VANCOUVER, BC / ACCESSWIRE / July 6, 2022 / Faraday Copper Corp. ("Faraday" or the "Company") (CSE:FDY) is pleased to announce an updated Mineral Resource Estimate ("MRE") for the Copper Creek project, located in Arizona, U.S. ("Copper Creek"). The MRE was prepared by SRK Consulting (U.S.) Inc. ("SRK") in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards and National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Paul Harbidge, President and CEO, commented "The delivery of the first combined open pit and underground resource for Copper Creek marks another key milestone in the advancement of the project. With over 355 million tonnes of Measured and Indicated Mineral Resources, the project has the potential to provide a U.S. domestic supply of copper for decades, supporting the decarbonization of the global economy."

"The geological model, completed earlier this year, provided the foundation to accurately segregate and estimate the updated resources. The deposit remains open along strike and at depth. With the recent completion of the 6,000 metre Phase I drilling program, which was not included in this MRE, there exists the potential for an increase to the resources as part of the technical work for the upcoming Copper Creek Preliminary Economic Assessment, expected to be issued in Q2 2023."

Mineral Resource Estimate Highlights

- Measured Mineral Resources: 65.1 million tonnes ("Mt") at a grade of 0.61% copper, 0.011% molybdenum and 1.7 g/t silver containing 872.9 million pounds ("Mlbs") of copper, 15.7 Mlbs of molybdenum, and 3.5 million ounces ("Moz") of silver, or 927.3 Mlbs copper equivalent ("CuEq")1, including open pit resources of 38.9 Mt at a grade of 0.72% CuEq;

- Indicated Mineral Resources: 290.0 Mt at a grade of 0.47% copper, 0.007% molybdenum and 1.2 g/t silver containing 3,034.2 Mlbs of copper, 47.2 Mlbs of molybdenum, and 11.0 Moz of silver, or 3,199.0 Mlbs CuEq, including open pit resources of 45.7 Mt at a grade of 0.46% CuEq;

- Inferred Mineral Resources: 75.0 Mt at a grade of 0.38% copper, 0.007% molybdenum and 0.8 g/t silver containing 634.9 Mlbs of copper, 12.0 Mlbs of molybdenum, and 2.0 Moz of silver, or 673.5 Mlbs CuEq, including open pit resources of 29.3 Mt at a grade of 0.36% CuEq;

- For the combined resource, 82.6% of the tonnage is within the Measured and Indicated category;

- Amenable to a combination of open pit and bulk underground extraction methods; and

- This MRE, together with the pending results of the 2022 Phase I drill program, will form the basis for the Preliminary Economic Assessment ("PEA") expected by the end of Q2 2023.

1 See Notes to Table 1 (Mineral Resources Estimate) in this news release for the calculation of copper equivalency.

Mineral Resource Estimate

This MRE for Copper Creek is based on data with a cut-off date of April 30, 2022 and excludes the majority of drill results currently pending from the Phase 1 drill program. This MRE is reported with an effective date of July 6, 2022, in Table 1.

Table 1: Combined Open Pit and Underground Mineral Resource Estimate, Copper Creek Project

| Category | Tonnes (Mt) | Grade | Contained Metal | ||||||

Cu | Mo | Ag | CuEq | Cu | Mo | Ag | CuEq | ||

(%) | (%) | (g/t) | (%) | (Mlbs) | (Mlbs) | (Moz) | (Mlbs) | ||

| Open Pit (OP) | |||||||||

| Measured | 38.9 | 0.68 | 0.010 | 1.8 | 0.72 | 584.2 | 8.7 | 2.2 | 614.6 |

| Indicated | 45.7 | 0.44 | 0.007 | 0.9 | 0.46 | 446.4 | 7.2 | 1.3 | 467.8 |

| M&I | 84.6 | 0.55 | 0.009 | 1.3 | 0.58 | 1,030.6 | 16.0 | 3.6 | 1,082.5 |

| Inferred | 29.3 | 0.35 | 0.004 | 0.8 | 0.36 | 224.6 | 2.9 | 0.8 | 233.0 |

| Underground (UG) | |||||||||

| Measured | 26.1 | 0.50 | 0.012 | 1.5 | 0.54 | 288.7 | 7.0 | 1.3 | 312.7 |

| Indicated | 244.4 | 0.48 | 0.007 | 1.2 | 0.51 | 2,587.8 | 39.9 | 9.7 | 2,731.1 |

