Cybersecurity Market size worth over USD 400 billion by 2027

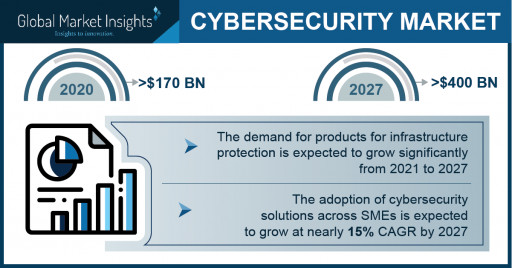

The Cybersecurity Market size is set to surpass USD 400 billion by 2027, according to a new research report by Global Market Insights Inc.

Global Market Insights Inc. has recently added a new report on the cybersecurity market that estimates the market valuation for cybersecurity will cross US$ 400 billion by 2027. The growing demand for security solutions across enterprises to protect financial transactions and highly sensitive information from unauthenticated access and vulnerabilities is contributing to market growth.

Growing technological advancements and internet penetration are driving enterprises to shift to cloud-based business models. Extensive digitization across enterprises is prone to cyber threats and information breaches; thus, established enterprises are investing heavily in cybersecurity solutions. Cybersecurity solutions are assisting enterprises in preventing potential monetary and non-monetary losses including interconnected servers and data storage devices.

Request a sample of this research report @ https://www.gminsights.com/request-sample/detail/3078.

The lack of infrastructure resources and technology expertise may create concerns for some corporations. Large enterprises except a few SMEs have dedicated IT departments with dedicated solutions and equipment for deploying over network infrastructure. The SMEs are facing budget concerns that are affecting the adoption of security solutions. However, continuous development and cost-effective security solutions may drive enterprises to adopt security solutions.

The demand for products for infrastructure protection is expected to grow significantly from 2021 to 2027. The enterprises have adopted BYOD trends to a large extent to provide flexibility to the employees and boost business productivity. The enterprises are adopting endpoint protection to prevent any vulnerabilities and unauthenticated access to enterprise data resources through mobile devices.

As cloud business infrastructure is prone to cyber risks, the cloud security solution helps the company to maintain streamlined network operations by following guidelines. It also manages the overall network security and prevents unauthenticated changes over network. The adoption of cybersecurity solutions across SMEs is expected to grow at nearly 15% CAGR by 2027. The growing cyberattacks over SMEs and increasing monitory losses have resulted in increasing adoption of advanced security solutions. Enterprises have adopted cybersecurity policies for BYOD to reduce the capital expenditure and boost employee productivity.

The demand for cybersecurity products & services is increasing across IT and telecommunication enterprises due to the buoyed demand for protection of personal sensitive data. The enterprises are adopting security solutions to protect servers, data centers, and virtual information systems. This helps them to mitigate cyber risks, detect vulnerabilities at earlier stage, and protect from live attacks.

The cybersecurity market size in Europe is expected to grow at a CAGR of over 10% by 2027. The enterprises operating in the banking sector are adopting advanced cybersecurity solutions. The government authorities and private enterprises are making collaborative efforts to prevent vulnerabilities across the financial landscape. For instance, in May 2021, Belgium's Belfius Bank partnered with OneSpan, a cybersecurity technology provider, to integrated OneSpan Mobile Security Suite (MSS) into Belfius' mobile app to make banking transactions safer. The initiative focuses on providing biometric authentication, mobile application security, risk analysis, and other safety features to prevent frauds.

Targeting the government sector for securing high-value contracts has been a major go-to-market strategy for cybersecurity vendors. For instance, in June 2021, IBM launched the IBM Center for Government Cybersecurity, a collaborative environment focused on helping federal agencies address current and future cybersecurity threats. The center will facilitate events and learnings, drawing on IBM's cybersecurity expertise from delivering software and managed services to over 17,500 security customers globally.

Request a customization of this research report at https://www.gminsights.com/roc/3078.

