Hospitality and casino entertainment company MGM Resorts (NYSE:MGM) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 5.3% year on year to $4.18 billion. Its non-GAAP profit of $0.54 per share was 11% below analysts’ consensus estimates.

Is now the time to buy MGM Resorts? Find out by accessing our full research report, it’s free.

MGM Resorts (MGM) Q3 CY2024 Highlights:

- Revenue: $4.18 billion vs analyst estimates of $4.21 billion (in line)

- Adjusted EPS: $0.54 vs analyst expectations of $0.61 (11% miss)

- EBITDA: $548.2 million vs analyst estimates of $1.16 billion (52.6% miss)

- Gross Margin (GAAP): 44.9%, down from 47.5% in the same quarter last year

- Operating Margin: 7.5%, down from 9.3% in the same quarter last year

- EBITDA Margin: 13.1%, down from 14.6% in the same quarter last year

- Market Capitalization: $12.76 billion

Company Overview

Operating several properties on the Las Vegas Strip, MGM Resorts (NYSE:MGM) is a global hospitality and entertainment company known for its resorts and casinos.

Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Sales Growth

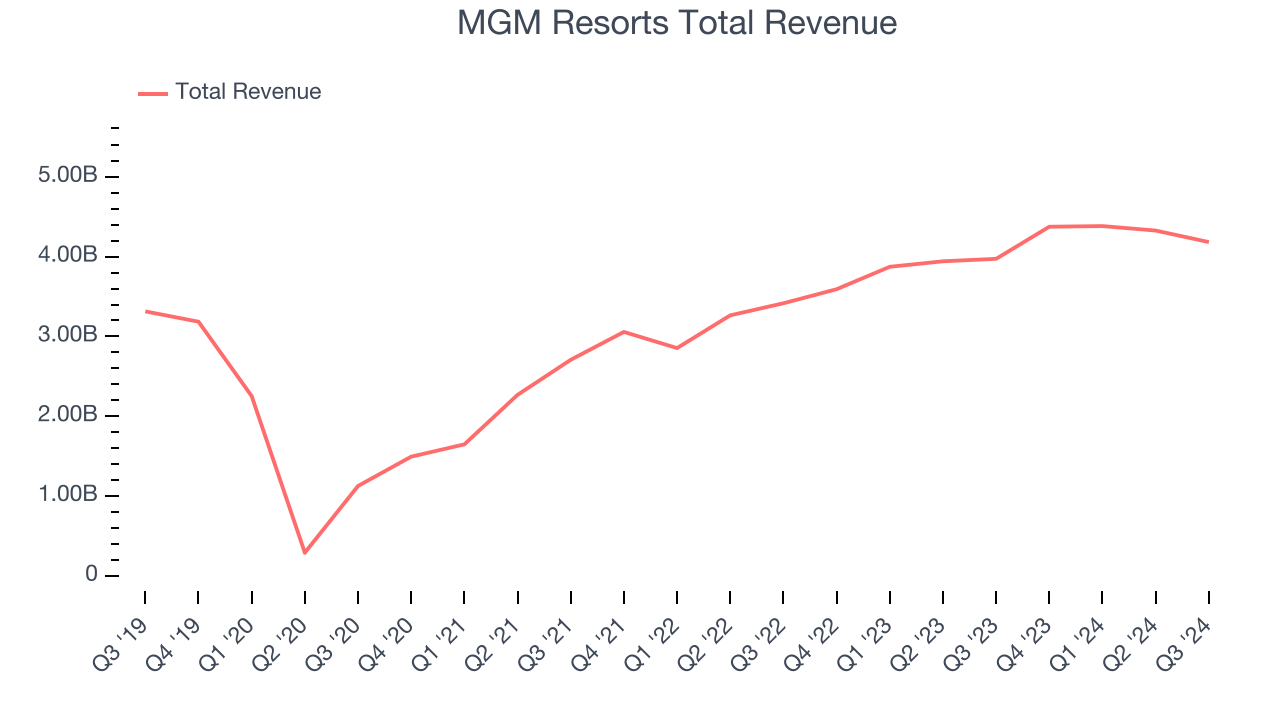

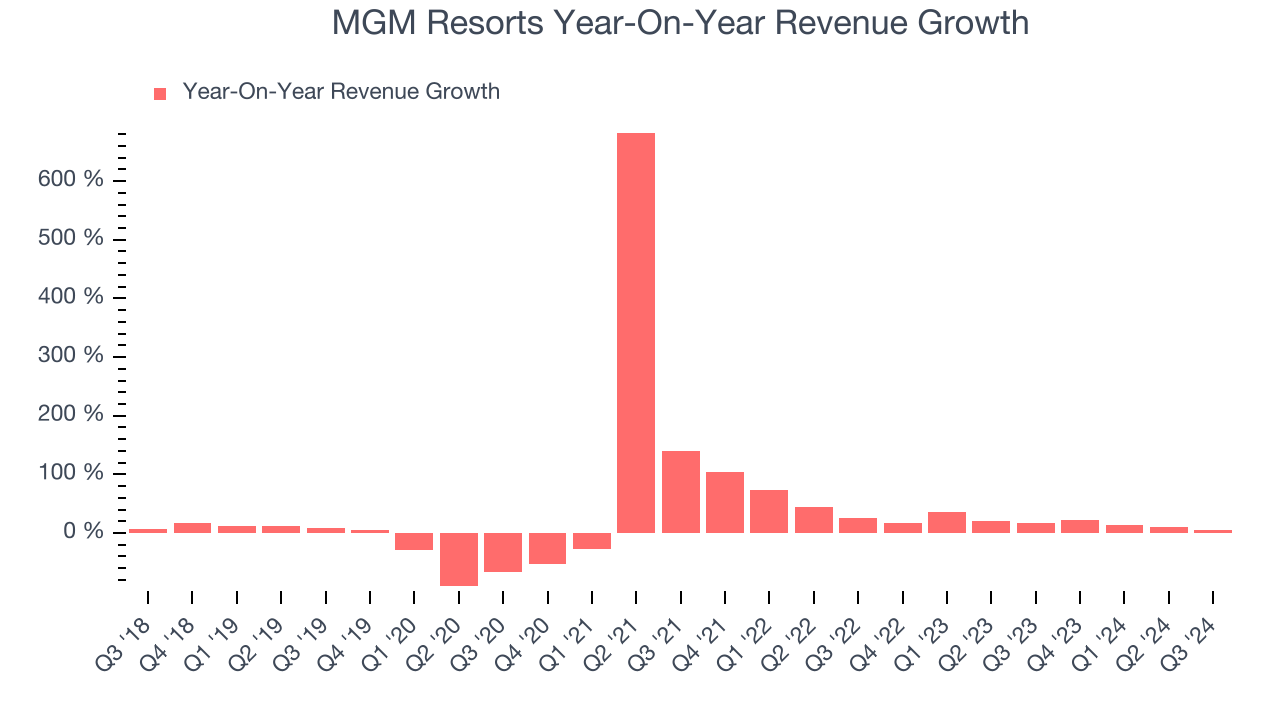

