Affinity Bancshares, Inc. (NASDAQ:“AFBI”) (the “Company”), the holding company for Affinity Bank (the “Bank”), today announced net income of $7.6 million for the year ended December 31, 2021 as compared to $3.1 million for the year ended December 31, 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220222006171/en/

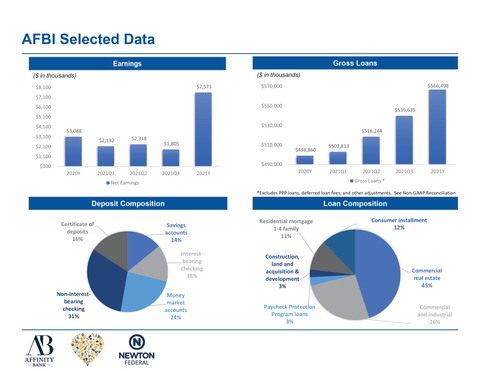

AFBI Selected Data (Graphic: Business Wire)

For the three months ended, |

For the year ended, |

||||||||||||||||

Performance

|

December

|

September

|

June

|

March

|

December

|

December

|

|||||||||||

Return on average assets |

0.66 |

% |

0.91 |

% |

1.18 |

% |

1.11 |

% |

0.96 |

% |

0.42 |

% |

|||||

Return on average equity |

4.36 |

% |

6.00 |

% |

7.95 |

% |

8.03 |

% |

6.52 |

% |

3.97 |

% |

|||||

Net interest margin |

3.64 |

% |

3.78 |

% |

4.10 |

% |

4.65 |

% |

4.04 |

% |

3.77 |

% |

|||||

Efficiency ratio |

74.29 |

% |

65.87 |

% |

58.30 |

% |

64.96 |

% |

65.62 |

% |

78.46 |

% |

|||||

Results of Operations

Net income was $7.6 million for the year ended December 31, 2021 as compared to $3.1 million for the year ended December 31, 2020, as we have increased our interest income while reducing interest and non-interest expense. Our net income in 2020 was reduced as a result of merger related expenses. Merger related expenses for the year ended December 31, 2020, were $2.8 million.

Net Interest Income and Margin

Net interest income increased $4.1 million, and was $29.3 million for the year ended December 31, 2021, compared to $25.1 million for the year ended December 31, 2020. Average interest-earning assets increased by $57.8 million for the year ended December 31, 2021. Net interest margin for the year ended December 31, 2021, increased to 4.04%, from 3.77% for the year ended December 31, 2020. The increase in net interest margin was primarily due to the decrease in the cost of funds. For the year ended December 31, 2021, the cost of average interest-bearing liabilities decreased to 0.67% from 1.10% for the year ended December 31, 2020. The total cost of deposits was 0.63% for the year ended December 31, 2021 compared to 1.12% for the year ended December 31, 2020. The decrease was due to decreasing deposit rates related to the decrease in market rates.

Provision for Loan Losses

For the year ended December 31, 2021, the provision for loan loss expense was $1.1 million compared to $2.0 million for the year ended December 31, 2020. We increased our provision expense in 2020 due to the uncertainty related to the COVID-19 pandemic. As the economy began to improve in 2021, less provision expense was required. Net loan recoveries were $1.1 million for the year ended December 31, 2021, compared to $227,000 for the year ended December 31, 2020. The increase in net recoveries was primarily driven by a $1.0 million recovery on a previously charged off commercial real estate loan.

Non-interest Income

For the year ended December 31, 2021, noninterest income increased $522,000 to $2.7 million compared to $2.2 million for the year ended December 31, 2020. This was a result of increases in service charges on deposits accounts, interchange income, and secondary market fee income.

Non-interest Expense

Operating expenses decreased $450,000 to $21.0 million for the year ended December 31, 2021, compared to $21.4 million for the year ended December 31, 2020. We saw an increase in legal and accounting fees as well as salary and employee expense in 2020 due to the merger.

Income Tax Expense

We recorded income tax expense of $2.3 million for year ended December 31, 2021, compared to $792,000 for the year ended December 31, 2020. The higher tax expense for the year ended December 31, 2021, was primarily due to higher pretax income.