| M&I | 270.5 | 0.48 | 0.008 | 1.3 | 0.51 | 2,876.5 | 46.9 | 11.0 | 3,043.8 |

| Inferred | 45.6 | 0.41 | 0.009 | 0.9 | 0.44 | 410.3 | 9.2 | 1.3 | 440.5 |

| Total (OP + UG) | |||||||||

| Measured | 65.1 | 0.61 | 0.011 | 1.7 | 0.65 | 872.9 | 15.7 | 3.5 | 927.3 |

| Indicated | 290.0 | 0.47 | 0.007 | 1.2 | 0.50 | 3,034.2 | 47.2 | 11.0 | 3,199.0 |

| M&I | 355.1 | 0.50 | 0.008 | 1.3 | 0.53 | 3,907.1 | 62.9 | 14.5 | 4,126.3 |

| Inferred | 75.0 | 0.38 | 0.007 | 0.8 | 0.41 | 634.9 | 12.0 | 2.0 | 673.5 |

Notes to Table 1:

- The Mineral Resources in this estimate were calculated using the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines (CIM, 2014) prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council.

- All dollar amounts are presented in U.S. dollars.

- Pit shell constrained resources with reasonable prospects for eventual economic extraction ("RPEEE") are stated as contained within estimation domains above 0.23% CuEq cut-off grade. Pit shells are based on an assumed copper price of $3.80/lb, assumed molybdenum price of $13.00/lb, assumed silver price of $20.00/oz and overall slope angle of 47 degrees based on preliminary geotechnical data. Operating cost assumptions include mining cost of $2.25/tonne ("t"), processing cost of $7.95/t, General & Administrative ("G&A") costs of $1.25/t, and Treatment Charges and Refining Charges ("TCRC") and Freight costs of $6.50/t.

- Underground constrained resources with RPEEE are stated as contained within estimation domains above 0.31% CuEq cut-off grade. Underground bulk mining footprints are based on an assumed copper price of $3.80/lb, assumed molybdenum price of $13.00/lb, assumed silver price of $20.00/oz, underground mining cost of $9.25/t, processing cost of $7.00/t, G&A costs of $1.25/t, and TCRC and Freight costs of $6.50/t.

- Average bulk density assigned by domain: 2.33 g/cm3 for all near-surface breccias; 2.40 g/cm3 for the Mammoth breccia; 2.56 g/cm3 for the Keel breccia, porphyry mineralization and all other areas outside of breccias.

- Variable metallurgical recovery by metal and domain are considered for CuEq, as follows: copper recovery of 92%, 85% and 60% within sulphide, transitional and oxide material, respectively; molybdenum recovery of 78% and 68% for sulphide and transitional material, respectively; silver recovery of 50% and 40% for sulphide and transitional material, respectively.

- CuEq is calculated by domain based on the above variable recovery. For example, sulphide CuEq = [(Cu grade/100 *0.92 Cu recovery *2204.62 *3.8 Cu price) + (Mo grade/100 *0.78 Mo recovery *2204.62 *13 Mo price) + (Ag grade*0.50 Ag recovery*20 Ag price/31.10348)] / (0.92 Cu recovery *2204.62 *3.8)*100.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves in the future. The estimate of Mineral Resources may be materially affected by environmental permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues.

- All quantities are rounded to the appropriate number of significant figures; consequently, sums may not add up due to rounding.

The near-surface mineralized breccias were subjected to partial in-situ oxidization that transformed part of the sulphides into secondary copper oxides. Three domains are recognized within the open pit resource, referred to as Oxide, Mixed, and Sulphide. The underground resources stated in Table 1 are comprised of only sulphide mineralization. The Copper Creek open pit Mineral Resources are reported by domain in Table 2.

