- Mace set to launch new, innovative product called CHAMELEON

- Mace branded bear spray sales up 103% over 4Q 2020 and 271% over full-year 2020

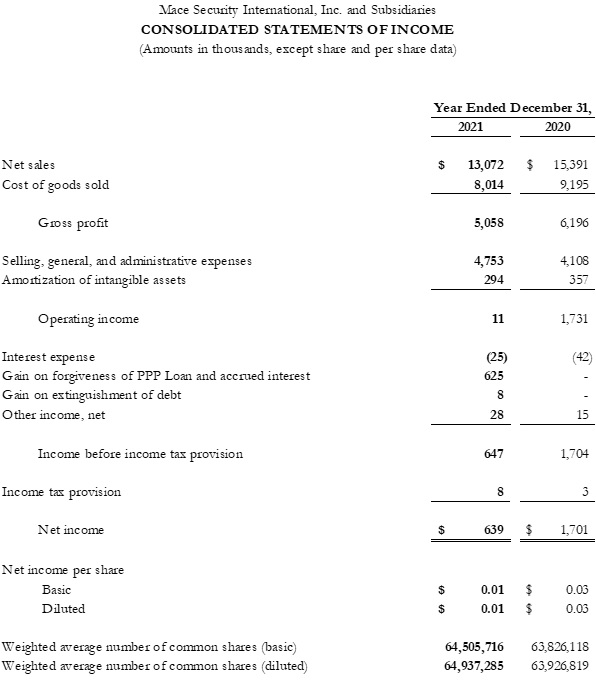

- 4Q 2021 net sales were $2,553,000, down $1,858,000, or 42%, compared to 4Q20 which was favorably impacted by social unrest

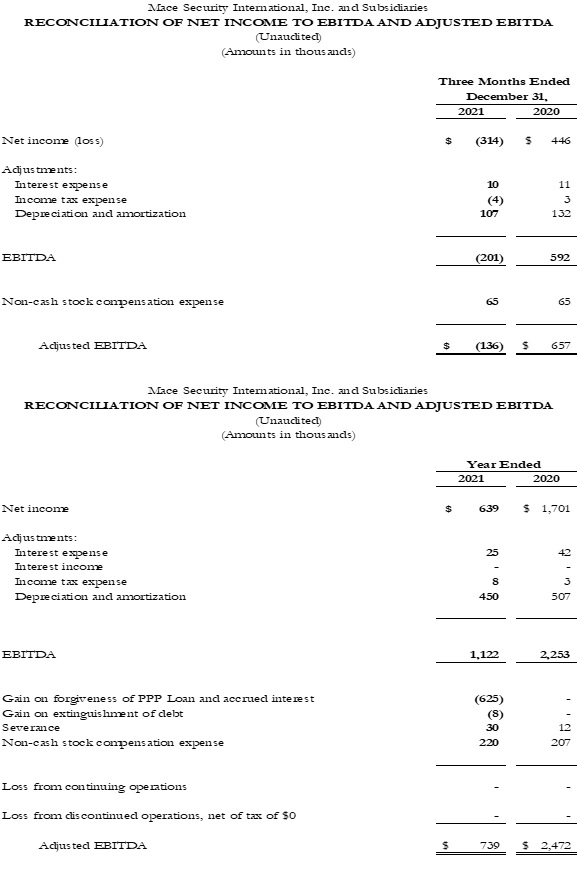

- EBITDA for the quarter was a loss of $201,000, or 8% of net sales, a decrease of $793,000 versus $592,000 EBITDA, or 13% of net sales, in the fourth quarter of 2020

- EBITDA for the year was $1,122,000 including $625,000 from forgiveness of its Paycheck Protection Program, or 9% of net sales, compared to $2,253,000, or 15% of net sales, for full-year 2020

CLEVELAND, OH / ACCESSWIRE / March 28, 2022 / Mace Security International (OTCQX:MACE) today announced its fourth quarter and full-year 2021 financial results for the periods ended December 31, 2021.

Mace reported net sales for the fourth quarter of $2,553,000, down 42% versus the same period in 2020. The decrease was the result of multiple factors including supply chain issues, an overall slowdown in retail sales from economic inflationary pressures along with a challenging comparison to strong retail sales in the fourth quarter of 2020 related to social unrest that did not recur in 2021. This drop was magnified by a precipitous decline related to private label fill customer insourcing. This decrease was partially mitigated with a 103% growth in Mace's branded Guard Alaska bear spray. While it was a challenging fourth quarter, net sales across the Company's retail and e-commerce channels were up $532,000, or 5%, for the year over the full-year 2020 results.

