Renewable energy and infrastructure solutions provider Gibraltar Industries (NASDAQ:ROCK) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 7.6% year on year to $361.2 million. The company’s outlook for the full year was also close to analysts’ estimates with revenue guided to $1.32 billion at the midpoint. Its GAAP profit of $1.11 per share was 4.6% below analysts’ consensus estimates.

Is now the time to buy Gibraltar? Find out by accessing our full research report, it’s free.

Gibraltar (ROCK) Q3 CY2024 Highlights:

- Revenue: $361.2 million vs analyst estimates of $360.4 million (in line)

- EPS: $1.11 vs analyst expectations of $1.16 (4.6% miss)

- EBITDA: $58.93 million vs analyst estimates of $58.97 million (small miss)

- The company dropped its revenue guidance for the full year to $1.32 billion at the midpoint from $1.4 billion, a 5.7% decrease

- Gross Margin (GAAP): 25.9%, down from 28.1% in the same quarter last year

- Operating Margin: 12.2%, down from 14.9% in the same quarter last year

- EBITDA Margin: 16.3%, in line with the same quarter last year

- Free Cash Flow Margin: 16.4%, down from 23% in the same quarter last year

- Market Capitalization: $1.98 billion

“Third quarter results were within our previously announced range, with the Renewables and Residential businesses coming in as we anticipated, Agtech sales growing over 30%, and three of our four segments delivering margin growth translating to $65 million in cash flow generation on solid execution and working capital management. We are managing well in a challenging sales environment and are well positioned to weather current market disruptions,” stated Chairman and CEO Bill Bosway.