Table 2: Open Pit Mineral Resource Estimate by Domain, Copper Creek Project

| Category | Domain | Tonnes (Mt) | Grade | Contained Metal | ||||||

Cu | Mo | Ag | CuEq | Cu | Mo | Ag | CuEq | |||

(%) | (%) | (g/t) | (%) | (Mlbs) | (Mlbs) | (Moz) | (Mlbs) | |||

| Measured | Oxide | 2.5 | 0.51 | 0.005 | 1.38 | 0.51 | 28.0 | 0.3 | 0.1 | 28.0 |

| Mixed | 5.8 | 0.59 | 0.005 | 1.24 | 0.61 | 75.1 | 0.6 | 0.2 | 77.3 | |

| Sulphide | 30.7 | 0.71 | 0.012 | 1.93 | 0.75 | 481.0 | 7.9 | 1.9 | 509.3 | |

| Total | 38.9 | 0.68 | 0.010 | 1.79 | 0.72 | 584.2 | 8.7 | 2.2 | 614.6 | |

| Indicated | Oxide | 5.7 | 0.38 | 0.007 | 1.17 | 0.38 | 48.3 | 0.9 | 0.2 | 48.3 |

| Mixed | 8.6 | 0.46 | 0.007 | 1.03 | 0.48 | 86.5 | 1.4 | 0.3 | 91.0 | |

| Sulphide | 31.3 | 0.45 | 0.007 | 0.84 | 0.48 | 311.7 | 5.0 | 0.8 | 328.5 | |

| Total | 45.7 | 0.44 | 0.007 | 0.91 | 0.46 | 446.4 | 7.2 | 1.3 | 467.8 | |

| M&I | Oxide | 8.2 | 0.42 | 0.006 | 1.23 | 0.42 | 76.3 | 1.1 | 0.3 | 76.3 |

| Mixed | 14.3 | 0.51 | 0.006 | 1.11 | 0.53 | 161.6 | 2.0 | 0.5 | 168.3 | |

| Sulphide | 62.0 | 0.58 | 0.009 | 1.38 | 0.61 | 792.7 | 12.8 | 2.7 | 837.8 | |

| Total | 84.6 | 0.55 | 0.009 | 1.32 | 0.58 | 1,030.6 | 16.0 | 3.6 | 1,082.5 | |

| Inferred | Oxide | 5.6 | 0.29 | 0.004 | 0.73 | 0.29 | 35.5 | 0.5 | 0.1 | 35.5 |

| Mixed | 8.3 | 0.31 | 0.005 | 0.82 | 0.33 | 57.1 | 0.8 | 0.2 | 59.9 | |

| Sulphide | 15.5 | 0.39 | 0.004 | 0.86 | 0.40 | 132.0 | 1.5 | 0.4 | 137.6 | |

| Total | 29.3 | 0.35 | 0.004 | 0.82 | 0.36 | 224.6 | 2.9 | 0.8 | 233.0 | |

Notes: Refer to the section titled "Notes to Table 1".

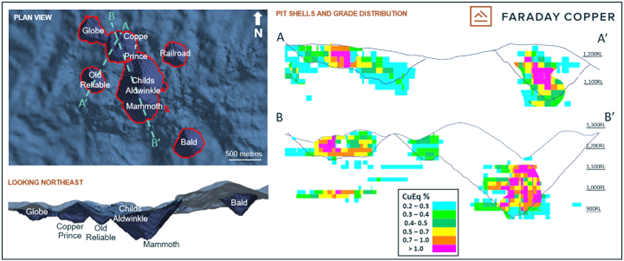

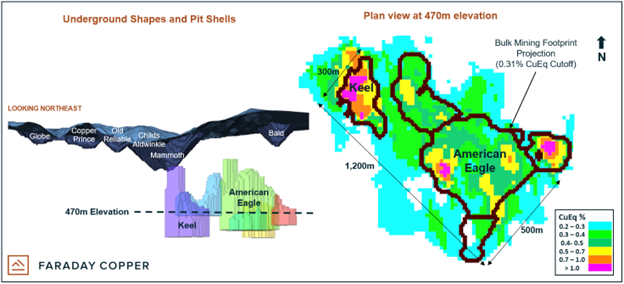

The RPEEE pit shells and underground shapes used to constrain the respective estimates, as well as grade distributions, are shown in Figure 1 and Figure 2.

