- Kohl's high caliber Board has the right experience to drive strategy forward while evaluating the ongoing review of expressions of interest

- Kohl’s Board has continued to be refreshed – adding six new independent Directors in the last three years

- Macellum’s nominees are underqualified to oversee Kohl’s strategy or run a strategic review process; six of ten nominees have never served on a public company board

- Ten Kohl’s Directors have M&A experience, in contrast to only one Macellum nominee

- Macellum’s involvement has contributed to value destruction at other retailers

- Kohl’s urges shareholders to VOTE the BLUE Proxy Card FOR ALL 13 of the Company’s highly qualified Directors today

- For more information, investors can visit www.KohlsMomentum.com

Kohl’s Corporation (NYSE: KSS) (“Kohl’s” or the “Company”) today mailed a letter to shareholders detailing their highly qualified Board of Directors that has the necessary skills to oversee Kohl’s evolving strategy.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220411005259/en/

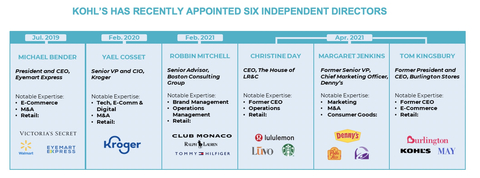

Kohl’s has recently refreshed its Board, adding six new directors in the last three years, three of whom joined last April as part of a settlement with Macellum and other investors. (Graphic: Business Wire)

Kohl’s urges shareholders to protect the value of their investment by voting the BLUE proxy card today FOR ALL 13 of Kohl’s highly qualified nominees. The Company’s Annual Meeting of Shareholders (the “Annual Meeting”) is scheduled to be held on May 11, 2022. Kohl’s shareholders of record as of the close of business on March 7, 2022 will be entitled to vote at the Annual Meeting.

The full text of the letter to shareholders follows.

***

Vote the BLUE card today “For All” 13 of Kohl’s highly qualified directors.

Dear Fellow Shareholder,

The value of your investment is at stake at Kohl’s Annual Meeting this year. Macellum Advisors GP, LLC (“Macellum”) is seeking to replace your Board with a far less qualified slate. In contrast to Macellum’s nominees, your Board has the right skills and expertise to drive our strategy forward while evaluating any value-creating opportunities.

The Kohl’s Board is highly qualified and recently refreshed.

Your Board has the necessary skills to oversee Kohl's evolving strategy and to contribute top-tier financial and governance direction as retail trends change. In addition, we have recently refreshed our Board, adding six new directors in the last three years, three of whom joined last April as part of a settlement with Macellum and other investors.

Kohl’s Board is well-equipped with the right balance of skills and experience to oversee continued value creation.

Your Board, comprised of 13 independent directors and our CEO,1 has leading experience in areas critical to our growth. Every member of your Board has extensive retail or consumer-facing industry experience from such companies as Walmart, Kroger, Burlington and lululemon. Ten of our directors have technology, e-commerce, or digital experience from their roles as senior executives at leading retailers, making them attuned to changes in the omnichannel retail space. Additionally, twelve of our directors have marketing or brand management experience, and eight of our directors are current or former CEOs.

Your Board has significant M&A experience.

Your Board has the right experience to oversee the ongoing review of expressions of interest to acquire the Company, and to measure any proposal against the value-creation potential of a compelling standalone plan. Ten of our 13 directors have experience in M&A, making them well-suited to support a robust process. Our incoming Chair has over 30 years of experience leading deals encompassing over $25 billion in transaction value.

Our Finance Committee, which became a standing committee in May 2021, is leading the process and is comprised entirely of independent directors, including a Macellum designee. The Finance Committee is chaired by John Schlifske, who has significant M&A and investment management experience as Chair and CEO of Northwestern Mutual. Collectively, our Finance Committee’s members have overseen several dozen M&A transactions.

Your Board is committed to choosing the path that maximizes value for all shareholders.

KOHL’S BOARD HAS THE RIGHT SKILLS AND EXPERIENCE TO MAXIMIZE SHAREHOLDER VALUE.

MICHAEL BENDER

Committees: Incoming Chair of the Nominating & ESG Committee

Background Highlights: President and CEO of Eyemart Express

- 16+ years in senior executive roles

- 4 years as CEO of Eyemart Express

- Led integration of Jet.com while serving as COO of Global eCommerce at Walmart

PETER BONEPARTH

Incoming Chair

Committees: Compensation, Finance, Nominating & ESG (Chair)

Background Highlights: Former Senior Advisor, The Blackstone Group

- 30+ years of experience leading deals of $25B+ transaction value

- 5 years as CEO of Jones Apparel Group

- Oversaw acquisition and development as well as marketing and distribution for an extensive portfolio of footwear and apparel brands

