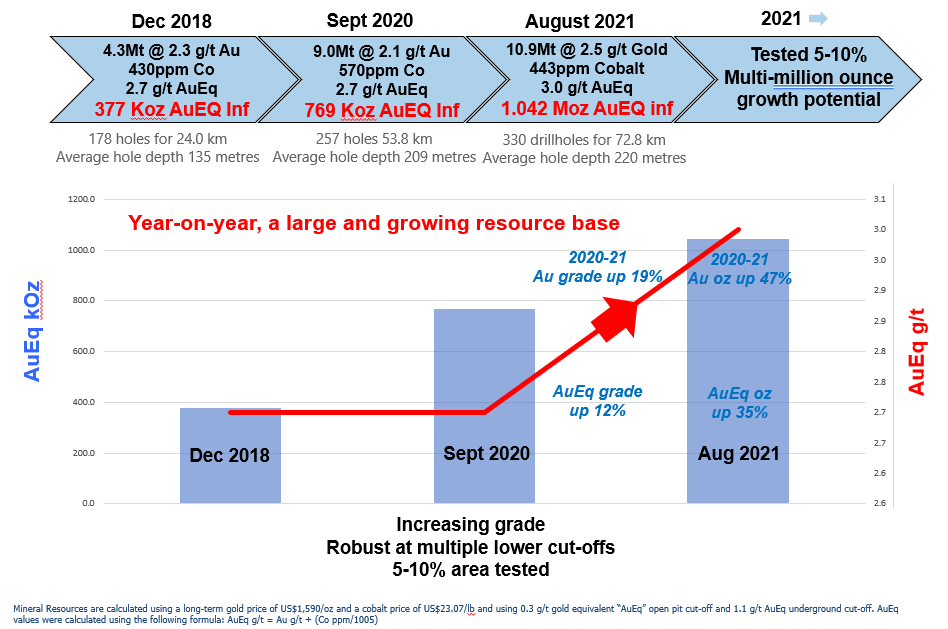

- Base case Mineral Resource estimate 10.91 Mt @ 3.0 g/t gold equivalent ("AuEq"), 2.5 g/t gold ("Au"), 443 ppm cobalt ("Co") for 887 koz Au, 4.8 kt Co equating to 1.04 Moz AuEq in the inferred category;

- Compared to the previous Rajapalot resource estimation published on September 14, 2020 (Figure 4):

- Gold grade increased by 19% (AuEq grade by 12%);

- Contained gold ounces increased by 47% (contained gold equivalent ounces by 35%);

