During the recent times of record high inflation (2021-2022), a few things have changed to dislocate markets from where they stood before the COVID-19 pandemic. However, this is not your grandfather's post-crisis rally; the next period could be what some economists call 'the lost decade.'

Today's economy could be setting up for a scenario of persistently high inflation with little to no economic growth. But it does not need to be as bad as the 2000-2010 lost decade, where the S&P 500 had gone nowhere, or the periods of stagflation seen throughout the 1970s.

MarketBeat has put together a sensible solution to guide you through a better stock selection process. Or, in this case, to sit tight and enjoy a near risk-free ride.

Back to Basics

A proven truth of investing is to get a greater return than the benchmark; always remember this. So, where do you turn if the S&P 500 is the benchmark for stocks and this one is expected to perform in a flattish pattern?

The next best thing is bonds, which are paying a nearly 5% yield today at virtually zero risk. But investing in bonds directly can be tedious, filled with terms and other complex lingo that can turn some away from their benefits.

Today, you can access two of the most popular - and widely used - bond ETFs to get the correct exposure to the yields offered today, with all the benefits of a regular stock investment.

Starting with the Vanguard Short-Term Inflation-Protected Securities ETF (NASDAQ: VTIP), you can automatically get a 3.9% dividend yield and some appreciation upside.

The holdings in this ETF are designed to provide you with a higher product that roughly matches inflation. When the rate of inflation slows, the price of the ETF will rise significantly due to its reduced yields.

The price chart shows that the ETF had a 10.6% rally during 2019-2021 when inflation fell to near-harmful levels after COVID-19 lockdowns took effect.

Coming in for a more exciting ride, you can add the iShares Core 10+ Year USD Bond ETF (NYSEARCA: ILTB) to your yield watchlist. This one offers a 4.8% dividend yield, beating most of the 'stable' high-dividend stocks.

All About Yield

Similar to the inflation-protected bonds, the 10+ year bond ETF also saw a rally of 38.5% during the same 2019-2021 period. Why the performance gap? Well, everyone knows about long-term bonds, and only a few know about inflation-protected ones.

With this popularity comes more market participants and more price swings. Though in this case, the higher yield can compensate for the volatility, or you can opt for the lower profit in the inflation-protected ETF, which also offers less volatility. Aren't you spoiled for choice?

What happens if the economy recovers and the FED begins to lower yields? Great question; the answer is straightforward. Price and yield are a seesaw for bonds, so if rates go down, prices will go up.

The catch? If you allocate at today's prices, you would have locked in the near 5.0% yield, all while riding the price up in the next cycle.

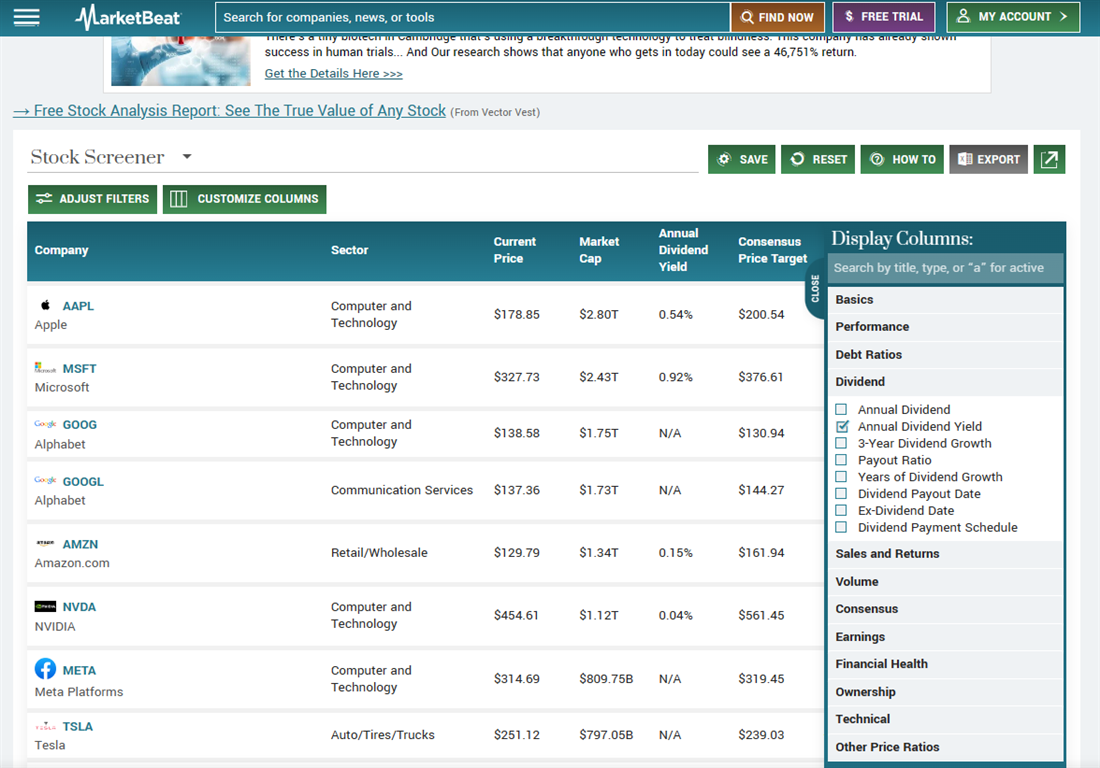

What else can you do with this new knowledge? You can improve your stock selection process. MarketBeat offers a fantastic stock screener tool where you can sort a list of stocks based on their current dividend yield.

By selecting to show the dividend yield, you can now filter through stocks that ideally offer a greater yield than these two bond ETFs; otherwise, is it really worth it to take the extra risk?

For example, Ray Dalio has recently invested in Chinese equities due to his perceived upside potential in the long term. His investments include companies like Alibaba Group (NYSE: BABA), which, according to analysts, carries a net upside of 63.6%.

However, this upside has a lot of bumps ahead of it. Geopolitical tensions between the United States and China, economic uncertainty, the risk of NYSE delisting, and so on. How can shareholders be compensated through these tough times? A prayer here, a blessing there; there are no dividends paid in that stock thus far.

Another example is Coca-Cola (NYSE: KO), which is potentially entering a buy zone. However, its dividend yield is only 3.5% today.

Despite a strong brand and a perceived 28.3% upside by analysts, Coca-Cola is still exposed to business cycle risks, whereas the long-term bond ETF is not. Here, you can compare a 4.8% yield with virtually no risk and added upside against a 3.5% yield with a slightly higher risk.

Catching the trend? No? Okay, one more: take Realty Income (NYSE: O) as a last example. Considered one of the most robust and stable commercial property REITs (real estate investment trusts), it offers a 6.1% dividend yield, beating the bond ETF.

Considering that this stock offers a higher yield and trades at its cheapest valuation since its IPO, providing you with an upside potential of 28.0%, this stock may be one of the few sensible options to replace the bond ETFs.

If you take anything away from this, be more selective. If you take risks, ensure the potential upside beats the risk-free 4.8% yield offered by these bond ETFs plus the appreciation upside; otherwise, you may be stuck holding the bag.