VANCOUVER, BC / ACCESSWIRE / March 15, 2022 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) ("Granite Creek" or the "Company") is pleased to announce an updated mineral resource estimate (the "2022 Resource Estimate") for the Company's 100%-owned Carmacks copper-gold-silver deposit ("Carmacks" or the "Deposit") located in the Minto Copper District of central Yukon, Canada. The 2022 Resource Estimate represents a major increase in tonnage and contained metal at Carmacks compared to the previous resource estimate1,2, with over 8,200 m of infill and expansion drilling in 25 holes completed by Granite Creek since its acquisition in 2020. The project remains open to significant expansion within the resource area and to new discovery at the underexplored, yet highly prospective, Carmacks North target area.

Highlights

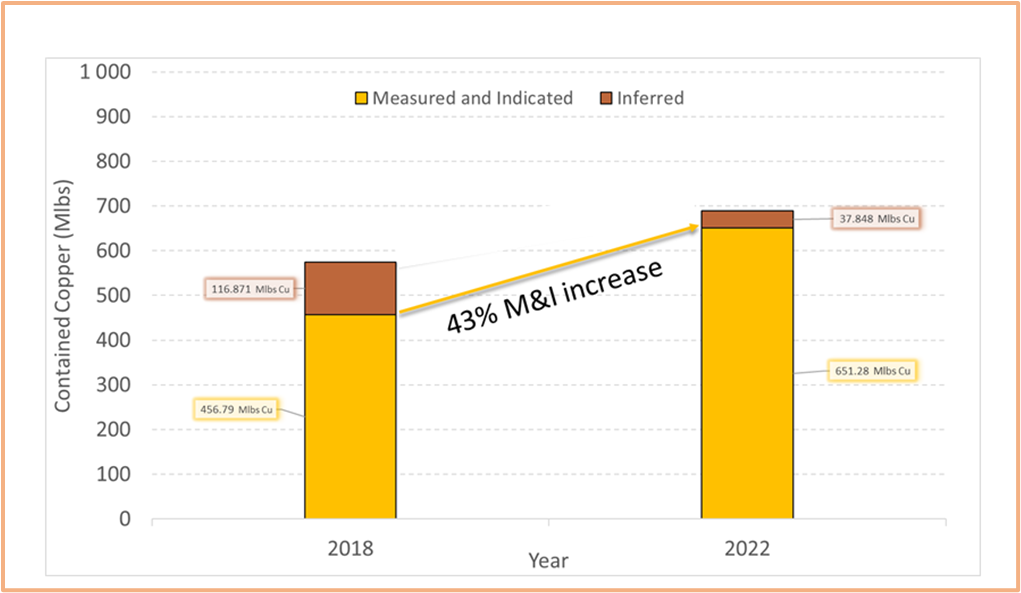

- 43% Increase in Contained Copper - The high grade Carmacks deposit now hosts 36.2 million tonnes (Mt) in Measured and Indicated categories (M&I), grading 1.07% CuEq (0.81% Cu, 0.26g/t Au, 3.23g/t Ag and 0.011% Mo) for a total of 651 million pounds (Mlbs) of contained M&I copper and an additional 38 Mlbs Cu Inferred (see table 1). The previous resource estimate published in 2018 defined 25.0 Mt M&I, grading 0.83% Cu, equating to 457 Mlbs of contained copper. (Figure1)

- Expansion of Gold and Silver Resources - Contained gold (M&I) increased 24% from 243,000 ounces to 302,000 ounces and contained silver (M&I) increased 41% from 2,684,000 ounces to 3,790,000 ounces.

- Addition of Molybdenum Resources - For the first time, molybdenum has been included in the resource estimate, with 8.5 Mlbs lbs in M&I.

- 93% of Resources in the M&I Categories - Only 7% of the 2022 resource remains in the Inferred category.