Company Overview

Gibraltar (NASDAQ:ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

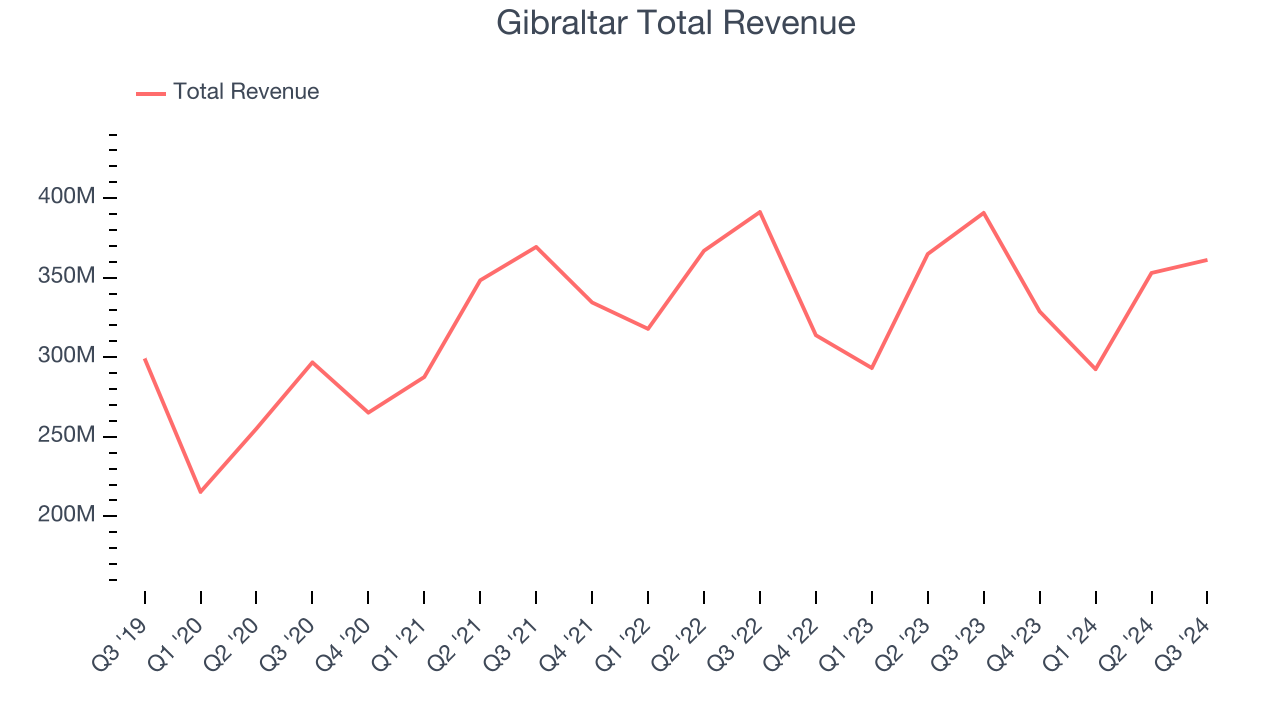

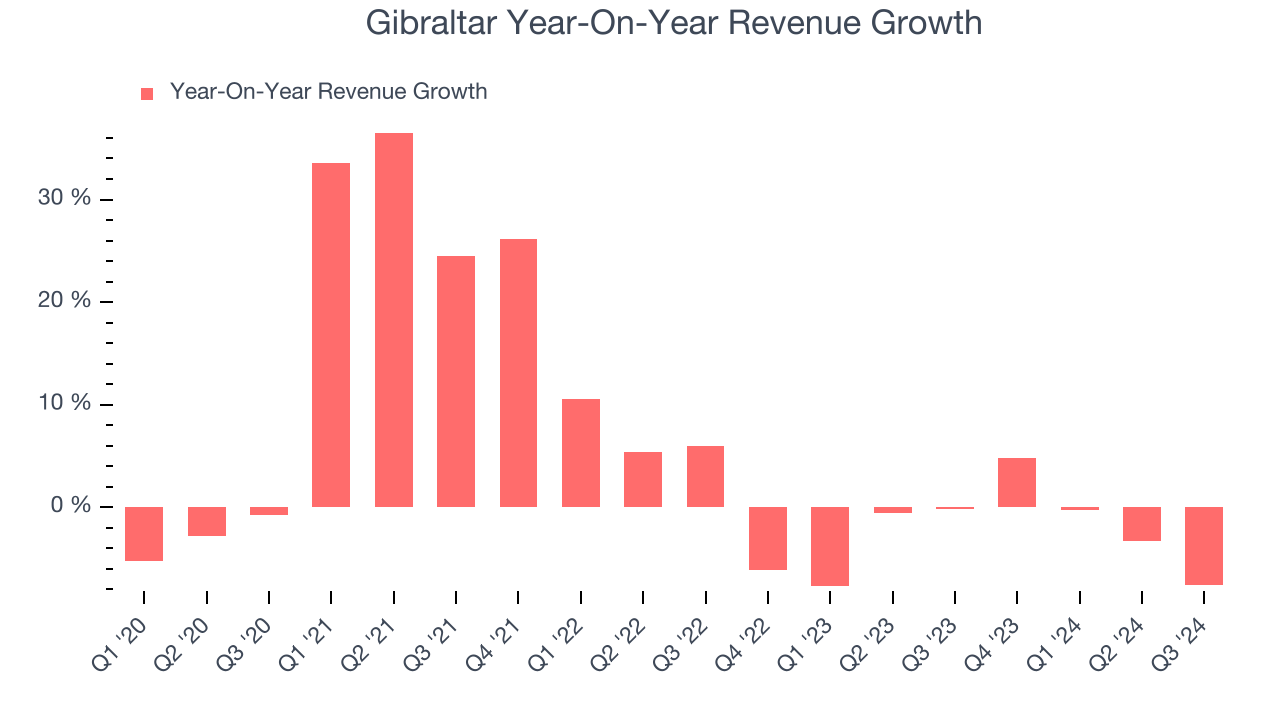

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Regrettably, Gibraltar’s sales grew at a tepid 5.3% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Gibraltar’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.7% annually.

This quarter, Gibraltar reported a rather uninspiring 7.6% year-on-year revenue decline to $361.2 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months. Although this projection indicates the market believes its newer products and services will fuel better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

