VANCOUVER, BC / ACCESSWIRE / May 30, 2023 / Clover Leaf Capital Corp. (TSXV:CLVR.P) ("Clover Leaf" or the "Company") is pleased to announce that North Shore Energy Metals Ltd. ("North Shore") has entered into an option agreement (the "Agreement") with Skyharbour Resources Ltd. ("Skyharbour") to earn up to a 100% interest in 11 mining claims that comprise the 42,900 hectare South Falcon property in the eastern Athabasca Basin region of Saskatchewan. The claim block is adjacent to and south and east of North Shore's 12,800 hectare 100% owned Falcon uranium property. The addition of the new claims to its portfolio will increase the size of the Falcon property to 55,700 hectares. The Agreement provides North Shore an opportunity to earn an 80% interest in the 11 claims over a three year period by fulfilling combined cash, share issue and exploration expenditure commitments of CAD$5.3 million.

As announced on May 3, 2023 Clover Leaf received conditional acceptance from the TSX Venture Exchange (the "TSXV") to close its acquisition of North Shore by way of a one for one share exchange agreement (the "Qualifying Transaction") as described in the Company's press release dated December 23, 2022. The Qualifying Transaction will constitute the Company's qualifying transaction pursuant to the policies of the TSXV. It is a condition to the completion of the Qualifying Transaction that North Shore complete a concurrent equity offering prior to the closing date of the Qualifying Transaction for minimum gross proceeds of $5,000,000. Upon completion of the Qualifying Transaction the name of the resulting company will be North Shore Uranium Ltd.

North Shore is now a private mineral exploration company focused on uranium exploration at the eastern margin of the Athabasca Basin through its Falcon property, which will be 55,700 hectares in size with the addition of the new claims, and its 4,500 hectare West Bear property located 90 kilometres to the northeast.

Tsend Tseren, Chief Executive Officer of Clover Leaf stated "This option deal with Skyharbour, a prolific uranium prospect generator, will increase North Shore Uranium's exposure to a potential new uranium discovery at the eastern Margin of the Athabasca Basin, an area with great uranium potential that is seeing a surge in uranium exploration activity."

About the Falcon Property

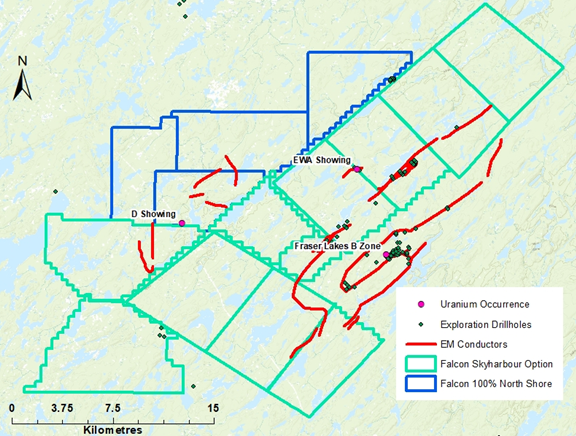

Upon completion of the Qualifying Transaction, the combined Falcon property will consist of 15 claims totaling 55,700 hectares, with four 100% owned claims totaling 12,800 hectares and the 11 claims totaling 42,900 hectares that are the subject of the Agreement (Figure 1). The property is located approximately 40 kilometres east of the Key Lake uranium mill and former mine.

The 100% owned claims were described in the Company's September 27, 2022 press release. In October, 2022, a 900 line kilometre airborne gravity, magnetic and radiometric survey was completed over the claims by North Shore. Interpretation of publicly available geophysical data and data from the 2022 survey has led to the identification of six uranium prospect areas that are now targeted for exploration.

Following are some comments on the uranium exploration potential of the 11 claims subject to the Agreement.

- Known Mineralization. Historical uranium mineralization discovered on the claims and nearby is shallow and hosted in several geological settings including classic Athabasca style basement-hosted, unconformity-related and pegmatite-hosted mineralization associated with well-defined EM conductors. One boulder found at the EWA Showing returned 0.492% U3O8 and 1,300 ppm lead (Saskatchewan SMDI 5038). The D Showing, which straddles claims 100% owned by North Shore and claims subject to the Agreement, is described as a mineralized vein with one sample having 1.26% uranium and 0.8% molybdenum.(Saskatchewan SMDI 2455).

- Untested EM conductors. There is a well-defined northeast-trending electromagnetic conductor zone that was defined through geophysical surveys by JNR Resources ("JNR") in the 2000s. In 2008, JNR drilled 28 holes in three portions of the conductor system. The remainder of the conductor system, with an approximate strike length of 28 kilometres remains untested (Figure 1). It was during this drill campaign that the Fraser Lakes B Zone was discovered approximately four kilometres to the southeast on a parallel EM conductor system.

- 2022 Airborne geophysical survey. In 2022, Skyharbour completed an airborne gravity and magnetic survey over nine of the 11 claims subject to the Agreement as part of its South Falcon survey. The survey had the same specifications as the survey completed by North Shore over its adjacent 100% owned adjacent Falcon claims in 2022 (200 m line-spacing and 80 m flying height). This new geophysical data will assist North Shore in prioritizing zones along the defined EM conductor zone described above for drilling.

