Beauty and waxing service franchise European Wax Center (NASDAQ:EWCZ) reported Q3 CY2024 results topping the market’s revenue expectations, but sales were flat year on year at $55.43 million. The company expects the full year’s revenue to be around $218.5 million, close to analysts’ estimates. Its GAAP profit of $0.05 per share was in line with analysts’ consensus estimates.

Is now the time to buy European Wax Center? Find out by accessing our full research report, it’s free.

European Wax Center (EWCZ) Q3 CY2024 Highlights:

- Revenue: $55.43 million vs analyst estimates of $54.16 million (2.3% beat)

- Adjusted EPS: $0.05 vs analyst estimates of $0.05 (in line)

- Adjusted EBITDA: $18.41 million vs analyst estimates of $16.74 million (10% beat)

- The company reconfirmed its revenue guidance for the full year of $218.5 million at the midpoint

- EBITDA guidance for the full year is $72 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 72.9%, up from 71.8% in the same quarter last year

- Operating Margin: 17.1%, down from 22.4% in the same quarter last year

- EBITDA Margin: 33.2%, down from 34.6% in the same quarter last year

- Free Cash Flow Margin: 26.6%, down from 31.4% in the same quarter last year

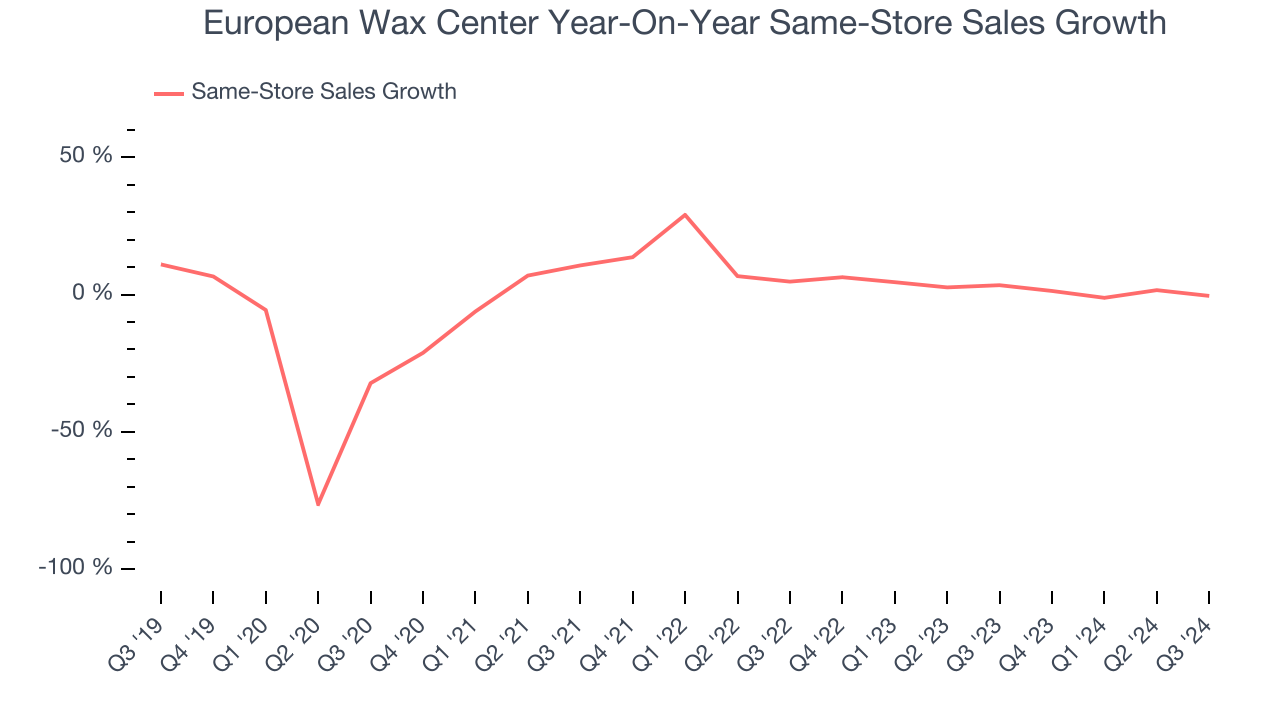

- Same-Store Sales were flat year on year (3.4% in the same quarter last year)

- Market Capitalization: $382.6 million

David Berg, Executive Chairman and CEO of European Wax Center, Inc. stated, “We are pleased that our third quarter results were in line with the revised expectations we provided in August. Over the past three months, I’ve been immersing myself in the business, refining our key focus areas and developing a robust action plan focused on driving new guests and ticket growth. Over time, we believe our efforts will enhance unit economics and financial returns for our franchise partners, enable thoughtful growth for European Wax Center, and deliver long-term value to our stakeholders.”

