No-brainer stocks are easy to own because they require little analysis to uncover their strengths, which include growth, cash flow, fortress balance sheets, and capital returns. From the buy-and-hold perspective, they fit right into the Warren Buffett school of investing and can deliver value for investors year after year. That’s because they operate in must-have industries similar to dentists, barbers, and morticians; as unexciting as the work can be, their services are needed, well-entrenched, with little danger of disruption, and they make money. Revenue and cash flow may not grow robustly, but growth is sustainable, which a long-term-oriented buy-and-hold portfolio requires.

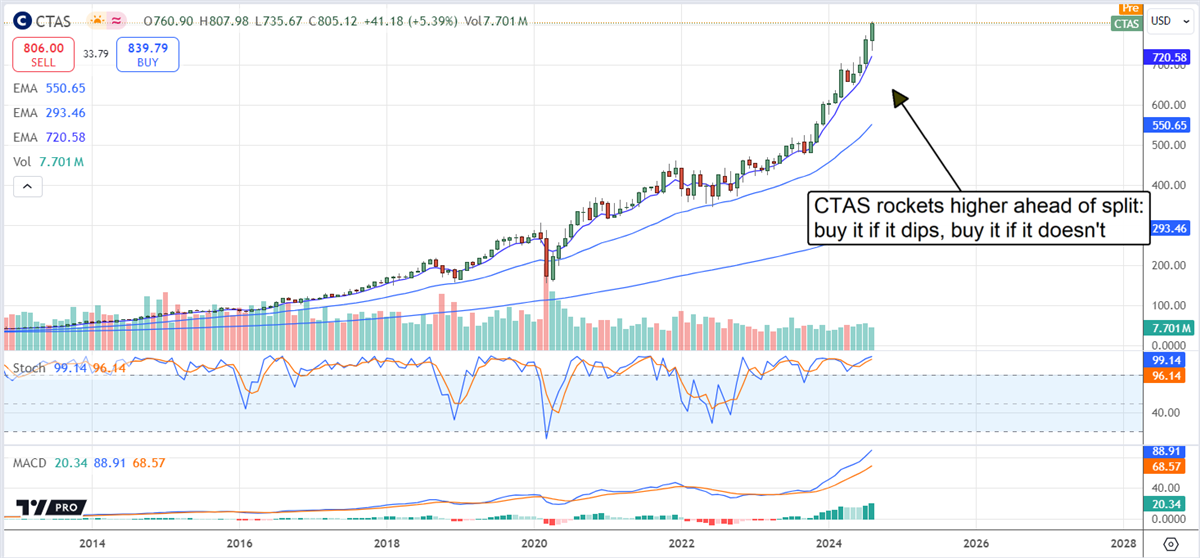

Growing Cintas Splits Stock: Buy It if It Dips

Cintas (NASDAQ: CTAS) will complete a 4:1 stock split the first week of September and set itself up for another triple-digit stock price increase. The stock split isn’t why the company stock will rise another triple digits but is evidence of the cause. Stocks that split tend to outperform the broad market; their prices steadily climb because they are fundamentally strong and deliver value. Cintas stock is up quadruple digits over the last decade because of this trend which includes dividends, dividend increases, and share repurchases.

Cintas is the leading operator in a still-fractured market. It provides uniform rental and ancillary services to many businesses and is growing organically and by acquisitions. Client acquisitions and growing employee counts aid organic growth, running at a mid-single-digit pace in 2024. Highlights from the 2024 fiscal year include significant margin improvement at the gross and operating levels, top and bottom line strength, and a 22% operating margin. Cash flow was positive, resulting in a nearly 3X build in cash, increased assets, decreased debt, and a 12% increase in shareholder equity.

Capital return includes share repurchases, which offset share-based compensation, and dividend distributions. The dividend is worth less than 1%, with shares at record highs, but it is ultra-safe. The payout ratio is under 40%, allowing distribution increases compounded by earnings growth. Earnings growth is forecasted to range from 7.5% to over 10%. The company is a Dividend Aristocrat and nearly a King, having increased the distribution annually for over forty years. Regarding the leverage, total long-term liabilities are less than 1X equity and assets, leaving Cintas unencumbered and positioned to continue investing in growth.

Casey’s General Stores: Keeps America Moving

Casey’s General Stores (NASDAQ: CASY) is a near-identical story to Cintas, including growth, balance sheet health, and capital returns. The only difference is the business model. It is a large and growing chain of gas stations/convenience stores in critical locations. The business produces solid cash flows and has improved its margins over the past two years. Highlights from F2024, which ended in calendar Q2 2024, include top and bottom line strength, a 5.6% inside sales comp, 1% sold fuel gallons growth, and guidance for organic and store count growth to continue in F2025. Casey’s shares are up 35% in 2024, 100% over the last two years, and more than 400% in the last ten.

Cash flow and balance sheet highlights include a cash draw used to fuel acquisitions, offset by increased assets, decreased debt, and a 13% increase in equity. Capital returns include $105 million in share repurchase, which offset share-based compensation and reduced the count incrementally compared to the prior year. Dividends aren’t robust but ultra-safe at 13% of earnings and growing at a mid-teens pace. As for leverage, total liabilities are just over 1X equity and about 0.5X assets.

Shopify: A Value-Building Stock in the Making

Shopify (NYSE: SHOP) doesn’t have the history or capital return of Cintas or Casey’s but is on track to join their ranks. Its eCommerce platform is necessary for small businesses seeking to create or enhance their digital presence. Its platform is also crucial to larger firms that rely on its cross-border services for international expansion.

Details from 2024 include stronger-than-expected double-digit growth, widening margin, and significantly improved free cash flow. The net result is that guidance was improved, the cash balance is up, and liability and debt are down, leaving equity up 1%. The critical detail is that cash flow is expected to remain strong, allowing for continued debt reduction and balance sheet improvement. As it is, leverage is ultra-low, with a total liability of about 0.15X equity, 0.2X assets and 1.5X cash. The takeaway is that Shopify will continue to grow and reinvest while maintaining its fortress financial position, setting itself up to pay dividends and repurchase shares down the road.