Home prices across the United States continued to climb in August, rising at an annualized 15.9 percent from the prior month, the third consecutive month reporting an all-time record month-over-month rate, according to Radian Home Price Index (HPI) data released today by Red Bell Real Estate, LLC, a Radian Group Inc. company (NYSE: RDN). The company believes the Radian HPI is the most comprehensive and timely measure of U.S. housing market prices and conditions available in the market today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210921006091/en/

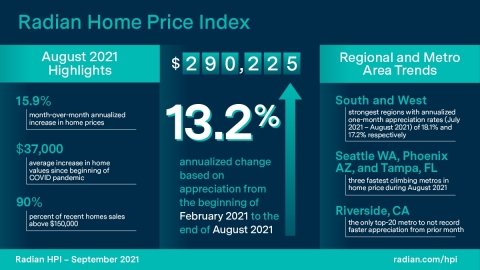

Radian Home Price Index (HPI) Infographic September 2021 (Graphic: Business Wire)

The Radian HPI has risen at an annualized rate of 13.2 percent over the last six months (February 2021 to August 2021), which was nearly double the rate of the same period in 2020. These annualized increases represent the continuation of the general upward trend in home price gains. The Radian HPI is calculated based on the estimated values of more than 70 million unique addresses each month, covering all single-family property types and geographies.

“While this month there are signs of some very slight softening in some of real estate and home price metrics, all-in-all, there is nothing in this month’s findings that would indicate a pending, rapid change in appreciation rates,” noted Steve Gaenzler, SVP of Data and Analytics. Gaenzler added that, “Cessation of state and federal emergency benefits to consumers and homeowners, including expanded unemployment insurance and foreclosure moratoriums, will have an impact in the upcoming months, although right now it appears to be limited in force.”

NATIONAL DATA AND TRENDS

- Median estimated home price in the U.S. rose to $290,225

- Demand for higher priced homes increased more than for more affordable ones

Nationally, the median estimated price for single-family and condominium homes rose to $290,225. Since the onset of the U.S. pandemic eighteen months ago, homes across the U.S. have appreciated, on average, by more than $37,000 significantly reducing leverage and increasing wealth through home equity.

The record rates of appreciation are the result of even stronger real estate sales activity in 2021 than the same period in 2020, which itself was the best year for residential home sales in history. In fact, through the first eight months of 2021, home sales are running 8.9 percent higher than the first 8 months of 2020. However, the last three months of 2020 saw surges in sales activity, largely a result of the release of pent-up demand from the early days of the pandemic and resulting shutdowns.

As home prices have appreciated, there has been an outsized increase in sale and listing activity in the market for the higher, if not the highest, priced homes.

Prior to the start of the pandemic, the highest priced homes, those with sales prices more than $500,000, represented 16.4 percent of all sales. At that time, homes priced between $150,000 and $200,000 represented 27.3 percent of all sales, the largest cohort of transactions. In the ensuing months, the demand for highest priced homes has skyrocketed and now represents the largest portion of the sales activity (27.7%) by count. Sales of homes with prices below $150,000 now represent less than 10 percent of all sales. Affordability has become a larger issue during the pandemic.

REGIONAL DATA AND TRENDS

- All Regions continue to grow

- South and West showed strongest growth for the second straight month

In August, all six of the Regional indices recorded higher annual home price appreciation rates than the prior month. The South and West remained the strongest regions with annualized one-month appreciation rates (July 2021 – August 2021) of 18.1 and 17.2 percent, respectively.

Home prices continue to be supported by a lack of supply. After rising for four consecutive months, the number of active listings fell in August. Months of Supply, which the Radian HPI measures as the current month’s active listings divided by last month's sales, is 2.73 months. This was only slightly higher than the record low ratio of 2.62 months measured in July.

METROPOLITAN AREA DATA AND TRENDS

- Appreciation rates rise in nearly every major city

- Large cities appreciating at a faster rate than before the pandemic

All 20-largest metro areas of the U.S. recorded faster annual price appreciation in August when compared to the prior month, except for Riverside, CA which fell three basis points. With annualized month-over-month change respectively, Seattle (+17.8%), Phoenix (+16.8%), and Tampa (+15.0%) were the three fastest climbers in home prices last month. However, it may prove telling that Riverside, a community that gained attention for its poor performance during the Great Recession, is the only metro that recorded slower home price appreciation this month. Nonetheless, as of now, according to the Radian HPI, this near unanimous show of price appreciation is a strong indicator as to the health of the current U.S. housing market.

ABOUT THE RADIAN HPI

Red Bell Real Estate, LLC, a subsidiary of Radian Group Inc., provides national and regional indices for download at radian.com/hpi, along with information on how to access the full library of indices.

Additional content on the housing market can also be found on the Radian Insights page located at https://radian.com/news-and-knowledge/insights.

Red Bell offers the Radian HPI data set along with a client access portal for content visualization and data extraction. The engine behind the Radian HPI has created more than 100,000 unique data series, which are updated on a monthly basis.

The Radian HPI Portal is a self-service data and visualization platform that contains a library of thousands of high-value indices based on both geographic dimensions as well as by market, or property attributes. The platform provides monthly updated access to nine different geographic dimensions, from the national level down to zip codes. In addition, the Radian HPI provides unique insights into market changes, conditions and strength across multiple property attributes, including bedroom count and livable square footage. To help enhance customers’ understanding of granular real estate markets, the library is expanded regularly to include more insightful indices.

In addition to the services offered by its Red Bell subsidiary, Radian is ensuring the American dream of homeownership responsibly and sustainably through products and services that include industry-leading mortgage insurance and a comprehensive suite of mortgage, risk, title, valuation, asset management and other real estate services. The company is powered by technology, informed by data and driven to deliver new and better ways to transact and manage risk.

Visit http://www.radian.com to see how Radian is shaping the future of mortgage and real estate services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210921006091/en/

Contacts

For Investors

John Damian – Phone: 215.231.1383

Email: john.damian@radian.com

For the Media

Rashi Iyer – Phone: 215.231.1167

Email: rashi.iyer@radian.com