Retail department store chain Macy’s (NYSE: M) stock has had a rollercoaster ride in the past two years as shares trade down (-32%) for the year. The iconic department store chain that brought Santa Claus into the mainstream has emerged from the pandemic as a well-oiled machine. The Polaris turnaround strategy has been a success; however, the recession is here and its hitting consumer discretionary stocks including like Nordstrom (NYSE: JWN), Kohl’s (NYSE: KSS), Ross Stores (NASDAQ: ROST), and Macy’s. Macy’s had negative top line growth for the first time in the post-pandemic period with comparable store sales down (-1.5%) in its second quarter. E-commerce sales also dropped (-5%) in the latest quarter. Inflationary pressures impacting costs and consumer spending had a negative impact on margins as they fell to 38.9% from 40.6% in the year ago period. The Polaris turnaround strategy has been successful, but the economic recession is making a negative material impact to both top and bottom lines. This has prompted Macy’s to lower its guidance for remainder of the year. The pandemic reminded investors of the valuable asset that lies beneath many of it’s store locations, the real estate.

Retail department store chain Macy’s (NYSE: M) stock has had a rollercoaster ride in the past two years as shares trade down (-32%) for the year. The iconic department store chain that brought Santa Claus into the mainstream has emerged from the pandemic as a well-oiled machine. The Polaris turnaround strategy has been a success; however, the recession is here and its hitting consumer discretionary stocks including like Nordstrom (NYSE: JWN), Kohl’s (NYSE: KSS), Ross Stores (NASDAQ: ROST), and Macy’s. Macy’s had negative top line growth for the first time in the post-pandemic period with comparable store sales down (-1.5%) in its second quarter. E-commerce sales also dropped (-5%) in the latest quarter. Inflationary pressures impacting costs and consumer spending had a negative impact on margins as they fell to 38.9% from 40.6% in the year ago period. The Polaris turnaround strategy has been successful, but the economic recession is making a negative material impact to both top and bottom lines. This has prompted Macy’s to lower its guidance for remainder of the year. The pandemic reminded investors of the valuable asset that lies beneath many of it’s store locations, the real estate.The Recession Takes a Swipe

On Aug 23, 2022, Macy’s released its second-quarter fiscal 2022 results for the quarter ending July 2022. The Company reported earnings-per-share (EPS) of $1.00 excluding non-recurring items versus consensus analyst estimates for a profit of $0.88, a $0.12 per share beat. Revenues fell (-0.8%) year-over-year (YoY) to $5.6 billion, beating consensus analyst estimates for $5.5 billion. Comparable same-store-sales (SSS) fell (-1.5%) YoY. Digital sales fell (-5%) YoY and up 37% compared to Q2 2019. Gross margins fell to 38.9% from 40.6%.

Polaris Turnaround Delivers

Macy’s CEO Jeff Gennette commented, “Our teams have consistently responded to the dynamic landscape with disciplined, data-driven actions to ensure the health and stability of our business. We believe that we are well positioned to respond to changing consumer behaviors. Despite inflationary pressures, consumers continued to shop Macy's as a style source and leading gifting destination. Additionally, Bloomingdale's and Blue Mercury captured demand for luxury brands, resulting in both nameplates outperforming in the quarter." He continued, “Over the past two years, our Polaris strategy has made us faster and more agile, which has been essential to navigate rapidly changing consumer trends and macro conditions. We expect to come out of this uncertain period in a strong position with a healthy balance sheet, new capabilities and a talented team ready to capture renewed demand.”

Bracing for the Slow Down

Macy’s lowered its full-year 2022 sales and EPS guidance to factor in the risks related to macroeconomic pressures. The full-year 2022 EPS guidance was lowered to come in between $4.00 to $4.20 from $4.53 to $4.95 versus $4.58 consensus analyst estimates. Full year 2022 revenues were lowered to come in between $24.34 billion to $24.58 billion from $24.46 billion to $24.58 billion previous estimates versus $24.37 billion consensus analyst estimates.