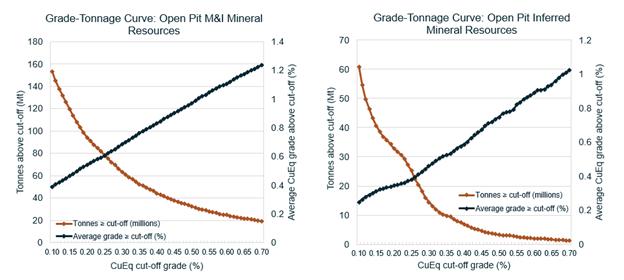

Sensitivity Analysis

The results of grade sensitivity analysis are presented below to illustrate the continuity of the grade estimates at various cut-off increments and the sensitivity of the potentially minable resource to changes in cut-off grade. The reader is cautioned that figures in the following tables should not be misconstrued as Mineral Resource or confused with the Mineral Resource Statement reported above. These figures are only presented to show the sensitivitity of the block model estimated grades and tonnnages to the selection of cut-off grade. The sensitivity analysis for Measured and Indicated blocks have been separated from Inferred blocks for reporting. Combined material type (oxide, mixed, and sulphide) sensitivity results by classification category for the open pit Mineral Resource are shown in Figure 3 and Table 3.

The grade-tonnage data presented below for open pit sensitivity reports tonnes and grade of the pit constrained mineral resource at various cut-off increments.

Figure 3: Grade-tonnage curves for Open Pit Measured & Indicated and Inferred Mineral Resources

Notes: See Notes to Table 1 (Mineral Resources Estimate) in this news release for the calculation of copper equivalency.

Table 3: Grade-tonnage for Open Pit Measured & Indicated Mineral Resource

Open Pit Mineral Resources | ||||||

Measured and Indicated | Inferred | |||||

Cut-off Grade | Tonnes | CuEq Grade | Contained Metal | Tonnes | CuEq Grade | Contained Metal |

0.10 | 153.0 | 0.39 | 1,315.7 | 60.8 | 0.25 | 332.9 |

0.20 | 94.1 | 0.54 | 1,127.6 | 32.9 | 0.34 | 249.8 |

0.23 | 84.6 | 0.58 | 1,082.5 | 29.3 | 0.36 | 233.0 |

0.30 | 63.4 | 0.69 | 958.7 | 14.5 | 0.46 | 146.7 |

0.40 | 44.3 | 0.83 | 813.3 | 6.9 | 0.59 | 89.7 |

0.50 | 32.6 | 0.97 | 697.5 | 3.4 | 0.75 | 55.2 |

0.60 | 24.7 | 1.11 | 603.0 | 2.0 | 0.89 | 38.5 |

The underground resource has been constrained using commercial software packages to define the potential mineable limits (i.e. footprint volumes) applicable to the resource using defined economic assumptions. Multiple footprint volumes were optimized at different costs to approximate sensitivity of the resource to changes in CuEq cut-off grade. As bulk underground mining is not selective, all material within each of the underground block cave footprints are reported. Sensitivity results by classification category for the underground resource are shown in Table 4.

Table 4: Grade-tonnage for Underground Measured & Indicated and Inferred Mineral Resource

Underground Mineral Resources | ||||||

Measured and Indicated | Inferred | |||||

Cut-off Grade | Tonnes | CuEq Grade | Contained Metal | Tonnes | CuEq Grade | Contained Metal |

0.20 | 737.8 | 0.37 | 5,981.9 | 618.5 | 0.28 | 3,802.2 |

0.31 | 270.5 | 0.51 | 3,043.8 | 45.6 | 0.44 | 440.5 |

0.40 | 148.4 | 0.61 | 1,987.7 | 3.6 | 0.50 | 42.3 |

0.50 | 57.0 | 0.78 | 976.4 | 1.4 | 0.71 | 21.0 |

Copper Creek Project Overview

Copper Creek is a 100% owned project located ~120 road kilometres ("km") northeast of Tucson, Arizona, and ~24 km northeast of the town of San Manuel, Arizona. The current resource area is ~3 km in length and open in all directions. The property consists of ~41 square km of contiguous patented and unpatented mining claims and state prospecting permits. The area is in a mining friendly and politically stable jurisdiction with extensive infrastructure including power, rail, water, roads, and access to skilled personnel.

