TORONTO, Aug. 08, 2024 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corp. (“Bunker Hill” or the “Company”) (TSX-V:BNKR; OTCQB:BHILL) announces that it has entered into definitive agreements with Monetary Metals Bond III LLC, an entity established by Monetary Metals & Co., for the previously announced silver loan in an amount of US dollars equal to up to 1.2 million ounces of silver, to be advanced in one or more tranches, in support of the re-start and ongoing development of the Bunker Hill Mine (the “Silver Loan”). The Company has closed the first tranche of the Silver Loan in the principal amount of US$16,422,039, being the amount of US dollars equal to, as of August 8, 2024, 609,805 ounces of silver (the “First Tranche”).

Sam Ash, President and CEO of Bunker Hill Mining, states, “By combining the solid support of our existing finance partner, Sprott Streaming, with our new and innovative Monetary Metals solution, our fully funded project is advancing on track and budget.”

Silver Loan

As described in the news release dated June 7, 2024, the Silver Loan will be for a term of three years, secured against the Company’s assets and repayable in cash or silver ounces. The Silver Loan will bear interest at the rate of 15% per annum, payable in cash or silver ounces on the last day of each quarterly interest period. This financing remains subject to TSX Venture Exchange (the “TSX-V”) approval.

As consideration for advancing the Silver Loan, the Company will issue to Monetary Metals & Co., subject to prior TSX-V approval, non-transferable bonus share purchase warrants (the “Warrants”) in one or more tranches. The number of Warrants issued in each tranche will be equal to: (a) in connection with the First Tranche, two times the number of silver ounces advanced under the First Tranche (the “Base Warrants”) and a bonus ratchet of: (i) 2.5% of the Base Warrants if at least 500,000 and up to 599,999 silver ounces are advanced, (ii) 5.0% of the Base Warrants if at least 600,000 and up to 699,999 silver ounces are advanced, (iii) 10.0% of the Base Warrants if at least 700,000 and up to 799,999 silver ounces are advanced, and (iv) 15.0% of the Base Warrants if at least 800,000 silver ounces are advanced; and (b) in connection with any additional tranches, two times the number of silver ounces advanced under such tranche. In any event, the number of Warrants issuable to Monetary Metals & Co. will not exceed 3,000,000.

Each Warrant will entitle the holder to acquire one share of common stock of the Company (the “Warrant Shares”) at an exercise price that is set at the last closing price of the Company’s common stock prior to the date such Warrant is issued (the “Exercise Price”). The Warrants will be exercisable until the earlier of (i) three years from their issuance date and (ii) the maturity date of the Silver Loan, subject to acceleration in accordance with the policies of the TSX-V. The issuance of the Warrant Shares is subject to the terms and conditions of the Warrants as well as the receipt of all regulatory approvals, including, without limitation, the approval of the TSX-V. The Warrants and Warrant Shares will be subject to a hold period of four months and a day from the date of issuance, in accordance with applicable securities laws.

In connection with closing of the First Tranche, the Company will, subject to TSX-V approval, issue a total of 1,280,591 Warrants to Monetary Metals & Co. (the “Tranche 1 Warrants”). The Tranche 1 Warrants will be exercisable until August 8, 2027, subject to acceleration in accordance with the policies of the TSX-V, and the Exercise Price of the Tranche 1 Warrants will be C$0.16.

The securities referenced herein or any securities underlying or derived from the financial instruments referenced herein, including but not limited to the Warrants, the Warrant Shares, and the Silver Loan, have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”). This news release does not constitute an offer to sell or the solicitation of an offer to buy such securities, nor shall there be any sale of such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Amendments to Existing Sprott Streaming Financing Package

A series of related transactions also took place concurrently with closing of the Silver Loan to amend certain terms of the existing financing package with Sprott Private Resource Streaming & Royalty Corp (“Sprott Streaming”). Firstly, the maturity dates of the series 1 convertible debentures and series 2 convertible debentures (together, the “Debentures”) previously issued by the Company to Sprott Streaming were extended from March 31, 2026 to March 31, 2028 and March 31, 2029, respectively. Additionally, the termination date of the royalty put option (the “Royalty Put Option”) previously granted by the Company to Sprott Streaming was amended from the later of the payment in full of the Debentures and the exercise of the Royalty Put Option, to the later of the payment in full of the Debentures and March 31, 2029. The Company also amended the existing loan facility with Sprott Streaming (the “Sprott Streaming Loan”) to extend the maturity date of the Sprott Streaming Loan from June 30, 2027 to June 30, 2030 and increase the interest payable from June 30, 2027 onwards from 10% to 15%.

The amendments to the Debentures, Royalty Put Option and Sprott Streaming Loan (collectively, the “Transactions”) each constitute a “related party transaction” pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The directors of the Company, all of whom are considered independent pursuant to Part 7 of MI 61-101, have unanimously determined that the Transactions are advisable and in the best interests of the Company, and that the Transactions are exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to the “financial hardship” exemptions provided under Section 5.5(g) and 5.7(1)(e), respectively, of MI 61-101.

ABOUT BUNKER HILL MINING CORP.

Under Idaho-based leadership, Bunker Hill intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating and then optimizing a number of mining assets into a high-value portfolio of operations, centered initially in North America. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

On behalf of Bunker Hill Mining Corp.

Sam Ash

President and Chief Executive Officer

For additional information, please contact:

Brenda Dayton

Vice President, Investor Relations

T: 604.417.7952

E: brenda.dayton@bunkerhillmining.com

Cautionary Statements

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, “plan” or variations of such words and phrases.

Forward-looking statements in this news release include, but are not limited to, statements regarding: the Company’s objectives, goals or future plans, including the restart and development of the Bunker Hill Mine; the achievement of future short-term, medium-term and long-term operational strategies; the Silver Loan; the Company receiving TSX-V approval for the Silver Loan and the issuance of the Warrants and the Warrant Shares; and the timing and advancement of additional tranches of the Silver Loan and additional Warrants. Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks and uncertainties identified in public filings made by Bunker Hill with the U.S. Securities and Exchange Commission (the “SEC”) and with applicable Canadian securities regulatory authorities, and the following: the Company not receiving the approval of the TSX-V for the issuance of the Warrants and the Warrant Shares; the Company’s inability to raise additional capital for project activities, including through equity financings, concentrate offtake financings or otherwise; the fluctuating price of commodities; capital market conditions; restrictions on labor and its effects on international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company’s cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such statements or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as to the actual size or terms of those financing initiatives. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that could affect the Company’s operations or financial results are included in the Company’s annual report and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through EDGAR on the SEC website (www.sec.gov).

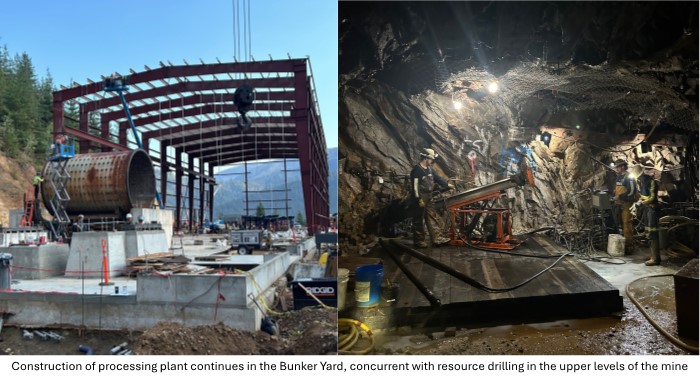

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f00bd5f7-b7e7-474d-bb80-f8078f23696b