Investors should be familiar with the expression, “Buy the Dip”(BTD) when it comes to the stock market. It means to buy stocks on a pullback. Traders are also familiar with the expression "Sell the Rip" (STR). It means to sell stocks into the strength.

Fending Off FOMO

Put together, “Buy the Dip, Sell the Rip” (BTD-STR) is what traders and investors should be doing: buying low and selling high. However, that’s not always the case. Unfortunately, it’s all too common for traders to fall into the fear-of-missing-out (FOMO) trap and chase the rip: buying high and selling low. Waiting for a dip to occur can be tedious since it's human nature to chase stocks when they are rising and walk away when they are falling.

The BTD-STR Options Strategy

Using stock options, you can buy the dip with stocks and get paid to do so. You can also sell the dip and get paid a premium once you buy it. The BTD-STR strategy should only be used for stocks you are willing to hold longer. It doesn’t mean you must hold the stock long, but you are comfortable holding it because you are familiar with it and believe it will move higher in the long run.

To administer the BTD-STR options strategy, we can break it down into 2 parts.

Buy the Dip (BTD) with a Cash-Secured Put

Rather than place a good-to-cancel (GTC) limit order on a stock, you can use options to buy the dip and collect a premium for it by selling cash-secured put options.

For example, an XYZ $50/$55 long strangle is comprised of a long 1 XYZ $55 put option and a long 1 XYZ $50 call option.

Sell the Rip (STR) with a Covered Call

Once you are executed on the long position, you can collect income via a premium and appreciation by writing a covered call. Depending on how much appreciation you want, you can opt for a smaller premium for a higher potential price rise. Remember, the strike price is the price you will receive for your stock if it closes above it upon expiration.

Willing to Hold But Won’t Fall for the FOMO

Let’s assume you’re a fan of the consumer staples sector drive-through coffee shop Dutch Bros Inc. (NYSE: BROS). You love the products and selection, especially the sugar-free options and the new protein coffee. Dutch Bros drinks are cheaper than Starbucks Co. (NASDAQ: SBUX) at $3.00 to $4.50 each, and the drive-through makes it a faster experience. The company is planning on opening up to 125 stores this year, and each 950-square-foot store pumps out $2 million in sales annually. Revenues surged 40% YoY in its Q1 2024. You have no problems holding it longer-term but refuse to fall for the FOMO. The future of the company looks strong as it has more room to grow than Starbucks.

Example of a BTDSTR Strategy on Dutch Bros Stock

BROS had a stellar Q1 2024 earnings release, causing the stock to gap and go running up 30%. BROS went into its Q1 2024 earnings around $28.50 gapped up to $30.14, and spiked up to $36.17. BROS is up against a double top resistance level, trading currently around $35.91.

There are 2 gap fill levels at $32.88 and $28.50. Let’s assume you are willing to buy the dip around a 10% pullback to the $32.50 strike level.