- Current Chairman of Jet Blue Board of Directors

YAEL COSSET

Committees: Audit

Background Highlights: Senior VP and Chief Information Officer of Kroger

- 5 years in senior executive roles at Kroger

- Expertise in using digital tools to power market expansion, product launches, and growth strategies

- Named one of “10 people transforming retail” for innovative use of data to expand distribution and increase shopping

CHRISTINE DAY

Committees: Audit, Compensation

Background Highlights: CEO of LR&C

- 6 years as CEO of lululemon

- Co-founded The House of LR&C

- 20+ years in leadership roles at Starbucks

H. CHARLES FLOYD

Committees: Compensation

Background Highlights: Global President of Operations of Hyatt

- 15+ years of senior executive positions at Hyatt

- Key leader in creation of 7 Hyatt brands and several acquisitions

- Deep expertise in operations efficiency in a consumer-facing context

MICHELLE GASS

Background Highlights: CEO and Director of Kohl’s

- 30+ years of experience in retail and consumer goods

- 16+ years leadership at Starbucks across marketing, merchandising, strategy, and operations

- Led the addition of impactful brands and partnerships to Kohl’s offering, including Under Armour, Amazon, Tommy Hilfiger, and Sephora

- Independent Director at PepsiCo

MARGARET JENKINS

Committees: Audit

Background Highlights: Former Senior Vice President, CMO of Denny’s Corporation

- 30+ years of experience in consumer goods

- 8+ years on the Board of Directors of PVH

- Helped lead the transformative acquisitions of Tommy Hilfiger and Warnaco

THOMAS KINGSBURY

Committees: Audit, Finance

Background Highlights: Former President, CEO, and Chairman of the Board of Burlington Stores

- 40+ years of retail experience

- 11 years as CEO of Burlington Stores

- Former senior executive vice president at Kohl’s

- Independent Director at Tractor Supply and BJ’s Wholesale Club

ROBBIN MITCHELL

Committees: Audit, Nominating & ESG

Background Highlights: Senior Advisor at The Boston Consulting Group

- 20+ years of experience in the apparel industry spanning luxury and contemporary segments, and across multiple key functions including operations, branding, and strategy

- Served in senior executive roles at 3 apparel companies

- Significant M&A experience advising private equity firms on sell-side and buyside transactions in the fashion and luxury space

- Independent Director at Piper Sandler Companies

JONAS PRISING

Committees: Compensation (Chair)

Background Highlights: Chair and CEO of ManpowerGroup

- 8 years as CEO of ManpowerGroup

- 10+ years of international retail and product development experience

- Extensive experience in human capital management, leading an organization that recruits millions of workers worldwide each year

JOHN E. SCHLIFSKE

Committees: Finance (Chair), Nominating & ESG

Background Highlights: Chair and CEO of Northwestern Mutual

- 12 years as CEO of Northwestern Mutual

- Significant investment management experience

- 40+ M&A transactions completed under his leadership

ADRIANNE SHAPIRA

Committees: Finance, Nominating & ESG

Background Highlights: Managing Director of Eurazeo Brands

- Leads Eurazeo Brands’ investments in North American consumer brands

- 20+ years of executive experience in retail investing and operations

- 13 years as an equity analyst in retail sector at Goldman Sachs

STEPHANIE A. STREETER

Committees: Audit (Chair), Compensation

Background Highlights: Former CEO of Libbey

- 11 total years as a CEO at Libbey and Banta

- As CEO of Libbey, oversaw marketing, sales and distribution of consumer products to global retailers including Walmart, Target, Alibaba, and Amazon

- Led sale of Banta as Chair and CEO, and acquisition of Cooper as Finance Chair of Goodyear

MACELLUM’S SLATE HAS INHERENT AND DANGEROUS FLAWS.

Macellum CEO Jonathan Duskin’s short-term approach threatens to destroy significant value, making him unfit to serve on the Kohl’s Board.

Jonathan Duskin’s attacks on Kohl’s reveals a short-term approach that threatens to destroy the value of your investment. Mr. Duskin’s promotion of baseless speculation and repeated falsehoods regarding the Board’s process – a process in which Mr. Duskin is not involved – is particularly concerning. Similarly problematic are his criticisms of the Board’s rejection of an opportunistic bid to acquire the Company at $64 per share, a price well below the value that Macellum itself publicly declared. Mr. Duskin appears to be advocating for a quick sale at any price.

Mr. Duskin’s focus on short-term value is further evidenced by his firm’s recent trading of Kohl’s securities. Macellum has sold Kohl’s stock in the low $60s over the last several months. Additionally, Macellum bought call options representing approximately 2.5 million shares of Kohl’s common stock just prior to Acacia's unsolicited expression of interest being publicly reported. In the following trading days, Macellum sold most of these options.2

Macellum’s nominees are underqualified to oversee Kohl’s strategy or run a sale process.

