They Are Repeating Their Falsehoods in Multiple Disclosures But That Does Not Make Them True

You Can Defend Your Company and Investment by Voting FOR Canagold's Board Nominees Using ONLY the YELLOW Proxy

- VOTE ONLY THE YELLOW PROXY - Questions or assistance with voting the YELLOW Proxy? Contact Laurel Hill Advisory Group at 1-877-452-7184 or by e-mail at assistance@laurelhill.com.

VANCOUVER, BC / ACCESSWIRE / June 30, 2022 / Canagold Resources Ltd. (TSX:CCM)(OTCQB:CRCUF)(Frankfurt:CANA) ("Canagold" or the "Company")urges Canagold shareholders to ignore and discard the SunValley Company DMCC ("SunValley" or the "Dissident") information circular released on June 27, 2022 which continues to show their complete disregard for both truthful disclosure and Canagold shareholders.

SunValley, led by their Managing Director Vikram Sodhi, is continuing their campaign of lies and misinformation against Canagold and its Chairperson, Bradford Cooke. They are repeating multiple falsehoods and misleading statements to deliberately distract Canagold's shareholders from the Dissident's true intention - to seize 60% control of the board, your Company and its core asset, the New Polaris gold mine project located in northern British Columbia while owning only 17% of the shares, without paying you, the shareholders, anything for control.

SunValley is Attempting to Conceal its Real Agenda

If the Dissident's three hand-picked and interconnected board nominees succeed in getting enough votes, they would control your board, and could use that control to advance the Dissident's creeping takeover attempt through additional cheap equity financings with the Dissident. All this without you, the shareholders, being able to do anything about it. The Dissident's nominees are clearly not independent, but there for the bidding of the Dissident. The Dissident's nominees have a history of working together and will likely do so at Canagold to ensure that SunValley and Vikram Sodhi advance their agenda of seizing control of Canagold, without consideration for the majority of our shareholders.

Now is the time to stop them in their tracks, by voting FOR Canagold's Management Nominees today using only the YELLOW Proxy.

Canagold Shareholders have the right to make decisions about the future of Canagold based on facts and truth, not lies and misinformation. To set the record straight and ensure that our shareholders act on facts rather than the inaccurate and false statements in the Dissident's circular, Canagold will, AGAIN, inform our shareholders about the truth about various matters in this and future news releases.

Falsehood #1 - "Mr. Cooke attempted to encumber the project with a second royalty."