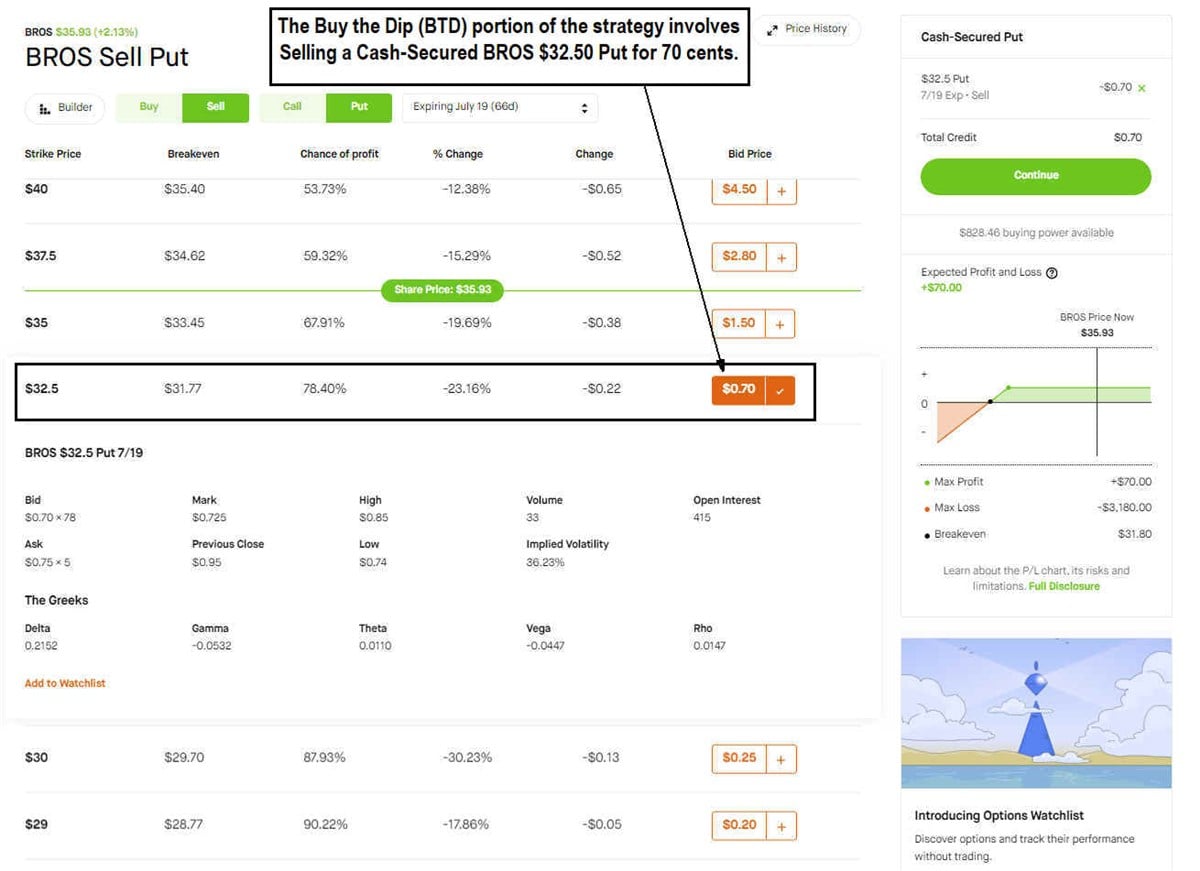

Executing the BTD Trade

Since you're willing to buy at the $32.50 level and hold for a longer duration, you can use the $32.50 strike price to sell a cash-secured put. Note that cash-secured means you should have the capital in your account to pay $32.50 per share if you get assigned. Most brokers will only enable you to sell a cash-secured put if you have the funds to pay from the stock.

The July 19, 2024, put option expires in 66 days and pays 70 cents. This lets you complete the BTD portion of the strategy by selling the July 19 BROS $32.50 Put for 70 cents. After you execute the trade, you will be credited $70 in your trading account. If BROS falls under the $32.50 level by expiration, then you will be assigned the stock at $32.50.

Keep in mind that you will still be paying $32.50 no matter how far under that strike price BROS falls. This is the risk when selling puts. There is also potential for early assignment if BROS falls deep-in-the-money (DTM). However, since you're a believer in the stock, you are comfortable holding the shares.