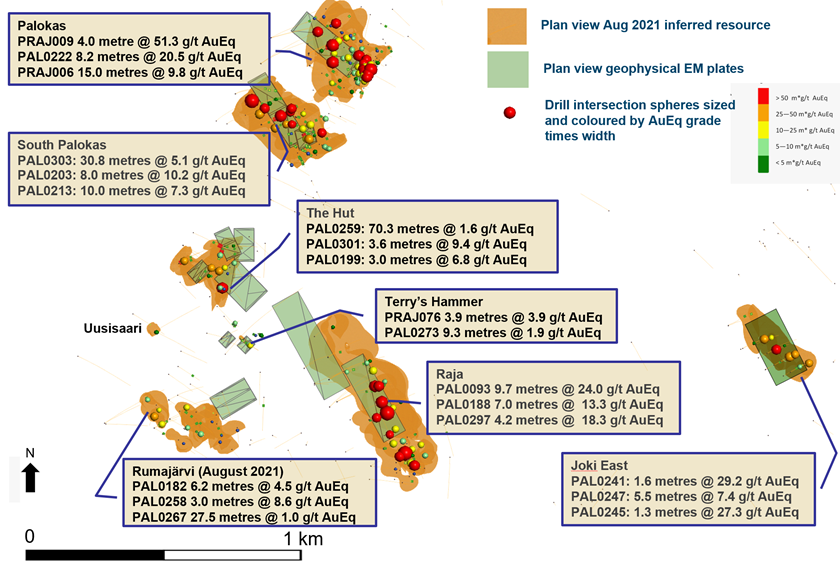

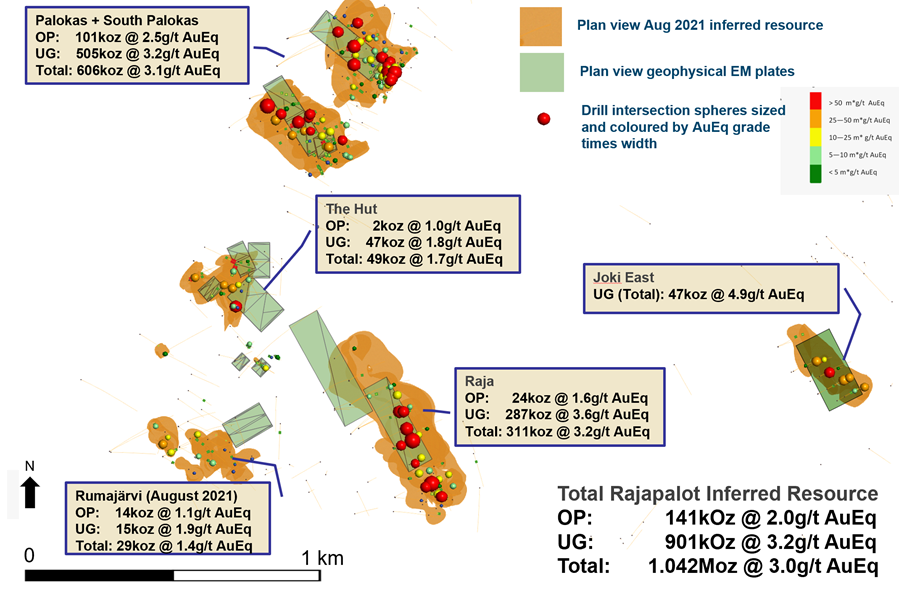

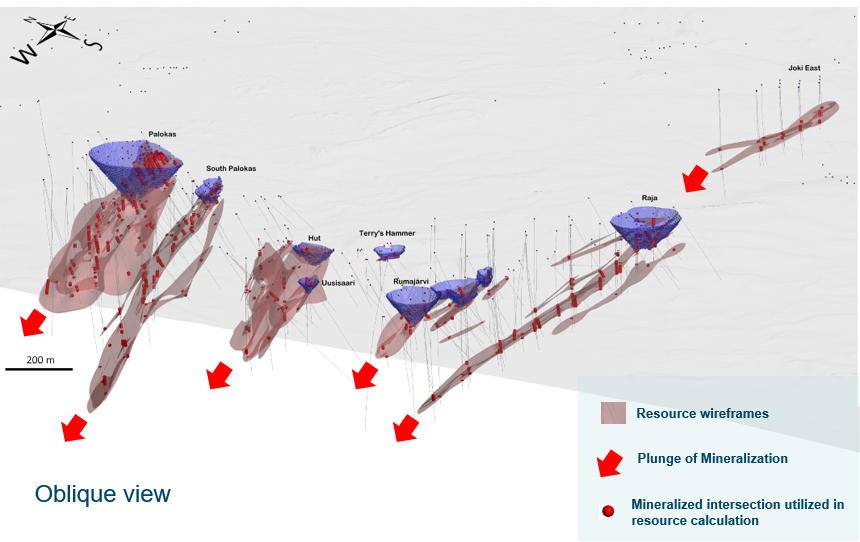

- Gold camp now comprises 8 distinct prospects, doubling the 4 previously contained in the 2020 Rajapalot Inferred Mineral Resource estimate (Figures 5 and 6);

- Substantial increases in existing resources demonstrate continuity within the deposits and expansion potential at depth and along strike (Figure 7):

- All resource areas remain open to depth and the Company has developed a strong geological and exploration model to target mineralization;

- Growth potential remains strong:

