Although Uber’s stock ($71.90 per share) has gained 8.9% over the last six months, it has trailed the S&P 500’s 14.8% return during that time. This might have investors contemplating their next move.

Given the relatively weaker price action, is now a good time to buy UBER’s stock?

Find out in our full research report, it's free.Why Are We Positive On Uber?

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

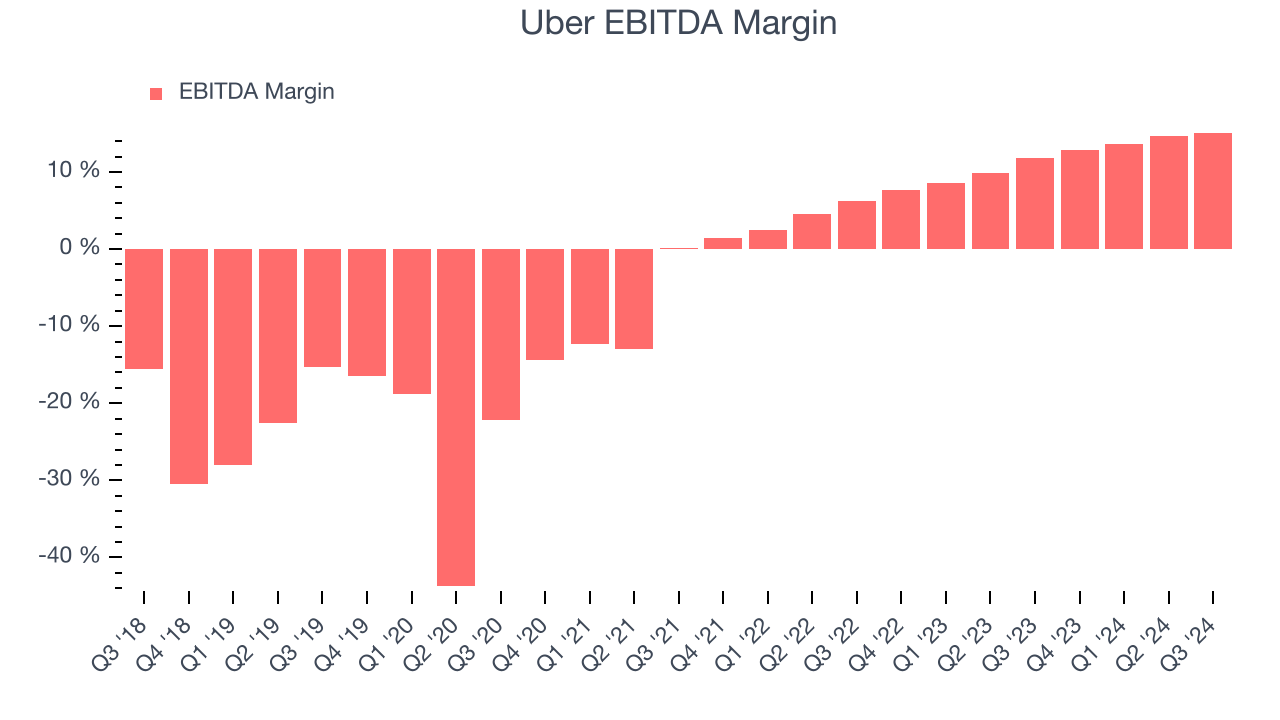

1. EBITDA Margin Rising, Profits Up

EBITDA is the predominant operating profitability metric for consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a more standardized view of the business’s profit potential.

Looking at the trend in its profitability, Uber’s annual EBITDA margin rose by 23 percentage points over the last three years, as its sales growth gave it immense operating leverage. Its EBITDA margin for the trailing 12 months was 14.1%.