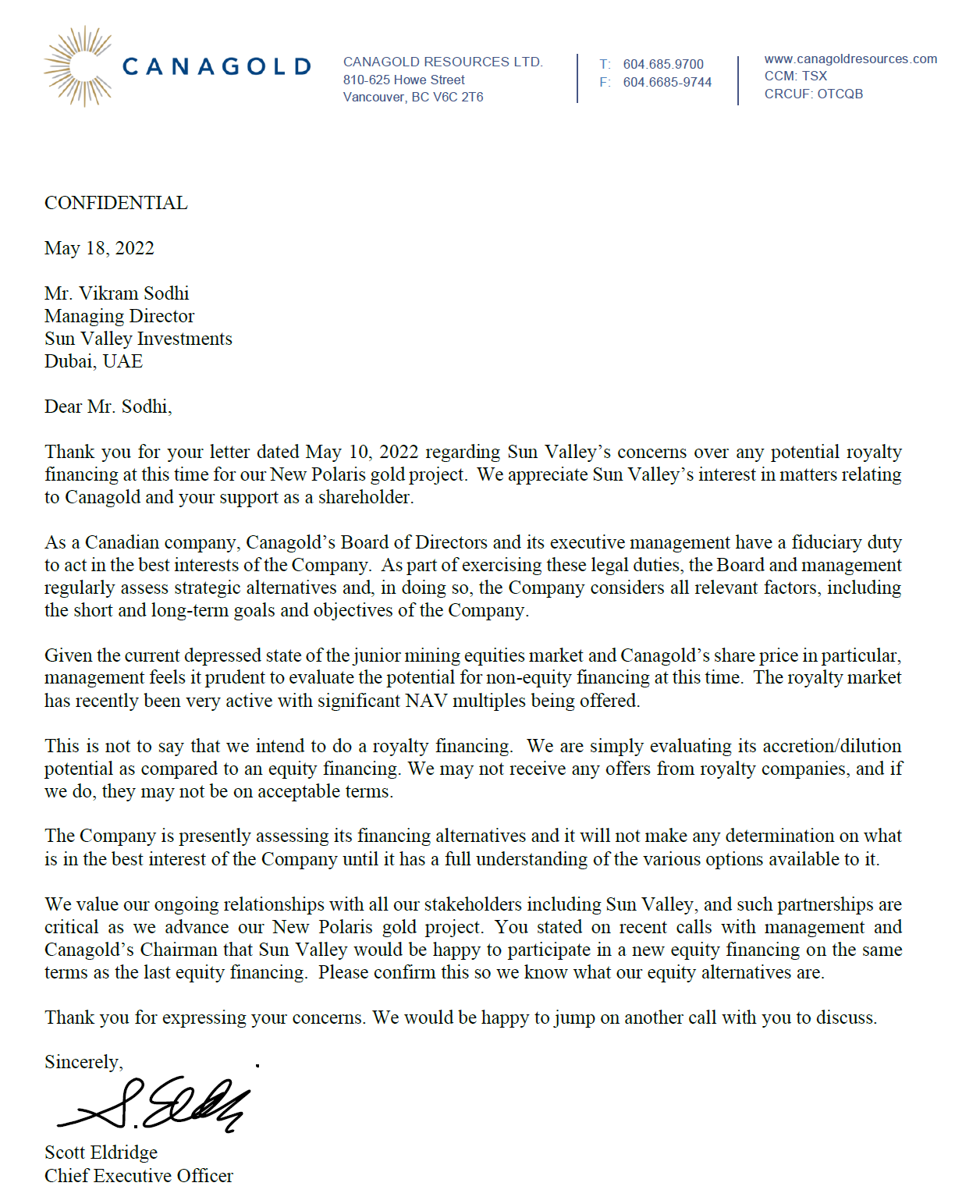

In a letter dated May 18, 2022, addressed to Mr. Sodhi, Scott Eldridge, Canagold's CEO, clearly informed Vikram Sodhi and SunValley on behalf of Canagold's Board as follows:

"Given the current depressed state of the junior mining equities market and Canagold's share price in particular, management feels it prudent to evaluate the potential for non-equity financing at this time. The royalty market has recently been very active with significant NAV multiples being offered. This is not to say that we intend to do a royalty financing. We are simply evaluating its accretion/dilution potential as compared to an equity financing. We may not receive any offers from royalty companies, and if we do, they may not be on acceptable terms. The Company is presently assessing its financing alternatives and it will not make any determination on what is in the best interest of the Company until it has a full understanding of the various options available to it." (Canagold letter to SunValley)

Notwithstanding this letter explaining management's fiduciary duty to evaluate all possible financing alternatives in order to select the best one for the benefit of ALL shareholders instead of just ONE shareholder, Mr. Sodhi insisted management ABANDON its review of financing alternatives and he continued his hostile attempt to seize control of your board, the Company and New Polaris.

In a text on June 9, 2022, Mr. Cooke reconfirmed to Mr. Sodhi that management completed their review of the royalty market and "dropped the idea of selling an NSR because we did not receive any offers".

What did Vikram Sodhi do, did he back off of his demands for 60% control of your board? No, instead he doubled down on his efforts to hijack control of your board of directors. These are not the actions of a reasonable shareholder; the Dissident is simply using this untrue allegation to misdirect other shareholders away from their real mission to seize control of the Company.

In the Dissident circular filed on Monday, June 27th, the Dissident continues to make false and misleading allegations about Canagold pursuing a royalty. This is in spite of the fact that your Board informed the Dissident in writing over a month ago and again two weeks ago that the Company is assessing all financing options available and does not intend to do a royalty financing, Knowing this to be the case, why would they intentionally repeat this false statement in their information circular? Because the facts do not suit their agenda - to seize control of your company without paying you the shareholders anything!

Falsehood #2 - "Mr. Cooke Rejected Multiple Premium Financing Offers"

Mr. Cooke did NOT receive multiple financing offers, he received ONE financing offer prior to SunValley's false, misleading disclosure, and he did NOT reject the offer, Canagold's board simply informed Mr. Sodhi in writing that Canagold was exploring all of its financing options and would include the Dissidents' ONE offer for consideration in the financing process that was already underway.

In an e-mail on June 17th, Mr. Cooke wrote to Mr. Sodhi, "Thank you for your letter of June 15 expressing Sun Valley's interest to participate in an equity financing for Canagold. As you know, management has already commenced a process to generate and evaluate expressions of interest from possible participants in an equity financing. We will get back to you once that process nears completion."

The uncertainty created by Vikram Sodhi and SunValley in attempting to take control of your company has stalled Canagold's financing process, as management has been forced to spend their time defending the Company and ALL of its shareholders from the predatory actions of ONE shareholder.

Moreover, the Dissident's defamatory attacks on Mr. Cooke are wholly unjustified. It is Canagold's Board including Mr. Cooke who have consistently considered the best interests of the Company and ALL shareholders. The Dissident proudly boasts of their $0.32 non-flow-through financing offer is at a 20% premium to market and his $0.42 flow-through financing offer is at a 60% premium to market, but:

- His non-flow-through financing offer is actually a 20% DISCOUNT to Canagold's last non-flow-through financing at $0.40 per share only 18 months ago

- His flow-through financing offer is actually a 16% DISCOUNT to Canagold's last flow-through financing at $0.50 per share only 9 months ago

- Nor did he disclose that his predatory financing offer would boost his Canagold shareholdings to 35%, just the next step in his hostile creeping takeover of the Company

- Your board feels it can do substantially better than Mr. Sodhi's offer once this proxy fight is over and it is allowed to complete the process of generating and evaluating multiple financing offers

It is important to inform shareholders of the steps Vikram Sodhi and SunValley are taking to hijack control of Canagold and its board:

- Step 1 of their hostile creeping take-over attempt was to buy a small stake in the $0.40 financing 18 months ago.