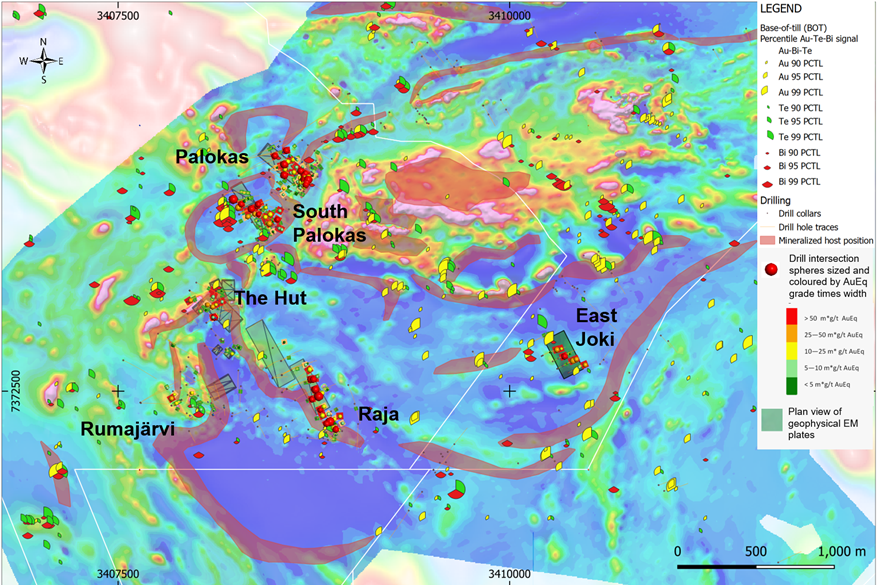

- Drilling covers only 20% of the mineralization-host package at Rajapalot (Figure 8);

- Rajapalot camp represents only 5% of 100 square kilometre Rompas-Rajapalot Finnish project area owned 100% by Mawson.

Mr. Hudson, Chairman and CEO, states, "Following a significant drilling effort, we are delighted to hit a milestone of 1.04 Moz AuEq, while delivering a year-on-year gold grade increase of 19% with contained gold up 47% from our last resource upgrade in 2020. Rarely does substantial resource growth come together with grade increases, and the robustness of Rajapalot at different cut-offs and constraining models is impressive. This year we doubled the number of prospects within the resource area, and our annual winter campaigns have been adding 300-400 koz AuEq resource growth in a predominant 10-week drilling window. We have developed a strong geological and exploration model to target high-grades, and excitingly it remains early days at Rajapalot with 80% of the target untested, which is just 5% of Mawson's larger 100 square kilometre Finnish project - all from a project that is one of the few in Finland that enjoys majority local support."

Table 1: Total Inferred Mineral Resources estimate as of August 26, 2021, at the listed cut-offs for constrained open pit and underground resources at Rajapalot.