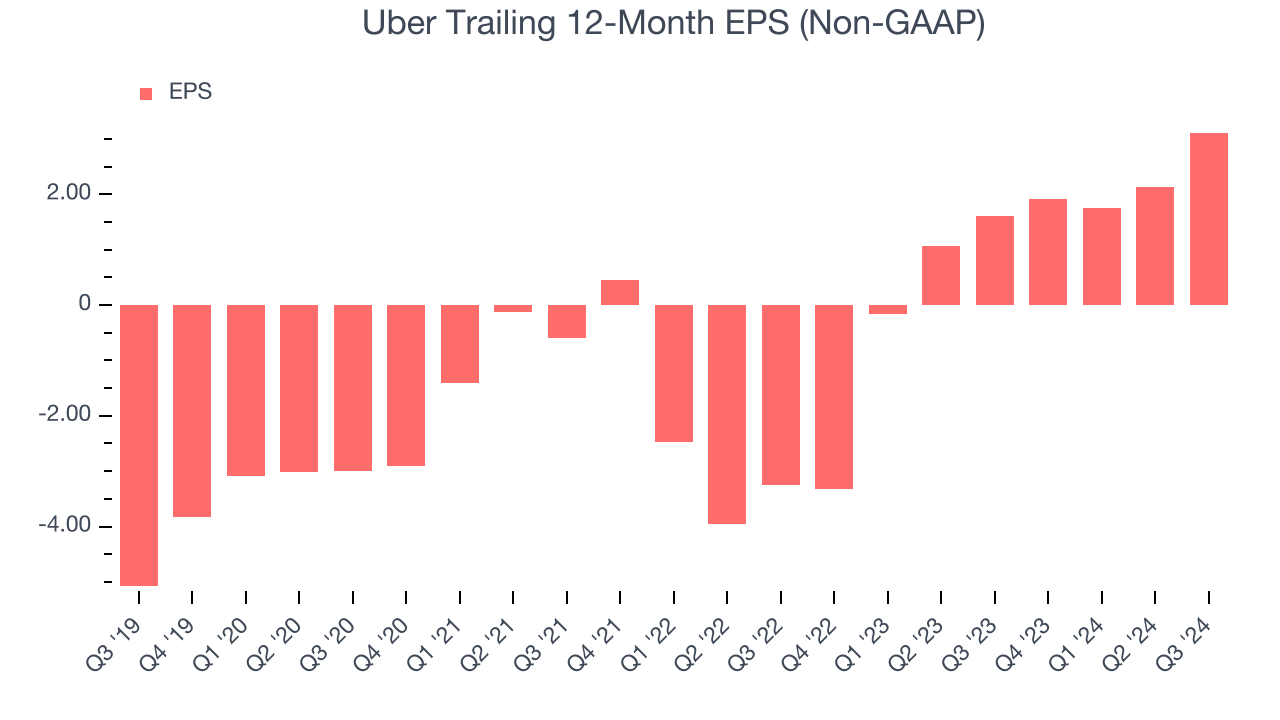

2. Long-Term EPS Growth Is Outstanding

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Uber’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and another data point that shows it’s at an inflection point.

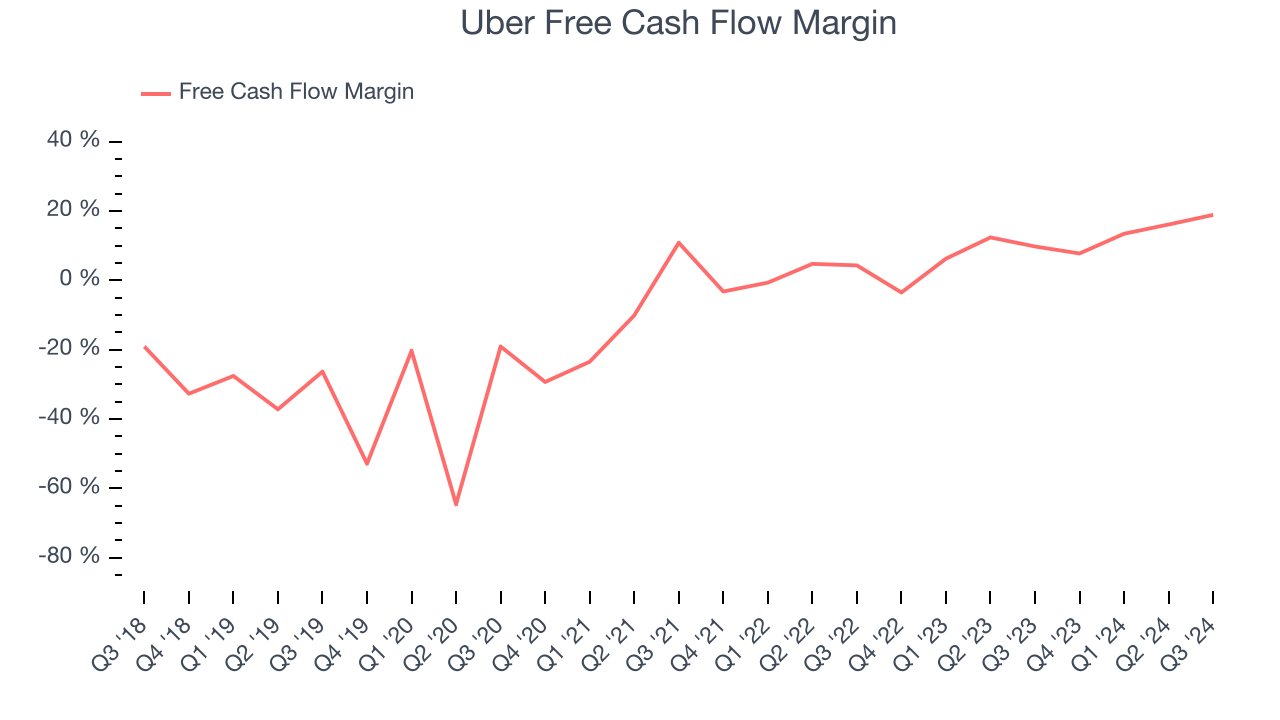

3. Free Cash Flow Margin Increased, Juicing Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Taking a step back, we can see that Uber’s margin expanded by 24.2 percentage points over the last three years. This is encouraging because its free cash flow profitability rose more than its operating profitability, suggesting it’s becoming a less capital-intensive business. Its free cash flow margin for the trailing 12 months was 14.2%.

Final Judgment

These are just a few reasons Uber is a high-quality business worth owning in your portfolio. With its shares underperforming the market lately, the stock trades at 19.2x forward EV-to-EBITDA, or $71.90 per share. Is now a good time to buy?

See our full research report, it's free.Stocks We Would Buy Instead of Uber

Now, with the elections behind us, rates dropping and inflation cooling off, many analysts are expecting a breakout market to the end of the year — and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. These are a curated subset of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% five-year return) as well as under-the-radar businesses like Comfort Systems (+783%) and United Rentals (+550%). Find your next big winner with StockStory today, it’s free.