Financial Condition

Total assets decreased by $62.5 million to $788.1 million at December 31, 2021, from $850.6 million at December 31, 2020. The decrease was due primarily to a decrease in cash and cash equivalents of $66.5 million due to our no longer using the Paycheck Protection Program Liquidity Facility (PPPLF) for funding as well as a decrease in net loans of $16.4 million. Cash and equivalents decreased $66.5 million, to $111.8 million at December 31, 2021, from $178.3 million at December 31, 2020, as the PPPLF was not used for funding at year end and excess cash from the stock offering was returned. Total investment securities available for sale increased by $24.6 million at December 31, 2021, as compared to December 31, 2020, as we deployed excess liquidity. Total loans decreased $14.2 million to $584.4 million at December 31, 2021 from $598.6 million at December 31, 2020, including Paycheck Protection Program (PPP) loans of $17.9 million and $101.7 million at December 31, 2021 and December 31, 2020, respectively. Deposits decreased by $25.4 million to $614.8 million at December 31, 2021 compared to $640.2 million at December 31, 2020, which reflected a decrease in certificate of deposits of $34.9 million, partly offset by an increase in non-interest-bearing deposits of $33.1 million. The loan-to-deposit ratio at December 31, 2021 was 93.7%, as compared to 92.5% at December 31, 2020. Interest-bearing checking accounts decreased $38.4 million as a result of the completion of the second step conversion. Stockholders’ equity increased to $121.0 million at December 31, 2021, as compared to $80.8 million at December 31, 2020, primarily due to the completion of our mutual-to-stock conversion and related stock offering on January 20, 2021. We sold 3,701,509 shares of common stock at $10.00 per share and raised gross proceeds of $37.1 million in the offering.

Asset Quality

The Company’s non-performing loans increased to $7.0 million at December 31, 2021, as compared to $4.9 million at December 31, 2020. The allowance for loan losses as a percentage of non-performing loans was 122.1% at December 31, 2021, as compared to 129.8% at December 31, 2020. The Company’s allowance for loan losses was 1.46% of total loans at December 30, 2021, as compared to 1.06% at December 31, 2020. The allowance as a percentage of total loans increased due to the decrease in PPP loans as well as a large recovery of a previously charged off loan.

About Affinity Bancshares, Inc.

The Company is a Maryland corporation based in Covington, Georgia. The Company’s banking subsidiary, Affinity Bank, opened in 1928 and currently operates a full-service office in Atlanta, Georgia, two full-service offices in Covington, Georgia, and a loan production office serving the Alpharetta and Cumming, Georgia markets.

Average Balance Sheets

The following tables set forth average balance sheets, average yields and costs, and certain other information for the years indicated. No tax-equivalent yield adjustments have been made, as the effects would be immaterial. All average balances are monthly average balances. Non-accrual loans were included in the computation of average balances. The yields set forth below include the effect of deferred fees, discounts, and premiums that are amortized or accreted to interest income or interest expense.

