Waste management services provider Waste Management (NYSE:WM) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 7.9% year on year to $5.61 billion. Its non-GAAP profit of $1.96 per share was also 4% above analysts’ consensus estimates.

Is now the time to buy Waste Management? Find out by accessing our full research report, it’s free.

Waste Management (WM) Q3 CY2024 Highlights:

- Revenue: $5.61 billion vs analyst estimates of $5.51 billion (1.7% beat)

- Adjusted EPS: $1.96 vs analyst estimates of $1.88 (4% beat)

- EBITDA: $1.71 billion vs analyst estimates of $1.68 billion (1.6% beat)

- EBITDA guidance for the full year is $6.5 billion at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 39.4%, in line with the same quarter last year

- Operating Margin: 20%, in line with the same quarter last year

- EBITDA Margin: 30.5%, in line with the same quarter last year

- Free Cash Flow Margin: 13.5%, up from 11.8% in the same quarter last year

- Market Capitalization: $82.99 billion

“The Company’s third quarter results again demonstrated the dedication of our people, the consistency of our business model, and the strength of our operations,” said Jim Fish, WM’s President and Chief Executive Officer.

Company Overview

Headquartered in Houston, Waste Management (NYSE:WM) is a provider of comprehensive waste management services in North America.

Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

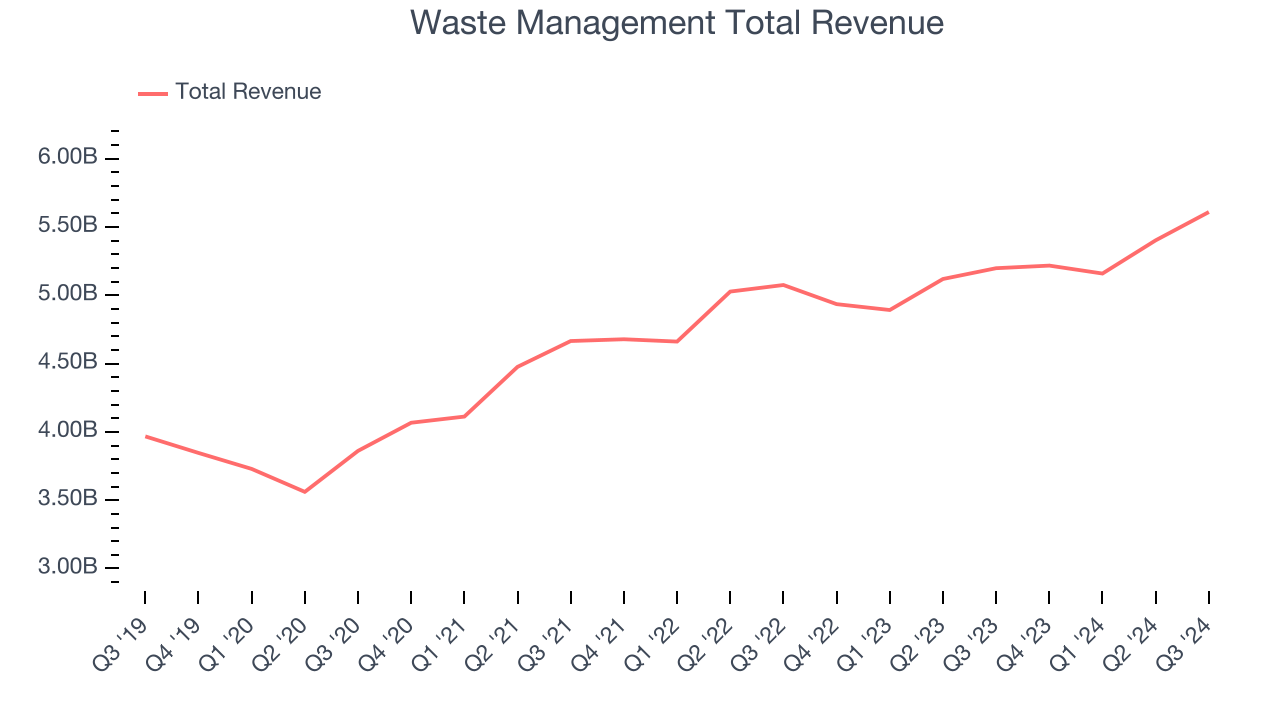

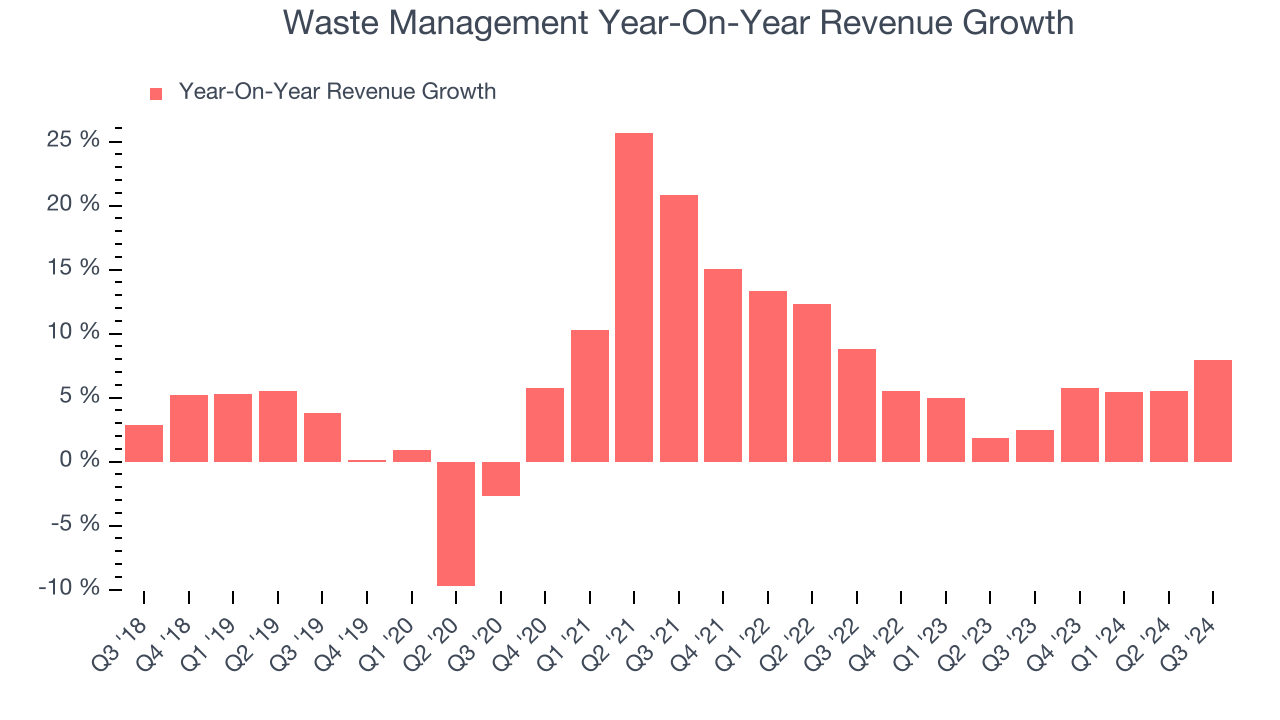

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Waste Management grew its sales at a mediocre 6.7% compounded annual growth rate. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Waste Management’s recent history shows its demand slowed as its annualized revenue growth of 4.9% over the last two years is below its five-year trend.

This quarter, Waste Management reported year-on-year revenue growth of 7.9%, and its $5.61 billion of revenue exceeded Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months. Although this projection indicates the market believes its newer products and services will catalyze better performance, it is still below average for the sector.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Waste Management has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Waste Management’s annual operating margin rose by 2.1 percentage points over the last five years, showing its efficiency has improved.

In Q3, Waste Management generated an operating profit margin of 20%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

