ANN ARBOR, MI / ACCESSWIRE / May 11, 2023 / Zomedica Corp. (NYSE American:ZOM) ("Zomedica" or the "Company"), a veterinary health company offering point-of-care diagnostics and therapeutic products for companion animals, today reported consolidated financial results for the three months ended March 31, 2023. Amounts, unless specified otherwise, are expressed in U.S. dollars and presented under accounting principles generally accepted in the United States of America ("U.S. GAAP").

Larry Heaton, Zomedica's Chief Executive Officer, commented: "We were pleased with our revenue of $5.5 million, representing our second highest revenue quarter to date and reflecting a $1.7 million and 45% increase over first quarter 2022 sales of $3.8 million. The first quarter is historically our lowest revenue quarter of the year and sequentially down from our fourth quarter as expected.

"Diagnostic segment revenue from TRUFORMA®, Revo Squared®, and VetGuardian® product sales was $0.4 million in the first quarter of 2023, an increase of approximately 300% over first quarter 2022 revenue of $0.1 million. Therapeutic segment revenue from PulseVet® and Assisi® product sales was $5.1 million in the first quarter of 2023, an increase of approximately 38% over the first quarter of 2022.

"Organic growth for the first quarter of 2023 versus the first quarter of 2022 was 11%, reflecting 222% growth in TRUFORMA product sales, and 8% growth in PulseVet products, which included 21 systems sold to small animal veterinarians. Products not present during first quarter 2022, including Assisi, Revo Squared and VetGuardian products, accounted for an additional $1.4 million in incremental sales in the first quarter of 2023.

"We were also pleased with our gross margins of 70%, especially as we are transitioning distribution of our Assisi products from the current third-party logistics provider to our Global Manufacturing and Distribution Center in Roswell, Georgia during the current quarter.

"Our transition of TRUFORMA product line research and development and manufacturing is proceeding to plan which will provide additional opportunity for margin improvement as it is completed. Accordingly, on May 10, we entered into an amended lease for our Georgia center to add 6,000 more square feet to our current 12,400 square feet, earmarked primarily for TRUFORMA cartridge manufacturing as we transition from third-party manufacturing to doing it ourselves.

"During the first quarter we launched the VetGuardian zero-touch vital signs remote monitoring system through our direct salesforce and are currently extending its launch through U.S. animal health distributors. Further, we decided to proceed with an acquisition of Structured Monitoring Products (SMP), the makers of the VetGuardian zero-touch vital signs remote monitoring system, which is currently underway. On May 5th, we paid SMP a non-refundable deposit of $250,000 to exercise our acquisition option and will now conduct diligence and finalize a definitive acquisition agreement.

"We've begun manufacturing in our Georgia center the TRUVIEWTM digital microscopy system that provides fully automated slide preparation, designed to significantly improve veterinarian practice workflow as well as to reduce the number of unreadable images due to suboptimal slide preparation, which we plan on launching during the current quarter.

"Overall, we are pleased with our progress in the first quarter and are excited to continue building on this growth trajectory as we introduce new product platforms into the market in 2023. We will continue to evaluate strategic business development and M&A opportunities to further bolster our overall growth opportunity in the large and growing animal health sector. We believe we are well positioned to continue the momentum."

First Quarter 2023 Financial Highlights

Revenue for the first quarter of 2023 was $5.5 million, an increase of 45% compared to first quarter 2022 sales of $3.8 million, primarily driven by:

- Growth in Diagnostic segment revenue from TRUFORMA, Revo Squared, and VetGuardian product sales to $0.4 million in the first quarter of 2023, an increase of approximately 300% over first quarter 2022 revenue; and

- Growth in Therapeutic segment revenue from PulseVet and Assisi product sales to approximately $5.1 million in the first quarter of 2023, an increase of approximately 38% over the first quarter of 2022

Gross margin was 70% for the first quarter of 2023.

Zomedica ended the first quarter with $147.5 million in cash, cash equivalents, and available for sale securities. Cash used in the first quarter was $8.3 million, including $4.0 million in licensing fees paid to our TRUFORMA development partner, approximately $1.8 million invested in SMP, and the remainder used for operating expenses, including non-recurring/integration related charges.

Summary First Quarter 2023 Results

Revenue for the three months ended March 31, 2023, was $5.5 million, compared to $3.8 million for the three months ended March 31, 2022, an increase of $1.7 million or approximately 45%. The increase was primarily due to the inclusion of our Assisi, Revo, and VetGuardian products, which were not part of our consolidated figures as of March 31, 2022.

In general, we expect revenue to increase in subsequent periods as we benefit from expanded product lines from our recent acquisitions and increased sales, marketing, and commercialization efforts. In addition, sales generally increase sequentially after the first quarter with historical high points in the fourth quarter.

Cost of revenue for the three months ended March 31, 2023 was $1.6 million, compared to $1.0 million for the three months ended March 31, 2022, an increase of $0.6 million or 60%. Margins remained strong at 70% overcoming many product mix headwinds.