- Step 2 of their hostile creeping take-over attempt was to buy a large stake in off-market transactions at $0.37, a 35% discount to the $0.50 flow through financing price paid by other shareholders to get to 9.4%!

- Step 3 of their hostile creeping take-over attempt was to buy out another shareholder at $0.325 in another off-market transaction last week to get to 17%.

Regarding these people attempting to take control of your investment, board, company and project, we know very little of Vikram Sodhi or SunValley.

Vikram Sodhi and SunValley. state they are a private equity fund based in Dubai, UAE and with a branch office in Colombia. But when you visit the SunValley website, you will find NO disclosure whatsoever about who they really are:

- NO DISCLOSURE about their team - no names, no photos, no bios

- NO DISCLOSURE about their assets - no investments, no shareholdings or properties

- NO DISCLOSURE about their financials - no balance sheet, no income statement, no cash flow statement or where their money comes from

It is clear that the hand-picked, interconnected nominees of Vikram Sodhi and SunValley, who have who have worked together in the recent past, are there to drive SunValley's agenda and do Vikram Sodhi's bidding.

Vote FOR Canagold's Management Nominees Using Only the YELLOW Proxy

We urge our shareholders to read Canagold's management information circular and visit our website www.canagoldresources.com for further details related to Canagold's annual and special meeting of shareholders scheduled for July 19, 2022. Your vote has never been more important. ACT TODAY to protect your investment by voting FOR Canagold's management nominees using only the YELLOW proxy that was mailed to shareholders with the management information circular on June 15, 2022. Voting is easy. You may vote online, by telephone or other methods found on the YELLOW Proxy.

VOTE your shares today to stop the Dissident Shareholder from taking control of your company.

Make the Right Choice - Vote FOR Canagold's Management Nominees Today - Using only the YELLOW Proxy

Shareholder Questions and Voting Assistance

If you have questions or require assistance with voting your shares, please contact Canagold's strategic advisor and proxy solicitation agent:

Laurel Hill Advisory Group

North American Toll Free: 1-877-452-7184 (416-304-0211 Outside North America)

Email: assistance@laurelhill.com

"Bradford Cooke"

Bradford Cooke

Founder and Chairman of the Board

CANAGOLD RESOURCES LTD.

"Scott Eldridge"

Scott Eldridge

Chief Executive Officer

CANAGOLD RESOURCES LTD.

About Canagold - Canagold Resources Ltd. is a growth-oriented gold exploration company focused on generating superior shareholder returns by discovering, exploring and developing strategic gold deposits in North America. Canagold shares trade on the TSX: CCM and the OTCQB: CRCUF.

For More Information - Please contact: Knox Henderson, VP Corporate Development

Toll Free: 1-877-684-9700 Tel: (604) 604-416-0337 Cell: (604) 551-2360

Email: knox@canagoldresources.com Website: www.canagoldresources.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of the United States private securities litigation reform act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Statements contained in this news release that are not historical facts are forward-looking information that involves known and unknown risks and uncertainties. Forward-looking statements in this news release include, but are not limited to, statements with respect to the Dissident's intentions in providing the advance notice and their plans for Canagold and its future financings; the Dissident's nominees working together at Canagold to advance the Dissident's agenda; and the availability of other financing opportunities on equal or better terms than those offered by the Dissident. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "has proven", "expects" or "does not expect", "is expected", "potential", "appears", "budget", "scheduled", "estimates", "forecasts", "at least", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "should", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others risks related to the uncertainties inherent in the estimation of mineral resources; commodity prices; changes in general economic conditions; market sentiment; currency exchange rates; the Company's ability to continue as a going concern; the Company's ability to raise funds through equity financings; risks inherent in mineral exploration; risks related to operations in foreign countries; future prices of metals; failure of equipment or processes to operate as anticipated; accidents, labor disputes and other risks of the mining industry; delays in obtaining governmental approvals; government regulation of mining operations; environmental risks; title disputes or claims; limitations on insurance coverage and the timing and possible outcome of litigation. Although the Company has attempted to identify important factors that could affect the Company and may cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, do not place undue reliance on forward-looking statements. All statements are made as of the date of this news release and the Company is under no obligation to update or alter any forward-looking statements except as required under applicable securities laws.

SOURCE: Canagold Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/707133/Vikram-Sodhi-and-SunValley-Investments-Will-Do-or-Say-Anything-to-Seize-Control-of-Your-Board-Company-and-Project