At his State of the Union address, US President Joe Biden promoted the Junk Fees Prevention Act (JFPA) to eliminate "junk fees". The act introduced in October of 2022 was initially aimed at the airline industry. The scope has expanded to include various industries, including credit cards, banking, broadband and cellphone providers, sporting events, concerts, ticketing, and live entertainment.

It is aimed at live entertainment ticketing and promotion giant Live Nation Entertainment Inc. (NYSE: LYV). It's been Teflon in the past, but this time may be different. Live Nation is no stranger to colliding with government agencies, notably over its alleged anticompetitive practices.

Cracking Down on Four Types of Junk Fees

While the US Department of Justice (DOJ) and Federal Trade Commission (FTC) enforce anticompetitive investigations and actions, President Biden wants to make changes to legislation to accelerate the change. The JFPA targets four types of junk fees that cost Americans billions of dollars annually and stifle competition. These hidden or unexpected fees can add up to hundreds of dollars a month.

Airline Fees

JFPA wants to ban airline fees for family members to sit with their children. While national carriers like United Airlines Holdings Inc. (NYSE: UAL) and American Airlines Group Inc. (NYSE: AAL) have policies that ensure families can sit together with their young children, many of the regional and budget airlines like Ryanair Holdings plc (NASDAQ: RYAAY) and Spirit Airlines Inc. (NASDAQ: SAVE) still charge a fee.

Early Termination Fees

JFPA seeks to eliminate "exorbitant" early termination fees for cable and satellite TV, phone, and internet service. These fees can exceed $200 when consumers opt to switch to another provider before their contract or promotion period expires. It makes it harder for innovative new companies to enter a market as customers get penalized for switching.

The incumbent behemoths like Comcast Co. (NASDAQ: CMCSA), AT&T Inc. (NYSE: T), and Verizon Communications Inc. (NYSE: VZ) can all get hit by this change.

Resort and Destination Fees

JFPA wants to ban surprise resort fees and destination fees. They usually appear on the bill at checkout or at the end of a lengthy online registration process. When they aren't included in the online reservation process, it distorts the actual price of a hotel or resort stay. This can impact Marriott International Inc. (NYSE: MAR), Hilton Worldwide Holdings Inc. (NYSE: HLT), Wyndham Hotels & Resorts Inc. (NYSE: WH), and InterContinental Hotels Group plc (NYSE: IHG).

Excessive Online Concert, Sporting Event, and Entertainment Ticket Fees

These are the undisclosed service fees charged by online ticket sellers. Of 31 sporting events across five ticketing sites, service charges averaged over 20% of the face value of the ticket. Total fees, including processing, delivery, and facility, can cost more than 50% of the ticket cost. Even worse is that the need for more consumer options leaves the consumer no choice.

Singled Out in the Junk Fee Prevention Act

The act specifically points out, “That means that even if consumers knew they might have to pay a large fee on top of the ticket cost, they would have no way to avoid it if they wanted to attend a particular show.

One company has exclusive partnerships with a reported 80 of the top 100 arenas in the United States, allowing it to charge fees to attend events at those leading venues without fear of competition.

” That “one company” can only be Live Nation, the owner of Ticketmaster, the nation’s most dominant ticket sales and distribution company.

Double Dipping Lawsuit

In 2019, pop music star Taylor Swift filed a lawsuit against Live Nation's subsidiary Ticketmaster for double dipping by charging a service fee and delivery fee for her Love Fest concert tour. The lawsuit was settled out of court with no disclosure of the settlement. However, this is the type of behavior that the JFPA is targeting.

Material Impacts and DOJ Investigation

Live Nation has a ticketing arrangement that deals with entertainment powerhouse Endeavor Group Holdings Inc. (NYSE: EDR) and sports entertainment giant World Wrestling Entertainment Inc. (NYSE: WWE). With the growth of streaming music, musicians earn fewer royalties and have to look to live concerts and merchandise sales to grow their income. This has strengthened Live Nation’s hold on the industry.

The Department of Justice is still investigating Live Nation and Ticketmaster over monopoly concerns over the concert and events ticketing industry. Further scrutiny could negatively impact sentiment despite a solid improvement in its business. If junk fees account for 20% to 50% of the price of a ticket, the elimination or reduction of such fees could impose a big material impact on Live Nation's revenues.