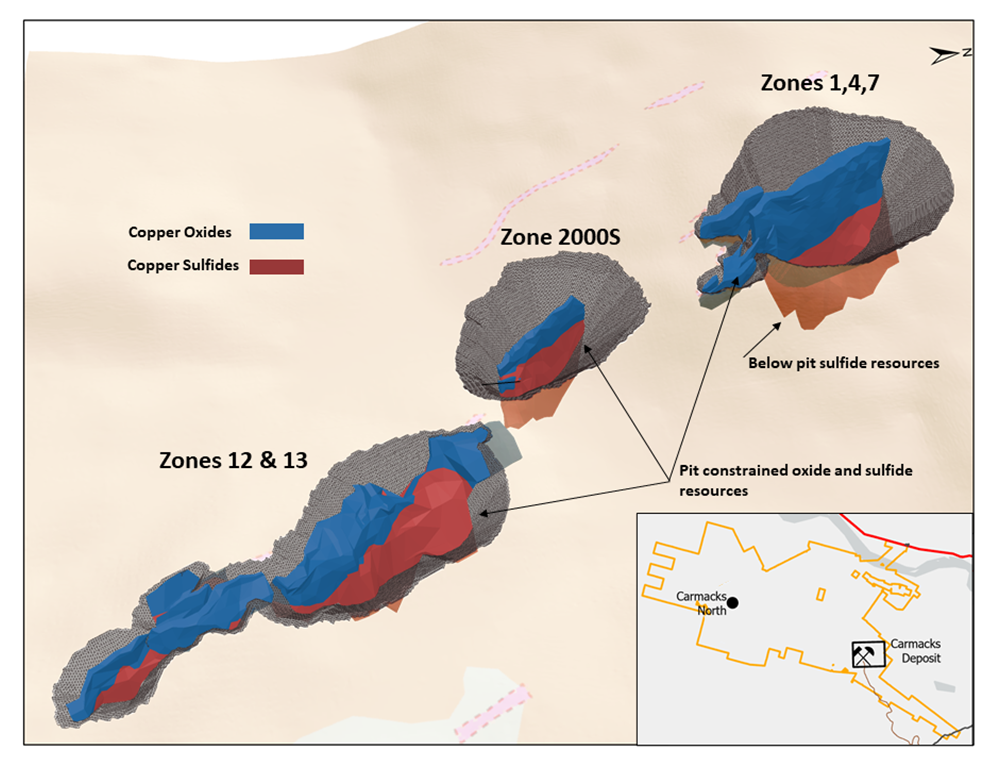

- High Proportion of Resources Modeled in Three Conceptual Open Pits - 96% of the 2022 resources are contained within the conceptual pits. (Figure 2)

- High Grade Copper-Gold in a Producing District - The 2022 Resource Estimate continues to advance the Carmacks project as one of the highest-grade resource-stage copper projects in North America.

Timothy Johnson, Granite Creek President & CEO, stated, "Since completing the acquisition the Carmacks deposit in November 2020, the Company has been successful in significantly growing copper, gold and silver resources through highly targeted drilling in 2020 and 2021. Our conceptual deposit model held up extremely well, with significant mineralized intercepts encountered in 22 of the 25 holes we drilled. The mineral resources contained within the conceptual pits will form the basis for an updated Preliminary Economic Assessment ("PEA") which the Company intends to initiate immediately. This study will assess the economics of processing both oxide and sulphide material as well as by product credits including gold, silver and molybdenum."

"From an exploration perspective, there remains the opportunity continue increasing copper resources by continued step out drilling on existing zones, adding to this resource. There is also high potential for discovery of new zones by applying the Company's increased understanding of the geological controls of mineralization and we remain committed to adding to this mineral inventory through continued exploration. "

Live Webinar

Granite Creek Copper will be hosting a live webinar on Thursday, March 17 at 10am PT (1pm ET), during which President & CEO, Timothy Johnson will be joined by Project Geologist, Dr Jacob Longridge, for a comprehensive update on the Company's Carmacks copper-gold silver project, including Q&A.

To register, click here.