|

For the Year Ended December 31, |

|

||||||||||||||||||||||

|

2021 |

|

|

2020 |

|

|||||||||||||||||||

|

Average

|

|

|

Interest |

|

|

Average

|

|

|

Average

|

|

|

Interest |

|

|

Average

|

|

|||||||

|

(Dollars in thousands) |

|

||||||||||||||||||||||

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Loans |

$ |

588,976 |

|

|

$ |

31,484 |

|

|

|

5.35 |

% |

|

$ |

575,548 |

|

|

$ |

29,933 |

|

|

|

5.20 |

% |

|

Securities |

|

35,109 |

|

|

|

709 |

|

|

|

2.02 |

% |

|

|

19,917 |

|

|

|

380 |

|

|

|

1.91 |

% |

|

Interest-earning deposits and federal funds |

|

98,554 |

|

|

|

180 |

|

|

|

0.18 |

% |

|

|

69,137 |

|

|

|

212 |

|

|

|

0.31 |

% |

|

Other investments |

|

2,324 |

|

|

|

80 |

|

|

|

3.43 |

% |

|

|

2,523 |

|

|

|

107 |

|

|

|

4.24 |

% |

|

Total interest-earning assets |

|

724,963 |

|

|

|

32,453 |

|

|

|

4.48 |

% |

|

|

667,125 |

|

|

|

30,632 |

|

|

|

4.59 |

% |

|

Noninterest-earning assets |

|

63,373 |

|

|

|

|

|

|

|

|

|

60,601 |

|

|

|

|

|

|

|

|||||

Total assets |

$ |

788,336 |

|

|

|

|

|

|

|

|

$ |

727,726 |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Savings accounts |

$ |

93,113 |

|

|

|

403 |

|

|

|

0.43 |

% |

|

$ |

88,425 |

|

|

|

878 |

|

|

|

0.99 |

% |

|

Interest-bearing checking accounts |

|

88,852 |

|

|

|

185 |

|

|

|

0.21 |

% |

|

|

70,678 |

|

|

|

286 |

|

|

|

0.40 |

% |

|

Money market checking accounts |

|

133,835 |

|

|

|

469 |

|

|

|

0.35 |

% |

|

|

112,863 |

|

|

|

965 |

|

|

|

0.86 |

% |

|

Certificates of deposit |

|

110,742 |

|

|

|

1,623 |

|

|

|

1.47 |

% |

|

|

154,020 |

|

|

|

2,623 |

|

|

|

1.70 |

% |

|

Total interest-bearing deposits |

|

426,542 |

|

|

|

2,680 |

|

|

|

0.63 |

% |

|

|

425,986 |

|

|

|

4,752 |

|

|

|

1.12 |

% |

|

Federal Home Loan Bank advances |

|

43,370 |

|

|

|

482 |

|

|

|

1.11 |

% |

|

|

44,574 |

|

|

|

569 |

|

|

|

1.28 |

% |

|

Paycheck Protection Program Liquidity Facility borrowings |

|

1,023 |

|

|

|

4 |

|

|

|

0.35 |

% |

|

|

20,324 |

|

|

|

72 |

|

|

|

0.35 |

% |

|

Other borrowings |

|

418 |

|

|

|

11 |

|

|

|

2.59 |

% |

|

|

8,184 |

|

|

|

97 |

|

|

|

1.18 |

% |

|

Total interest-bearing liabilities |

|

471,353 |

|

|

|

3,177 |

|

|

|

0.67 |

% |

|

|

499,068 |

|

|

|

5,490 |

|

|

|

1.10 |

% |

|

Noninterest-bearing liabilities |

|

200,756 |

|

|

|

|

|

|

|

|

|

150,781 |

|

|

|

|

|

|

|

|||||

Total liabilities |

|

672,109 |

|

|

|

|

|

|

|

|

|

649,849 |

|

|

|

|

|

|

|

|||||

Total stockholders' equity |

$ |

116,227 |

|

|

|

|

|

|

|

|

$ |

77,877 |

|

|

|

|

|

|

|

|||||

Total liabilities and retained earnings |

$ |

788,336 |

|

|

|

|

|

|

|

|

$ |

727,726 |

|

|

|

|

|

|

|

|||||

Net interest income |

|

|

|

$ |

29,276 |

|

|

|

|

|

|

|

|

$ |

25,142 |

|

|

|

|

|||||

Net interest rate spread (1) |

|

|

|

|

|

|

|

3.81 |

% |

|

|

|

|

|

|

|

|

3.49 |

% |

|||||

Net interest-earning assets (2) |

$ |

253,610 |

|

|

|

|

|

|

|

|

$ |

168,057 |

|

|

|

|

|

|

|

|||||

Net interest margin (3) |

|

|

|

|

|

|

|

4.04 |

% |

|

|

|

|

|

|

|

|

3.77 |

% |

|||||

Average interest-earning assets to interest- bearing liabilities |

|

153.80 |

% |

|

|

|

|

|

|

|

|

133.67 |

% |

|

|

|

|

|

|

|||||

(1) |

Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average rate of interest-bearing liabilities. |

(2) |

Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities. |

(3) |

Net interest margin represents net interest income divided by average total interest-earning assets. |