The property is in the prolific southwest porphyry copper region at the projected intersection of a major northwest belt of copper deposits (Ray, Miami/Globe, Superior/Resolution, Johnson Camp) and a major east-northeast belt of copper deposits (San Manuel/Kalamazoo, Silver Bell, Lakeshore, Safford, Morenci). The project hosts a porphyry copper deposit in addition to high-grade, near-surface, breccia mineralization. With over 200,000 m of historical drilling and modest past production, the Company believes significant exploration upside remains. There are over 400 known breccia occurrences mapped at surface, of which only 35 have been drilled and 14 are included in the MRE.

Geological Model

The geological model (see news release dated May 12, 2022) was used to constrain the mineralization in the MRE. The geological model is based on the relogging of approximately 15,000 metres ("m") of historical core, observations from new drilling, short wave infrared spectral data and multi-element geochemistry. This data was modeled in Seequent Leapfrog Geo™ to generate three-dimensional wireframe models. Moreover, the Copper Creek geological model and MRE are delineated at surface by newly acquired detailed one-metre contour topography.

The Copper Creek batholith intruded Paleocoene Glory Hole volcanics and Proterozoic to Paleozoic sedimentary rocks and is the main mineralization host. Some of the breccias also crosscut the Glory Hole volcanics. The batholith is compositionally zoned and contains a shallowly west dipping monzogranite domain at depth and a dioritic border phase with the bulk being granodioritic composition. Four main types of granodiorite to quartz diorite porphyry dykes and plugs have been recognized. These largely intruded as narrow steeply dipping dikes and plugs before and during mineralization.

The underground resource occurs largely in early halo porphyry style veins and magmatic cupola zones, while the open pit resource is dominantly hosted in magmatic-hydrothermal breccias. Hypogene copper is predominantly contained in chalcopyrite and bornite.

Data Verification

The data used in this MRE is supported by industry standard Quality Assurance and Quality Control ("QA/QC") procedures, such as the insertion of certified standards and blanks into the sample stream and the utilization of certified independent analytical laboratories for all assays. Historical QA/QC data and methodology on the project were reviewed and will be summarized in the NI 43-101 technical report. No significant QA/QC issues were discovered during review of the data.

All geological data used in the MRE was reviewed and verified by Berkley Tracy, PG, CPG, P.Geo, SRK Principal Consultant. Mr. Tracy visited the Copper Creek project from March 7 to 10, 2022. The site visit included:

- Review of the geology, available outcrop exposures, and general geological understanding;

- Review of historical and recent drill core and procedures used to collect, record, store and analyze project exploration data;

- Independent audit of the drilling, logging and sampling techniques in practice during Faraday's Phase 1 drill campaign; and

- Observation of drill hole locations and an overview of claim/property boundaries in the field.

SRK compared a portion of the original laboratory data certificates, geological logs and downhole deviation surveys to entries in the Faraday database. The database subset was compared line-by-line to the fundamental data and no material errors were observed during the review. The verification data was chosen randomly and contained over 11,100 m of drilling in 13 drill holes, which represents approximately 5% of total drilling. Additional discussion on the data verification will be included in the NI 43-101 technical report for the MRE.

Mineral Resource Estimation Methodology

Sixteen individual breccias were modeled in Leapfrog Geo™ software (version 2021.2.4) by Faraday and verified as suitable estimation domains by SRK. Fourteen of these breccias contained mineralization above cut-off grade and were included in the MRE. Samples were analyzed for potential outlier capping by metal on a global basis and no top cuts were applied. Historical sample collection was in imperial units and averaged 3.05 m per sample. Raw assay samples were averaged into 6.10 m composites broken on breccia domain boundaries with residual lengths up to 3.05 m added to the previous interval. Certain historical drill holes were selectively sampled within the breccias during previous drilling campaigns and any unsampled intervals were ignored during primary compositing.

The estimation was constrained within discrete breccia domains interpreted by Faraday based on geological logging and assay grades. Grade estimation was based on parent block dimensions of 20 m in X-Y-Z and sub-blocked along the domain boundaries to 1 m in X-Y-Z. The sub-blocked resource models and block grade estimates were created using Leapfrog Edge™ software (version 2021.2.4).

The resource was estimated for copper, molybdenum and silver using inverse distance weighting cubed and considering hard boundaries at the breccia unit outer contacts. The grade estimation evaluated all parent blocks with centroids within the estimation domains and sub-blocks are coded based on the parent block centroid. Estimation outside of the defined breccia units, within the deeper porphyry-style mineralization and "halo" zones around the near-surface breccias, considered a 5 m soft boundary with the breccia units. Bulk density was scripted by general domain, based on analysis of specific gravity measurements collected by Faraday and previous project operators.

