Third quarter revenue up 6.3% year-over-year to $73.4 million

Adjusted EBITDA up significantly year-over-year to $10.5 million

Spark Power continues to make meaningful progress on its margin improvement plan

(Spark Power reports in Canadian dollars unless otherwise specified)

OAKVILLE, ON / ACCESSWIRE / November 14, 2022 / Spark Power Group Inc. (TSX:SPG), parent company of Spark Power Corp. ("Spark Power" or the "Company"), has announced its financial results for the three and nine month periods ended September 30, 2022. The related financial statements and MD&A will be available on Spark Power's website at www.sparkpowercorp.com and on SEDAR at www.sedar.com.

Richard Jackson, President & CEO of Spark Power, commented on the third quarter 2022 results, "We continue to see positive momentum across our portfolio, both financially and with respect to our ongoing focus on integration and improvements in operating performance. Despite the macro-level challenges in the market, the significant efforts of the Spark Power team in recent months to streamline and optimize our business are becoming increasingly evident in our results. At the same time, we are establishing a sound foundation for long-term success as we prepare for the launch of our new 2025 Let's Grow Better Strategy." Mr. Jackson continued, "As we begin to roll-out our new technology and business process platform (Project Darwin) and approach the end of our integration efforts, we expect to close out 2022 on strong footing, positioning us to deliver ongoing value creation in 2023 and beyond with our One Spark operating model. We look forward to embarking on the next stage of our strategic growth plan, capitalizing on market tailwinds and the multitude of profitable growth opportunities available to Spark Power."

"The third quarter was one in which we delivered continued progress on our financial objectives. Not only did we generate strong revenue once again, but we also delivered sequential improvement in our margins for the third consecutive quarter. This is reflective of the great work our team has done to mitigate inflationary cost pressures, focus on right-sizing our cost structure, shift our business mix to higher value-add revenue opportunities, and our recent integration efforts," said Richard Perri, Executive Vice President & CFO of Spark Power. "With the financial improvements we are delivering, alongside the recently announced sale of our Bullfrog Power Inc. business unit which is expected to close this month, we are well positioned to finalize the terms of an amended credit facility agreement with our lender. We anticipate having additional liquidity and operating flexibility available in the coming months, and we believe that the actions we are undertaking are supportive of our growth strategy focused on our core Technical Services and Renewables businesses," Perri concluded.

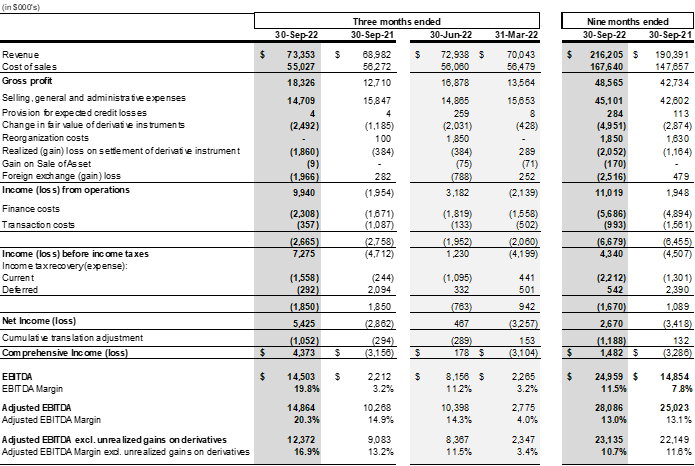

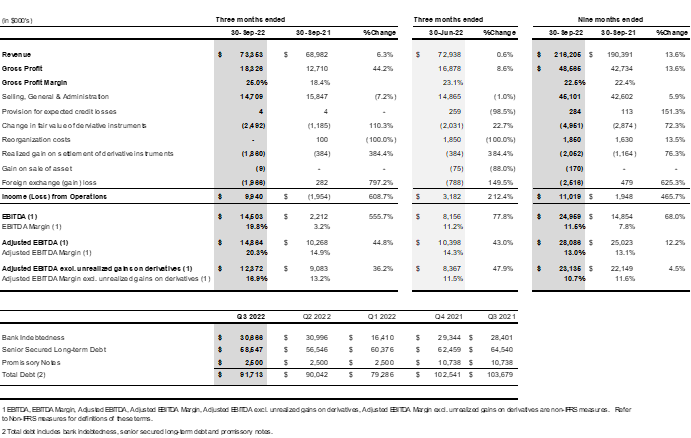

Consolidated Financial Highlights for Q3 2022

- Total Revenue was $73.4 million in Q3 2022. This result represents an increase of 6.3% year-over-year, as compared to $69.0 million in Q3 2021, and is consistent with the record $72.9 million in revenue we generated in Q2 2022. The year-over-year growth is reflective of strength across the Spark Power portfolio, most notably in the Technical Services and Renewables segments.