AFFINITY BANCSHARES, INC. Consolidated Balance Sheets |

||||||||

|

|

December 31,

|

|

|

December 31,

|

|

||

|

|

(In thousands except share amounts) |

|

|||||

Assets |

|

|

|

|

|

|

||

Cash and due from banks, including reserve requirement of $0 at December 31, 2021 and 2020, respectively |

|

$ |

16,239 |

|

|

|

5,552 |

|

Interest-earning deposits in other depository institutions |

|

|

95,537 |

|

|

|

172,701 |

|

Cash and cash equivalents |

|

|

111,776 |

|

|

|

178,253 |

|

Investment securities available-for-sale |

|

|

48,557 |

|

|

|

24,005 |

|

Other investments |

|

|

2,476 |

|

|

|

1,596 |

|

Loans, net |

|

|

575,825 |

|

|

|

592,254 |

|

Other real estate owned |

|

|

3,538 |

|

|

|

1,292 |

|

Premises and equipment, net |

|

|

3,783 |

|

|

|

8,617 |

|

Bank owned life insurance |

|

|

15,377 |

|

|

|

15,311 |

|

Intangible assets |

|

|

18,749 |

|

|

|

18,940 |

|

Accrued interest receivable and other assets |

|

|

8,007 |

|

|

|

10,360 |

|

Total assets |

|

$ |

788,088 |

|

|

|

850,628 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

||

Liabilities : |

|

|

|

|

|

|

||

Savings accounts |

|

$ |

86,745 |

|

|

|

96,591 |

|

Interest-bearing checking |

|

|

91,387 |

|

|

|

129,813 |

|

Market rate checking |

|

|

145,969 |

|

|

|

121,317 |

|

Noninterest-bearing checking |

|

|

193,940 |

|

|

|

160,819 |

|

Certificate of deposits |

|

|

96,758 |

|

|

|

131,625 |

|

Total deposits |

|

|

614,799 |

|

|

|

640,165 |

|

Federal Home Loan Bank (FHLB) advances |

|

|

48,988 |

|

|

|

19,117 |

|

Paycheck Protection Program Liquidity Facility (PPPLF) borrowings |

|

|

— |

|

|

|

100,814 |

|

Other borrowings |

|

|

— |

|

|

|

5,000 |

|

Accrued interest payable and other liabilities |

|

|

3,333 |

|

|

|

4,748 |

|

Total liabilities |

|

|

667,120 |

|

|

|

769,843 |

|

Commitments |

|

|

|

|

|

|

||

Stockholders' equity: |

|

|

|

|

|

|

||

Common stock (par value $0.01 per share, 40,000,000 shares authorized,

|

|

|

69 |

|

|

|

69 |

|

Preferred stock (1,000,000 shares authorized, no shares outstanding) |

|

|

— |

|

|

|

— |

|

Additional paid in capital |

|

|

68,038 |

|

|

|

33,628 |

|

Treasury stock, 0 shares at December 31, 2021 and 102,816 shares at December 31, 2020, at cost |

|

|

— |

|

|

|

(1,268 |

) |

Unearned ESOP shares |

|

|

(5,004 |

) |

|

|

(2,453 |

) |

Retained earnings |

|

|

58,223 |

|

|

|

50,650 |

|

Accumulated other comprehensive (loss) income |

|

|

(358 |

) |

|

|

159 |

|

Total stockholders' equity |

|

|

120,968 |

|

|

|

80,785 |

|

Total liabilities and stockholders' equity |

|

$ |

788,088 |

|

|

|

850,628 |

|

(1) |

Amounts related to periods prior to the date of Conversion (January 20, 2021) have been restated to give the retroactive recognition to the exchange ratio applied in the Conversion (0.90686). |