Senator Amy Klobuchar has pushed for a breakup between Live Nation and Ticketmaster if misconduct is proven. Ticketmaster generates a significant portion of Live Nation’s revenues, and a breakup could send its stock plunging off a cliff.

Weekly Descending Price Channel

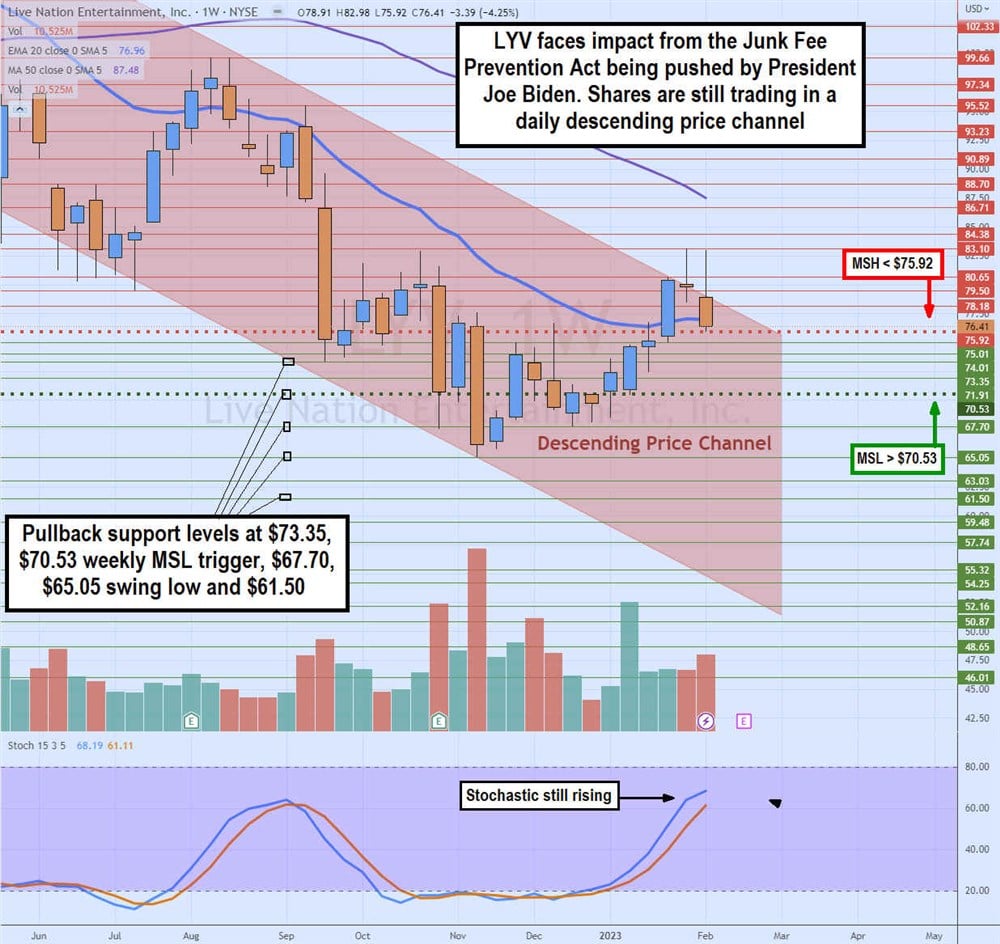

LYV weekly candlestick chart illustrates the descending price channel that commenced in April 2022 as shares had been sinking from $114.84 to a low of $65.05 in November 2022. Shares staged a rally after the immediate impact of a report of a DOJ antitrust probe. The weekly stochastic finally bounced back up through the 20-band in December, triggering a weekly market structure low (MSL) breakout above $74.01.

The rally continued to $83.10 in January 2023 before forming a weekly market structure high (MSH) sell trigger under $75.92. The weekly 20-period exponential moving average (EMA) support has turned into resistance at $76.96, while the 50-period MA resistance continues to fall at $87.48. The weekly stochastic is still climbing towards the 80-band.

Pullback support levels are $73.35, $70.52 weekly MSL trigger, $67.70, $65.05 swing low, and $61.50.