A two-pass search was used to optimize block estimation, so that well-informed blocks are interpolated using a tighter search ellipse than less informed blocks. The estimation search neighborhood was defined for individual breccia units based on the copper data population, as the key economic variable. Estimation parameters for the minor elements were identical to copper. To assess the impact of missing data, additional copper variables were estimated using null and nominal assignments for unsampled data in separate composited data sets. Un-estimated blocks outside of the search neighborhood were scripted with null values equal to one-half of the lower limit of detection.

The selection criteria used for search ellipsoid size, number of samples and other conditions are derived based on data spacing to ensure appropriate interpolation, as well as visual and statistical evaluation, during iterative trial estimation runs. Across all breccias, the estimation is informed by an average of nine composites from at least two drill holes with average sample distance of 49 m, although this varies for individual estimation domains. Outside of the breccias, the estimation is informed by an average of 11 composites at average sample distance of 134 m.

Limited historical mining has occurred at Copper Creek, mainly in the Old Reliable and Childs-Aldwinkle breccias. Block grades were depleted in the model according to available records of historical mining, which have inherent limitations.

For Mineral Resource classification a confidence variable was defined as follows:

- Class 1 reflects the highest confidence in grade and potential measured classification. These blocks were estimated with seven or more composites in three or more drill holes. The average distance to samples is 40 m or less within breccia domains and 60 m outside.

- Class 2 reflects potential indicated classification. Blocks are estimated with four or more composites from two or more drill holes. The average distance to samples is 80 m or less within breccia domains and 100 m outside.

- Class 3 reflects potential inferred classification. Blocks are estimated with two or more composites from at least one drill hole. The average distance to samples is 200 m or less.

Class 4 delineates blocks within the modelled estimation domains that are not classified as Mineral Resources. These areas of the model may have exploration potential.

Technical Report

The effective date of the Mineral Resource Estimate is July 6, 2022. A NI 43-101 technical report prepared by SRK Consulting (U.S.) Inc. will be filed on SEDAR within 45 days of this news release and will be available at that time on the Faraday website.

For readers to fully understand the information in this news release they should read the technical report in its entirety when it is available, including all qualifications, assumptions, exclusions and risks. The technical report is intended to be read as a whole and sections should not be read or relied upon out of context.

Qualified Persons

The scientific and technical information contained in this news release pertaining to Copper Creek has been reviewed and approved by the following qualified persons under NI 43-101:

- Geology and Mineral Resources: Berkley Tracy, PG, CPG, P.Geo, SRK Principal Consultant;

- Geology: Dr. Thomas Bissig, P.Geo., Faraday's Vice President of Exploration; and

- Mining: Zach Allwright, P.Eng., Faraday's Vice President of Projects and Evaluations.

The qualified persons have verified the information disclosed herein, including the sampling, preparation, security and analytical procedures underlying such information, and are not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein. Also see the discussion under the heading "Data Verification".

Market Making Services

Faraday has retained PI Financial Corp. ("PI") to provide Market Making services in accordance with Canadian Stock Exchange ("CSE") policies in order to make a two-sided market, contribute to market liquidity and depth, and maintain activity in the market for the Company. PI will trade securities of the Company on the CSE for the purpose of maintaining an orderly market of Faraday securities.

In consideration of the services provided, Faraday will pay PI a monthly cash fee of C$4,000. PI will not receive shares or options as compensation. However, PI and its clients may have or may acquire a direct interest in the securities of Faraday. Faraday and PI are unrelated and unaffiliated entities. PI is a member of the Investment Industry Regulatory Organization of Canada and can access all Canadian stock exchanges and alternative trading systems. The capital and securities required for any trade undertaken by PI as principal will be provided by PI. The agreement will have a minimum term of 3 months, upon which Faraday may terminate the agreement on 30 days notice.