The Company's gross margin rate for the fourth quarter of 2021 was 37% vs 40% for the like quarter last year. Gross margin declined as fixed costs became a greater percentage of the lower sales volume coupled with increased freight costs; however, product margins improved quarter-over-quarter and manufacturing costs were reduced. SG&A expenses were $1,180,000, or 46% of net sales, compared with $1,204,000, or 27% of net sales, in the same quarter of 2020. The decline in SG&A expenses was predominantly related to a reduction in the Company's sales commissions and employee incentive expenses that were partially offset by an increase in its digital advertising and branding costs along with non-comparable personnel costs for open positions filled in early 2021.

Sanjay Singh, Chairman and CEO, commented, "We had a tough quarter from an incoming order perspective and had to pivot very quickly. We executed on our plans of reducing base costs which led to a sixteen percent reduction vs. same quarter in the prior year. We expect lower than normal revenues from some of our larger retailers to continue and have laid out action plans to mitigate that by further reducing controllable costs and by increasing penetration in our base business that includes international customers, gun, and ammo stores through additional inside sales efforts, and regional convenience and sports stores which are seeing an increase in pepper spray sales driven by a spike in crimes in specific pockets of the country."

Mr. Singh added, "In line with our mission, we are seeking to offer free products to Ukrainian women refugees who may be vulnerable to abuse or human trafficking. We expect to accomplish this initiative through a donation to a US resident who is in the Ukraine with his wife to assist with the ongoing situation there."

The Company is announcing the launch of its new, versatile look Chameleon product. The Chameleon features replaceable "skins" that make it the first pepper spray on the market to enable a customized look. Like a chameleon, this new pepper spray product will enable consumers to change its appearance to suit their own preferences, such as Ukrainian flag colors for some of the units we will send to the Ukraine. The powerful stream of pepper spray provides up to 10 feet of protection. Its unique design provides protection against accidental discharge and helps the user aim squarely at their target. The Chameleon will be available on April 1st on Mace's web site at www.mace.com and on Amazon.

On March 25, 2022, Bradley J. Dickerson, Director, announced that he will be resigning from the Company's Board of Directors effective March 31, 2022, due to his other pressing commitments. The Company wants to thank Mr. Dickerson for his contributions over the past three years.

Fourth Quarter 2021 Financial Highlights

- Net sales were $2,553,000 and while down 42% from the fourth quarter of 2020, they were up 7% from the more comparable fourth quarter of 2019. Continued growth in overall bear spray sales, led by the 2021 launch of Mace's Guard Alaska product, coupled with two-year ecommerce growth were the catalyst for the increase over fourth quarter 2019 sales. The decline from prior year was due to the slowdown in retail sales from the healthy retail sales that occurred in the Company's record fourth quarter sales of 2020 prompted by the social unrest in the U.S. along with an 89% decline in non-Mace brand, private label sales primarily due to customer insourcing.

- Gross margin rate of 37% was down 3% from the same period in 2020 as the lower sales volume led to deleveraging of the fixed manufacturing costs coupled with increased freight costs. Product margins improved both quarter-to-quarter, for the fourth consecutive quarter, and quarter-over-quarter to last year. The Company continued to reduce its manufacturing cost structure to improve its leverage on a go-forward basis.

- Gross profit for the fourth quarter decreased by $822,000, or 47%, from the fourth quarter of 2020, predominantly due to the decline in sales volume.

- SG&A expenses decreased $24,000 to $1,180,000 for the quarter, or 46% of net sales, from a reduction in outside sales commissions and internal incentive pay provisions. These expense declines were partially offset as Mace continued to invest in its online advertising and branding initiative intended to further penetrate the direct-to-consumer market. Additionally, in the first quarter of 2021, the Company filled open positions and as such, the corresponding personnel related expense was not incurred in the fourth quarter of 2020.

- Net loss of $314,000 for the quarter was a reduction in income of $760,000 when compared to the Company's record fourth quarter 2020 net income of $446,000. The decline was solely attributable to the lower sales volume.

