The fear of contraction and analysts' sentiment pressured J.B. Hunt (NASDAQ: JBHT) stock to a long-term low earlier this year, but a shift signals the opposite for 2025. The Q3 results weren’t robust—far from it—but they came in better than feared. They reaffirmed the longer-term outlook and the reliability of capital returns, spurring analysts to raise their stock price targets and revert to the long-term trend.

The critical takeaway is that economic normalization following the COVID-19 pandemic and macroeconomic headwinds impact J.B. Hunt's results this year. However, its diversified trucking and logistics business is still good, up nearly 25% compared to 2020, with growth expected to resume next year. It may be a few more quarters before significant improvement is seen in the results. Still, broad economic improvement and business tailwinds are expected to form in 2025 due to falling interest rates. Until then, capital returns are reliable.

J.B. Hunt’s Diversified Business Can Sustain Its Capital Return

J.B. Hunt didn’t have a strong quarter, but the $3.07 billion in net revenue, down 2.8% year-over-year (YoY), was nearly 200 basis points better than the consensus reported by MarketBeat and closer to 500 bps above the whisper figures. The primary cause of the decline is a 5% and 6% decrease in revenue per load in the intermodal and trucking segments, compounded by volume weakness in the integrated and dedicated capacity solutions businesses. Final Mile also contributed to the weakness with fewer stops.

Strengths included the intermodal segment reporting an increase in volume and ICS a 3% increase in revenue per load. Segmentally, the intermodal business produced flat results, with volume offsetting the decline in revenue per load while all others contracted. Trucking was the weakest link, with a 12% YoY decline in revenue but still a solid result regarding the company’s financial health and capacity for capital return.

Margin news is also mixed. The company experienced margin compression due to deleveraging and increased personal and equipment expenses but, again, not as bad as feared.

The 90 basis point contraction in the operating margin left income down 7% and the net income by 17%, but still well above forecasts. The $1.49 in GAAP EPS is $0.08 ahead of forecasts, more than 500 basis points, and sufficient to sustain operational quality and capital returns.

Capital returns include the dividend, which yields about 0.8% with shares near $182.5, and share repurchases. Share repurchases were accelerated this year, and the count was reduced by an average of 2.15% year over year during the quarter.

Analysts' Support Improving for the J.B. Hunt Freight Wagon

Analysts' support for J.B. Hunt has been firm, with sentiment pegged at Moderate Buy for over a year. However, a trend of reduced price targets weighed on the price action over the summer, a trend that ended with the Q3 results. The initial reaction was very bullish, with more than a dozen analysts tracked by MarketBeat increasing their price target. The consensus is now rising, indicating fair value near the mid-point of the multi-year trading range, with fresh target pointing to higher levels. The high range of analysts' targets suggests a move to the high end of the trading range, with a gain of 10% to 20% possible by the year’s end.

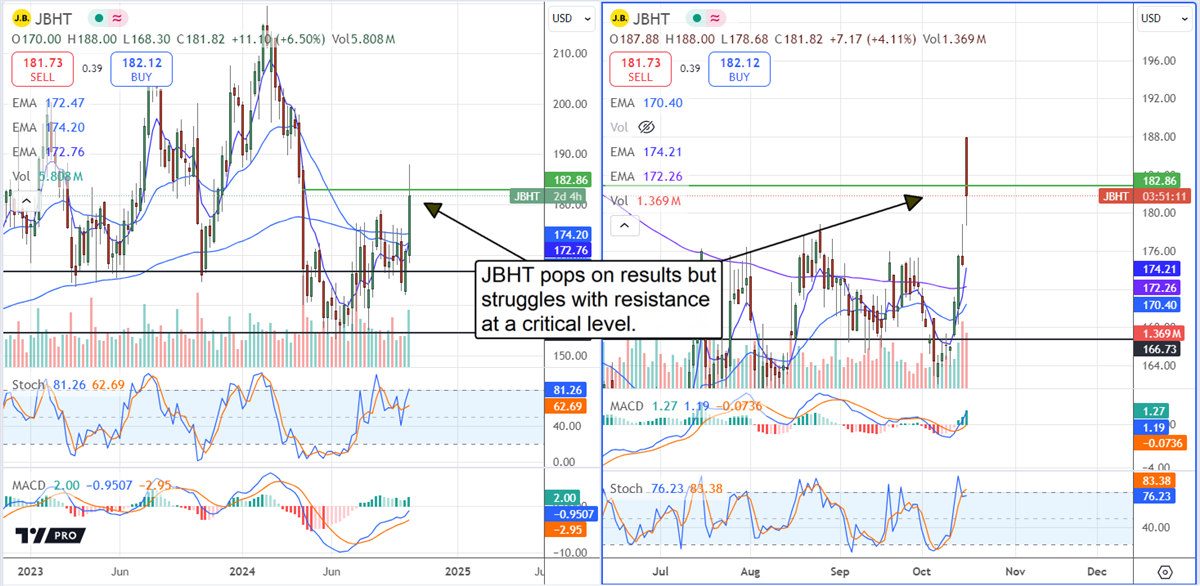

The price action in JBHT stock is favorable following the release. The market surged more than 5% at the high, confirming support and reversal at the low end of a trading range. However, resistance is present at the middle of the range, consistent with the top of a price gap formed earlier this year, and may cap gains in Q4. Trading at 30x its earnings and yielding less than 1%, JBHT is a highly valued stock yielding less than the S&P 500 average, which is a headwind for the market. Assuming the market cannot close above $182.75, JBHT will likely remain range-bound until more news is available.