Some major findings of the Cybersecurity Market Report include:

- The growing need for cyber protection and advanced security for network infrastructure across enterprises are supporting market growth.

- Government guidelines and initiatives in the market are supporting the adoption of security services by IT & telecom service providers.

- The adoption of cloud computing services by enterprises is enabling them to adopt advanced security solutions.

- Major players operating in the cybersecurity market are Amazon Web Services, IBM Corporation, Microsoft Corporation, Nokia Networks, Oracle Corporation, Google LLC, etc.

- The companies operating in the market are focusing on strategic collaborations for the development of advanced cybersecurity solutions.

Partial chapters of report table of contents (TOC):

Chapter 3 Cybersecurity Industry Insights

3.1 Introduction

3.2 Industry segmentation

3.3 Impact of COVID-19 outbreak

3.3.1 Global outlook

3.3.2 By region

3.3.2.1 North America

3.3.2.2 Europe

3.3.2.3 Asia Pacific

3.3.2.4 Latin America

3.3.2.5 Middle East & Africa

3.3.3 Industry value chain

3.3.3.1 Suppliers

3.3.3.2 Cybersecurity technology providers

3.3.3.3 Marketing & distribution channels

3.3.4 Competitive landscape

3.3.4.1 Strategy

3.3.4.2 Distribution network

3.3.4.3 Business growth

3.4 Cybersecurity ecosystem analysis

3.4.1 Cybersecurity hardware suppliers

3.4.2 Cybersecurity software developers

3.4.3 Cybersecurity service providers

3.4.4 Cloud service providers

3.4.5 System integrators

3.4.6 Third party managed service providers

3.4.7 Distribution channel

3.4.8 End users

3.4.9 Profit margin analysis

3.4.10 Vendor matrix

3.5 Cybersecurity evolution

3.5.1 Evolution of cyber-attacks

3.6 Regulatory landscape

3.6.1 ISO/IEC 270001

3.6.2 Gramm-Leach-Billey Act of 1999, U

3.6.3 Cybersecurity Law, China

3.6.4 Federal Information Security Management Act (FISMA)

3.6.5 Health Insurance Portability and Accountability Act (HIPAA)

3.6.6 The General Data Protection Regulation (GDPR) (EU)

3.6.7 Directive on Security of Network and Information Systems (NIS Directive) (EU)

3.6.8 The National Institute of Standards and Technology (NIST), U

3.6.9 Cyber Security Framework, Saudi Arabian Monetary Authority (SAMA)

3.7 Technology and innovation landscape

3.7.1 Virtualized firewall

3.7.2 AI and machine learning

3.7.3 Blockchain

3.8 Patent analysis

3.9 Investment portfolio

3.10 Industry impact forces

3.10.1 Growth drivers

3.10.1.1 Increasing incidents of cyber-attacks

3.10.1.2 Growing need among organizations to minimize security risks

3.10.1.3 Increase in the number of IoT devices demanding network security solutions

3.10.1.4 Penetration of smartphones

3.10.1.5 Increasing demand for enterprise mobility

3.10.2 Industry pitfalls & challenges

3.10.2.1 Lack of IT resources and in-house expertise

3.10.2.2 Lack of knowledge about IAM solutions

3.10.2.3 Limited security budget among SMEs

3.11 Cybersecurity statistics

3.11.1 Security incidence by type of asset

3.11.2 Data breaches per industry vertical

3.11.3 Target device/network

3.11.4 Average cost of stolen data per industry vertical

3.12 Porter's analysis

3.13 PESTEL analysis

About Global Market Insights

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients penetrative insights and actionable market data specially designed and presented to aid strategic decision-making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Arun Hegde

Corporate Sales, USA

Global Market Insights, Inc.

Phone: 1-302-846-7766

Toll Free: 1-888-689-0688

Email: sales@gminsights.com

Press Release Service by Newswire.com

Original Source: Cybersecurity Market Size to Hit $400 Bn by 2027: Global Market Insights, Inc.