Cybersecurity firm SentinelOne Inc. (NYSE: S) shares have staged a full 180-degree reversal from its heartbreaking collapse at $12.32 in May 2023 to striking new 52-week highs on December 8, 2023. The company specializes in autonomous extended (threat) detection and response (XDR) solutions powered by artificial intelligence (AI) and machine learning (ML). XDR simultaneously matches data across multiple security layers, including network, email, endpoint, server, identity, firewall, sandbox and cloud workloads for real-time threats, which improves response times and investigations. As a member of the Business Services sector, it competes with popular cybersecurity players like CrowdStrike Holdings Inc. (NASDAQ: CRWD) and Palo Alto Networks Inc. (NASDAQ: PANW).

AI Platform features

SentinelOne proclaims itself to be "The first security AI platform to protect the entire enterprise." AI powers its Singularity XDR platform to respond autonomously to threats even before they happen. It provides deep visibility into all endpoint activity, which is analyzed by AI to identify malicious behavior and respond in real-time to prevent security breaches. Its AI and ML capabilities provide a significant advantage over legacy signature-based detection methods.

Singularity can be applied to endpoint, cloud and identity. It has also started to sell Purple AI to select customers, with general availability expected in fiscal 2025. Purple AI is its integrated generative AI platform that uses conversational language and dialog. Check out the sector heatmap on MarketBeat.

Robust revenue acceleration

On December 5, 2023, SentinelOne reported a fiscal Q3 2024 loss of 3 cents per share, beating consensus analyst estimates for a loss of 8 cents by 5 cents. Revenues surged 42.4% YoY to $164.2 million, beating analyst estimates of $156.09 million. Annualized recurring revenues (ARR) rose 43% to $663.9 million. The total customer count grew to over 11,500. Customers with an ARR of at least $100,000 rose 33% YoY to 1,060. Dollar-based net revenue retention rate exceeded 115%. This means the company was able to retain 115% of existing customers and additional upsells and cross-sells.

Gross margin expansion and cash

GAAP gross margins grew to 73%, up from 64% in the year-ago period. Non-GAAP gross margin was 79%, up from 71% in the year-ago period. GAAP operating margin was negative 50%, an improvement from negative 90% in the year-ago period. The non-GAAP operating margin was negative 11% compared to negative 43%. SentinelOne closed the quarter with $1.1 billion in cash, cash equivalents and investments.

Raised forecasts

SentinelOne raised fiscal Q4 2023 revenue guidance to $169 million versus $166.48 million consensus analyst estimates. Non-GAAP gross margins are expected to be 77.5%, and non-GAAP operating margin is expected to be negative 14%. The company also raised fiscal full-year 2024 revenues to $616 million versus $605.39 million consensus analyst estimates. Non-GAAP full-year margins are expected to be 77%, and non-GAAP operating margins are negative 20%.

CEO Insights

SentinelOne CEO Tomer Weingarten had a very confident tone during the upbeat conference call. He noted the strong demand witnessed for Cloud Security and Data Lake solutions, which saw triple-digit growth combined. The company led the MITRE ATT&CK Evaluation with 100% real-time protection driven by autonomous security for the fourth consecutive year. Managed security service providers (MSSPs) represent the fastest-growing channel category in the cybersecurity market and are vital to protecting small and medium-sized businesses (SMBs). SentinelOne continued to solidify its leadership position with MSSPs.

He commented, "Our market-leading, AI-based security across endpoint, cloud, and data continues to differentiate SentinelOne as a true innovator. The increasing velocity and complexity of cyber-attacks require a new approach to cyber security. We are delivering a modern, enterprise-wide unified security platform, helping enterprises manage risk and stay ahead of evolving threats now and into the future."

SentinelOne analyst ratings and price targets are at MarketBeat. SentinelOne peers and competitor stocks can be found with the MarketBeat stock screener.

