Recreational vehicle (RV) and boat retailer Camping World (NYSE:CWH) reported Q3 CY2024 results exceeding the market’s revenue expectations, but sales were flat year on year at $1.72 billion. Its GAAP profit of $0.09 per share was also 145% above analysts’ consensus estimates.

Is now the time to buy Camping World? Find out by accessing our full research report, it’s free.

Camping World (CWH) Q3 CY2024 Highlights:

- Revenue: $1.72 billion vs analyst estimates of $1.64 billion (5.4% beat)

- EPS: $0.09 vs analyst estimates of $0.04 ($0.05 beat)

- EBITDA: $67.52 million vs analyst estimates of $64.66 million (4.4% beat)

- Gross Margin (GAAP): 28.9%, down from 30.3% in the same quarter last year

- Operating Margin: 3.7%, down from 5.1% in the same quarter last year

- EBITDA Margin: 3.9%, down from 6.6% in the same quarter last year

- Free Cash Flow Margin: 17.7%, up from 15.8% in the same quarter last year

- Market Capitalization: $950.9 million

Marcus Lemonis, Chairman and Chief Executive Officer of Camping World Holdings, Inc. stated, “Our combined new and used same store unit sales returned to positive growth for the first time in 10 quarters, with our record new unit market share(1) a direct result of our relentless focus on product development and affordability. I’m very encouraged by our October-to-date same store volume trends, with used units tracking to flat year-over-year, and new units remaining solidly up by a double-digit percentage, providing significant momentum as we focus on an improved 2025.”

