Retail trader clients were net buyers in the Consumer Discretionary, Communication Services, Information Technology, and Financials sectors

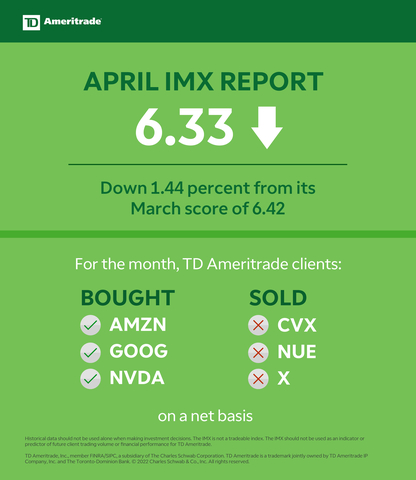

The Investor Movement Index® (IMXSM) decreased to 6.33 in April, down from 6.42 in March. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220509005158/en/

TD Ameritrade's IMX vs. S&P 500 (Graphic: TD Ameritrade)

The reading for the five-week period ending April 29, 2022 ranks “Moderate” compared to historic averages.

“Demand for equities was light to start the month, but as the major indices continued their strong pullback below key support levels, we saw demand accelerate,” according to Shawn Cruz, head trading strategist, TD Ameritrade. “Ultimately, TD Ameritrade clients were net buyers in April despite a slightly decreased appetite for market exposure generally and light selling in the Consumer Staples, Materials, Healthcare and Utilities sectors.”

Plenty of catalysts sparked elevated market volatility in April, leading to an ugly finish to what was already a bad month for equities as the final 15 minutes of trading in the period saw a gap lower down to the 4,125 level for the S&P 500. Although earnings generally came in above consensus, disappointing results from some of the largest companies by weighting in the S&P 500 failed to give the market the shot of optimism it needed. Despite widespread concerns and negative headlines around input costs, particularly on the commodity front, Consumer Staples was the only sector to finish the month in positive territory. After a turbulent month in March, Treasury volatility fell after the Federal Reserve made their highly anticipated rate hike. However, this stability may have been misleading as interest rates were on the move, steadily climbing and pausing just below 3% on the key 10-year Treasury Yield.

In April, TD Ameritrade clients were net buyers of equities and strong buyers of fixed income instruments. Some of the popular equity names bought in April were:

- Amazon.com Inc. (AMZN)

- Alphabet Inc. (GOOG)

- NVIDIA Corporation (NVDA)

- Twitter Inc. (TWTR)

- Ford Motor Company (F)

Names sold during the period included:

- Chevron Corp (CVX)

- Nucor Corp. (NUE)

- United States Steel Corp. (X)

- General Electric Company (GE)

- American Airlines Group Inc. (AAL)

Millennial Buys & Sells

TD Ameritrade Millennial clients mirrored the overall client population in reducing exposure for the third straight month but ultimately net buying during the period. Both TD Ameritrade Millennial clients and the overall TD Ameritrade client population favored some high beta semiconductor names, such as NVIDIA Corp. (NVDA) and Advanced Micro Devices, Inc. (AMD). News of Tesla CEO Elon Musk’s purchase of Twitter Inc. (TWTR) led to a surge in activity in the name from both the Millennial and overall TD Ameritrade client populations. At a sector level, TD Ameritrade Millennial clients were net buyers in Communication Services, Consumer Discretionary, Financials, Information Technology, and Materials, all of which were lower on the month.

Of the most popular names net bought in April, Millennials differed from the general client population in buying Microsoft Corp. (MSFT). Of the most popular names net sold, Millennials stood apart in selling Nokia Corp. (NOK) and Crowdstrike Holdings Inc. (CRWD).

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010; to view the full report from April 2022, or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or thinkorswim Mobile platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

About TD Ameritrade

TD Ameritrade provides investing services and education to self-directed investors and registered investment advisors. A leader in U.S. retail trading, we leverage the latest in cutting edge technologies and one-on-one client care to help our clients stay on top of market trends. Learn more by visiting www.amtd.com.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org), a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2022 Charles Schwab & Co. Inc. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220509005158/en/

Contacts

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com