Zone | Cut-off | Tonnes | Au | Co (ppm) | AuEq (g/t) | Au | Co (tonnes) | AuEq |

Palokas Pit | 0.3 | 1,228 | 2.2 | 382 | 2.5 | 85,513 | 469 | 100,511 |

Palokas UG | 1.1 | 4,878 | 2.7 | 501 | 3.2 | 427,797 | 2,443 | 505,941 |

Palokas total | 6,106 | 2.6 | 477 | 3.1 | 513,310 | 2,911 | 606,451 | |

Raja Pit | 0.3 | 485 | 1.3 | 289 | 1.6 | 19,722 | 140 | 24,206 |

Raja UG | 1.1 | 2,492 | 3.2 | 401 | 3.6 | 254,600 | 999 | 286,574 |

Raja total | 2,977 | 2.9 | 383 | 3.2 | 274,322 | 1,140 | 310,780 | |

East Joki (no pit) | ||||||||

East Joki UG | 1.1 | 299 | 4.5 | 363 | 4.9 | 43,378 | 109 | 46,859 |

East Joki total | 299 | 4.5 | 363 | 4.9 | 43,378 | 109 | 46,859 | |

Hut Pit | 0.3 | 61 | 0.1 | 874 | 1.0 | 214 | 54 | 1,928 |

Hut UG | 1.1 | 816 | 1.4 | 411 | 1.8 | 35,943 | 336 | 46,682 |

Hut total | 877 | 1.3 | 444 | 1.7 | 36,157 | 389 | 48,610 | |

Rumajärvi Pit | 0.3 | 401 | 0.6 | 496 | 1.1 | 8,107 | 199 | 14,467 |

Rumajärvi UG | 1.1 | 246 | 1.5 | 356 | 1.9 | 12,009 | 88 | 14,813 |

Rumajärvi total | 647 | 1.0 | 443 | 1.4 | 20,116 | 286 | 29,279 | |

Total Pit | 0.3 | 2,175 | 1.6 | 396 | 2.0 | 113,556 | 861 | 141,112 |

Total UG | 1.1 | 8,732 | 2.7 | 455 | 3.2 | 773,728 | 3,974 | 900,868 |

Total | 10,907 | 2.5 | 443 | 3.0 | 887,284 | 4,836 | 1,041,980 |

CIM Definition Standards (2014) were used for Mineral Resource classifications. AuEq=Au+Co/1,005 based on assumed prices of Co US$23.07/lb and Au US$1,590/oz. Rounding of grades and tonnes may introduce apparent errors in averages and contained metals. Drilling results to 20 June 2021. These are Mineral Resources that are not Mineral Reserves and do not have demonstrated economic viability.

Resource Methodology

- Mineral Resource estimation reporting follows the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards (2014) for mineral resources and reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101;

- Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers;

- Constrained Resources are presented undiluted and in-situ and are considered to have reasonable prospects for eventual economic extraction. The Qualified Person considers that the reported Mineral Resource has reasonable prospects for eventual economic extraction by the open pit and underground mining method at the specified cut-off grades. An assessment of whether the project as a whole is economically viable has not been made under this analysis. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Whittle software (version 4.7.3) was used in the optimization on Palokas, South Palokas, Raja, Hut, Rumajärvi, Uusisaari, Terry's Hammer and Joki prospect wireframes to define the mineralization falling within the confines of an open pit (demonstrating reasonable prospects for eventual economic extraction, "RPEEE"). Five block models were created covering the eight prospects. Mineralization falling outside the pits above the cut-off grade of 1.1 g/t AuEq was then defined as underground resources with RPEEE.

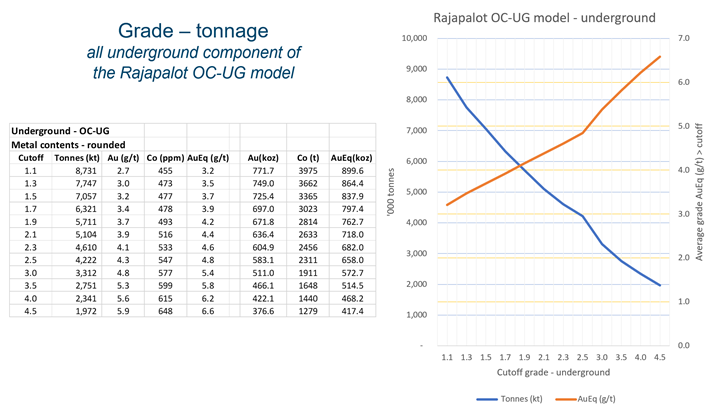

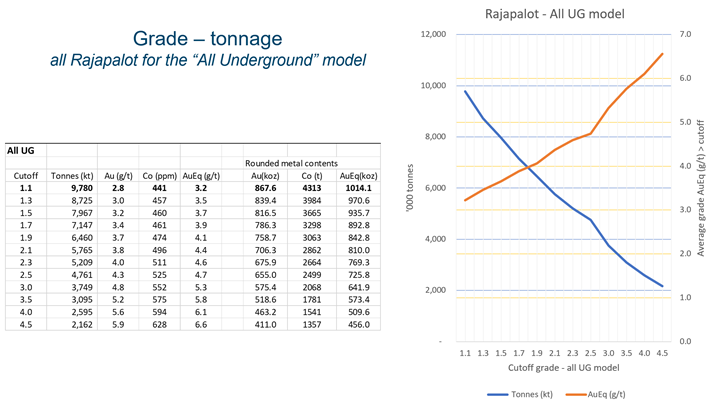

- Optimized open pit constrained resources are reported at a cut-off grade of 0.3 g/t AuEq. Underground resources are reported at a cut-off grade of 1.1 g/t AuEq (Figures 1-3). The cut-off grades used for reporting were based on up to date third party metal price research, forecasting of long-term gold and cobalt prices, and a cost structure from benching marking Finnish mining, metallurgical and G&A operational costs. Costs include mining, processing and general and administration ("G&A"). Net Smelter Return ("NSR") includes metallurgical recoveries and selling costs inclusive government royalties. Gold equivalent "AuEq" = Au+(Co/1005) based on assumed prices of cobalt US$23.07/lb and gold US$1,590/oz.