- Total gross profit margins, excluding depreciation and amortization, were 29.1% in Q3 2022. These margins mark a continued improvement relative to the 27.5% margins realized in Q2 2022 and the 23.7% margins realized in Q1 2022. This continued improvement reflects Spark Power's focus on mitigating recent inflationary pressures, including through pricing actions, as well as the company's recent focus on pursuing higher margin revenue opportunities. Gross profit margins increased as compared to 22.8% in Q3 2021, primarily owing to the impact of favorable revenue mix and the impact of estimate updates in the prior year.

- Total Selling, General and Administration (SG&A) expenses, excluding depreciation and amortization, were $12.8 million, representing 17.5% of revenue. This compares to SG&A of 19.1% of revenue in Q3 2021, with the year-over-year improvement reflecting the benefits of recent cost actions taken by Spark Power to streamline corporate overhead. Through Q3 2022, $6.5 million of pro-forma annualized SG&A cost savings have been realized.

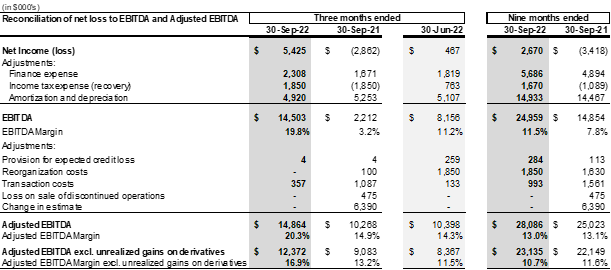

- Total Adjusted EBITDA was $14.9 million or 20.3% of revenue in Q3 2022, including unrealized gains on derivatives of $2.5 million in the quarter. This compares to $10.3 million or 14.9% of revenue in Q3 2021. Excluding unrealized gains on derivatives, total Adjusted EBITDA was $12.4 million or 16.9% of revenue in Q3 2022, as compared to $9.1 million or 13.2% of revenue in Q3 2021. Total Adjusted EBITDA excluding unrealized gains on derivatives and foreign exchange gains was $10.5 million. The year-over-year growth in Adjusted EBITDA reflects higher revenues and enhanced gross margin realization.

- Working capital demands were higher in the quarter, with increases in Contract Assets and Accounts Receivable at September 30, 2022. Significant progress has been made through the start of the fourth quarter to accelerate cash conversion by end of year.

Business Highlights for Q3 2022

- During the third quarter of 2022, Spark Power continued to see strong demand for its Technical Services and Renewables business in both the Canadian and U.S. markets. This included the company continuing to grow its business with the addition of several new customers in the quarter.

- Spark Power continued to execute on its enterprise-wide technology and business process integration, Project Darwin, during the third quarter. This integration will bring all operating companies onto one single platform, including common processes and operating protocols. The expected benefits of this integration include improved customer experience, unlocking operational efficiencies in both the field and the back office, and establishing a scalable platform to support the next stage of growth for the Company. The first go-live of the new Enterprise Resource Planning (ERP) software installation took place in September 2022. The full roll-out remains on track to be completed in the next three to six months.

- The company continues to integrate it business operations in both Canada and the U.S. launching a streamlined management structure overseeing both the Technical Services and Renewables business segments. Aside from the cost efficiencies gained under the new operating structure, the changes provide for better go to market synergies across the entire Spark portfolio.

- Spark's leadership team began the process of formulating a new 3-year strategy for the period of 2023 - 2025. The new strategy, named Let's Grow Better, will officially launch across the organization in January 2023 and focuses the business on more intentional growth aimed on creating more sustainable and long-term value for shareholders as a fully integrated platform company.

- Subsequent to quarter end, on October 28, 2022, Spark Power announced that it has entered into a binding agreement with an arm's length buyer to sell its Bullfrog Power Inc. business unit, which comprises the Sustainability Solutions Segment. Total proceeds from the sale will be up to $35.0 million, subject to customary adjustments, and includes an earnout of up to $3.5 million, payable over a maximum of five years. Proceeds from the transaction are expected to be used to reduce Spark Power's debt and fund working capital needs. This strategic divestiture supports Spark Power's renewed focus on its core business and will provide the necessary capital to support the growth strategy of its Technical Services and Renewables segments. The transaction is anticipated to close by the end of November 2022, subject to the Purchaser securing financing for the transaction, approval of Spark Power's lender, and other customary closing conditions.