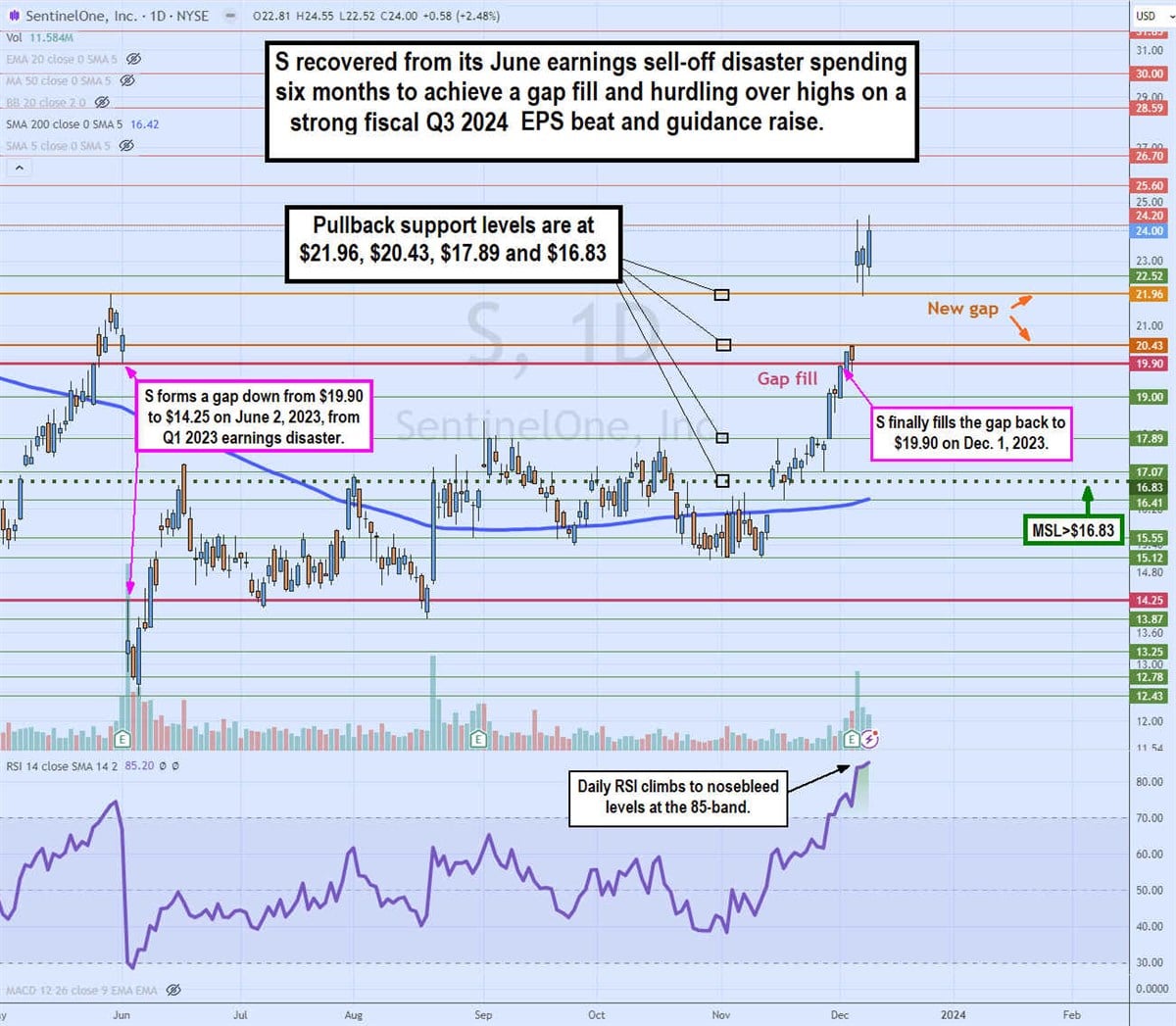

Daily gap fill and new gap

The daily candlestick chart for S illustrates a daily gap fill and a new gap on its Q3 2023 earnings reaction. On June 2, 2023, S shares gapped down over 20% from $19.90 to $14.25 on its Q1 2023 earnings report. Shares continued to fall to a low of $12.43 by June 5, 2023. The daily relative strength index (RSI) fell to the oversold 30-band. S spent the next six months chopping and grinding through the $16.83 daily market structure low (MSL) trigger and the daily 200-period moving average at $16.42, finally staging a rally to fill the gap at $19.90 on December 1, 2023, heading into its Q3 2023 earnings.

Shares formed another gap again, this time to the upside from $20.43 to $21.96 on its strong Q3 performance and raised forecasts as shares ground up to $24.55. As with gaps, they eventually need to get filled, so a pullback to the $20.43 is in the cards at some point in the future. Pullback support levels are at $21.96, $20.43, $17.89, and $16.83.