German Mittelstand companies double down on global expansion despite supply chain friction

Study finds a significant number of companies plan for ownership transitions in the medium term, mainly within the family, but also externally

Undeterred by supply chain challenges thrown up by COVID-19, German businesses are doubling down on globalization, embracing technology as a means to adapt, and planning for ownership transitions in the medium term, according to J.P. Morgan’s inaugural Germany Business Leaders Outlook survey released today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210527005147/en/

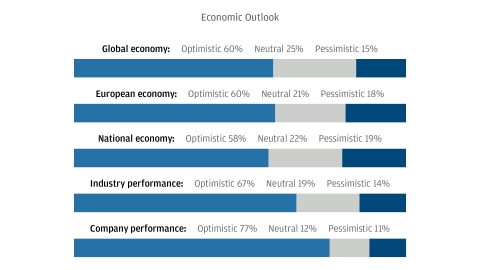

According to the J.P. Morgan Business Leaders Outlook survey, about 6 in 10 of senior executives from German companies think the economy is heading in a positive direction over the next year, and an even greater share are bullish about the performance of their own company (77%) and industry (67%). (Graphic: Business Wire)

J.P. Morgan surveyed 238 senior executives of German mid-cap companies and found that nearly 60% believe the global and German economies are heading in a positive direction over the next year. This optimism is being fueled by three-quarters of respondents reporting that they anticipate revenue/sales and profits will increase in the year ahead.

While many executive leaders are optimistic about the future, they’re faced with the realities of an unpredictable operating environment. According to the survey, top challenges include:

- COVID-19: Many of the challenges executive leaders face are still directly related to COVID-19, as 37% of businesses report shifting consumer habits due to COVID-19 as their top challenge.

- Supply Chain: After the desire for new customers, another challenge executives cite around their international activity is gaining access to suppliers and materials. As contributing factors, 62% of executives say the pandemic has increased supply chain issues, and 28% say Brexit has made supply chains worse as well.

- Internet Reliability: More than a quarter (26%) of executives surveyed cited a need for technology upgrades to stay relevant as one of their top three business challenges. A lack of high-speed internet is a longstanding issue that has only become more apparent over the past year—nearly half (46%) of executives would like the German government to focus on improving access over the next year.

“Businesses operate in a world in constant change, but this past year required them to pivot and invest in their operating models in new and challenging ways—from technology adoption for remote employees to managing their supply chains,” said Bernhard Brinker, Head of Commercial Banking, J.P. Morgan Germany. “However, companies are optimistic that the changes they’ve made over the past year will help them be increasingly efficient within the year and poised for growth domestically and internationally.”

In addition to planning for operating challenges, German businesses responded to 2020’s economic realities by shifting their operating models and adapting their business strategies to maintain some level of success in the new environment. As they begin to look toward a post-pandemic world, German executives are now looking to progress their businesses in new ways, including:

- Continued Global Expansion: In today's globalized economy, 85% of German companies say that 25% or more of their sales come from outside the European Union. Despite their already strong international footprint, two-thirds (65%) of German companies expect to further increase the number of countries they’ll operate in over the next five years.

- Embracing Technology: 57% of respondents have already increased their use of online banking tools for electronic payments, have changed their operating model to be more online and have shifted employees to work from home. Of respondents who haven’t yet made these changes, 24% plan to take these actions in the next six months.

- Preparing for Business Transitions: Responses from executives also indicate that a surge in mergers and acquisitions may be coming within the next five years, with nearly two-thirds (63%) saying they’re considering a full or partial ownership transfer. The most common path for German business leaders is to transition their business to a family member, with 25% saying they anticipate ownership transfers to family through inheritance, 21% reporting they expect to transfer ownership to family as a gift and another 21% anticipating a transfer of ownership to family through a sale. Nearly one-third (30%) of respondents plan to transition their businesses outside of their family—15% to the company’s current management and another 15% to a third party.

“Mittelstand companies are the engine of the German economy. We look forward to continuing to serve this core section of our client base as many look to expand beyond their traditional border and fulfil their international ambitions, and as we expand our footprint in this important segment in the market,” said Stefan Povaly, Head of J.P. Morgan Germany, Senior Country Officer.

For more information on the 2021 J.P. Morgan Business Leaders Outlook in Germany, visit www.jpmorgan.com/businessleadersoutlook-germany.

Survey Methodology

J.P. Morgan’s Business Leaders Outlook survey was conducted online from March 10-29, 2021. In total, 238 senior executives (CEOs, CFOs, heads of finance and owners) from German Mittelstand companies, with a majority of annual revenues ranging from $100 million to $2 billion participated in the survey. Results are within statistical parameters for validity, and the error rate is +/-6.4% at a 95% confidence rate.

About JPMorgan Chase

JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm with assets of $3.7 trillion and operations worldwide. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. A component of the Dow Jones Industrial Average, JPMorgan Chase & Co. serves millions of customers in the United States and many of the world’s most prominent corporate, institutional and government clients under its J.P. Morgan and Chase brands. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210527005147/en/

Contacts

J.P. Morgan Germany: Kate Haywood, kate.l.haywood@jpmorgan.com

J.P. Morgan Commercial Banking: Ashley Frost, ashley.c.frost@jpmorgan.com