The optimization process was conducted considering three scenarios:

- The first using Whittle optimization for a pit of Revenue Factor 1 (Rev-F-1);

- The second optimization utilised the changeover from open cut (OC) to underground (UG) based on the estimated differential operating expenses of OC and UG (model termed OC-UG or "base case");

- The third was an underground scenario where a depth of 20 metres below the top of solid rock was regarded as the near-surface limit of potential mining (UG only).

These three scenarios were developed to allow consideration of reasonable prospects for eventual economic extraction (RPEEE). Without further consideration of economic viability, the second optimization (OC-UG) is regarded as the most reasonable. The Pit Optimization section provides details of the three scenarios considered.

Table 2: Grade/tonnage relationships for alternate constraining models for Rajapalot

Model | Tonnes (kt) | Au (g/t) | Co (ppm) | AuEq (g/t) | AuEq (oz) |

RF= 1 Whittle | 13,395 | 2.1 | 423 | 2.5 | 1,094,125 |

Base Case | 10,907 | 2.5 | 443 | 3.0 | 1,041,980 |

All UG | 9,780 | 2.8 | 441 | 3.2 | 1,004,732 |

- A gold top cut of 50 g/t Au was used for the gold domains. A cobalt top cut was not applied.

- Bulk density values were calculated for each block within the wireframes based on 3,345 density measurements (linear relationship of iron oxide to density was used to make an Ordinary Kriged estimate of density for each wireframe).

- Wireframe models were generated using gold and cobalt shells separately. Forty-eight separate gold and cobalt wireframes were constructed in Leapfrog Geo and grade distributions independently estimated using Ordinary Kriging in Leapfrog Edge.

- Sub-block triggers in each case were created using the gold and cobalt wireframes, the base of till and lidar surface wireframes were also used to control the density model for "air" and till blocks (till density is set to 2 t/m 3 . Parent blocks were used in all cases for grade estimation. A range of parent block sizes was tested with an optimal 12 m x 12 m x 4 m size determined (>20% of the drill hole spacing) as suitable. Sub-blocking down to 4 m x 4 m x 0.5 m was optimal for geologic control on volumes, thinner and moderately dipping wireframes (testing of options up to the parent block size showed less than 5% overall variation in the Mineral Resource estimate).

For creation of the SMU model for pit optimization, the sub-block model was copied and controlled to regular 5 m x 5 m x 2.5 m blocks. There was less than 0.5% difference in the total Mineral Resource estimate created during the change to regularized blocks.

- AFRY created the Rajapalot Mineral Resource estimate using the drill results available to 20June 2021.

- Additional metals were estimated using ordinary kriging in the resource base case. The average contents of these metals were arsenic (234 ppm), copper (198 ppm), iron oxide (11.0%), nickel (108 ppm), sulphur (2.2%), uranium (31 ppm) and tungsten (100 ppm). From a resource efficiency point of view, it appears that only gold (2.5 g/t) and cobalt (443 ppm) have the potential to be extracted economically, considering the low background values of the other metals. Certain environmental opportunities potentially exist to extract and capture some of the other metals to produce a cleaner tailings product.

A National Instrument 43-101 Technical Report will be filed on SEDAR shortly.