Alarmingly, multiple Macellum nominees do not have the experience that any other public company comparable to Kohl’s would expect from its board members:

- Six of Macellum’s 10 nominees have never served on a public company board.

- None of Macellum’s nominees have served on a retail company board with a comparable market capitalization to Kohl’s.

- Only one nominee has technology, e-commerce, or digital experience – a glaring oversight given how vital this expertise is for omnichannel retailers to grow and capture market share in the current industry environment.

For a slate that is supposed to deliver first-rate oversight of strategic alternatives, it is especially surprising that most of Macellum’s nominees lack M&A experience.

Additionally, half of Macellum’s slate has close professional ties to Macellum. Instead of selecting a strong, independent slate, Mr. Duskin evidently hand-picked his nominees knowing that, if elected, their proximity to Mr. Duskin would amplify his hedge fund’s short-term agenda, including a sale at any price.

Several of Macellum’s nominees have overseen significant value destruction.

The track records of the Macellum nominees with limited public company director or executive experience raise serious concerns:

- One of Macellum’s nominees served as a director at five companies that declared bankruptcy either during or shortly after their tenure.

- Two of Macellum’s nominees also served as senior executives at companies that filed for bankruptcy shortly after their departures.

- One nominee was an Audit Committee member of a SPAC that acquired a fraudulent company with negligible revenue.

Macellum’s involvement has contributed to value destruction at other retailers.

Macellum’s track record of value creation leaves much to be desired. The fund’s campaigns at Bed Bath & Beyond, Big Lots, and Citi Trends have led to disappointing results for shareholders.

- Macellum said they would “stabilize and grow sales” and “quickly prioritize increasing profitability” at Bed Bath & Beyond, but sales and operating margin have deteriorated since four Macellum designated directors joined the company’s Board on May 29, 2019.3 Macellum’s appointees remain on Bed Bath & Beyond’s Board and have overseen a one-year TSR of -34%.4

- Macellum claimed “substantial value can be created by pursuing a sale leaseback” at Big Lots, yet sales and operating margin have declined since the company completed a sale leaseback in June 2020. The sale leaseback also thwarted a possible buyout by Apollo Global Management, according to Bloomberg. Macellum nonetheless continues to push for sale leasebacks at Kohl’s.

- Macellum criticized Citi Trends for “declining operating metrics” and “erratic results”5 before securing a board seat for Jonathan Duskin in May 2017.6 The company has a current one-year TSR of -67%.4

PROTECT THE VALUE OF YOUR INVESTMENT. VOTE THE BLUE CARD TODAY FOR ALL 13 OF KOHL’S HIGHLY QUALIFIED DIRECTORS.

VISIT WWW.KOHLSMOMENTUM.COM FOR MORE INFORMATION.

YOUR VOTE IS IMPORTANT!

Please refer to the enclosed BLUE proxy card for information on how to vote by telephone or by Internet, or simply sign and date the BLUE proxy card and return it in the postage-paid envelope provided.

If you have any questions, or need assistance in voting your shares, please call our proxy solicitor:

INNISFREE M&A INCORPORATED TOLL-FREE, at 1-877-687-1874 BANKS AND BROKERS MAY CALL COLLECT, at 1-212-750-5833

|

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward looking statements include information concerning the Board’s review of expressions of interest and the Company’s business strategies, plans, and objectives. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and Kohl’s undertakes no obligation to update them.

About Kohl's

Kohl’s (NYSE: KSS) is a leading omnichannel retailer. With more than 1,100 stores in 49 states and the online convenience of Kohls.com and the Kohl's App, Kohl's offers amazing national and exclusive brands at incredible savings for families nationwide. Kohl’s is uniquely positioned to deliver against its strategy and its vision to be the most trusted retailer of choice for the active and casual lifestyle. Kohl’s is committed to progress in its diversity and inclusion pledges, and the company's environmental, social and corporate governance (ESG) stewardship. For a list of store locations or to shop online, visit Kohls.com. For more information about Kohl’s impact in the community or how to join our winning team, visit Corporate.Kohls.com or follow @KohlsNews on Twitter.

| 1 | 13 directors are standing for reelection |

| 2 | Macellum Proxy Statement, March 18, 2022 |

| 3 | Macellum’s “Restore Bed Bath & Beyond” presentation April 26, 2019 |

| 4 | As of close of trading on April 8, 2022 |

| 5 | Macellum proxy statement, March 9, 2017 |

| 6 | CTRN / Macellum settlement: May 24, 2017 resulting in the appointment of Jonathan Duskin to the board |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220411005259/en/

Contacts

Investor Relations:

Mark Rupe, (262) 703-1266, mark.rupe@kohls.com

Media:

Jen Johnson, (262) 703-5241, jen.johnson@kohls.com

Lex Suvanto, (646) 775-8337, lex.suvanto@edelman.com