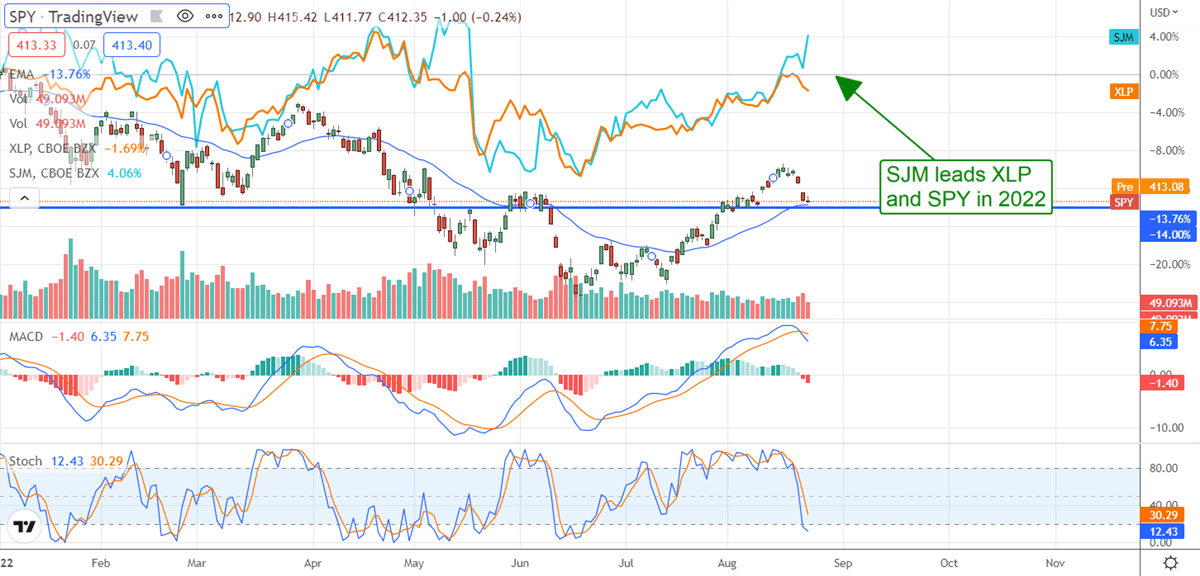

The J.M. Smucker Company’s (NYSE: SJM) FQ2 results prove once again why the Consumer Staples Sector (NYSEARCA: XLP) is outperforming the S&P 500 (NYSEARCA: SPY) in 2022: Pricing Power. The J.M. Smucker Company, like others in the group such as Kraft-Heinz (NASDAQ: KHC), reported better than expected results and raised the guidance for the full year on the back of demand and pricing. The company is in a great position as the owner of beloved consumer staples brands and is not only seeing sustained demand but an increase in prices that is driving margin health. Considering the staples group and The J.M. Smucker Company within it are a high-quality dividend-growing group and inflation is cutting into retail sales across the sphere, this is some of the best news the market isn’t talking about right now.

"We delivered another quarter that exceeded our expectations, as consumers' demand for our iconic brands continued in a rising cost environment, driving robust organic top-line growth for our key focus platforms of pet, coffee, and snacking,” said Mark Smucker, Chairman of the Board, President, and Chief Executive Officer of The J.M. Smucker Company.

The J.M. Smucker Company Rises On Margin Strength

The J.M. Smucker Company had a good quarter but there are two issues with the revenue that might otherwise have held the price action in check. The $1.87 billion in net revenue is up 0.5% versus last year but it’s down in the 2,3, and 4-year comparisons due to the tough pandemic comps and divestitures made over the past two years. On an adjusted ex-divestiture and FX neutral basis, revenue is up 4% including the 900 basis point impact from the Jif Peanut recall which are some good numbers and supportive of price action.

The margins were a bit soft but this is due primarily to the Jif recall and deleveraging and costs related to it. At the gross level, margins contracted in the mid-teens while at the operating level, income contracted by more than 30% but the adjusted results are better. The adjusted operating income fell only 17% and far less than expected. So, the revenue was flat and only as expected while the GAAP and adjusted earnings both came in ahead of expectations. The adjusted $1.67 beat by $0.40 which is no small margin and led the company to increase the full-year guidance as well.

The revenue guidance was increased by 50 basis points at both ends of the range putting the target at 4% to 5% YOY growth compared to the 3.62% consensus as indicated by Marketbeat.com analyst tracking tools. This should lead to some upward revisions as well as the earnings which are now expected in a range of $8.20 to $8.60 compared to the prior top-end of $8.25 and the consensus of $8.04. Assuming consumer trends remain healthy, these figures could be cautious.

The J.M. Smucker Is Relatively High-Yielding And A Value

The J.M. Smucker Company is no value compared to the broad market S&P 500 but it is a bargain relative to its peers. Trading at 17X its earnings it’s far cheaper than names like Hormel (NYSE: HRL), Clorox (NYSE: CLX), and McCormick & Company (NYSE: MKC) which trade in a range of 27X to 35X their earnings while paying far smaller dividends. The J.M. Smucker Company is also a dividend grower with 19 years of consecutive annual increases to its credit and paying out only 35% of its earnings. Shares of The J.M. Smucker Company advanced 3.5% in the wake of the report and guidance increase and are on track to retest recent highs near $146.75. A break above this level would be bullish and could lead the market up another $20 to $25.