About the Rajapalot Project

Diamond Drilling

Mawson completed 76 holes for 19,422 metres during the 2020/21 winter drill season. At the completion of the 2020/21 winter drill program a total of 544 drillholes for 84,507 metres had been drilled at the Rajapalot project with an average depth of 155 metres. Key results from the program are outlined below. The 100% owned gold-cobalt Rajapalot discovery hosts numerous hydrothermal gold-cobalt prospects drilled between 2013 and April 2020 within a 3 by 4-kilometre area. A total of 76,155 drilling metres (90% of total) has been completed since 2017. A total of 330 holes for 72.8 kilometres and an average depth of 250 metres were used in the upgraded August 2021 resource estimation. In comparison, a total of 257 holes for 53.8 km and an average depth of 209 metres were used the upgraded September 2020 resource estimation and a total of 178 holes for 24.0 km with an average depth of 135 metres were used within the December 2018 maiden resource estimation.

Geology

The host sequence comprises a polydeformed, isoclinally folded package of amphibolite facies metamorphosed Paleoproterozoic supracrustal rocks of the Peräpohja belt. The Paleoproterozoic of northern Finland is highly prospective for gold and cobalt, and include the Europe's largest gold mine, Kittilä, operated by Agnico Eagle Finland Oy.

Stratabound gold-cobalt mineralization occurs near the boundary of the Kivalo and Paakkola groups with two contrasting host rocks, either iron-magnesium or potassic-iron types. Multi-stage development of the mineralization is evident, with early-formed cobalt and a post-tectonic hydrothermal gold event.

Prospects with high-grade gold and cobalt at Rajapalot occur across 3 km (east-west) by 2 km (north-south) area within the larger Rajapalot project exploration area measuring 4 km by 4 km with multiple mineralized boulders, base-of-till (BOT) and rare outcrops. High-grade Au-Co mineralization at Rajapalot has been drilled to 540 metres deep at Raja and South Palokas prospects, but is not closed out at depth in any prospect. The only surface exposure of mineralization is at Palokas, however except for East Joki, all mineralization comes to the top of the bedrock below the till, less than 6 metres below the surface. East Joki is 110 metres from the surface at its shallowest, but is not drilled yet in the up-dip direction.

Mawson's primary target type across the whole Rajapalot-Rompas area is the disseminated Au-Co style, with Mawson's geological team in Finland devoted to uncovering more prospects based on their increased understanding of the host sequence.

Two distinct styles of gold mineralization dominate the Rajapalot area. The first, is a variably sulphidic magnesian-iron host, previously referred to internally as "Palokas" style. The magnesian-iron host is most likely an ultramafic volcanic (komatiitic) and occurs within approximately 100 vertical metres of the inferred Kivalo-Paakkola boundary (that is, near the incoming of pelites, calc-pelites and quartz muscovite rocks). A largely retrograde mineral alteration assemblage includes chlorite, Fe-Mg amphiboles (anthophyllite and cummingtonite series), tourmaline and pyrrhotite commonly associated with quartz-veining. Subordinate almandine garnet, magnetite and pyrite occur with bismuth tellurides, scheelite, ilmenite and gold, cobalt pentlandite and cobaltite. Metallurgical testing at Palokas reveals the gold to be non-refractory and 95% pure (with minor Ag and Cu) with excellent recoveries by gravitational circuit with conventional cyanidation and/or flotation. QEMSCAN studies also show that the gold occurs as native grains, found both on grain boundaries and within minerals. Detailed work by Jukka Pekka Ranta of the University of Oulu (plus co-workers) on fluid inclusions and the host rocks to the Fe-Mg mineralization at Palokas indicates weakly saline, methane-bearing fluids at depths as shallow as 5 km and temperatures of approximately 250 degrees were responsible for deposition of the gold.

The second style of gold-cobalt mineralization at Rajapalot, a potassic-iron (K-Fe) style (formerly referred to internally as "Rumajärvi" type) is characteristically associated with muscovite and / or biotite and chlorite in a diverse range of fabrics. Gold grades of more than 1 g/t Au are associated with pyrrhotite and contained within muscovite-biotite schists, muscovite and biotite‑bearing albitic granofels and brecciated, variably micaceous albitic rocks. Magnetite is a common mineral, but not a necessity for anomalous gold grades. The host rocks are grey to white owing to their reduced nature and may be enclosed by light pink to red calcsilicate-bearing albitites. To date, the K-Fe gold-cobalt mineralization style has been intersected near the muscovite-bearing quartzite at Raja and Rumajärvi, but as other rock types are also mineralized and the clear strong structural control on grade, stratigraphic constraints may locally not be relevant.