Operating expenses are up $4.3 million for the three months ended March 31, 2023 or 61%.

Research and development expense for the three months ended March 31, 2023 was $0.9 million, compared to $0.4 million for the three months ended March 31, 2022, an increase of $0.5 million or 125%. The increase was primarily driven by our continued buildup of internal capabilities to develop, test, and manufacture our next generation of Diagnostic products.

Total SG&A for the three months ended March 31, 2023 was $10.4 million, compared to $6.7 million for the three months ended March 31, 2022, an increase of $3.7M or 55%

- The Sales and Marketing portion of the $10.4M was $3.7 million or approximately 36% of total SG&A. This compares to $1.4 million for the three months ended March 31, 2022, or 22% of total SG&A. The increase was primarily driven by the hiring of 22 additional salespeople, 16 of whom are selling directly to the customer, as well as increased marketing campaigns/attendance at tradeshows to build brand awareness and recognition of our expanding suite of products.

- The remaining portion of the $10.4 million relates to non-commercial general and administrative expense, which was $6.7 million for the three months ended March 31, 2023. This compares to $5.3 million for the three months ended March 31, 2022, an increase of $1.4M or 26%. We are pleased to see leverage in this cost category, even when considering the increases in non-recurring charges such as CFO transition costs and other growth / integration related expenses.

Net loss for the three months ended March 31, 2023, was $6.4 million,or $0.007 per share, compared to a net loss of $3.9 million, or $0.004 per share, for the three months ended March 31, 2022. This increase in losses of $2.5 million or approximately 64% was almost entirely attributable to the expanded commercial activities as noted previously.

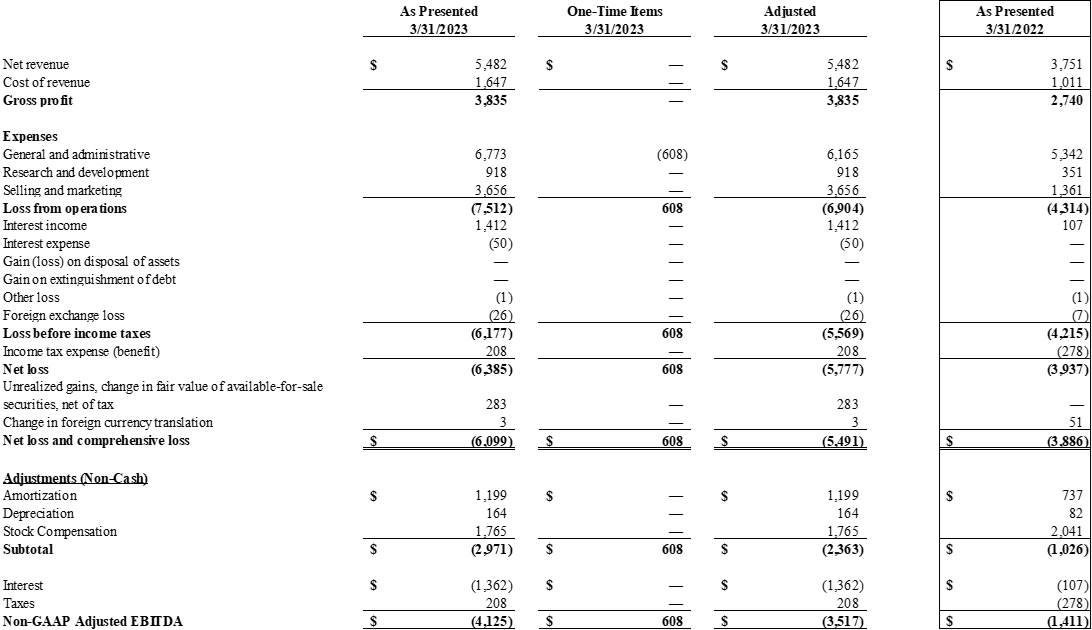

*Non-GAAP EBITDA loss (which includes adjustments for Stock Compensation) for the three months ended March 31, 2023, was $4.1 million compared to a loss of $1.4 million for the three months ended March 31, 2022. When adjusting for one-time items associated with our Qorvo / TRUFORMA related transition, our transition to a new Chief Financial Officer, and adjustments associated with our Revo earnout liability, our **Adjusted Non-GAAP EBITDA loss was $3.5 million.

Liquidity and Outstanding Share Capital

Zomedica had cash, cash equivalents, and available-for-sale securities of $147.5 million as of March 31, 2023, compared to $195.0 million as of March 30, 2023. The decrease in cash was primarily driven by the acquisitions of our Assisi and Revo platforms, Qorvo related transition payments, and general operating activity.

- Net cash used in operating activities for the three months ended March 31, 2023 was $4.3 million, compared to $2.5 million for the three months ended March 31, 2022, an increase in cash used of $1.8 million or 72%. The increase in cash used in operations primarily resulted from the losses noted above and non-cash accretion on currently held available-for-sale securities, partially offset by increases in non-cash amortization and stock compensation.

