Madison Square Garden Sports (NYSE: MSGS) owns both the New York Knicks and New York Rangers, two crown jewels of their respective leagues. MSG Sports is unique because it's one of two pure plays on major US sports teams, with the only other being the Atlanta Braves (NYSE: BATRA).

The soaring values of professional sports teams soaring over the last several years haven't been accurately represented in MSG Sports' stock price. As things stand today, investors can buy the Knicks and Rangers at what looks like a substantial discount to intrinsic value.

But the question remains, will the market ever revalue MSG Sports?

Check out MarketBeat's MarketRank Forecast for MSG Sports:

How Much Are The Rangers and Knicks Worth?

Professional sports teams tend to sell at valuations that don’t make sense when you apply traditional financial analysis techniques. They tend to fetch incredibly high prices, often seen as playthings for billionaires and vehicles for potential tax relief.

The NBA market is scorching recently. Recent deals include a part of the Milwaukee Bucks being sold at a valuation of $3.5 billion and the Phoenix Suns going for $4 billion.

Despite the Milwaukee metro area being one of the smallest NBA markets, the NFL's Cleveland Browns owner shelled out for a 25% stake in the Bucks at that hefty valuation.

And yet, Sportico estimates the Knicks' value at a comparatively modest $6.58 billion, likely underestimating the team's potential on the open market. The Knicks are in the largest media market in the country (NYC), with a TV market seven times larger than the Bucks. And according to YouGov, they are the third most popular NBA team.

Moreover, the Rangers are ranked as the second most valuable NHL team, with Sportico giving them a valuation of $2 billion. Using only Sportico's likely understated valuations, the Knicks and Rangers are worth $8.58 billion, far above MSG Sports' $4.2 billion market cap.

That's a double-bagger alone, without considering additional MSG Sports assets like minor league teams or the likely premium an open market sale would bring.

And MSG Sports agrees with this view. The company plans to use its cash flow for share buybacks as it believes the intrinsic value of the Knicks and Rangers is higher than the market value of the shares:

"During the fiscal 2023 second quarter, the Company implemented its plan to return approximately $250 million to shareholders, in light of the Company's strong financial performance in fiscal 2022 and the trading price of its common stock relative to the intrinsic value of its professional sports teams. The return consisted of a special cash dividend of $7.00 per share (approximately $173 million) and a $75 million accelerated share repurchase ("ASR") program, which the Company completed in January 2023."

MSG Sports: The Bear Case

There's a strong argument against using the buyout value of the Knicks and Rangers to value MSG Sports (NYSE: MSGS) because the Knicks or Rangers are unlikely to ever be sold.

MSG Sports chairman and majority shareholder James Dolan has been adamant for years that he has zero plans to sell the Knicks or Rangers. However, he has indicated that he's open to selling a minority stake. The Dolan family owns and controls MSG Sports, meaning there's little opportunity for activist shareholders to get involved to force a sale, either.

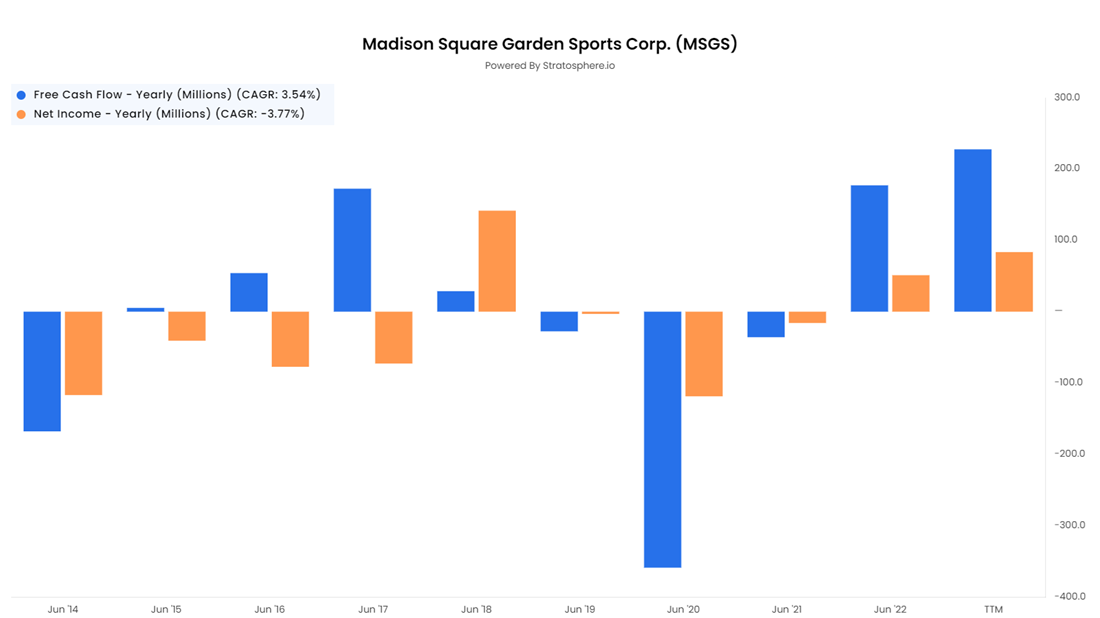

So if you can't value MSGS as a takeover target, it must be valued based on basic financials. This makes the picture far less exciting. The stock trades at 50x earnings, and its income is quite volatile. For instance, take a look at the following chart, which plots MSG Sports' free cash flow and net income over the last decade:

Bottom Line

While the Dolan family is unlikely to sell MSG Sports or any of its premier assets outright, James Dolan has shown openness to selling a minority stake. If a minority deal is struck at a high valuation, that could be a catalyst for Wall Street to revalue MSG Sports (NYSE: MSGS).