Funeral services company Carriage Services (NYSE:CSV) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 11.3% year on year to $100.7 million. The company expects the full year’s revenue to be around $400 million, close to analysts’ estimates. Its GAAP profit of $0.63 per share was also 38.5% above analysts’ consensus estimates.

Is now the time to buy Carriage Services? Find out by accessing our full research report, it’s free.

Carriage Services (CSV) Q3 CY2024 Highlights:

- Revenue: $100.7 million vs analyst estimates of $93.18 million (8.1% beat)

- EPS: $0.63 vs analyst estimates of $0.46 ($0.17 beat)

- EBITDA: $30.7 million vs analyst estimates of $24.99 million (22.9% beat)

- The company lifted its revenue guidance for the full year to $400 million at the midpoint from $395 million, a 1.3% increase

- EBITDA guidance for the full year is $122.5 million at the midpoint, above analyst estimates of $119.2 million

- Gross Margin (GAAP): 35.2%, in line with the same quarter last year

- Operating Margin: 22.7%, up from 17.8% in the same quarter last year

- EBITDA Margin: 30.5%, up from 26.9% in the same quarter last year

- Free Cash Flow Margin: 19.9%, down from 23.6% in the same quarter last year

- Market Capitalization: $495.6 million

Carlos Quezada, Vice Chairman and CEO, stated, “I am pleased to announce that our growth continues with another strong quarter of performance. Our cemetery sales team achieved a notable increase of 27.1% year-over-year in preneed sales, affirming the continued effectiveness of our cemetery sales growth strategy. Together with an increase of 3.1% in our funeral average revenue per contract, these factors significantly propelled our total revenue, which grew by 11.3% over the same period last year. This marks the third straight quarter of exceeding $100 million of revenue, a first for Carriage.

