Company embarks on multi-year initiative to design the bank of the future.

Regions Bank on Thursday announced Scott Peters will serve as Chief Transformation Officer for the company, and Kate Danella will serve as head of Regions’ Consumer Banking Group – part of a multi-year initiative to create the Regions Bank of the future.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220512005226/en/

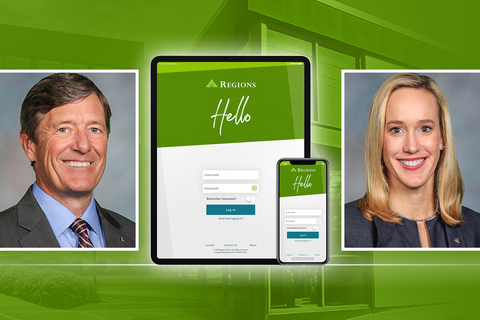

Scott Peters, left, will serve as Regions’ Chief Transformation Officer, and Kate Danella, right, will serve as head of Regions’ Consumer Banking Group. (Photo: Business Wire)

These key leadership appointments add to the company’s recent announcement of Dan Massey as Chief Enterprise Operations and Technology Officer. Together, Peters, Danella, and Massey, along with teams from across the bank, will prioritize innovations and enhancements designed to deliver a more seamless customer experience, more cutting-edge and intuitive technology, and more customized solutions to help people and businesses reach their financial goals.

The foundation of Regions’ multi-year initiative will be the replacement of the bank’s core operating systems. As Chief Transformation Officer, Peters will lead this initiative in collaboration with business group leaders throughout the company. With new, more adaptive technology, Regions will be able to redefine the customer experience, including in-person interactions, self-service solutions, and more.

“Regions Bank is already known for providing superior service through our network of consumer, commercial, and wealth management bankers, as well as our digital banking capabilities,” said John Turner, President and CEO of Regions Financial Corp. “Now, we are taking a fundamental step forward by rapidly evolving our processes and technology to create more forward-thinking solutions in a nimble and agile manner. The result will be even higher levels of customer service and business growth across convenient and connected channels.”

Peters, a member of Regions’ Executive Leadership Team, will continue reporting to Turner in his new role. Peters joined Regions in 2004 and most recently served as head of the company’s Consumer Banking Group. Among his achievements, Peters led extensive modernization efforts in Regions’ updated branch network. In addition, he has overseen significant evolutions in mortgage services, indirect consumer lending, and marketing strategies. Before joining Regions, Peters held leadership roles with Fidelity Personal Investments, KeyCorp, and Citibank.

Succeeding Peters as head of the Consumer Banking Group is Kate Danella, who most recently served as Chief Strategy and Client Experience Officer for Regions. In that role, she led the company to a 36 percent increase in new deposit account openings and loans booked through digital channels in 2021. She also championed critical assistance for consumers and businesses throughout the pandemic. Danella joined Regions in 2015 as Wealth Strategy and Effectiveness Executive, later leading Private Wealth Management and serving as head of Strategic Planning and Consumer Bank Products and Origination Partnerships. Danella, who is also a member of Regions’ Executive Leadership Team, will continue to report to Turner. Prior to Regions, Danella held leadership roles in sales, strategy, client services, and marketing at Capital Group Companies.

“Through the leadership of Kate and Scott – as well as the insights Dan Massey is bringing to his leadership role – we are well positioned to enhance our value proposition and grow our customer base,” Turner concluded. “Regions’ focus on innovation and superior service extends to leaders and associates throughout our organization. We are committed to delivering our best for the people and communities we serve, and the progress underway will build on that commitment.”

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $164 billion in assets, is a member of the S&P 500 Index and is one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services. Regions serves customers across the South, Midwest and Texas, and through its subsidiary, Regions Bank, operates approximately 1,300 banking offices and more than 2,000 ATMs. Regions Bank is an Equal Housing Lender and Member FDIC. Additional information about Regions and its full line of products and services can be found at www.regions.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220512005226/en/

A more seamless #CustomerExperience. More cutting-edge and intuitive technology. More customized solutions. Learn about a transformation underway at @askRegions – and see the impact it will create for customers. Regions Bank, Member FDIC

Contacts

Jeremy D. King

Regions Bank

(205) 264-4551

Regions News Online: regions.doingmoretoday.com

Regions News on Twitter: @RegionsNews