Figure 1 - Increase in Contained Copper

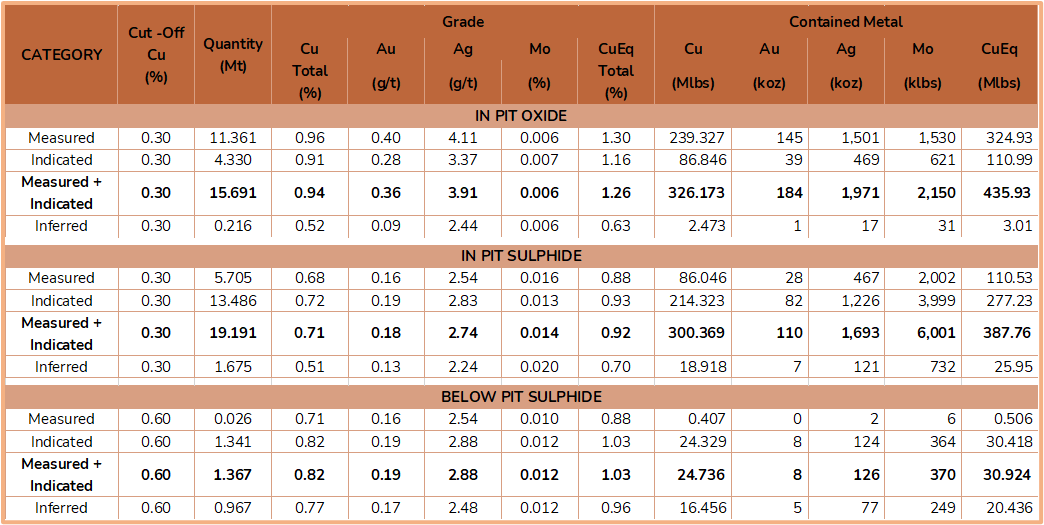

Table 1 - 2022 Carmacks Copper Project Mineral Resources

Cu=copper, Au=gold, Mo=molybdenum, Ag=silver, Mt=millions of tonnes, Mlbs=millions of pounds, klbs=thousands of pounds, koz=thousands of ounces. Mineral Resources are reported using the 2014 CIM Definition Standards. Mineral Resources are reported within a conceptual constraining pit shell that includes the following input parameters: Metal prices of $3.60/lb Cu, $1,750/Au, $22/oz Ag, $14/lb Mo and pit slope angles that vary from 35° for overburden to 55°for granodiorite host, metal prices are in US$. Metallurgical recoveries reflective of prior test work that averages: 85% Cu, 85% Au, 65% Ag in the oxide domain and 90% Cu, 76% Au, 65% Ag in the sulphide domain. Mo recovery is assumed to be 70% in both oxide and sulphide domain. Tonnes are metric tonnes, with Cu and Mo grades as percentages and Au and Ag grades as gram per tonne units. Cu and Mo metal content is reported in lb and Au and Ag content is reported in troy oz. Totals and Metal content may not sum due to rounding and significant digits used in calculations. Cu Eq calculation is based on 100% recovery of all metals using the same metal prices used in the resource calculation: $3.60/lb Cu, $1,750/Au, $22/oz Ag, $14/lb Mo.

Grade Sensitivity

A copper and copper equivalent grade sensitivity analysis for both oxide and sulphide resources contained in the proposed pits is provided in Table 2 below, which demonstrates the variation in grade and tonnage in the deposit at these various cut-off grades. This sensitivity analysis is reflective of the discrete nature of the mineralized bodies. Comparing the cut-off grade of 0.30% Cu with a 0.25% Cu and a 0.35% Cu cut-off, show a <3% variation in contained copper and a ~5% variation in the tonnage.

Table 2 - Grade Sensitivity Table

Mineralization

Mineralization is constrained to discrete tabular bodies of schistose to gneissic metamorphic rock. These tabular bodies are enveloped in granodiorite that dominates the majority of the Carmacks project. The contact between these tabular metamorphic bodies and granodiorite is sharp, with little to no gradation between these units. This sharp contact creates a very distinct geochemical and geophysical pattern between the two rock types assisting in exploration vectoring.

Upon acquiring the Carmacks Deposit in 2020, Granite Creek immediately recognized the potential of the relatively untested sulphide portion that may significantly alter the scope and scale of the deposit. This conceptual understanding has been validated with the sulphide resources now roughly equal in size to the oxide resources and provides the case for an updated PEA, which will evaluate the economics of both the oxide and the sulphide portions of the resource.

Copper mineralization in the oxide domain is primarily malachite and azurite with copper sulphides accounting for up to 20% of the copper tenor in the form of chalcopyrite. A surface representing the boundary between the upper oxide and lower sulphide mineralization was interpolated based on drill hole intersections. The depth of transition between oxide to sulphide is variable in each zone. The boundary between the oxide and sulphide is defined by the solubility of copper in sulphuric acid, when >20% of total copper total tenor is soluble in sulphuric acid, the domain is classified as a copper oxide domain. Conversely, the sulphide domain is defined where <20% of the total copper is soluble in sulphuric acid, as per the previous resource. The previously defined ‘transitional zone' is largely re-classified as part of the sulphide domain. The copper in the upper 200m of zone 1, is oxidized, whereas in zones 13 and 12, the oxidized zone can be as thin as 40m, zones 4 and 7 are primarily oxide (Figure 2). The copper sulphides in the sulphide domain consist primarily of course grained chalcopyrite, bornite and minor chalcocite and covellite.

Previous metallurgical testing has shown that the oxide copper is very amenable to leach extraction with recoveries of greater than 85% New metallurgical results from 2021 test work showed that a ~67% liberation of copper sulphide minerals is possible at 154um P80 primary grind, considering most two-product copper concentrations operate with 50-60% liberation in floatation feed, this is considered excellent and possibly coarser grinds may be sufficient in liberating copper. Flotation testing showed a 25% copper concentrate grade could be produced with recoveries of up to 95% of copper and 85% for gold, with gold reporting closely to the copper. Continuing metallurgical test work will include determining recoveries for silver and molybdenum as well as additional testing to confirm the copper and gold recoveries.

Figure 2 Oblique view of 2022 resources and proposed pits (total strike length of 2,950 m )

Estimation Methodology and Parameters

The classification of the current Mineral Resource Estimates into Measured, Indicated and Inferred are consistent with current 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves. All figures are rounded to reflect the relative accuracy of the estimate.