Company Overview

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Sales Growth

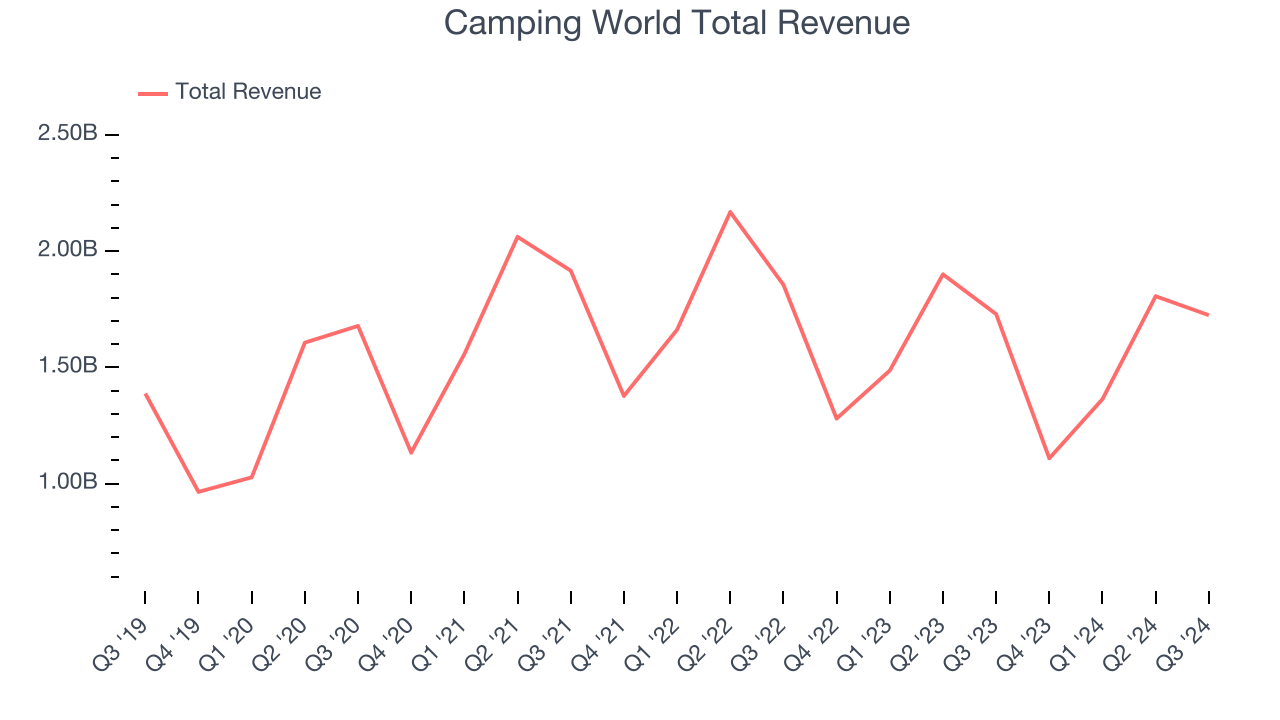

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Camping World is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Camping World grew its sales at a sluggish 4.1% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Camping World’s $1.72 billion of revenue was flat year on year but beat Wall Street’s estimates by 5.4%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, similar to its five-year rate. This projection is admirable and illustrates the market sees some success for its newer products.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

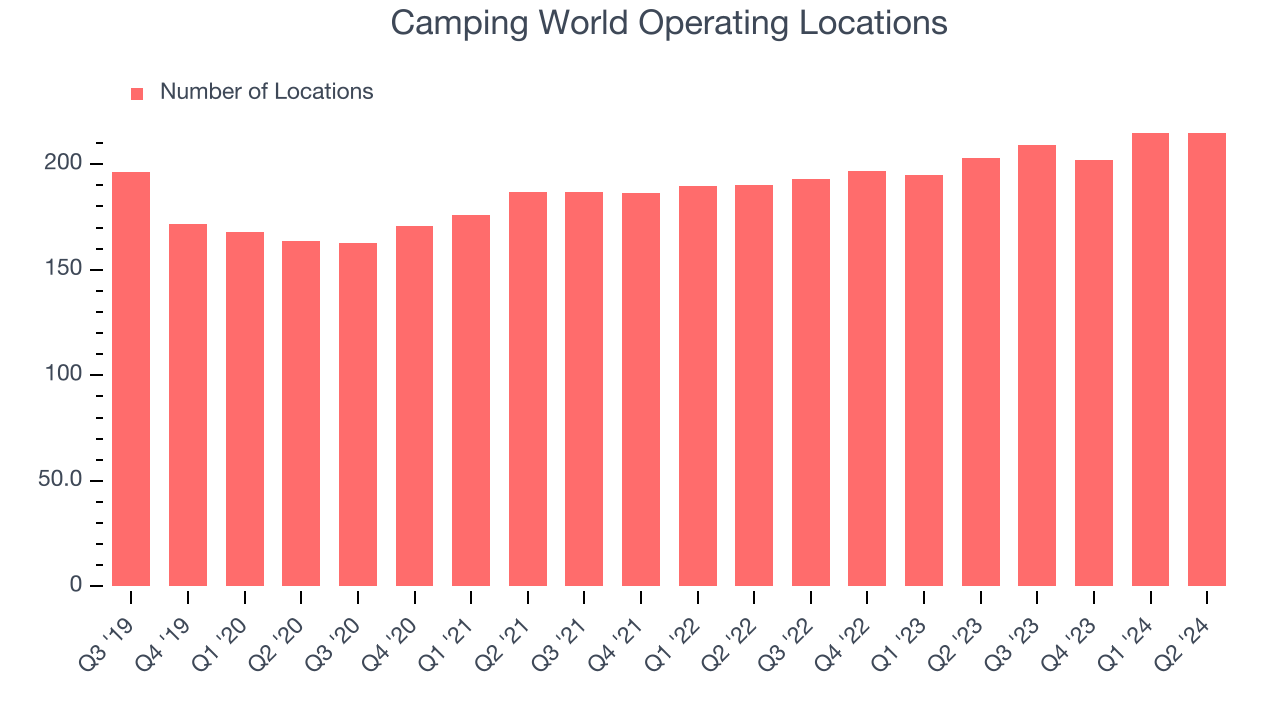

Over the last two years, Camping World opened new stores at a rapid clip and averaged 6% annual growth, among the fastest in the consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Camping World reports its store count intermittently, so some data points are missing in the chart below.

