If you've ever applied for a mortgage preapproval or bought insurance online, you likely saved time and money by working with a fintech company.

Fintech stocks have taken the world by storm, providing tech-minded investors an avenue to combine their vision with some of the top healthcare and finance companies.

Read on to learn more about which fintech companies stocks are in the news, what to look for in fintech investments and some of the best fintech stocks of 2023.

Overview of Fintech Stocks

A blend of financial knowledge and convenience with the convenience of technology, there's little question why consumers have shown a significant demand for fintech companies. A portmanteau of the words "finance" and " technology," fintech stocks are stocks issued by companies that use technology to make financial services more accessible.

What are fintech stocks, and why is there a growing investor demand for them? Fintech stocks assist in a range of financial services that make day-to-day life more convenient for the everyday consumers that require the services. Some examples of ways fintech has changed our daily lives include the following arenas:

- Digital payments: Fintech companies are part of why you don't need cash to shop at most stores. Fintech investing has resulted in many digital payment processing companies offering services like personal credit lines and buy-now-pay-later services that make shopping easier and safer.

- Online lending: Previously, getting a mortgage loan meant going to your local bank or credit union and applying for a loan in person and waiting through the manual underwriting process. Fintech companies have streamlined and digitized the mortgage process, allowing most buyers to get pre-approved shortly after submitting their funding application.

- Blockchain and cryptocurrencies: Blockchain and cryptocurrency technologies have challenged traditional payment systems, proposing a decentralized method to send money that doesn't rely on a central transaction authority. While cryptocurrencies have proven to be more volatile assets when compared to other types of fintech offerings, a small amount of exposure can provide a unique level of exposure to social media-driven assets.

Incorporating multiple types of fintech companies into your portfolio can help increase diversification, limiting loss in each area in the event of a sudden market turn. It can be especially important in the tech sector, where consumer trends change rapidly according to evolving consumer preferences.

Why Invest in Fintech Stocks?

As more and more public fintech companies debut on major markets, you may consider adding a fintech stock or two to your portfolio. The following are some benefits you might see after investing.

- Rapid industry growth: Fintech is a fast-growing sector driven by increasing demand for digital financial solutions, technological advancements and changing consumer preferences. Investing in fintech stocks allows you to capitalize on this growth potential and be part of an industry reshaping the financial landscape.

- Addressing unmet needs: Fintech companies often address unmet needs in the financial market. For example, a major benefit of fintech companies that offer mortgage solutions is allowing the borrower to apply for a loan at any time by utilizing online underwriting processes. Applying for a mortgage loan is possible if you work a traditional 9-to-5 job, when banks are traditionally open for in-person services. This inclusivity can allow you, as an investor, to put money into companies serving underserved segments of the market.

- Technological innovation: Fintech companies are at the forefront of technological innovation, leveraging artificial intelligence, big data, blockchain and other cutting-edge technologies. As these technologies continue to advance, fintech firms may benefit from staying ahead of the curve, meaning that the top fintech stocks may offer you the chance to benefit from these innovations.

- Participation in the cashless economy: As digital payments become increasingly prevalent, fintech companies facilitating online transactions and digital payments stand to benefit from the growth of the cashless economy. If you believe that consumer preferences will continue to trend toward cashless payments, investing in fintech companies might provide the chance to be an early adopter in these sectors.

As with any investment sector, only invest as much money as you can afford to lose in an individual fintech company comfortably.

5 Best Fintech Stocks to Buy Now

Now that you understand how to buy fintech stocks and some benefits of adding these assets to your portfolio, you can consider individual investment options. Our top fintech stocks list will provide a place to get started.