About Faraday Copper

Faraday Copper is a Canadian exploration company focused on advancing two copper projects in The United States of America. The Copper Creek project, located in Arizona, is one of the largest undeveloped copper projects in North America with open pit and bulk underground mining potential. The Contact Copper project, located in Nevada, provides potential for a low-cost open pit, heap leach, oxide project. The Company is well-funded to deliver on its key milestones over the next 18 months and benefits from a management team and board of directors with senior mining company experience and expertise. Faraday trades on the CSE under the symbol "FDY".

For additional information please contact:

Stacey Pavlova, CFA

Vice President, Investor Relations & Communications

Faraday Copper Corp.

E-mail: info@faradaycopper.com

Website: www.faradaycopper.com

Cautionary Note on Forward Looking Statements

Some of the statements in this news release, other than statements of historical fact, are "forward-looking statements" and are based on the opinions and estimates of management as of the date such statements are made and are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results, level of activity, performance or achievements of Faraday to be materially different from those expressed or implied by such forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements concerning the expected timing for the PEA, the expected timing MRE Technical Report, development and future drilling of the Copper Creek property, the extent of future drilling at the Copper Creek property, and the exploration potential of the Copper Creek property.

Although Faraday believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements should not be in any way construed as guarantees of future performance and actual results or developments may differ materially. Accordingly, readers should not place undue reliance on forward-looking statements or information.

Factors that could cause actual results to differ materially from those in forward-looking statements include without limitation: market prices for metals; the conclusions of detailed feasibility and technical analyses; lower than expected grades and quantities of resources; receipt of regulatory approval; receipt of shareholder approval; mining rates and recovery rates; significant capital requirements; price volatility in the spot and forward markets for commodities; fluctuations in rates of exchange; taxation; controls, regulations and political or economic developments in the countries in which Faraday does or may carry on business; the speculative nature of mineral exploration and development, competition; loss of key employees; rising costs of labour, supplies, fuel and equipment; actual results of current exploration or reclamation activities; accidents; labour disputes; defective title to mineral claims or property or contests over claims to mineral properties; unexpected delays and costs inherent to consulting and accommodating rights of Indigenous peoples and other groups; risks, uncertainties and unanticipated delays associated with obtaining and maintaining necessary licenses, permits and authorizations and complying with permitting requirements, including those associated with the Copper Creek property; and uncertainties with respect to any future acquisitions by Faraday. In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental events and hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and the risk of inadequate insurance or inability to obtain insurance to cover these risks as well as "Risk Factors" included in Faraday's disclosure documents filed on and available at www.sedar.com.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such an offer or solicitation in such jurisdiction. This press release is not, and under no circumstances is to be construed as, a prospectus, an offering memorandum, an advertisement or a public offering of securities in Faraday in Canada, the United States or any other jurisdiction. No securities commission or similar authority in Canada or in the United States has reviewed or in any way passed upon this press release, and any representation to the contrary is an offence.

Risks Relating to Mineral Resource Estimates

The figures for mineral resources contained herein are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that the mineral resources could be mined or processed profitably. Actual reserves, if any, may not conform to geological, metallurgical or other expectations, and the volume and grade of ore recovered may be below the estimated levels. There are numerous uncertainties inherent in estimating mineral resources, including many factors beyond the Company's control. Such estimation is a subjective process, and the accuracy of any resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation. Short-term operating factors relating to the mineral resources , such as the need for orderly development of the ore bodies or the processing of new or different ore grades, may cause the mining operation to be unprofitable in any particular accounting period. In addition, there can be no assurance that metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. Lower market prices, increased production costs, the presence of deleterious elements, reduced recovery rates and other factors may result in revision of its resource estimates from time to time or may render the Company's resources uneconomic to exploit. Resource data is not indicative of future results of operations. If the Company fails to develop its resource base through the realization of identified mineralized potential, its results of operations or financial condition may be materially and adversely affected.

All of the forward-looking statements contained in this press release are qualified by these cautionary statements. Faraday does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation. For more information on the Faraday, readers should refer to www.sedar.com for the Faraday's filings with the Canadian securities regulatory authorities.

SOURCE: Faraday Copper Corp.

View source version on accesswire.com:

https://www.accesswire.com/707643/Faraday-Copper-Announces-Updated-Mineral-Resource-Estimate-for-the-Copper-Creek-Project-in-Arizona-Measured-and-Indicated-Mineral-Resources-Exceed-39-Billion-Pounds-of-Copper