AFFINITY BANCSHARES, INC. Consolidated Statements of Income |

||||||||

|

|

For the Year Ended December 31, |

|

|

For the Year Ended December 31, |

|

||

|

|

2021 |

|

|

2020 |

|

||

|

|

(In thousands except per share amounts) |

|

|||||

Interest income: |

|

|

|

|

|

|

||

Loans, including fees |

|

$ |

31,484 |

|

|

|

29,933 |

|

Investment securities, including dividends |

|

|

789 |

|

|

|

487 |

|

Interest-earning deposits |

|

|

180 |

|

|

|

212 |

|

Total interest income |

|

|

32,453 |

|

|

|

30,632 |

|

Interest expense: |

|

|

|

|

|

|

||

Deposits |

|

|

2,680 |

|

|

|

4,752 |

|

Borrowings |

|

|

497 |

|

|

|

738 |

|

Total interest expense |

|

|

3,177 |

|

|

|

5,490 |

|

Net interest income before provision for loan losses |

|

|

29,276 |

|

|

|

25,142 |

|

Provision for loan losses |

|

|

1,075 |

|

|

|

2,000 |

|

Net interest income after provision for loan losses |

|

|

28,201 |

|

|

|

23,142 |

|

Noninterest income: |

|

|

|

|

|

|

||

Service charges on deposit accounts |

|

|

1,506 |

|

|

|

1,359 |

|

Gain on sales of investment securities available-for-sale |

|

|

— |

|

|

|

20 |

|

Other |

|

|

1,172 |

|

|

|

777 |

|

Total noninterest income |

|

|

2,678 |

|

|

|

2,156 |

|

Noninterest expenses: |

|

|

|

|

|

|

||

Salaries and employee benefits |

|

|

10,415 |

|

|

|

10,969 |

|

Deferred compensation |

|

|

248 |

|

|

|

279 |

|

Occupancy |

|

|

2,935 |

|

|

|

2,820 |

|

Advertising |

|

|

339 |

|

|

|

200 |

|

Data processing |

|

|

1,975 |

|

|

|

2,343 |

|

Other real estate owned |

|

|

18 |

|

|

|

20 |

|

Net loss (gain) on sale and write-down of other real estate owned |

|

|

(127 |

) |

|

|

289 |

|

Legal and accounting |

|

|

827 |

|

|

|

1,447 |

|

Organizational dues and subscriptions |

|

|

363 |

|

|

|

306 |

|

Director compensation |

|

|

198 |

|

|

|

203 |

|

Federal deposit insurance premiums |

|

|

260 |

|

|

|

401 |

|

Other |

|

|

3,517 |

|

|

|

2,141 |

|

Total noninterest expenses |

|

|

20,968 |

|

|

|

21,418 |

|

Income before income taxes |

|

|

9,911 |

|

|

|

3,880 |

|

Income tax expense |

|

|

2,338 |

|

|

|

792 |

|

Net income |

|

$ |

7,573 |

|

|

|

3,088 |

|

Basic earnings per share (1) |

|

$ |

1.10 |

|

|

|

0.41 |

|

Diluted earnings per share (1) |

|

$ |

1.09 |

|

|

$ |

0.41 |

|

(1) |

Amounts related to periods prior to the date of the Conversion (January 20, 2021) have been restated to give the retroactive recognition to the exchange ratio applied in the Conversion (0.90686-to-one). |

Non-GAAP Reconciliation

Reported amounts for total loans are presented in accordance with GAAP. The Company’s management believes that the following supplemental non-GAAP information, which consists of total loans excluding PPP loans, deferred loan fees and other loan adjustments (consisting of loans in process), provides a better comparison of the amount of the Company’s loan portfolio. Additionally, the Company believes this information is utilized by market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures which may be presented by other companies.

December 31,

|

September 30,

|

June 30,

|

March 31,

|

December 31,

|

||||||||||||||||

(In thousands) |

||||||||||||||||||||

Non-GAAP Reconciliation |

||||||||||||||||||||

Total Loans |

|

$ |

584,384 |

|

$ |

571,170 |

|

$ |

590,011 |

|

$ |

626,096 |

|

$ |

598,615 |

|||||

Plus: |

||||||||||||||||||||

Fair Value Marks |

|

|

1,350 |

|

|

|

1,422 |

|

|

|

1,529 |

|

|

|

1,607 |

|

|

|

1,772 |

|

Deferred loan fees |

|

|

953 |

|

|

|

1,077 |

|

|

|

1,666 |

|

|

|

2,466 |

|

|

|

1,980 |

|

Less: |

|

|

|

|

|

|

|

|

||||||||||||

Payroll Protection Program |

|

|

18,124 |

|

|

|

32,204 |

|

|

|

73,020 |

|

|

|

126,054 |

|

|

|

101,749 |

|

loans |

|

|

|

|

|

|

|

|

|

|

||||||||||

Indirect Auto Dealer Reserve |

|

|

1,846 |

|

|

|

1,724 |

|

|

|

1,495 |

|

|

|

1,302 |

|

|

|

1,167 |

|

Other Loan Adjustments |

|

|

219 |

|

|

|

102 |

|

|

|

447 |

|

|

|

0 |

|

|

|

591 |

|

Gross Loans |

|

$ |

566,498 |

|

|

$ |

539,639 |

|

|

$ |

518,244 |

|

|

$ |

502,813 |

|

|

$ |

498,860 |

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20220222006171/en/

Contacts

Edward J. Cooney

Chief Executive Officer

(678) 742-9990