|

Name |

Fintech stock symbol |

Market capitalization |

Industry |

|

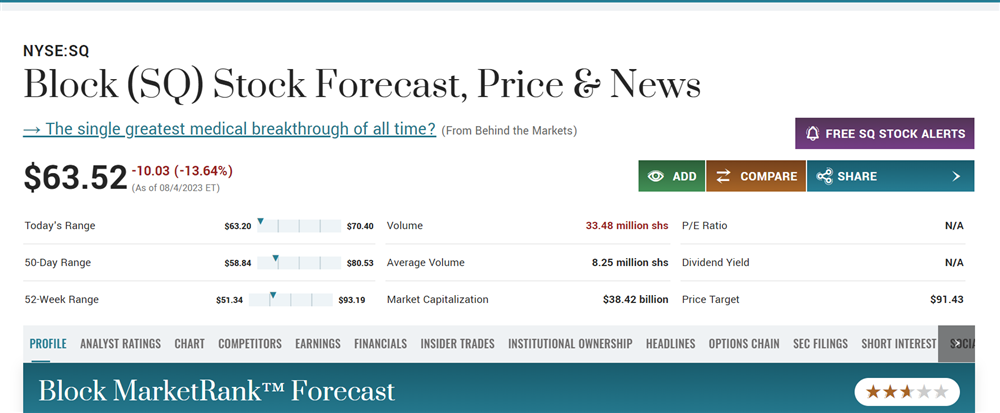

Block |

NYSE: SQ |

$38.42 billion |

Digital payments |

|

Adyen |

OTC: ADYEY |

$53 billion |

Digital payments |

|

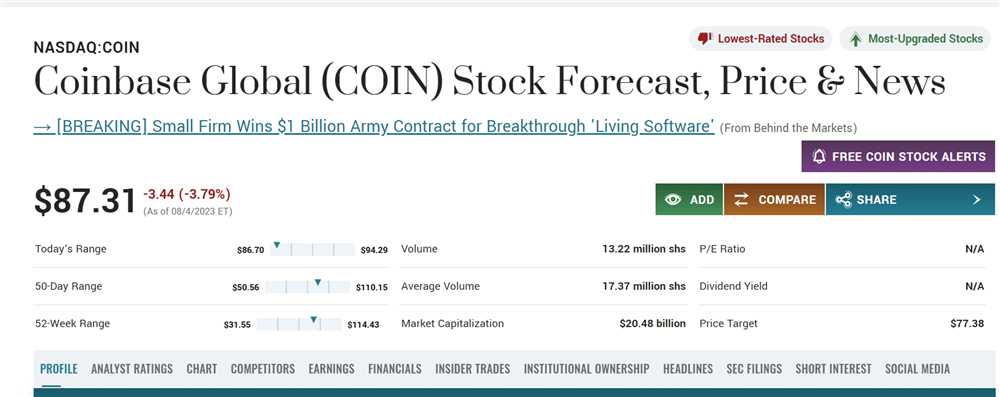

Coinbase Global |

NASDAQ: COIN |

$20 billion |

Cryptocurrency sales and purchases |

|

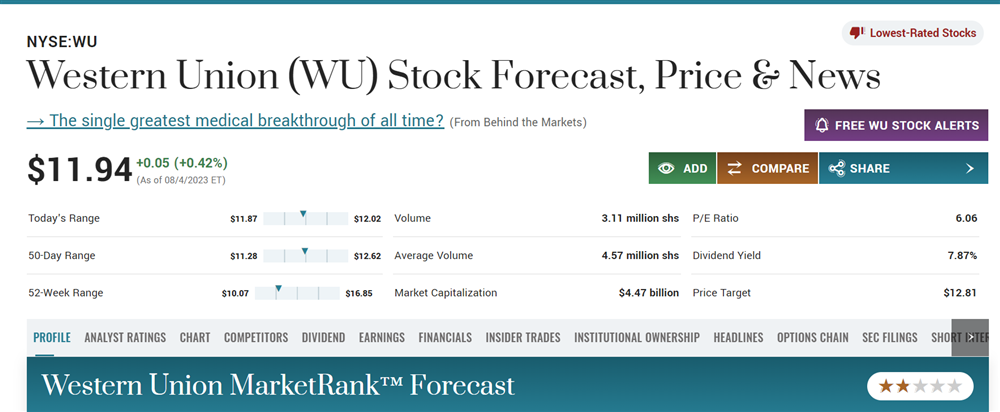

Western Union |

NYSE: WU |

$4.47 billion |

Forex transfers |

|

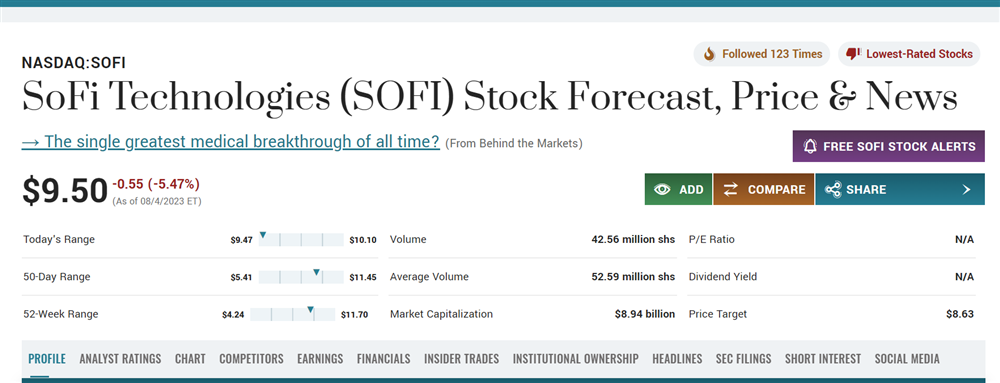

SoFi Technologies |

NASDAQ: SOFI |

$8.94 billion |

Mortgage and loan services |

Block

If you're like most investors, you likely know of Block (NYSE: SQ) by its former name, Square Inc. A top name in fintech, the company was co-founded by Jack Dorsey (also the co-founder of Twitter) and focuses on providing various financial tools and services primarily geared toward small businesses and individuals. Square's core offering is its point-of-sale system that allows businesses to accept card payments using mobile devices or dedicated hardware.

