Leonardo DRS has had an impressive run over the past six months as its shares have beaten the S&P 500 by 27.4%. The stock now trades at $33.58, marking a 37.9% gain. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Leonardo DRS, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.Despite the momentum, we're cautious about Leonardo DRS. Here are three reasons why there are better opportunities than DRS and one stock we like more.

Why Is Leonardo DRS Not Exciting?

Developing submarine detection systems for the U.S. Navy, Leonardo DRS (NASDAQ:DRS) is a provider of defense systems, electronics, and military support services.

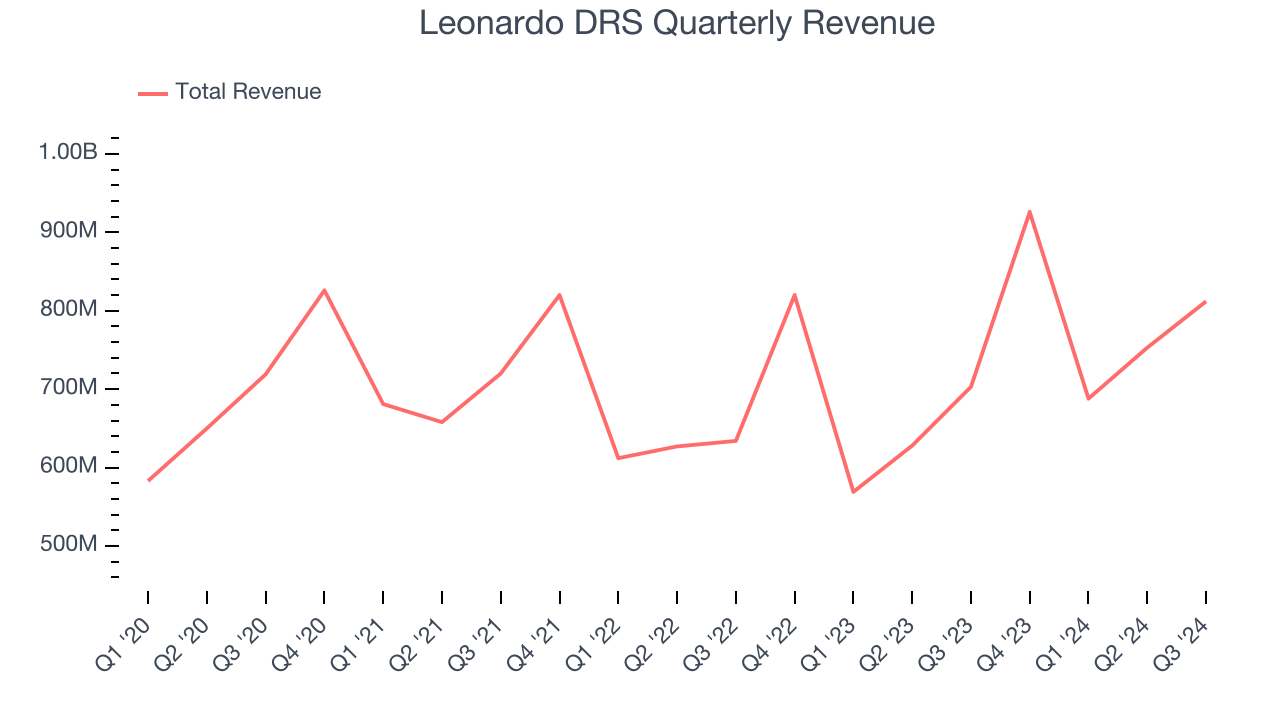

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Unfortunately, Leonardo DRS’s 3.7% annualized revenue growth over the last four years was sluggish. This fell short of our benchmark for the industrials sector.

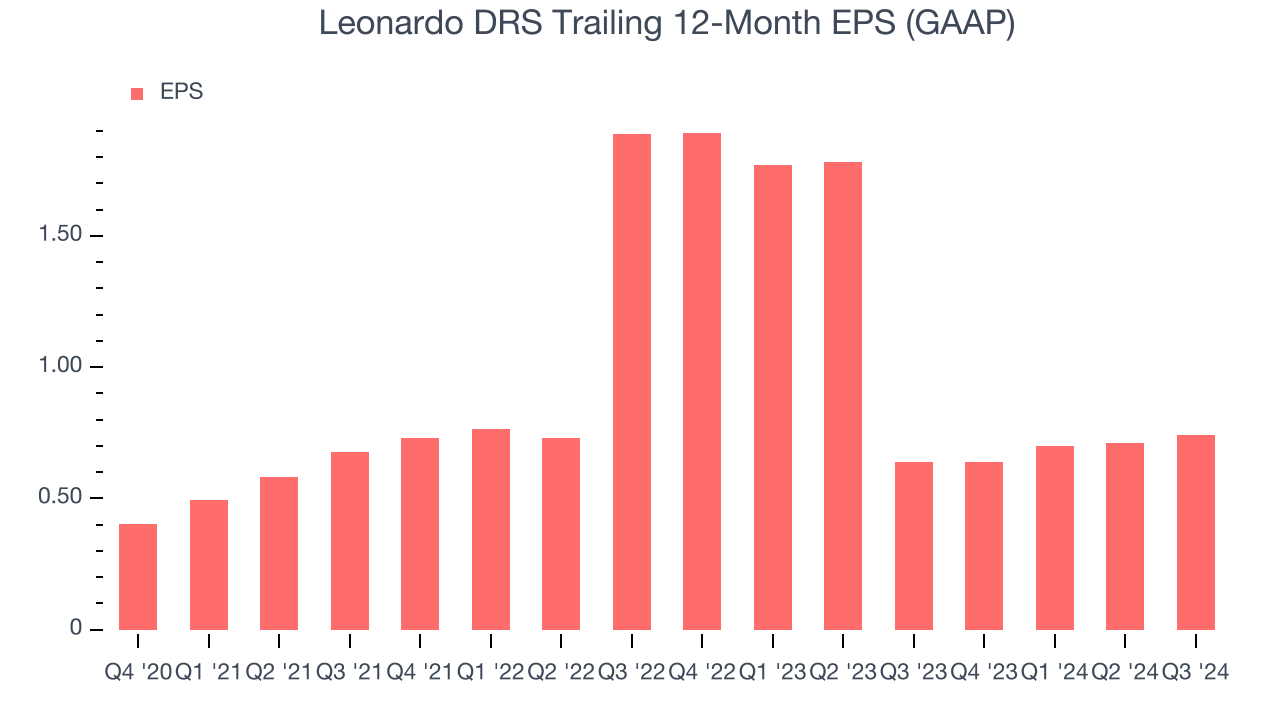

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Leonardo DRS, its EPS declined by 37.4% annually over the last two years while its revenue grew by 8.6%. This tells us the company became less profitable on a per-share basis as it expanded.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, Leonardo DRS’s ROIC has decreased significantly. We like what management has done in the past but are concerned its ROIC is declining, perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Leonardo DRS isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 34x forward price-to-earnings (or $33.58 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. We’d suggest taking a look at Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Leonardo DRS

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.