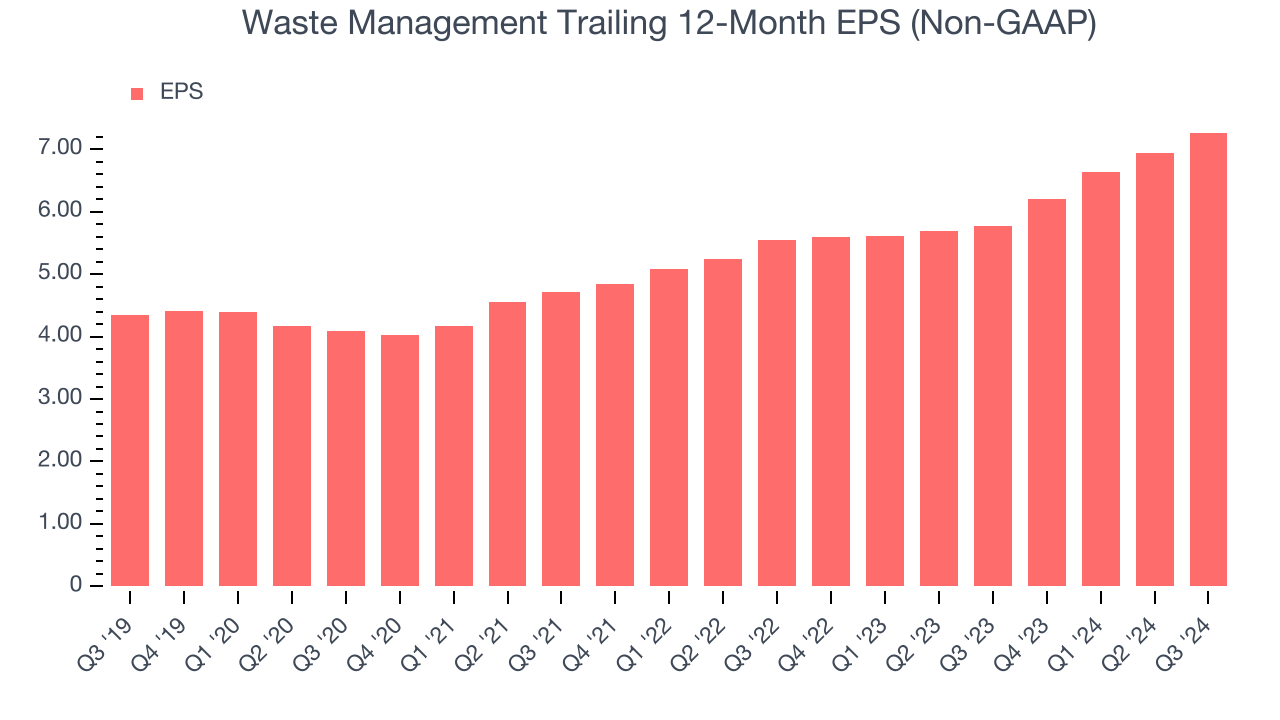

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Waste Management’s EPS grew at a solid 10.8% compounded annual growth rate over the last five years, higher than its 6.7% annualized revenue growth. This tells us the company became more profitable as it expanded.

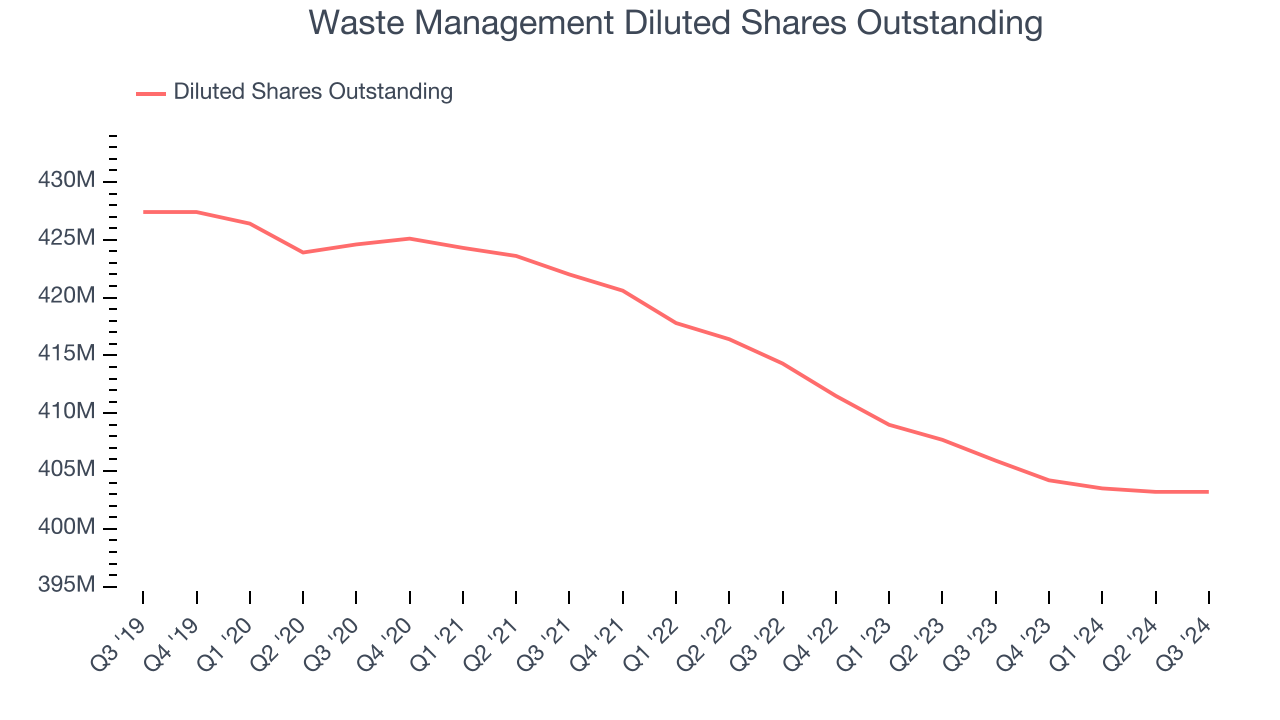

Diving into Waste Management’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Waste Management’s operating margin was flat this quarter but expanded by 2.1 percentage points over the last five years. On top of that, its share count shrank by 5.7%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Waste Management, its two-year annual EPS growth of 14.5% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, Waste Management reported EPS at $1.96, up from $1.64 in the same quarter last year. This print beat analysts’ estimates by 4%. Over the next 12 months, Wall Street expects Waste Management’s full-year EPS of $7.26 to grow by 5.9%.

Key Takeaways from Waste Management’s Q3 Results

It was good to see Waste Management beat analysts’ revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 2% to $212.50 immediately following the results.

Waste Management put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment.We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.