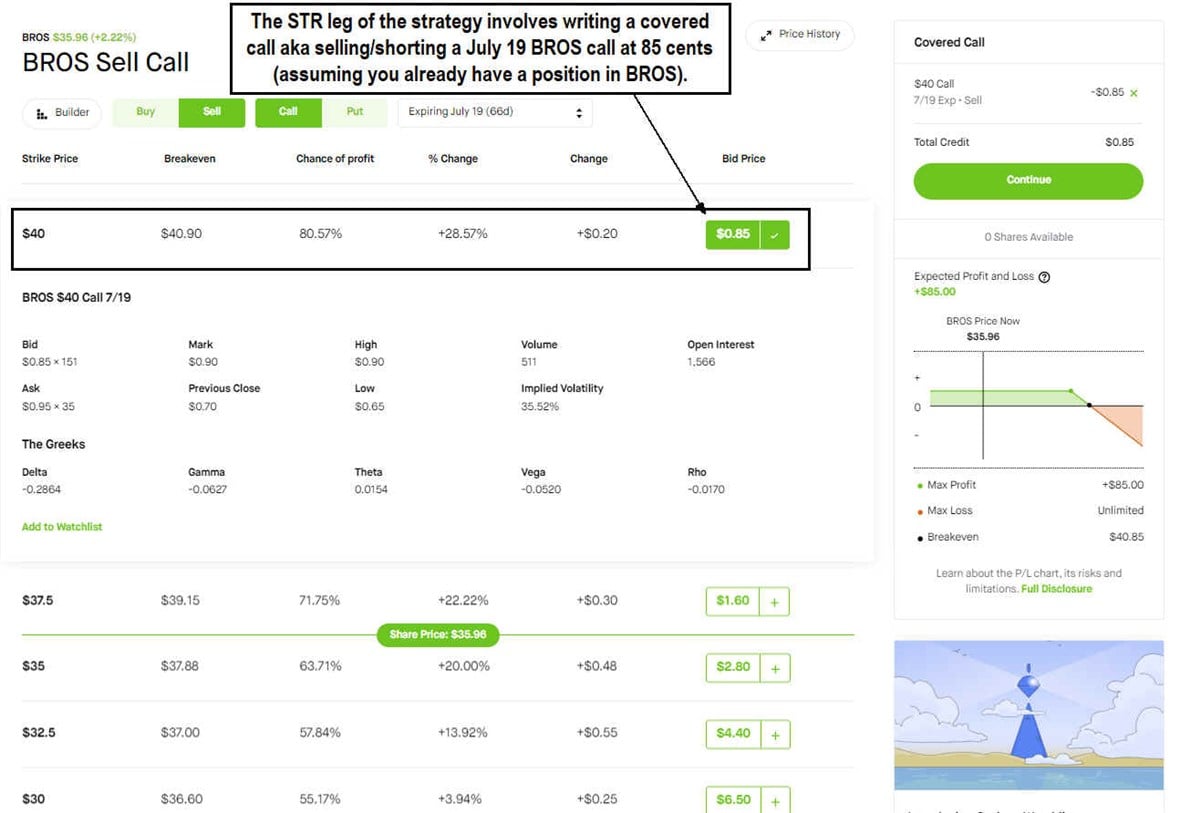

Executing the STR Trade

Once you get filled on the BTD order, you can add the second part of the strategy to your BROS position. To STR, you will write a covered call with an upside strike price for capital appreciation while collecting a premium in the meantime.

Let’s assume that you already have a BROS position, and now you will execute the STR leg of the strategy. If your position is at $32.50, you can aim for a round number around the $40.00 strike price. You can write the July 19, 2024, $40.00 covered call for 85 cents. This gives you a $7.50 upside for a potential 18.75% gain and a premium of 85 cents as a credit.

If BROS fails to close above the $40.00 by expiration, then you can keep the premium and write another covered call again. You can continue to write covered calls until you are called out. Keep in mind the farther out your expiration, the higher the premium you get paid for it.

Plan Your Trade and Trade Your Plan

The BTD-STR strategy helps to avoid the fear of missing out (FOMO). FOMO is the all-too-familiar course of action that traders and investors fall into when chasing a hot stock. FOMO is the opposite of BTD because it is more like "Chase the Rip."

Pre-selecting a strike price that you're willing to buy and hold on to a stock avoids impulse trading and lets you plan the trade ahead of time. It also provides you with some income while you wait. If you don't get filled by expiration, just place another BTD leg of selling a cash-secured put at your comfortable strike price levels. Once you get filled, move on to the STR leg of the strategy and trade your plan.