Microsoft (NASDAQ: MSFT) just hit another snafu in its proposed acquisition of Activision-Blizzard (NASDAQ: ATVI). This time, the FTC requested an emergency court order to block the merger, which a California judge granted.

Run-ins with regulators have become par for the course in one of the more storied merger transactions in recent history. While the United States FTC is giving Microsoft and Activision headaches as of late, the two companies have gone through the wringer responding to objections from the US, EU, and UK.

Despite the EU's reputation for being regulation-hungry, the EU has already approved the deal. It's just the US and the UK now, and the UK is getting the spotlight.

Details of the Deal

Let's step back to January 2022 when Microsoft (NASDAQ: MSFT) offered to buy Activision Blizzard (NASDAQ: ATVI) for $95 per share in cash -- a generous 45% premium on Activision's then-stock price.

Despite the initial excitement, Activisions’ shares have since languished, currently trading below the stock’s post-announcement closing price. With the deal’s termination date of July 18 on the horizon, shares are still trading at a 14% spread to the acquisition price, a testament to market jitters about this merger.

A Series of Regulator Problems

Western governments aggressively scrutinizing mergers and acquisitions transactions is not exclusive to this deal. It's a growing trend, with recent examples including Amazon's acquisition of iRobot and Pfizer's buyout of Seagen.

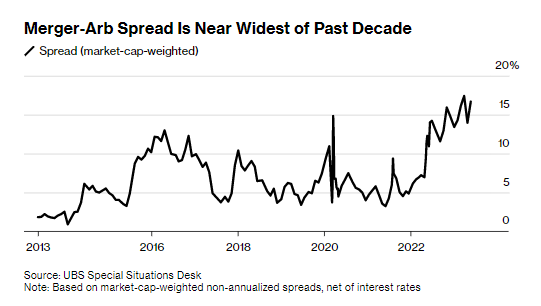

Such scrutiny has led to the highest merger arbitrage spreads in a decade, although higher risk-free rates certainly play a role:

Interestingly, while the EU has given the green light to the deal, the main problem lies in the UK, where the Competition and Markets Authority (CMA) has been a thorn in the side of the companies since day one.

The FTC, as remarked in this article's introduction, also raises eyebrows. Still, traders are less concerned here, as the consensus is that Microsoft will win in court.

But the UK CMA has a less generous appeals process, making CMA approval the primary target.

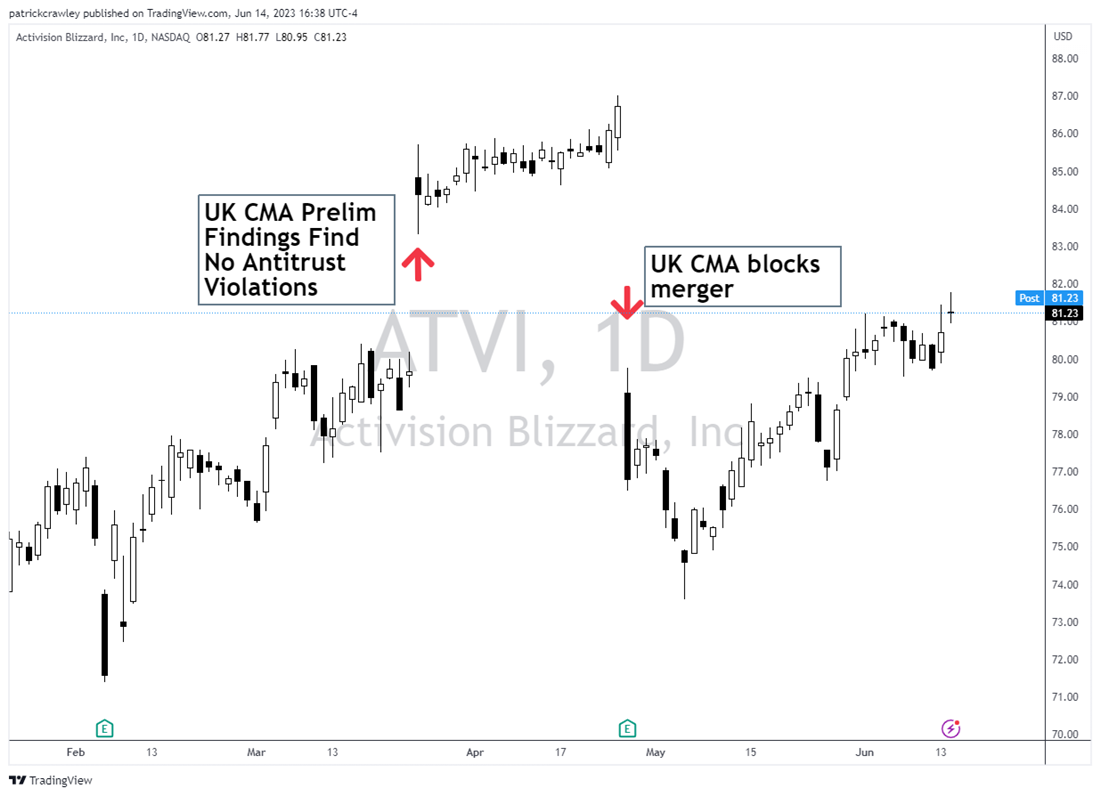

The UK CMA's flip flop in April illustrates this deal's roller coaster ride. In March, the CMA announced preliminary findings of no antitrust violations, and Activision stock rose rapidly in response. The deal spread narrowed considerably, and the deal's prospects looked better than ever.

Fast forward to April, and the CMA blocked the deal, seemingly out of nowhere. Activision’s stock chart is the best illustration of how surprised the market was:

The CMA cited competitive issues in cloud gaming related to Microsoft's Game Pass product as the reason for blocking the deal. This opens up potential remedies, like geofencing cloud gaming and not offering the service in the UK.

However, recent chatter indicates that Microsoft is considering going rogue. Instead of fighting the CMA through its appeals process, for which the CMA has a very high win rate, some are suggesting that Microsoft might go forward with the transaction without CMA approval.

This would be a drastic measure, either kicking the can down the road to fight appeals later or outright calling the UK government's bluff and pulling operations out of the UK.

If Microsoft chooses to go hostile, it must shore up US approval quickly before the July 18 outside date. Activision's recent operational turnaround with its massively successful Diablo IV launch could give Activision leverage to renegotiate if the two parties reach the outside before they can close the deal.

Microsoft and Activision asked a judge Wednesday to expedite their challenge to the FTC. A quick appeal process is critical for the timely success of the deal.

Activision: Bullish With Or Without The Deal?

Activision struck its deal with Microsoft amidst a tough time for the company. The company was involved in an SEC investigation and sexual harassment lawsuits, causing significant internal strife. This was all while its operational performance was on the downswing.

However, Activision is amid a turnaround. Its recent launch of Diablo IV is Blizzard's fastest-selling game ever, and the company reported its highest revenue since Q4 2020 in its recent earnings report.

Trading at a relatively modest 22x PE ratio, which is cheaper than the S&P 500, Activision looks like an attractive opportunity with or without the potential of the Microsoft buyout.

Bottom Line

As with any merger arbitrage trade, view the deal spread as one would a sports betting spread. The market offers 14% returns in the next few months if the deal closes, with considerable and unquantifiable downside should the deal fail. The reward is high, but the risk should be paid equal mind.