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, MGM Resorts’s 6.2% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. MGM Resorts’s annualized revenue growth of 17.1% over the last two years is above its five-year trend, suggesting some bright spots. Note that COVID hurt MGM Resorts’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Casino. Over the last two years, MGM Resorts’s Casino revenue (Poker, sports betting) averaged 25.2% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, MGM Resorts grew its revenue by 5.3% year on year, and its $4.18 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market believes its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

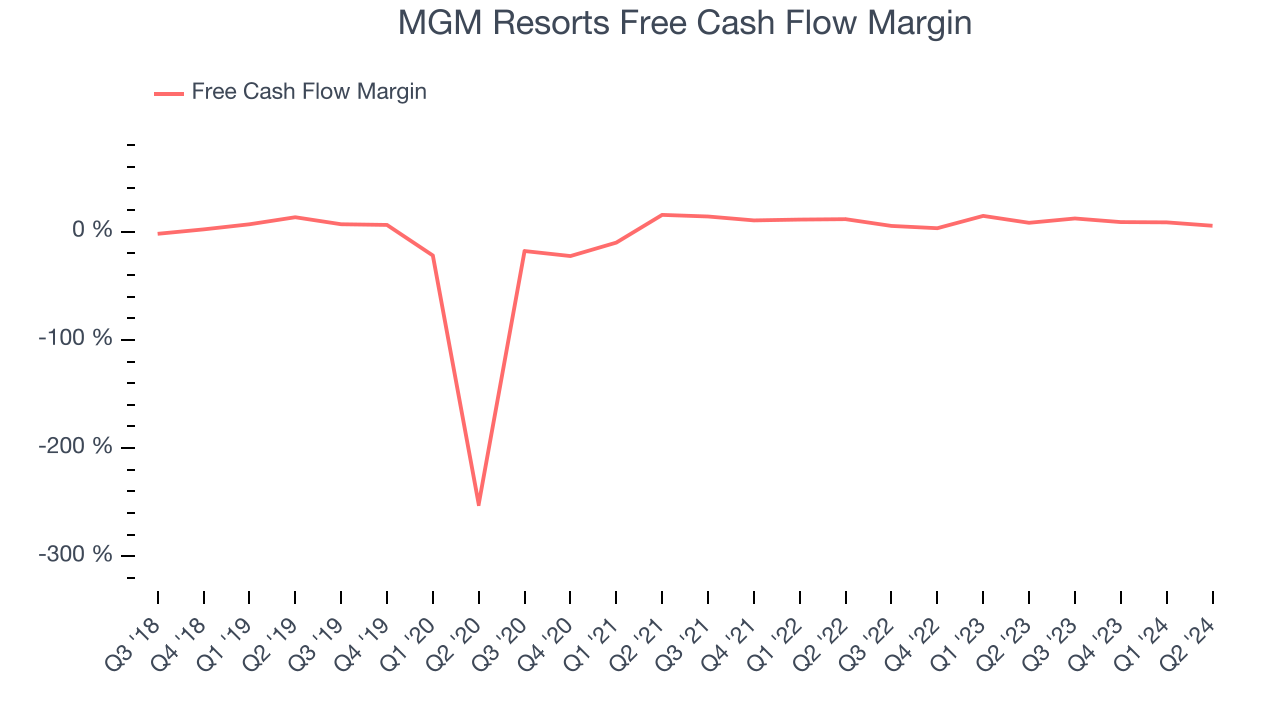

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

MGM Resorts has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.7%, subpar for a consumer discretionary business.

Key Takeaways from MGM Resorts’s Q3 Results

We struggled to find many strong positives in these results. Its Casino revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.9% to $38.97 immediately following the results.

MGM Resorts didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.