Company Overview

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

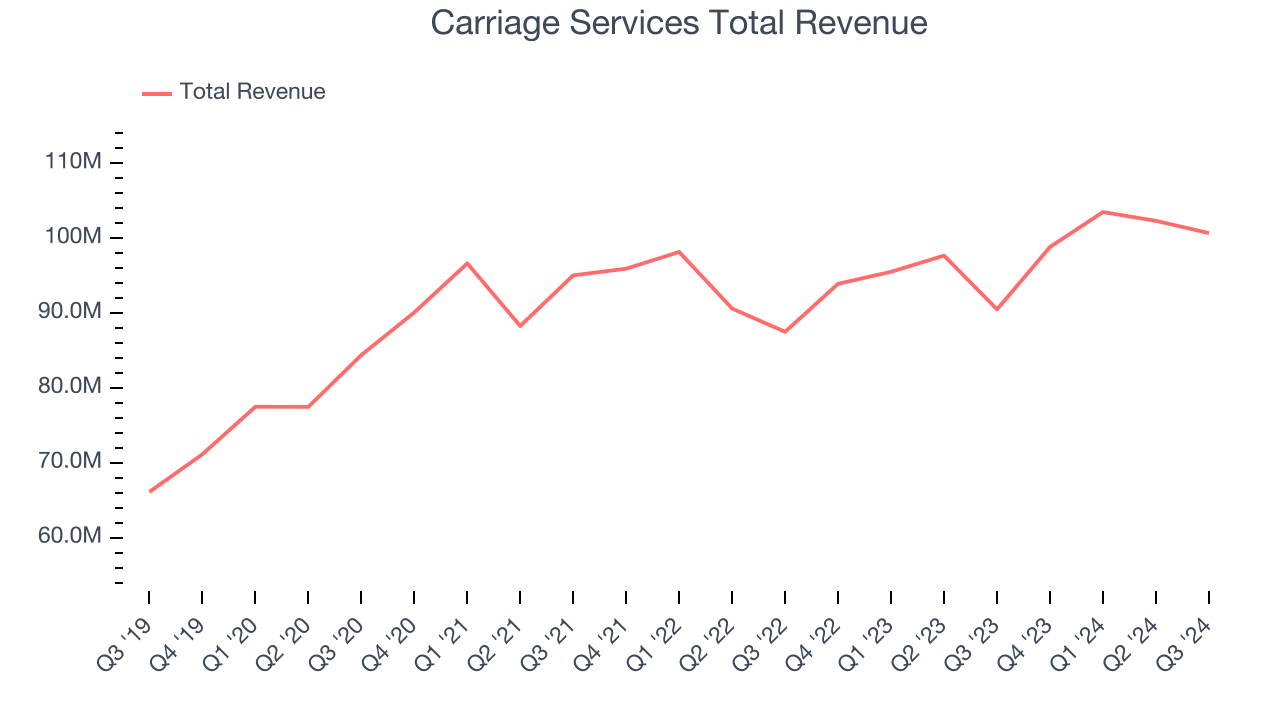

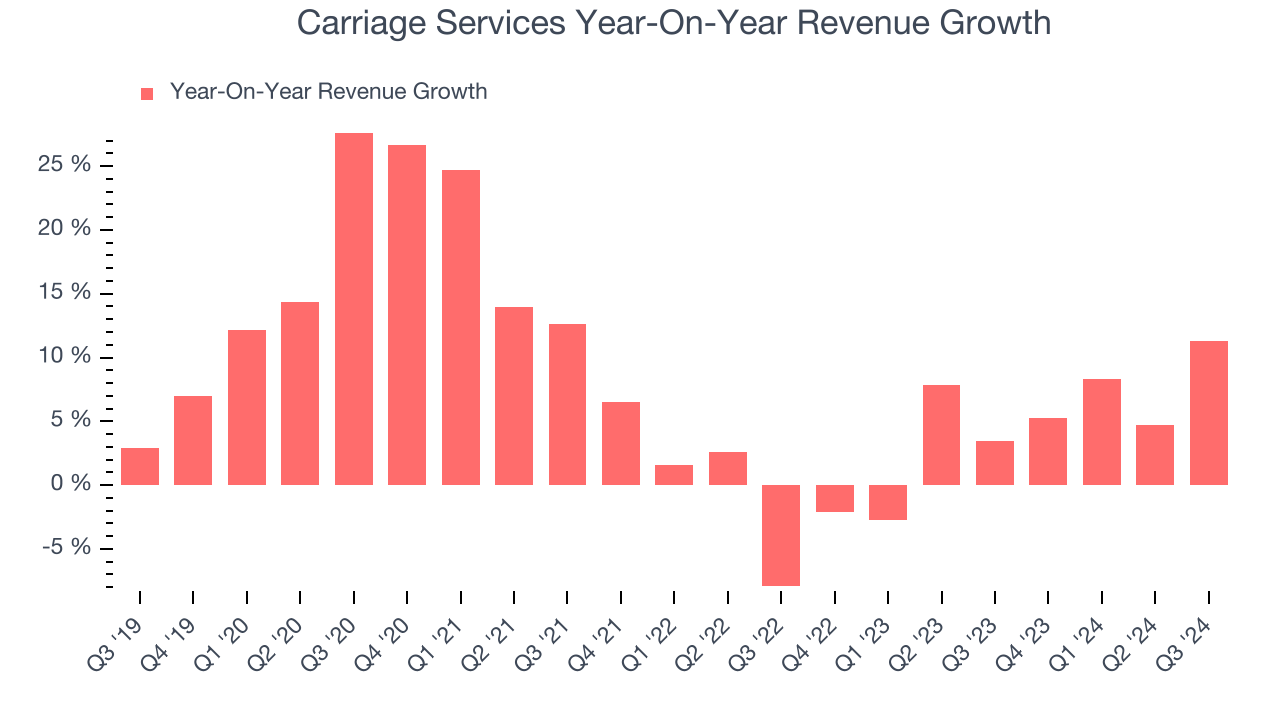

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Unfortunately, Carriage Services’s 8.5% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Carriage Services’s recent history shows its demand slowed as its annualized revenue growth of 4.4% over the last two years is below its five-year trend.

