The chip and semiconductor industry has recently felt, for investors and operators alike, like a battleground. Competition and market share seem to be taking off exponentially in decisive directions and specific spaces within the ecosystem. The rise of artificial intelligence and its many uses, such as self-driving electric vehicles, facial and voice recognition advances, and the explosive breakout of the hottest tool of the day, ChatGPT, has directed the attention of markets and investors alike, who are attempting to figure out which of the several players in the space will come out as the winner.

To start, a quick history lesson is in order so that readers can understand why China and the United States find themselves under heightened political tensions around chip exports and a possible Taiwan invasion. For the better part of the 1950s and early 2000s, the United States was the global hub for anything technology and computing power.

Anything that had Palo Alto, "Silicon Valley," and "Garage" in the same sentence was surely destined to become a disruptive giant. When companies like International Business Machines (NYSE: IBM) and Apple (NYSE: AAPL) started to gain significant market share, competition pressure for margin expansion began to eat into their bottom lines, thus prompting the exploration of cheaper operations overseas.

China was the hub for manufacturing these chips for a few decades, while the United States was the place to go for engineering and development. Once China started to become a wealthier nation and its citizens got a taste of achievement and competition, companies like Huawei and Semiconductor Manufacturing International (OTCMKTS: SMICY) began to release products that targeted the vast market share of their American counterparts.

Huawei had so much success in competing that several governments had to ban their devices from being sold. China remained in the back seat as it kept manufacturing and collecting intellectual property for more advanced chip manufacturing methodologies, as well as exposing itself to the world's largest manufacturer Taiwan Semiconductor Manufacturing (NYSE: TSM).

Current State of the Chip Industry

Up until the mid-2010s, the chip industry was stagnant around x86 chips and the microprocessor, relying heavily on Chinese and Taiwanese abilities to meet output demands and keep costs low. Modern-day demand has shifted toward artificial intelligence and data center-enhancing chips, which require a step farther from the classic CPU. A CPU can only process one dataset at a time and manipulate it one iteration at a time. Thus, the machine learning models that drive A.I. take forever to train and complete, and data centers become negligible in the eyes of outstanding needs.

NVIDIA (NASDAQ: NVDA) has dominated this space with its leadership position in the GPU market. A GPU - compared to a CPU - can process several data sets simultaneously and perform various iterations simultaneously, thus delivering the computing power that A.I. and data centers need to perform.

This GPU revolution is extremely important because missing that train is what has kept Intel (NASDAQ: INTC) in the dark for many years as it stuck to x86 and microprocessors mainly, completely dropping the ball on mobile and A.I. tailwinds.

U Turn Ahead

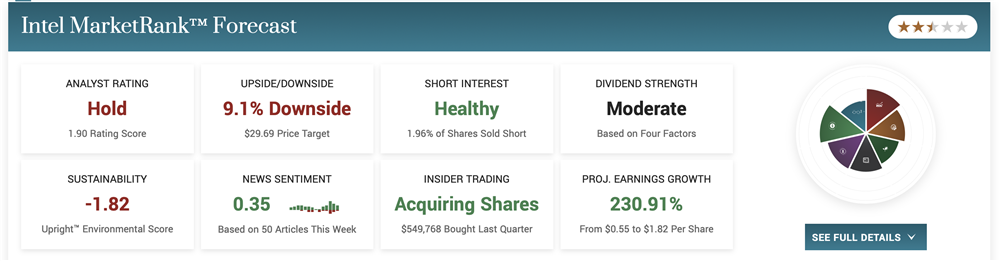

Despite the overall industry experiencing 20%+ CAGRs, Intel has delivered single digit revenue growth since 2015, accompanied by decreasing market share in their respective markets and a 20% compression in gross margins to 2022. New CEO Pat Gelsinger has taken these and other stagnant drivers to heart.

Gelsinger devised a plan for the company to return to its former glory and serve as the leader in decoupling chip manufacturing dependency on China and Taiwan. First, he made it clear that the company will see significantly leaner free cash flows for investors, as he plans to deploy $20 billion USD, with contingency for more, into foundries in the United States - a first step into bringing back domestic production and increased control over the supply chain. These foundries will be granted ASML's latest technology in extreme ultraviolet (EUV) lithography, allowing for the making of 10 nanometer chips codenamed Sierra Forest.

Yes, this has caused the company to severely strip the dividend payout to shareholders, cut executive pay, and execute layoffs. What this means is that delayed gratification will bring on a new wave of customers that are looking to decouple from the volatility and geopolitical risk currently being experienced in East Asia, with China placing more restrictions on chip exports, as well as the United States' retaliation in restricting chip manufacturing machinery to China.

This effectively means for Intel shareholders and potential investors a double tailwind coming from the two main narratives affecting the chip industry. Firstly, the new foundries being U.S.-based will provide increased market share and governmental support as it has become top of mind to domesticate the chip industry. Secondly, the release of the Sierra Forest chip will be a direct competitor to the GPUs made by NVIDIA, thus placing Intel back in the fight for A.I. and data center customer preference.

A Test of Faith

Investors are faced with a renewed growth story, which comes with greater risks and possible delays. The new chips have been released ahead of schedule, and the Sierra Forest chips will come in 2024 when originally scheduled for 2025. However, shareholders who liked Intel for its steady share price and reliable dividend may have to look deeper into their motives for holding or getting into this stock.

Analysts see a downside in their consensus price targets from here, given that most are still doubtful about what numbers could look like in the following years with regards to foundry completion and operational capacity. There is a beacon of hope for those who think the boat has sailed. The stock presents a strong weekly support level in the $24-$25 range, which also acts as a weekly RSI oversold area and a "golden ratio" Fibonacci retracement. Moreover, the company's NAV (Net Asset Value, computed as total assets minus total debt) stands at $26.10 per share, and the book value per share is $24.60.

Further tension with China and a global slowdown in the PC market demand may give investors another chance to consider buying these cheap shares.