Company Overview

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Sales Growth

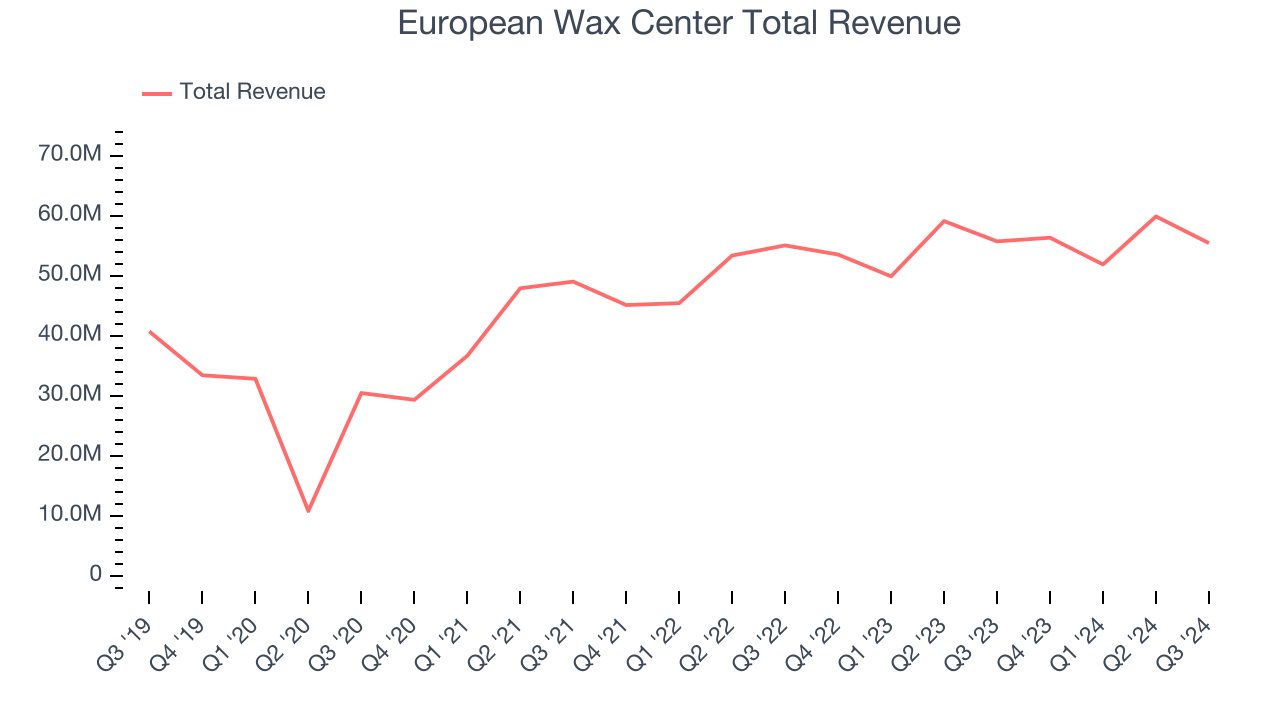

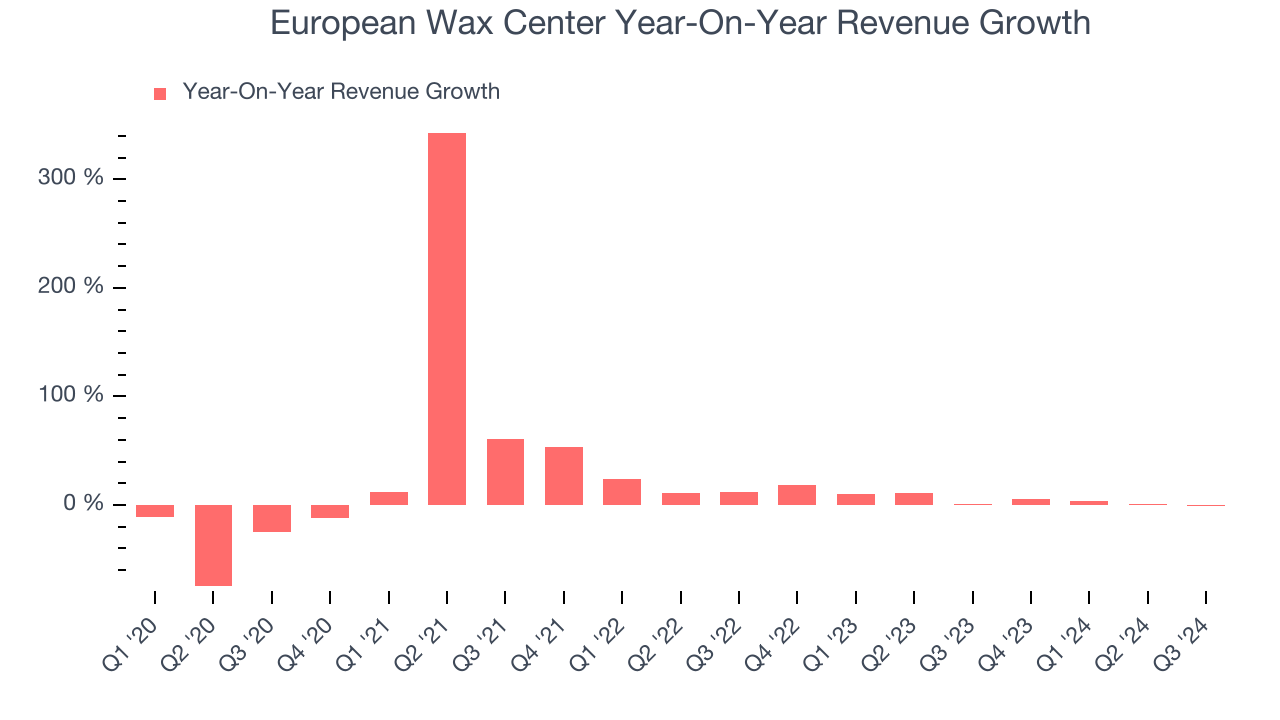

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, European Wax Center’s sales grew at a sluggish 6.7% compounded annual growth rate over the last five years. This shows it couldn’t expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. European Wax Center’s annualized revenue growth of 6% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak. Note that COVID hurt European Wax Center’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, European Wax Center’s same-store sales averaged 2.3% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, European Wax Center’s $55.43 million of revenue was flat year on year but beat Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

