Signs within the RH (NYSE: RH) report indicate that a bottom could be in play for the stock. While results are worse than the Marketbeat.com consensus figures and the guidance is poor, there is an expectation for margin improvement throughout the year. The company is doubling-down on restructuring efforts, has cut 440 jobs, and has begun a mission to reduce inventory and ferret out other cost-saving measures. These efforts may not result in a sustainable rally until the economic conditions improve, but they will set the business up for leverage when it does. At that time, this stock could see revenue growth with accelerated earnings growth that drives it back to the pandemic highs.

“It’s clear that the stay-at-home restrictions of the pandemic created an exponential lift for home-related businesses, and it’s also clear the lift, like the pandemic, was a temporal isolated event versus something structural or systemic… Additionally, inflation that was thought to be “transitory” is now deemed “persistent” by the Federal Reserve, resulting in a record rise in interest rates triggering a dramatic decline of the housing market … Add to that an underperforming stock market, and a banking crisis no one saw coming and the data points to business in our sector likely getting worse before it gets better,” said RH in a letter to shareholders.

RH Steadies On Weak Results, Outlook

RH did not have a great quarter, with revenue declines and rising costs driving significant deleveraging on the bottom line. The takeaway from the market action is that analysts were expecting worse and seeing the glimmers of light at the end of the tunnel. The worst news is the margin contracted at the gross and operating levels, with the adjusted operating margin down 860 basis points compared to last year. This drove weaker-than-expected earnings with adjusted EPS of $2.88, down 50% YOY and almost $0.50 less than the analysts expected.

The guidance is also weak but comes with an expectation for margin expansion in the back half of the year. The Q1 guidance assumes $735 million in revenue at the high end compared to the consensus of $780 with an operating margin of 13% to 14%. The operating margin is expected to increase by at least 300 basis points by the end of the year. Revenue may also exceed expectations due to the company’s planned expansions into interracial markets such as the Med, where wealthy people go on vacation.

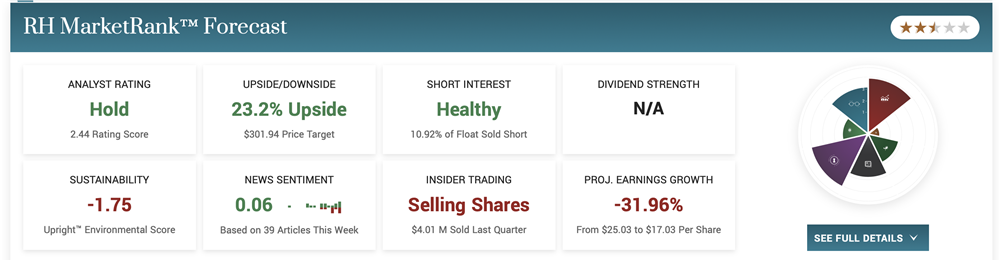

Analysts Lower Their Targets For RH, Still See Upside

The analysts have lowered their targets following RH’s Q4 release, but the sentiment holds firm at Hold. The Hold rating is down from last year’s Moderate Buy, and the price target is moving lower, but most still see at least some upside for the stock. Assuming this holds, the stock should continue to bottom at this level, but there is a risk of additional downgrades. The 7 most recent reports have the stock trading slightly below the consensus, and the group low is below the current price action.

The chart shows support at the $225 level. The chart also shows the market is oversold and listless after a year of short-selling and profit-taking. The short interest is near 15% and could cap gains if the bears keep selling. The stock appears to be rangebound, with sell-siders buying at the bottom of the range and bears selling at the top. This situation may not end until later in the year when results and guidance confirm the bottom or point to lingering weakness.