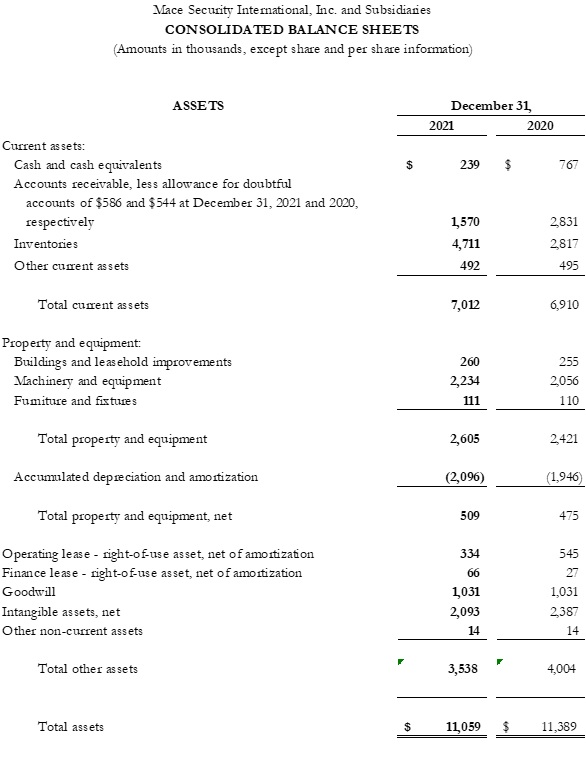

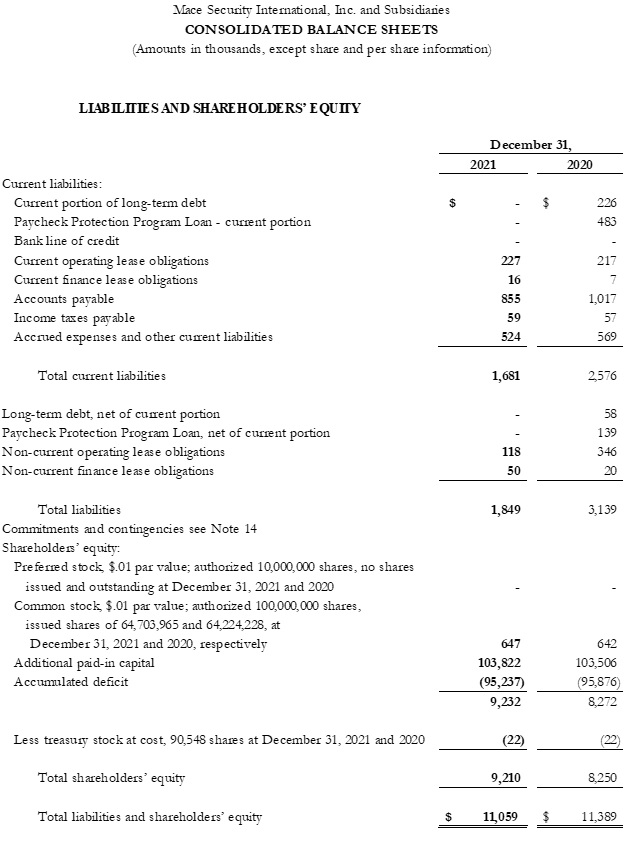

- Cash and cash equivalents decreased to $239,000 as of December 31, 2021, a decline of $528,000 from the $767,000 on hand on December 31, 2020. This includes completely paying off $284,000 of outstanding debt during 2021 associated with a prior acquisition.

- Working capital increased by $997,000 compared to December 31, 2020, with an increase of $1,894,000 in inventory of which $958,000, or 51% of the increase, was in raw materials or component goods. Supply chain reliability, uncertainty and delays has expanded lead times and the need to increase component part quantities. The slowdown in retail sales led to an increase in finished goods from the Company's position at the end of the third quarter. The increase in inventory was somewhat offset by a $1,261,000 decrease in net accounts receivable.

- Adjusted EBITDA for the quarter was a loss of $136,000 compared to Mace's fourth quarter record of $657,000 for the fourth quarter of 2020.

Fourth Quarter 2021 Operational Highlights

- Mace further reduced its manufacturing cost structure for the fifth consecutive quarter as it continues to streamline its operations. Investments in manufacturing automation has assisted the Company in achieving these cost reductions and improving its manufacturing efficiency rate by over 1,900 bp from the fourth quarter in 2020. The Company has targeted even further improvement going forward.

Full Year 2021 Financial Highlights

- Net Sales of $13,072,000 decreased by $2,319,000, or 15%, versus full year 2020 driven down by a 69% decline in private label sales, which was partially offset by a 5% increase in online and retail sales.