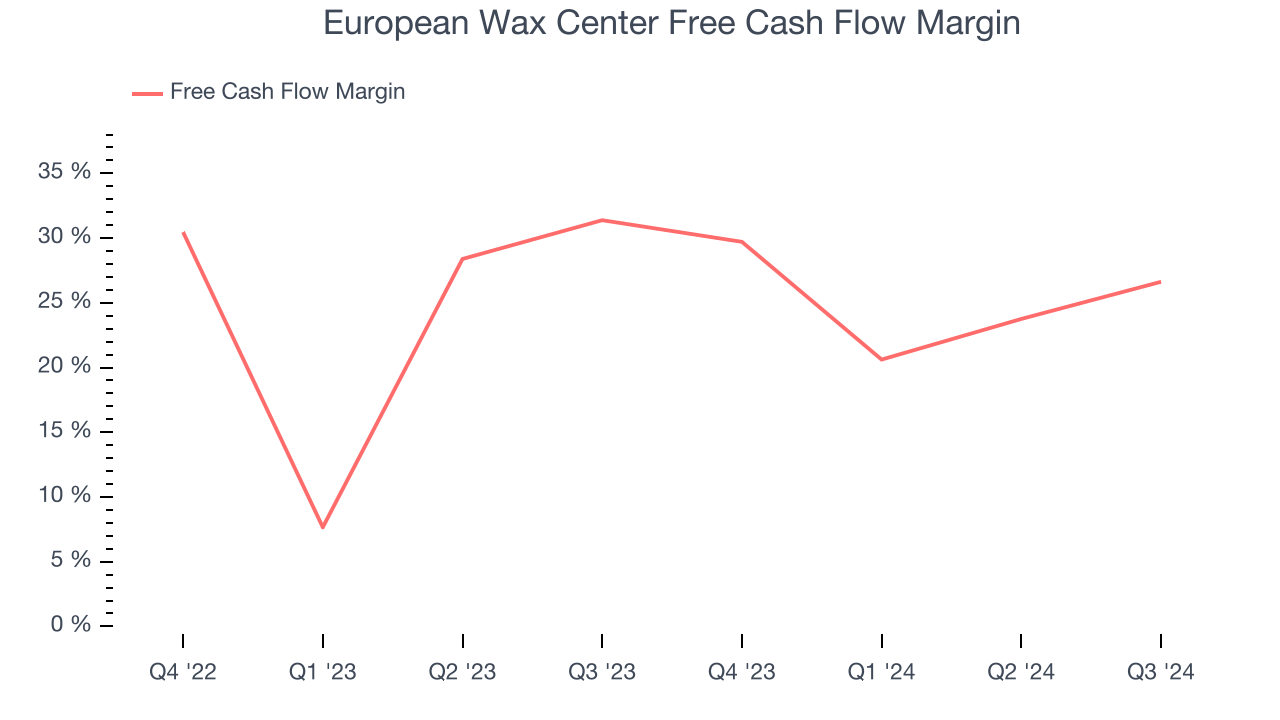

European Wax Center has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer discretionary sector, averaging 25.1% over the last two years.

European Wax Center’s free cash flow clocked in at $14.76 million in Q3, equivalent to a 26.6% margin. The company’s cash profitability regressed as it was 4.8 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Key Takeaways from European Wax Center’s Q3 Results

We were impressed that European Wax Center beat analysts’ revenue and EPS expectations this quarter. It was a solid quarter. The stock remained flat at $7.99 immediately following the results.

Is European Wax Center an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.