- Spark Power is engaged in advanced negotiations with its senior lender, Bank of Montreal, on terms of an amended and restated credit facility. It is anticipated that the amended credit facility will include a path to Spark Power reverting to traditional financial covenants at the end of Q1 2023. The amendments are also expected to extend the maturity date of the credit facility to September 30, 2024, and extend the term loan amortization period, while reducing quarterly principal payments to $1.1 million. The terms of the amended credit facility are expected to be finalized, and the agreement signed, concurrent with the closing of the sale of the Bullfrog Power Inc. business unit, by the end of November 2022.

Quarterly Conference Call

Management will be hosting an investor conference call and webcast tomorrow, Tuesday, November 15, 2022, at 8:30 a.m. ET to discuss its results for the third quarter of 2022. To join by telephone dial: +1-888-506-0062 (toll-free in North America) or +1-973-528-0016 (international), with conference ID: 47051 and entry code: 650247.

The conference call will also be available via webcast and can be accessed through the investor relations section of Spark Power's website at https://sparkpowercorp.com/about-us/investor-relations/. An archived replay of the webcast will be available following the conclusion of the call. Please dial in or log on 10 minutes prior to the start time to provide sufficient time to register for the event.

About Spark Power

Spark Power is a leading independent provider of end-to-end electrical services, operations and maintenance services, and energy sustainability solutions to the industrial, commercial, utility, and renewable asset markets in North America. We work to earn the right to be our customers' Trusted Partner in Power™. Our highly skilled and dedicated people, located in the communities we serve, combined with our knowledge of the power industry, technology expertise, and commitment to safety, ensures we deliver the right solutions that keep our customers' operations up and running today and better equipped for tomorrow. Learn more at www.sparkpowercorp.com.

Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws) which reflect Spark Power's current expectations regarding future events. Forward-looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this press release include statements regarding the Company's future performance, expansion and/ or growth, outcomes from integration, and liquidity improvement, including from sale of non-core assets, as well as comments from Messrs. Jackson respecting future market conditions and Messrs. Perri regarding drivers supporting the long-term growth strategy. The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements. Such factors include, among others: currency fluctuations; disruptions or changes in the credit or security markets; results of operations; and general developments, market and industry conditions. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, Spark Power assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Non-IFRS Measures

The Company prepares and releases unaudited consolidated interim financial statements and audited consolidated annual financial statements prepared in accordance with IFRS. In this and other earnings releases and investor conference calls, as a complement to results provided in accordance with IFRS, the Company also discloses and discusses certain financial measures not recognized under IFRS and that do not have standard meanings prescribed by IFRS. These include "EBITDA", "Adjusted EBITDA", "Pro-forma Adjusted EBITDA", "EBITDA Margin", "Adjusted EBITDA Margin", "Pro-forma Adjusted EBITDA Margin", "Pro-forma Revenue", "Adjusted Working Capital", and "Adjusted Net and Comprehensive Income (Loss)". These non-IFRS measures are used to provide investors with supplemental measures of Spark Power's operating performance and highlight trends in Spark Power's business that may not otherwise be apparent when relying solely on IFRS measures. Spark also believes that providing such information to securities analysts, investors and other interested parties who frequently use non-IFRS measures in the evaluation of issuers will allow them to better compare Spark Power's performance against others in its industry. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation. For a reconciliation of these non-IFRS measures see the Company's management's discussion and analysis for the three- and nine- months ended September 30, 2021. The non-IFRS measures should not be construed as alternatives to results prepared in accordance with IFRS.

Selected Consolidated Financial Information:

Reconciliation of comprehensive income (loss) to EBITDA, Adjusted EBITDA, and Pro-forma Adjusted EBITDA:

The following table is a summary of Spark Power's results for the periods indicated:

Investor and Regulatory Inquiries:

Richard Perri, Executive Vice President & Chief Financial Officer

Richard.perri@sparkpowercorp.com

+1 (905) 829-3336

Media Inquiries:

Bryan Sparks, Manager, Corporate Communications & Brand

media@sparkpowercorp.com

+1 (289) 218-6829

SOURCE: Spark Power Group Inc.

View source version on accesswire.com:

https://www.accesswire.com/725745/Spark-Power-Delivers-Continued-Momentum-in-Its-Operations-and-Earnings-Growth-with-Strong-Third-Quarter-Results