- Fraser Lakes "B Zone". In 2008, JNR discovered the pegmatite-hosted Fraser Lakes B zone located approximately three kilometres southeast of claims that are the subject of the Agreement. In 2015 Skyharbour declared an inferred resource of 7.0 million pounds of U3O8 at an average grade of .03% U3O8 within 10.4 million tonnes of ore. A qualified person has not verified the foregoing mineral resource estimate on behalf of the Company. Readers are cautioned that mineralization on adjacent properties is not necessarily indicative of mineralization on the Falcon property.

- Future Work. North Shore's initial goals will be to assess untested EM conductors by prospecting and/or drilling, principally at the southwestern end of the system, and complete airborne geophysics over the two westernmost claims.

The Agreement

The terms of the Agreement, in Canadian dollars are summarized in the table below. The Agreement is subject to the closing of the Qualifying Transaction.

Requirements for North Shore to Acquire an 80% Interest in 11 Claims from Skyharbour

Closing |

By December 31, 2023 |

1st Ann. |

2nd Ann. |

3rd Ann. |

Totals |

|

$ |

$ |

$ |

$ |

$ |

$ |

|

| Cash | 50,000* |

- |

100,000 |

150,000 |

225,000 |

525,000 |

| Shares** | 150,000 |

- |

200,000 |

350,000 |

525,000 |

1,225,000 |

| Exploration Work | - |

250,000 |

250,000 |

1,300,000 |

1,750,000 |

3,550,000 |

| Totals | 150,000 |

250,000 |

550,000 |

1,800,000 |

2,500,000 |

5,300,000 |

* $25,000 paid, $25,000 and 500,000 shares at $0.30 due on completion of the Qualifying Transaction.

** Cash or shares at North Shore's option on the first, second and third anniversaries, with the share price being based on the five-day volume-weighted average price at the time of issuance, subject to minimum pricing rules of the TSXV with a minimum issue price of $0.05 per share.

Figure 1. North Shore's Falcon property and vicinity showing claims that are 100% owned by North Shore and the claims subject to the Agreement and select geologic features of interest. Sources: Saskatchewan government database and Skyharbour disclosure. The figure contains information about a property adjacent to the Falcon property which North Shore does not have the right to explore.

Upon North Shore earning an 80 percent interest in the 11 claims from Skyharbour, it will have 90 days to acquire the remaining 20 percent interest in the claims by paying Skyharbour $5 million in cash and issuing Skyharbour $5 million worth of shares. If North Shore does not elect to acquire the remaining 20 percent interest, a joint venture will be formed with Skyharbour holding a 20 percent participating interest.

North Shore will be the operator of the exploration programs during the earn-in stage and for the joint venture. Two claims totaling 10,673 hectares that were previously part of Skyharbour's Foster River property are subject to a one percent NSR royalty payable to Skyharbour. The remaining nine claims totaling 32,235 hectares t are subject to a two percent NSR royalty payable to Denison Mines Corp. ("Denison") with North Shore having the right to purchase one percent of the royalty from Denison at any time by paying $1 million. In 2014, Skyharbour purchased these claims from Denison.

Qualified Person

Mr. Brooke Clements, a qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects and President of North Shore, has reviewed and approved the scientific and technical disclosure in this press release.

About the Company

The Company is a capital pool company ("CPC") within the meaning of the policies of the TSXV that has not commenced commercial operations and has no assets other than cash. Except as specifically contemplated in the CPC policies of the Exchange, until the completion of its "Qualifying Transaction" (as defined therein), the Company will not carry on business, other than the identification and evaluation of companies, business or assets with a view to completing a proposed "Qualifying Transaction".

The Qualifying Transaction remains subject to conditions, including but not limited to, TSXV acceptance and, if applicable pursuant to TSXV requirements, majority of the minority shareholder approval. Where applicable, the Qualifying Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Qualifying Transaction will be completed as proposed or at all. Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Qualifying Transaction, any information released or received with respect to the Qualifying Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative. The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release.

On behalf of the Board of Directors

Tsend Tseren,

Chief Executive Officer

Contact Information - For more information, please contact:

Ben Meyer,

Corporate Secretary

Tel: 604.536.2711

Email: ben@gocs.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction.

Cautionary Statement Regarding Forward-Looking Information

This news release contains certain forward-looking statements, including statements relating to the Qualifying Transaction and certain terms and conditions thereof, the concurrent equity offering, the ability of the parties to complete the Qualifying Transaction and close the Agreement, and any other statements that are not historical facts. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These risks and uncertainties include, but are not limited to, geological risks, risks associated with the financial markets generally, the results of the due diligence investigations to be conducted in connection with the Qualifying Transaction, the ability of the Company to complete the Qualifying Transaction and close the Agreement or obtain requisite TSXV acceptance and, if applicable, shareholder approvals. As a result, the Company cannot guarantee that the Qualifying Transaction or Agreement will be completed on the terms described herein or at all. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this press release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this press release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Clover Leaf Capital Corp.

View source version on accesswire.com:

https://www.accesswire.com/757928/Clover-Leaf-Capital-Announces-Option-Agreement-between-North-Shore-Energy-and-Skyharbour-Resources-for-the-42900-hectare-South-Falcon-Property-in-the-Eastern-Athabasca-Region-of-Saskatchewan