Coffeehouse chain Starbucks (NASDAQ:SBUX) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 3.2% year on year to $9.07 billion. Its non-GAAP profit of $0.80 per share was 10.6% below analysts’ consensus estimates.

Is now the time to buy Starbucks? Find out by accessing our full research report, it’s free.

Starbucks (SBUX) Q3 CY2024 Highlights:

- Revenue: $9.07 billion vs analyst estimates of $9.14 billion (in line)

- Adjusted EPS: $0.80 vs analyst expectations of $0.89 (10.6% miss)

- EBITDA: $1.70 billion vs analyst estimates of $1.87 billion (9.1% miss)

- Gross Margin (GAAP): 26.3%, down from 29.3% in the same quarter last year

- Operating Margin: 14.4%, down from 18.2% in the same quarter last year

- EBITDA Margin: 18.8%, down from 22% in the same quarter last year

- Locations: 40,199 at quarter end, up from 38,038 in the same quarter last year

- Same-Store Sales rose 7% year on year (miss vs expectations of down 5% year on year)

- Market Capitalization: $110.4 billion

“It is clear we need to fundamentally change our strategy to win back customers. ‘Back to Starbucks’ is that fundamental change,” commented Brian Niccol, chairman and chief executive officer.

Company Overview

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ:SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Starbucks is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. However, its scale is a double-edged sword because there are only a finite number places to build new restaurants, making it harder to find incremental growth.

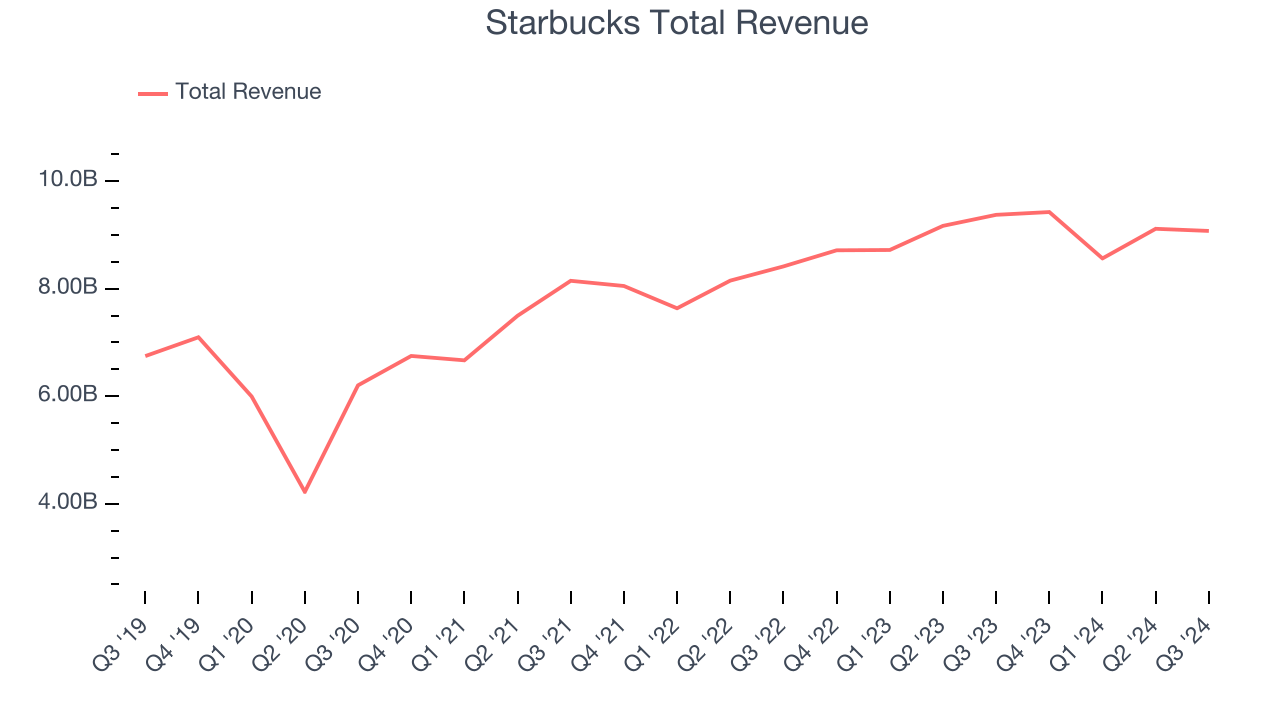

As you can see below, Starbucks’s 6.4% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre, but to its credit, it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Starbucks reported a rather uninspiring 3.2% year-on-year revenue decline to $9.07 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, similar to its five-year rate. This projection doesn't excite us and illustrates the market believes its newer offerings will not lead to better top-line performance yet. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