- Net cash used in investing activities for the three months ended March 31, 2023 was $14.8 million, compared to $0.2 million for the three months ended March 31, 2022, an increase of $14.6 million or 7,300%. The increase in cash used in investing activities primarily resulted from investment in available for sale securities, additional investments in SMP, and Qorvo license related intangibles.

- There was no cash used in financing activities for the three months ended March 31, 2023 or 2022.

As of March 31, 2023, Zomedica had 979,949,668 common shares issued and outstanding.

For complete financial results, please see Zomedica's filings on EDGAR and SEDAR or visit the Zomedica website at www.zomedica.com.

About Zomedica

Based in Ann Arbor, Michigan, Zomedica (NYSE American:ZOM) is a veterinary health company creating diagnostic and therapeutic products for horses, dogs, and cats by focusing on the unmet needs of clinical veterinarians. Zomedica's product portfolio includes innovative diagnostics and medical devices that emphasize patient health and practice health. Zomedica's mission is to provide veterinarians the opportunity to increase productivity and grow revenue while better serving the animals in their care. For more information, visit https://www.zomedica.com.

Follow Zomedica

- Email Alerts: http://investors.zomedica.com

- LinkedIn: https://www.linkedin.com/company/zomedica

- Facebook: https://m.facebook.com/zomedica

- Twitter: https://twitter.com/zomedica

- Instagram: https://www.instagram.com/zomedica_inc

Reader Advisory

Except for statements of historical fact, this news release contains certain "forward-looking information" or "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur and include statements relating to our expectations regarding future results. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance, or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information.

Forward-looking information is based on the opinions and estimates of management at the date the statements are made, including assumptions with respect to economic growth, demand for the Company's products, the Company's ability to produce and sell its products, sufficiency of our budgeted capital and operating expenditures, the satisfaction by our strategic partners of their obligations under our commercial agreements, our ability to realize upon our business plans and cost control efforts and the impact of COVID-19 on our business, results and financial condition.

Our forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: the finalization of the accounting procedures necessary to report our financial results for 2023, the application of generally accepted accounting principles, which are highly complex and involve many subjective assumptions, estimates, and judgments, uncertainty as to whether our strategies and business plans will yield the expected benefits; uncertainty as to the timing and results of development work and verification and validation studies; uncertainty as to the timing and results of commercialization efforts, as well as the cost of commercialization efforts, including the cost to develop an internal sales force and manage our growth; uncertainty as to our ability to successfully integrate acquisitions; uncertainty as to our ability to supply products in response to customer demand; uncertainty as to the likelihood and timing of any required regulatory approvals, and the availability and cost of capital; the ability to identify and develop and achieve commercial success for new products and technologies; veterinary acceptance of our products; competition from related products; the level of expenditures necessary to maintain and improve the quality of products and services; changes in technology and changes in laws and regulations; our ability to secure and maintain strategic relationships; performance by our strategic partners of their obligations under our commercial agreements, including product manufacturing obligations; risks pertaining to permits and licensing, intellectual property infringement risks, risks relating to any required clinical trials and regulatory approvals, risks relating to the safety and efficacy of our products, the use of our products, intellectual property protection, risks related to the COVID-19 pandemic and its impact upon our business operations generally, including our ability to develop and commercialize our products, and the other risk factors disclosed in our filings with the SEC and under our profile on SEDAR at www.sedar.com. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Investor Relations Contacts:

Dave Gentry

RedChip Companies Inc.

1-800-RED-CHIP (733-2447)

Or 407-491-4498

ZOM@redchip.com

Non-GAAP Measures

Non-GAAP EBITDA, Adjusted Non-GAAP EBITDA, and other measures presented on an adjusted basis are not recognized terms under U.S. GAAP and do not purport to be alternatives to the most comparable U.S. GAAP amounts. Since all companies do not use identical calculations, our definition and presentation of these measures may not be comparable to similarly titled measures reported by other companies. Management uses the identified non-GAAP measures to evaluate the operating performance of the Company and its business segments and to forecast future periods. Management believes these non-GAAP measures assist investors and other interested parties in evaluating Zomedica's on-going operations and provide important supplemental information to management and investors regarding financial and business trends relating to Zomedica's financial condition and results of operations. Investors should not consider these non-GAAP measures as alternatives to the related GAAP measures. Reconciliations of non-GAAP measures to their closest U.S. GAAP equivalent are presented below.

* Non-GAAP EBITDA is defined as net loss and comprehensive loss excluding amortization, depreciation, non-cash stock compensation, and taxes while reversing out the benefits derived from interest income.

** Non-GAAP Adjusted EBITDA is defined as Non-GAAP EBITDA, as defined above, excluding expenses related to the transition of TRUFORMA development and manufacturing capabilities, our transition to a new Chief Financial Officer, and adjustments associated with our Revo earnout liability valuation.

SOURCE: Zomedica Corp.

View source version on accesswire.com:

https://www.accesswire.com/754267/Zomedica-Announces-Record-First-Quarter-2023-Financial-Results-Revenue-up-45-to-55-Million-Strong-70-Gross-Margin-1475-Million-in-Liquidity