Exploration for Palokas and Rumajärvi style gold prospects is not restricted to the Rajapalot area. Recognition of the host stratigraphic package (near the boundary of the Kivalo-Paakkola Group boundary) enclosing the 6 km long vein-hosted Rompas Au-U system increases the search space for the pyrrhotite-Au-Co systems to cover Mawson's full permit area. The geochemical characteristics of the ultramafic volcanics and related intrusives are not only present in the southern drill section at South Rompas but have more than 50 km of strike length in Rompas-Rajapalot. It is the interaction of this reactive rock package with late gold-bearing hydrothermal systems driven by ca. 1.8 Ga granitoids, that now form the most highly prospective targets away from the Rajapalot area. The cobalt component of the system is largely stratabound and formed much earlier, most likely from oxidized saline basinal fluids interacting with reduced strata.

Metallurgy

Preliminary metallurgical testing on drill core from the Rajapalot prospect demonstrate excellent gold extraction results of between 95% and 99% (average 97%) by a combination of gravity separation and conventional cyanidation and or/flotation. Metallurgical test work indicates gold recovery and processing are potentially amenable to conventional industry standards with a viable flowsheet which could include crushing and grinding, gravity recovery, and cyanide leaching with gold recovery via a carbon-in-pulp circuit for production of onsite gold doré. Further metallurgical test work is currently underway, with Mawson a participant of Finland's BATCircle consortium, a program designed to value-add to the Finnish battery metals circular economy. Initial indications suggest the cobalt minerals present (cobaltite and linnaeite) can float or be separated by magnetic separation methods.

Strategic Cobalt

Rajapalot is a significant and strategic gold-cobalt resource and one of Finland's largest gold resources by grade and contained ounces and one of a small group of cobalt resources prepared in accordance with NI 43-101 policy within Europe. Finland refines half the world's cobalt outside China. The world's largest cobalt refinery is located 400 kilometres south of Rajapalot, where CRU estimates annual refining of 22,734 tonnes of cobalt (approximately 18% of world refined cobalt production), 90% of which was sourced from Chinese-owned mines in the Democratic Republic of Congo. Finland mines only 650 tonnes or 0.5% of the world's cobalt per year. The Rajapalot resource has the potential to support Finland's desire to source ethical and sustainable cobalt.

ESG

Mawson acknowledges that Environmental, Social and Governance ("ESG") forms a comprehensive framework for our Company to successfully navigate and balance the benefits of our projects to the planet, people and profit. Mawson has had an active ESG program operating for many years, and we are constantly developing and adding to it as our projects grow and develop.

Mawson appreciates the overwhelmingly strong support it receives from local stakeholders in Finland. The Ylitornio municipality, which hosts the Rajapalot project, is a sparsely populated area with a decreasing population. The Rajapalot project could create many opportunities for both the current population and those in the future who settle within the area.

During late 2020, Mawson Oy, Mawson's 100%-owned subsidiary in Finland, requested the Lapland Centre for Economic Development, Transport and the Environment ("ELY") to arrange a preliminary consultation in accordance with section 8 of the Environmental Impact Assessment ("EIA") Procedure Act. The EIA procedure identifies, assesses, and describes the significant environmental effects of a project and subsequently allows Mawson to consult with the authorities and those whose conditions or interests may be affected by the project. The EIA procedure is not a permit procedure, but provides information on the environmental effects of a project that will subsequently be taken into account by official authorities during mine permitting. Mawson has also proposed to the regional municipality of Ylitornio and the city of Rovaniemi that these bodies request the Regional Lapland Council ("Lapin Liitto") to initiate regional land use planning for the Rajapalot project.

In combination with the EIA, the two municipal areas where the Rajapalot gold-cobalt project is located, the City of Rovaniemi and Municipality of Ylitornio, at the request of Mawson, have formally decided to start the sub-area Local Master land use planning processes. Both municipalities have made decisions to propose to the Regional Council of Lapland (" Lapin Liitto ") to start the phased provincial land use plan for the Rajapalot gold-cobalt project.