For example, if a small business is selling its products at an offsite location, Square'sSquare's technology can empower them to collect credit card payments in addition to cash. Square is also the parent company of several additional app-based payment systems, including CashApp and AfterPay. It had a total market capitalization of $38 billion in August of 2023, making it one of the most prominent names in digital payments.

Adyen

While Adyen (OTC: ADYEY) isn't yet on the level of competitors like PayPal regarding name recognition, it has begun making waves with European investors. Founded in 2006 in the Netherlands, Adyen has rapidly grown into a leading payment service provider with a strong international presence, expanding beyond Europe and into the Asia Pacific, Latin America and Africa.

Adyen's primary business provides seamless and comprehensive payment processing solutions to businesses, enabling them to accept various payment methods online, in-store and through mobile channels. The company's platform handles payments across multiple geographies and currencies, making it an attractive choice for global businesses. Despite its $50 billion market capitalization in 2023, Adyen maintains a fintech stock price of less than $20 a share, making it an appealing choice for lower-value investors.

Coinbase Global

It's impossible to talk about fintech and cryptocurrency without at least mentioning Coinbase Global (NASDAQ: COIN). One of the first cryptocurrency exchanges to appeal to traditional investors and a more mainstream audience, Coinbase is notable for being one of the first and easiest providers of Bitcoin market services. Since joining the market space in June 2012, Coinbase has expanded beyond Bitcoin into hundreds of additional digital assets.

As a fintech stock, Coinbase's value is tied to the growing popularity and adoption of cryptocurrencies worldwide. The company'scompany's revenue primarily comes from transaction fees and other services related to cryptocurrency trading, and the company has gained attention as one of the largest and most reputable cryptocurrency exchanges. This can make it an attractive investment option for investors interested in the potential of the digital asset market who are looking for more established options to put funds into.

Western Union

While Western Union (NYSE: WU) is not a fintech company in the traditional sense, its online financial transaction service company has become indispensable in an interconnected world. Western Union is a leader in international payment processing, allowing users to send money across currencies to friends and family living abroad. Its primary business model involves collecting transaction fees in exchange for providing payment transfer services.

Western Union has embraced several fintech innovations. For example, it has developed online platforms and mobile applications to enable customers to initiate money transfers and track transactions from their devices conveniently. These digital platforms aim to offer a user-friendly experience and streamline the transfer process, allowing customers to complete financial transactions from their phones. Western Union can be another of the top cheap fintech stocks with a per-share price of less than $12.

Western Union has embraced several fintech innovations. For example, it has developed online platforms and mobile applications to enable customers to initiate money transfers and track transactions from their devices conveniently. These digital platforms aim to offer a user-friendly experience and streamline the transfer process, allowing customers to complete financial transactions from their phones. Western Union can be another of the top cheap fintech stocks with a per-share price of less than $12.

SoFi

Rounding out our list with a top choice for tech-forward investors, SoFi Technologies (NASDAQ: SOFI) is an appealing option for online loan and lending investors. SoFi offers a comprehensive suite of financial products, including student loan refinancing, personal loans, mortgages, home loans and investment services, all available online or using a mobile application. This diverse product range allows the company to cater to customer needs across various life stages.

SoFi operates as a digital-first financial institution, providing online and mobile banking solutions that align with the preferences of tech-savvy customers. In addition to lending, SoFi offers investment services, including stock and ETF trading, automated investing through robo-advisors, and retirement accounts. This diversity can make SoFi a more inclusive investment for buyers looking for a one-stop shop for fintech innovation.

Investing in the Future of Finance

Regarding finance, consumer trends indicate that customers will continue to reward companies that make it easier and more intuitive to connect with online applications and services. However, it's important to understand and remember that no individual company can guarantee returns, no matter how promising they seem. Investing in a tech-oriented ETF or multiple funds of a similar nature can provide exposure to the sector while protecting you against loss potential.

FAQs

Still wondering, "What is a fintech stock, exactly?" The following answers to some of the most common industry questions will clear up any last-minute confusions that you may have.

What is a fintech stock?

A fintech stock refers to the shares of a company operating in the financial technology (fintech) sphere. Fintech companies use technology and innovation to provide financial services and solutions, disrupting traditional financial processes by offering more convenient services to consumers. Investors can buy these stocks in the stock market to gain exposure to the growth potential and innovation in the fintech sector, which might fuel further preferences toward fast, easy-to-use services.

Is fintech a good investment now?

Fintech can be a good investment for 2023, as it focuses on providing customers with more convenient financial services. However, like any other space of new invention and innovation, fintech investing also comes with risk. For example, online insurance and financial product providers may be over-invested because online underwriting is a newer process. Avoid investing too much capital into individual companies to even out your holdings and limit the risk of loss.

Is fintech a good long-term investment?

Fintech is an attractive option for long-term investors, but it does come with some caveats you'll need to consider. Fintech companies are experiencing rapid growth due to increasing consumer demand for digital financial services and the continuous advancement of technology. Fintech companies may benefit from a broader customer base and expanding market opportunities as the world continues to move towards digitalization and cashless transactions.