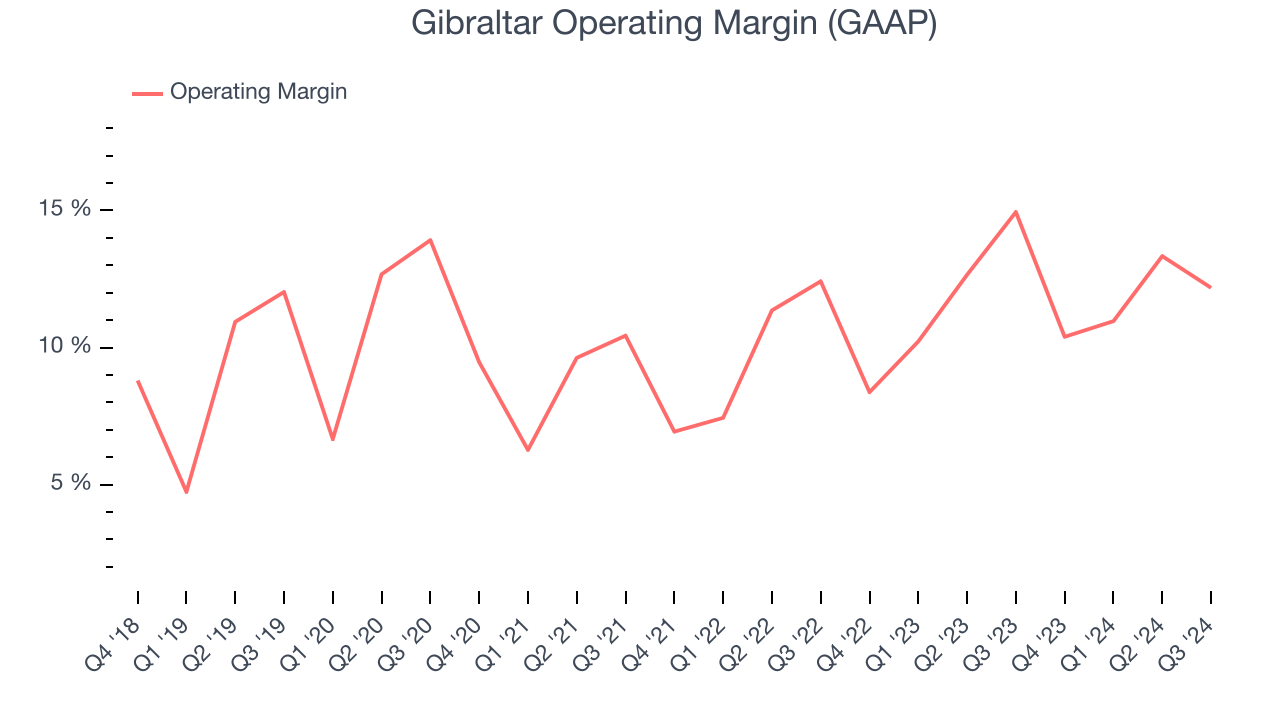

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Gibraltar has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Gibraltar’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, Gibraltar generated an operating profit margin of 12.2%, down 2.8 percentage points year on year. Since Gibraltar’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

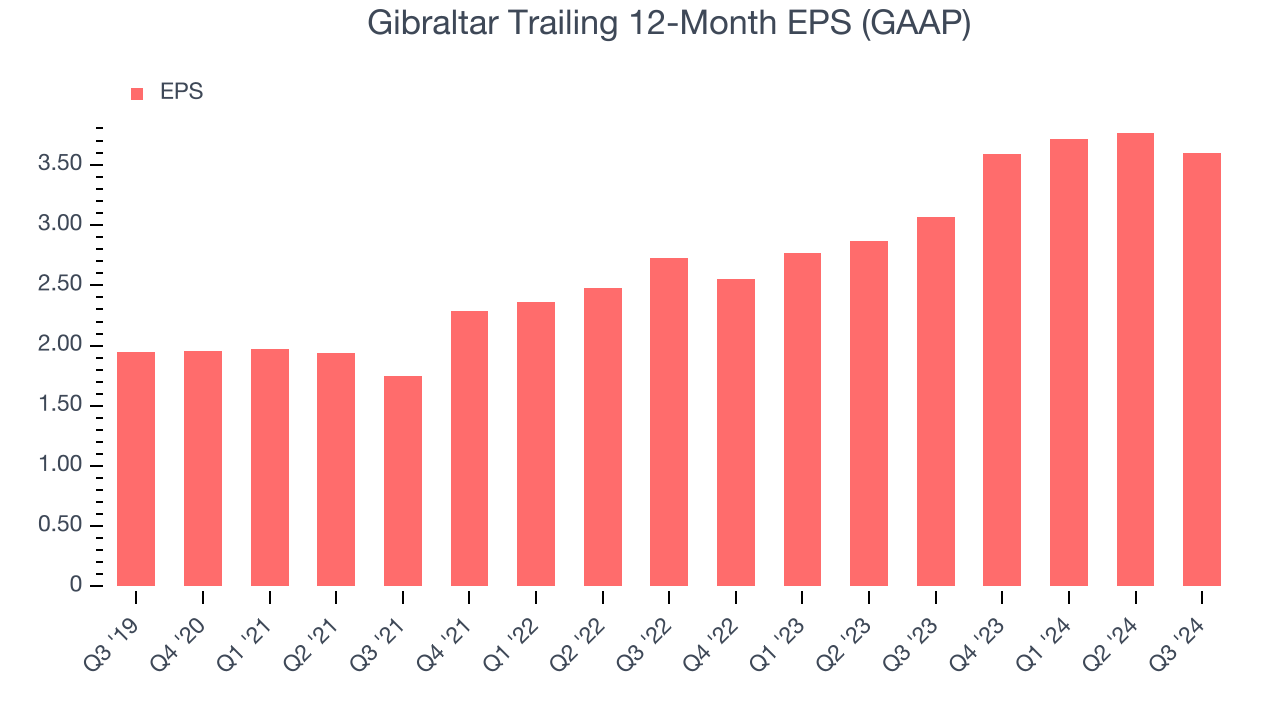

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Gibraltar’s EPS grew at a remarkable 13% compounded annual growth rate over the last five years, higher than its 5.3% annualized revenue growth. However, this alone doesn’t tell us much about its day-to-day operations because its operating margin didn’t expand.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business. For Gibraltar, its two-year annual EPS growth of 14.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Gibraltar reported EPS at $1.11, down from $1.28 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Gibraltar’s full-year EPS of $3.60 to grow by 25.5%.

Key Takeaways from Gibraltar’s Q3 Results

We struggled to find many strong positives in these results as its EPS missed expectations and it lowered its full-year revenue guidance. Overall, this quarter could have been better. The stock traded down 2.4% to $63.51 immediately after reporting.

Gibraltar’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.