Completion of the 2022 Resource Estimate involved the assessment of a drill hole database, which included all data for surface drilling completed through the fall of 2021, as well as 3D mineral resource models, and available written reports. SGS used 489 surface drillholes and 56,679 meters of drill data from 1970 to 2021 to delineate three deposits (zones 147 combined, zone 2000S and zones 12 and 13 combined) in the 2022 resource estimate. Thirty-six holes (RC and diamond) totalling 9,413m completed by Granite Creek between October 2020 and October 2021 are included.

Composites of 2.0 metre used for the resource estimation procedure have been capped where appropriate. Grades for Cu (oxide, sulphide and total), Ag, Au and Mo for each deposit were interpolated into blocks 5m by 5m by 5m by the Inverse Distance Squared (ID2) calculation method. Appropriate interpolation parameters were generated for each deposit based on drill hole spacing, mineralization style and geometry.

All Resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction. It is envisioned that parts of the Carmacks Project deposits may be mined using open pit mining methods. In- pit mineral resources are reported at a base-case cut-off grade of 0.30 % total copper("Cu_T") within conceptual pit shells. A pit slope of 55 degrees for rock and 35 degrees for overburden are used for the pit optimization. It is envisioned that parts of the Carmacks Project deposits may be mined using lower cost underground bulk mining methods. A selected base-case cut-off grade of 0.6 % Cu_T is used to determine the below pit resources.

Cut-off grades are based on metal prices of $3.60/lb Cu, $22.00/oz Ag, $1,750/oz Au and $14.00/lb for Mo, processing and G&A cost of $US23.00 per tonne milled, and variable mining costs including $US2.10 for open pit and $US25.00 for underground. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, mining costs, processing costs etc.).

Metal recoveries used for pit optimization and calculation of base-case cut-off grades include: for oxide material 85% for copper, 65% for Ag, 85% for Au and 70% for Mo; for sulphide material, 90% for copper, 65% for Ag, 76% for Au and 70% for Mo. Fixed specific gravity values of 2.64 for oxide material and 2.71 - 2.78 (depending on deposit) were used to estimate the Mineral Resource tonnage from block model volumes. Waste in all areas was given a fixed density of 2.66.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. The results from the pit optimization are used solely for the purpose of testing the "reasonable prospects for economic extraction" by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Carmacks Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade.

Quality Control and Quality Assurance

Quality assurance and quality control procedures for drilling completed by the Company and consultants to the Company include the systematic insertion of duplicate, blank and standard samples, making up 12% of the sample stream. Drill core samples were sawn in half, labelled, placed in sealed bags and shipped directly to the Bureau Veritas preparation laboratory in Whitehorse. All geochemical analyses were performed by Bureau Veritas in Vancouver. Copper, molybdenum and silver analysis was performed by four-acid digestion with an ICP-ES finish. Non-sulphide copper was determined through a sulphuric acid leach with an AAS finish. Gold was analyzed by igniting a 15 g sample followed by an aqua regia digestion with an ICP-MS finish.

Qualified Persons

The Carmacks project 2022 Resource Estimate was prepared by Allan Armitage, P.Geo., of SGS Geological Services, an independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") with an effective date of February 25, 2022. Armitage conducted a site visit to the property on November 9, 2021.

Ms. Debbie James, P.Geo., a qualified person for the purposes of National Instrument 43-101, has reviewed and approved the technical disclosure not pertaining to the resource estimate contained in this news release. Ms. James is a Senior Geologist with TruePoint Exploration and a Project Manager at Carmacks.

[1]PEA: "NI 43-101 Preliminary Economic Assessment Technical Report on the Carmacks Project, Yukon, Canada" Effective Date 12 October 2016. Report Date: 25 November 2016. SEDAR Filing Date: 9 February 2017

[2]News Release: "Copper North Expands Oxide Mineral resources at Carmacks" Published on SEDAR 9 April 2018.

About Granite Creek Copper

Granite Creek, a member of the Metallic Group of Companies, is a Canadian exploration company focused on the 176 square kilometer Carmacks project in the Minto copper district of Canada's Yukon Territory. The project is on trend with the high-grade Minto copper-gold mine, operated by Minto Metals Corp., to the north, and features excellent access to infrastructure with the nearby paved Yukon Highway 2, along with grid power within 12 km. More information about Granite Creek Copper can be viewed on the Company's website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll-Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Twitter: @yukoncopper

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View source version on accesswire.com:

https://www.accesswire.com/693022/Granite-Creek-Copper-Announces-Updated-NI-43-101-Mineral-Resource-Estimate-for-High-Grade-Carmacks-Copper-Gold-Silver-Project-in-Yukon-Canada-Highlighted-by-43-Increase-in-Measured-and-Indicated-Contained-Copper