Here’s What the Charts Say

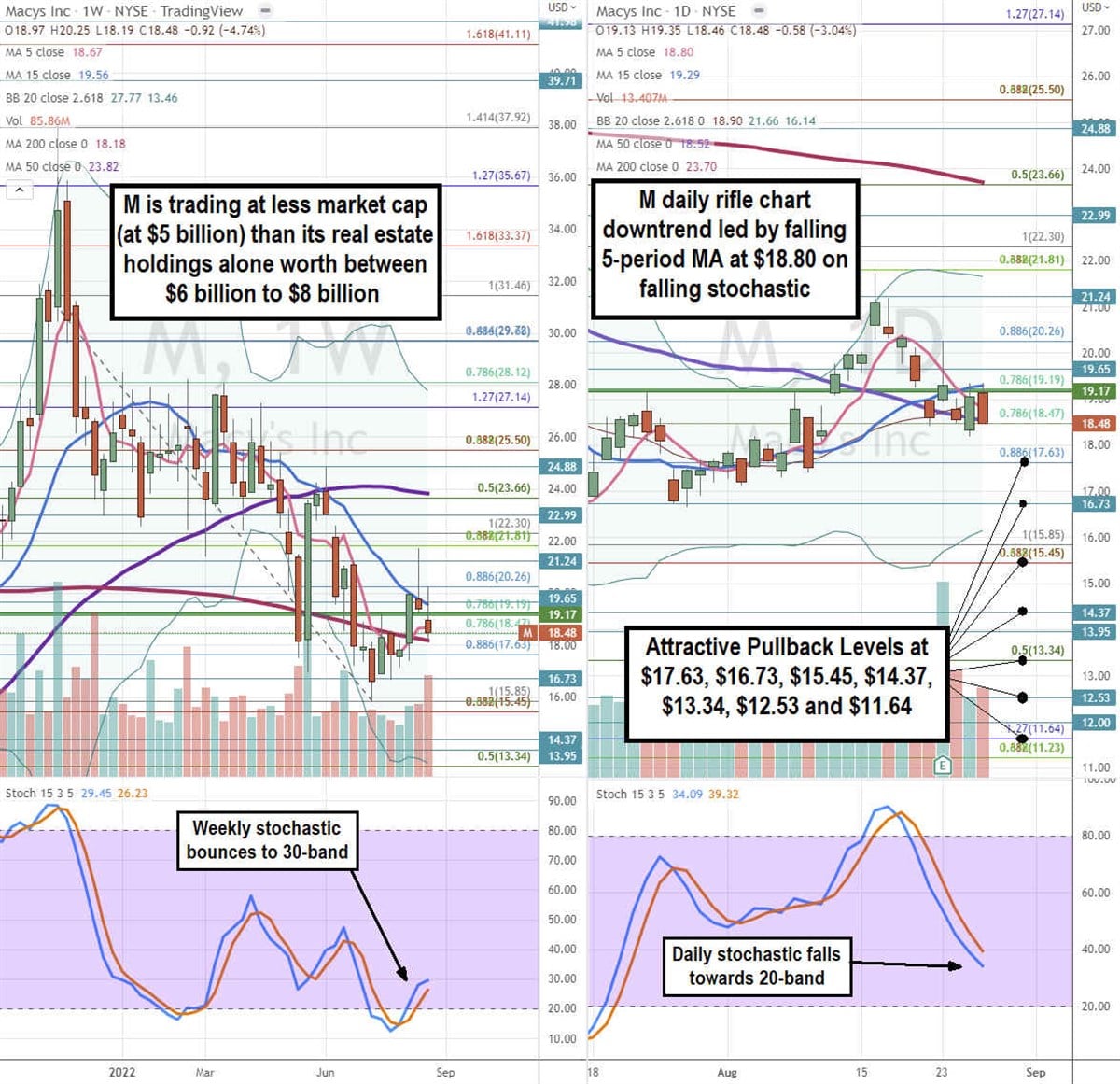

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for M stock. The weekly rifle chart peaked and put in a post-pandemic swing high near the $37.92 Fibonacci (fib) level. Shares collapsed down to the $15.85 level before staging a reversal bounce. The weekly rifle chart is forming a make or break. The weekly downtrend is slowing due to the flattening 5-period moving average (MA) at $18.67 against the falling 15-period MA at $19.56. The weekly 200-period MA is attempting to hold support at $18.18. The weekly 50-period MA resistance sits at $23.82. The stochastic bounces through the 20-band but is slowing down for the make or break. The weekly market structure low (MSL) buy triggers on a breakout above $19.17. The weekly upper Bollinger Bands (BBs) sit at $27.77 versus weekly lower BBs at $13.46. The daily rifle chart uptrend reversed into a downtrend with falling daily 5-period MA at $18.80 followed by the daily 15-period MA at $19.29. The daily 50-period MA is trying to hold a support at $18.52. The daily stochastic has been falling towards the 20-band. The daily upper BBs sit at $21.66 versus lower BBs at $16.14. Attractive pullback levels to watch for are the $17.63 fib, $16.73, $15.45 fib, $14.37, $13.34 fib, $12.52, and the $11.63 fib.

The Value is Beneath the Stores

While Macy’s operates over 700 physical locations that include Macy’s, Bloomingdales, Bloomingdales outlets and Blue Mercury stores. It also owns many of those locations. Some of the highlights include its 291,000 square-foot 16 acre Bloomingdale’s store at South Coast Plaza. It’s crown jewel is the Manhattan flagship 2.2 million square-foot Herald Square location which takes up a whole block in midtown Manhattan estimated to be worth between $3 billion to $4 billion. During pandemic it was looking to issue new bonds backed by its real estate, minus the Herald Square Manhattan property. Starboard pegged the value of Macy’s real estate holdings at $20 billion in 2020. There was even speculation that Macy’s would change its structure into a REIT, but management decided against it. In 2022, Cowen assessed the Macy’s real estate holdings to be worth between $6 billion to $8 billion alone. Macy’s has a market cap of $5 billion and trades at just 4X forward profits with a 3.3% dividend yield. Keep in mind that Macy’s has the ability to monetize its real estate holdings by collateralizing or selling off pieces of property. Even if the real estate holdings matched Macy’s market capitalization around $5 billion, the business itself would be free including its e-commerce division, which was also rumored to be spun off to create more value for shareholders. Shares can become a value play on further pullbacks.