Bank of America and Charles Schwab Rank Highest in a Tie in Digital Participant Satisfaction

While economists are still divided on whether the United States is in a recession, retirement investors have a clearer sentiment: their financial health is deteriorating, they are concerned about their investments and, when they turn to their plan’s websites and apps for help they are not finding what they need. According to the J.D. Power 2022 U.S. Retirement Plan Digital Experience Study,SM released today, overall satisfaction is down 12 points (on a 1,000-point scale) this year as 53% of retirement plan investors are now classified as financially unhealthy,1 and 63% say they have challenges managing their accounts digitally.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220915005078/en/

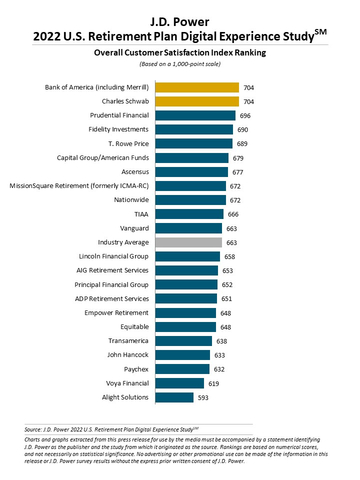

J.D. Power 2022 U.S. Retirement Plan Digital Experience Study (Graphic: Business Wire)

“Retirement investors are under a great deal of financial stress right now and they are looking to their plan’s websites and apps for information and guidance,” said Mike Foy, senior director and head of wealth intelligence at J.D. Power. “Unfortunately, many are not finding what they need and end up having to call customer service for help. This is a moment-of-truth opportunity for plan providers. When they get the digital experience right, they see a very significant lift in the likelihood to grow and retain participant assets long after they have left their current employer.”

Following are some key findings of the 2022 study:

- Deteriorating financial health sours digital experience: During the past year, the percentage of retirement investors classified as financially healthy has plunged to 47% from 60%, with more than one-fourth (28%) of investors now falling into the financially vulnerable category. Overall satisfaction with retirement plan digital experience has fallen 12 points, in lockstep with the deterioration in financial health.

- Digital experience becomes battleground for customer retention: Strong digital performance is highly correlated with retirement investor asset acquisition and retention. Among top digital performers, 50% of investors say they “definitely will” keep their assets with their current provider in the event of a job change, vs. 17% of investors with low-performing firms. With average job tenure for Millennials2 and members of Gen Z now hovering below three years,3 retaining investors through employment changes has become a top priority for retirement plans.

- Missing the mark on digital account management: Overall customer satisfaction with retirement plan digital experience rises 191 points to 671 when participants can complete tasks by themselves on their plan’s website or mobile app. However, just 37% of investors say they can manage their accounts digitally without contacting customer service.

- Huge upside potential in proactive guidance: Overall customer satisfaction rises 178 points when investors believe the retirement plan websites and apps offer proactive guidance and help, yet just 22% of firms evaluated are meeting this key performance indicator.

Study Ranking

Bank of America (including Merrill) and Charles Schwab rank highest in retirement plan digital satisfaction, in a tie, with a score of 704. Prudential Financial ranks third with a score of 696.

The U.S. Retirement Plan Digital Experience Study, formerly known as the U.S. Retirement Plan Participant Satisfaction Study, measures customer satisfaction across four factors: information/content; navigation; speed; and visual appeal. The study is based on responses of 7,069 retirement plan participants and was fielded in May-June 2022.

For more information about the U.S. Retirement Plan Digital Experience Study, visit https://www.jdpower.com/business/financial-services/us-retirement-plan-digital-experience-study.

See the online press release at http://www.jdpower.com/pr-id/2022118.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, credit worthiness and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.

2 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.

3 “Millennials or Gen Z: Who’s Doing the Most Job-Hopping,” CareerBuilder, Oct. 5, 2021 https://www.careerbuilder.com/advice/how-long-should-you-stay-in-a-job

View source version on businesswire.com: https://www.businesswire.com/news/home/20220915005078/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com