This quarter, Carriage Services reported year-on-year revenue growth of 11.3%, and its $100.7 million of revenue exceeded Wall Street’s estimates by 8.1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates the market thinks its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

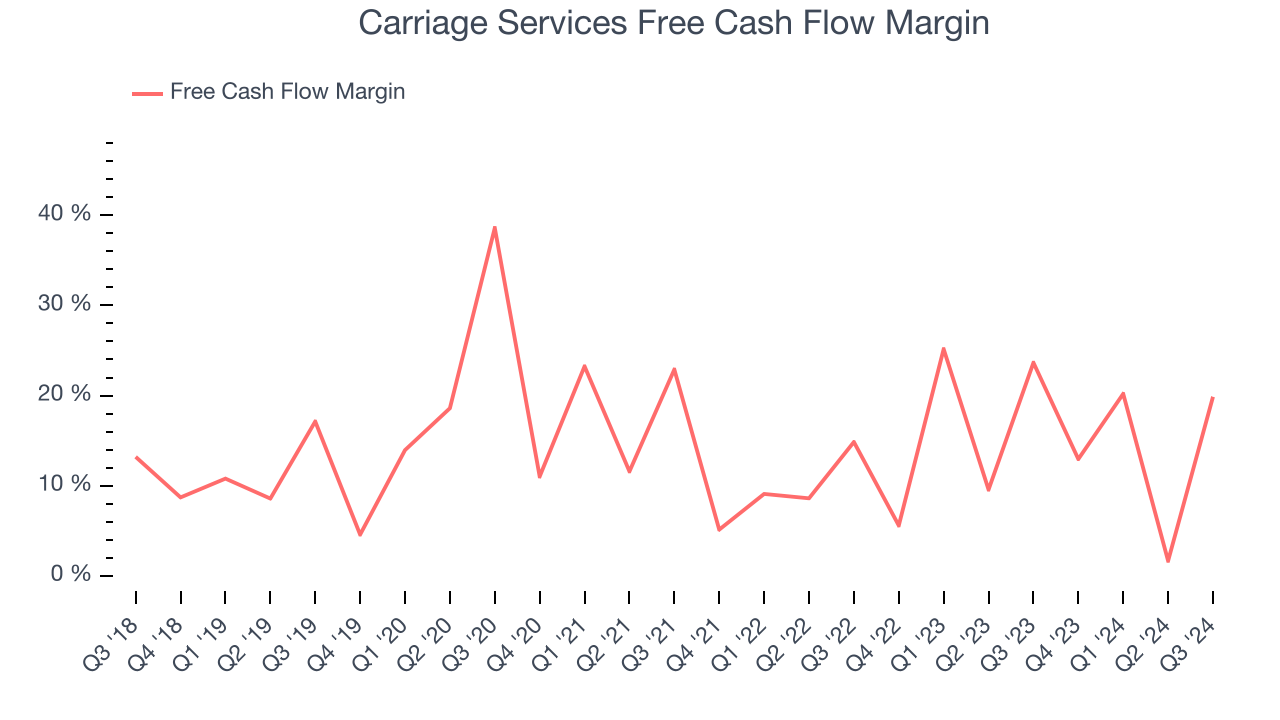

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Carriage Services has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 14.7% over the last two years, better than the broader consumer discretionary sector.

Carriage Services’s free cash flow clocked in at $20 million in Q3, equivalent to a 19.9% margin. The company’s cash profitability regressed as it was 3.8 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Key Takeaways from Carriage Services’s Q3 Results

We were impressed by how significantly Carriage Services blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 3.8% to $33.90 immediately following the results.

Carriage Services had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.