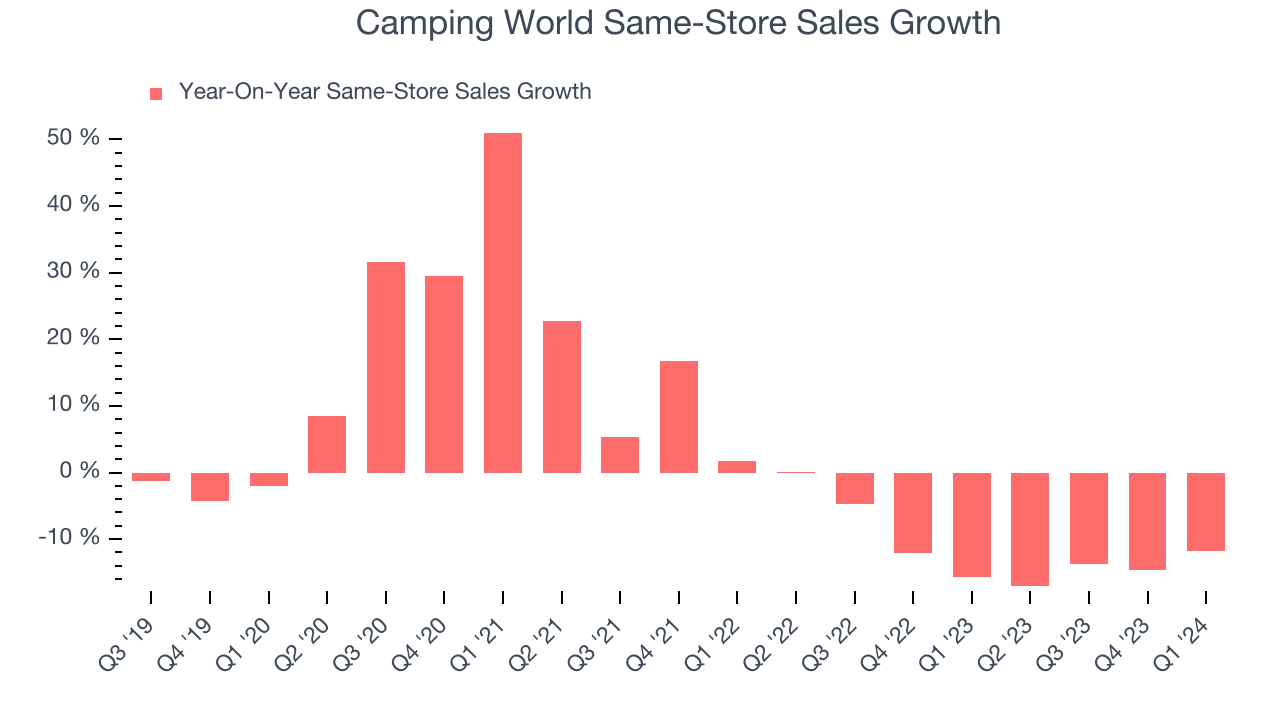

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Camping World’s demand has been shrinking over the last two years as its same-store sales have averaged 14.2% annual declines. This performance is concerning as it shows Camping World artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

Note that Camping World reports its same-store sales intermittently, so some data points are missing in the chart below.

Key Takeaways from Camping World’s Q3 Results

We were impressed by how significantly Camping World blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. On the other hand, its gross margin missed analysts’ expectations. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 7.2% to $22.95 immediately after reporting.

Indeed, Camping World had a rock-solid quarterly earnings result, but is this stock a good investment here?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.