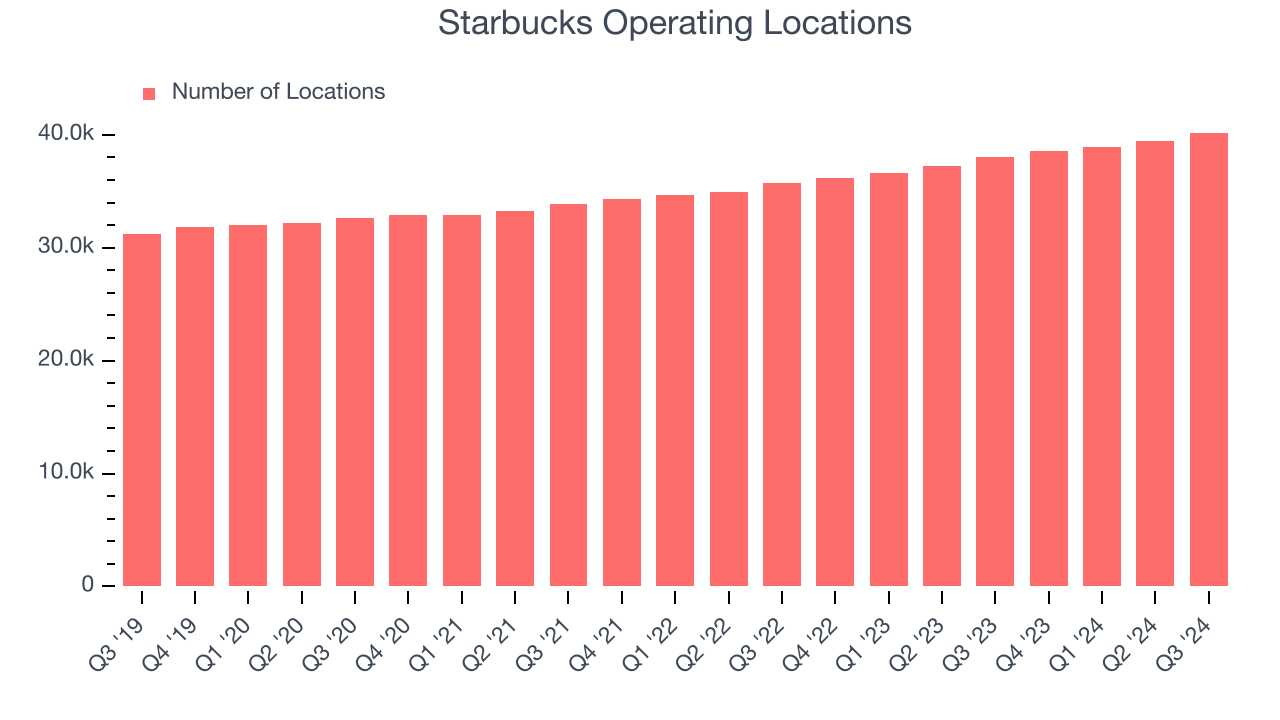

Starbucks operated 40,199 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years and averaged 6.1% annual growth, much faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth for restaurants open for at least a year.

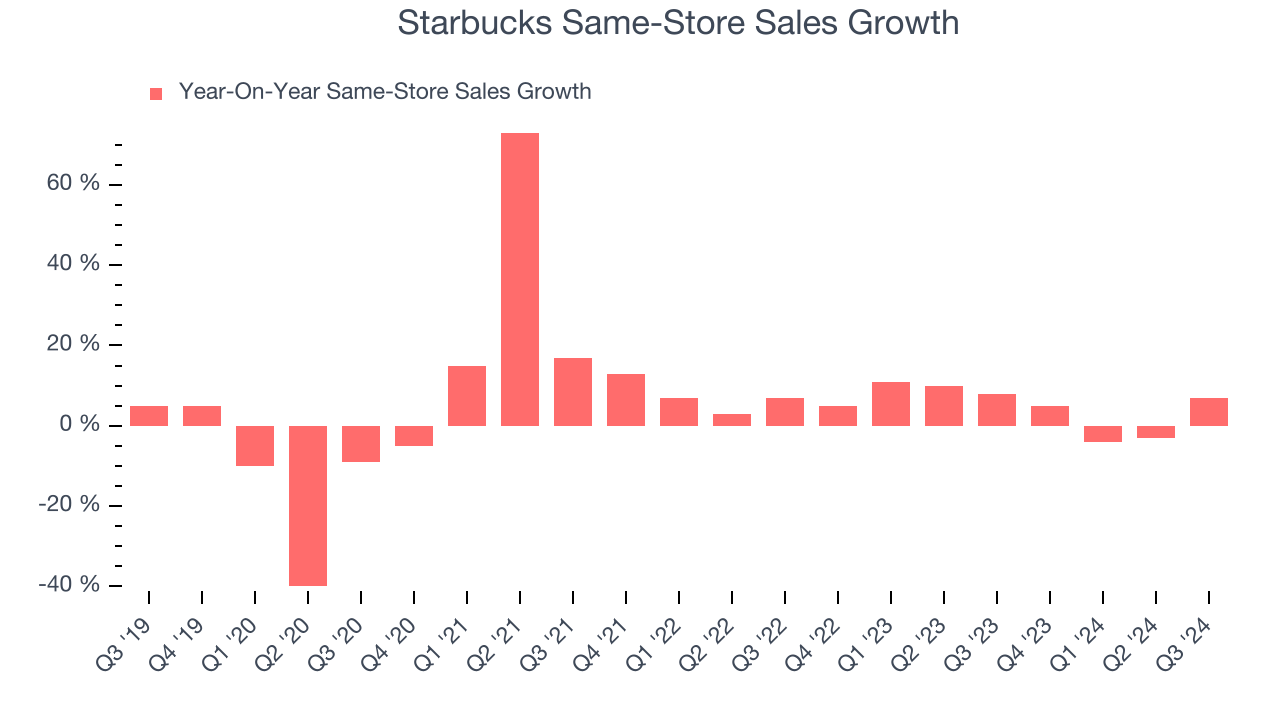

Starbucks has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 4.9%. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop because it gives Starbucks multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Starbucks’s same-store sales rose 7% annually. This performance was more or less in line with the same quarter last year.

Key Takeaways from Starbucks’s Q3 Results

We struggled to find many strong positives in these results. Its EBITDA missed and its EPS missed Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $97.30 immediately after reporting.

Starbucks didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.