Technical Background

Qualified Persons - Mineral Resources: The Mineral Resources disclosed in this press release have been estimated by Eemeli Rantala, AFRY - P.Geo, Ville-Matti Seppä, AFRY - EurGeol of Finland and the metallurgical sections by Craig Brown, Mining Associates P/L - FAusIMM of Australia . All authors are independent "qualified persons" as defined by NI 43-101. The NI 43-101 technical report is entitled "Mineral Resource Estimate NI 43-101 Technical Report - Rajapalot Property". By virtue of their education and relevant experience, all authors are "Qualified Persons" for the purpose of National Instrument 43-101. The Mineral Resources have been classified in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014). All authors have read and approved the contents of this news release as it pertains to the disclosed Mineral Resource estimates. The Qualified Person, Dr Nick Cook, Mawson's Chief Geologist, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

About Mawson Gold Limited (TSX:MAW, FRANKFURT:MXR, PINKSHEETS:MWSNF)

Mawson Gold Limited is a gold exploration and development company and has distinguished itself as a leading exploration company with a focus on the flagship Rajapalot gold-cobalt project in Finland and its Victorian gold properties in Australia.

On behalf of the Board, "Michael Hudson" | Further Information |

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable Canadian securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements and are based upon various estimates and assumptions including, without limitation, the expectations and beliefs of management, including that the Company can access financing, appropriate equipment and sufficient labor. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to: capital and other costs varying significantly from estimates; changes in world metal markets; changes in equity markets; ability to achieve goals; that the political environment in which the Company operates will continue to support the development and operation of mining projects; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; risks related to negative publicity with respect to the Company or the mining industry in general; reliance on a single asset; planned drill programs and results varying from expectations; unexpected geological conditions; local community relations; dealings with non-governmental organizations; delays in operations due to permit grants; environmental and safety risks; and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Mawson, in light of management's experience and perception of current conditions and expected developments, Mawson can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Figure 1: Grade/tonnage relationships at different AuEq g/t cut-off grades for the combined open pit portion of the Rajapalot constrained base case ("OC-UG") inferred resource

Figure 2: Grade/tonnage relationships at different AuEq g/t cut-off grades for the combined underground portion of the Rajapalot constrained base case ("OC-UG") inferred resource

Figure 3: Grade/tonnage relationships at different AuEq g/t cut-off grades for the Rajapalot underground only ("All Underground") inferred constrained resource. This is not the base case.

Figure 4: Resource growth at Rajapalot, highlighting August 2021 grade increase

Figure 5: Plan view of resource wireframes and EM geophysical plates with drill intersections coloured by grade times width with key drill results. Note a strong correlation of the resource block model wireframe and electromagnetic conductors that extend each target area to at least 800-1,000 metres down-plunge and provide a large upside footprint for increasing the resources in future drill campaigns.

Figure 6: Plan view of resource wireframes and EM geophysical plates with drill intersections coloured by grade times width with summarized resource number by prospect area. Note a strong correlation of the resource block model wireframe and electromagnetic conductors that extend each target area to at least 800-1,000 metres down-plunge and provide a large upside footprint for increasing the resources in future drill campaigns.

Figure 7: Oblique view towards northeast of Rajapalot project with the OC-UG model pits in light blue along with the semi-transparent Lidar surface, drill traces, and mineralized intersections and wireframes. All resource areas remain open to depth and the Company has developed a strong geological and exploration model to target mineralization.

Figure 8: Plan view showing growth potential remains strong in the Rajapalot gold camp. Approximately 80% of the Rajapalot area, or 20 kilometres of mineralization-host package remains untested by drilling. Rajapalot forms a smaller part of Mawson's larger 100 square kilometre Rompas-Rajapalot Finnish permit area owned 100% by Mawson.

SOURCE: Mawson Gold Limited

View source version on accesswire.com:

https://www.accesswire.com/661460/Mawson-Announces-Over-1-Million-Ounces-Gold-Equivalent-at-Rajapalot-Finland-Gold-Ounces-Up-47-Gold-Grade-Up-19