- Gross margin rate declined to 39% for 2021 compared to 40% for 2020 primarily due to the deleveraging of the Company's fixed 4-wall costs and its increased freight costs. This was partially offset by an increase in product margins.

- Gross Profit decreased by $1,138,000, or 18%, when compared to full-year 2020 results due predominantly to the lower sales volume.

- SG&A increased by $645,000, or 16%, mostly from advertising to increase the Company's penetration in the direct-to-consumer market, increase in insurance premiums related to market conditions, increase in provision for loss on trade accounts receivable, and research and development costs for new product introductions. These expense increases were partially offset with a reduction in employee incentive pay and outside sales commissions.

- Net Income was $639,000, or 5% of net sales, a decline of $1,062,000 from net income of $1,701,000 for 2020. The 2021 net income was enhanced by a $625,000 gain from PPP Loan forgiveness obtained in the first half of 2021.

- Adjusted EBITDA for the 2021, which excludes the $625,000 gain from PPP Loan forgiveness, was $739,000 compared to the Company's record $2,472,000 for 2020.

Conference Call

Mace® will conduct a conference call on Wednesday, March 30, 2022, at 11:00 AM EDT, 8:00 AM PDT to discuss its financial and operational performance for the fourth quarter and full year 2021. The call can be accessed by telephone within the US at (833) 360-0862. Please use the conference identification number 4367119.

A digital recording of the conference call will be available for replay after the call's completion. It will be available two hours after the call and will expire on April 6, 2022, at 11:59 PM. To access the recording, use the dial in numbers listed below and the conference ID 4367119.

Encore dial-in number: (855) 859-2056 or internationally on (404) 537-3406.

The full set of financial statements and an accompanying slide presentation is available on Mace's website www.corp.mace.com under the subheading "Newsroom."

About Mace Security International, Inc.

Mace® Security International, Inc. (MACE) is a globally recognized leader in personal safety and security. Based in Cleveland, Ohio, the company has spent more than 40 years designing and manufacturing consumer and tactical products for personal defense and security under its world-renowned Mace® Brand - the original trusted brand of defense spray products. The company also offers aerosol defense sprays and tactical products for law enforcement and security professionals worldwide through its Mace® Take Down® brand, KUROS!® Brand personal safety products, Vigilant® Brand alarms, and Tornado® Brand pepper spray and stun guns. MACE® distributes and supports Mace® Brand products through mass market retailers, wholesale distributors, independent dealers, Amazon.com, Mace.com, and other channels. For more information, visit www.mace.com.

Forward-Looking Statements

Certain statements and information included on this website constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. When used on this site, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "projected," "intend to" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to several known and unknown risks and uncertainties that may cause our actual results, trends, performance or achievements, or industry trends and results, to differ materially from the future results, trends, performance, or achievements expressed or implied by such forward-looking statements. Those risks and uncertainties may include, but are not limited to, (a) general economic and business conditions, including the impact of the COVID-19 pandemic and other possible pandemics and similar outbreaks; (b) competition; (c) potential changes in customer spending; (d) acceptance of our product offerings and designs; (e) the variability of consumer spending resulting from changes in domestic economic activity; (f) a highly promotional retail environment; (g) any significant variations between actual amounts and the amounts estimated for those matters identified as our critical accounting estimates, as well as other significant accounting estimates made in the preparation of our financial statements; (h) the impact of current and potential hostilities in various parts of the world, as well as other geopolitical or public health concerns; (i) the impact of international supply chain disruptions and delays; (j) the impact on the Company of changes in U.S. Federal and State income tax regulations; and (k) the impact of inflation and the Company's inability to pass on rising prices to its customers. You are urged to consider all such factors. Because of the uncertainty inherent in such forward-looking statements, you should not consider their inclusion to be a representation that such forward-looking matters will be achieved. Mace Security International, Inc. assumes no obligation for updating any such forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements.

In this press release, the Company's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. Management believes that presentation of operating results using non-GAAP financial measures provides useful supplemental information to investors and facilitates the analysis of the Company's core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company's business. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached schedules.

CONTACT:

Mike Weisbarth

Chief Financial Officer

mweisbarth@mace.com

SOURCE: MACE SECURITY INTERNATIONAL INC

View source version on accesswire.com:

https://www.accesswire.com/694977/Mace-RSecurity-International-a-Global-Leader-in-Personal-Self-Defense-Sprays-Announces-4Q21-Financial-Results