As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the automobile manufacturers industry, including General Motors (NYSE:GM) and its peers.

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

The 7 automobile manufacturers stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 3.4%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Best Q3: General Motors (NYSE:GM)

Founded in 1908 by William C. Durant, General Motors (NYSE:GM) offers a range of vehicles and automobiles through brands such as Chevrolet, Buick, GMC, and Cadillac.

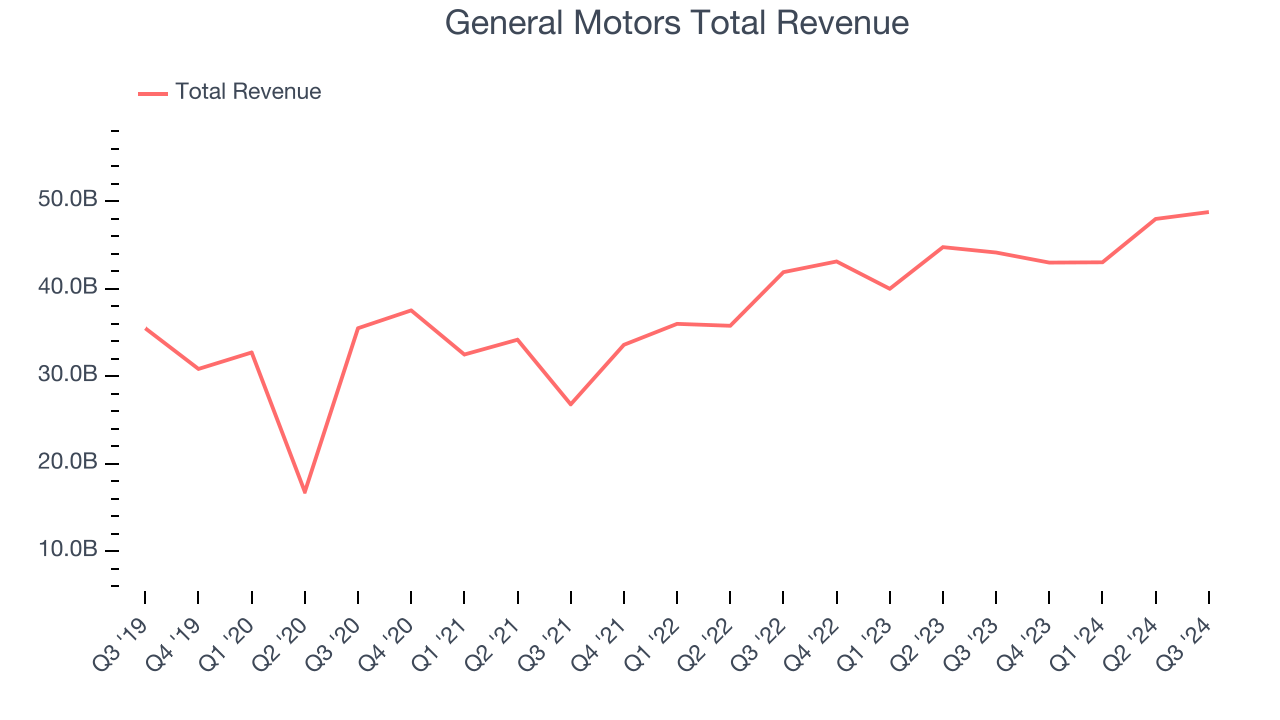

General Motors reported revenues of $48.76 billion, up 10.5% year on year. This print exceeded analysts’ expectations by 9.9%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ Wholesale revenue estimates.

General Motors achieved the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 13% since reporting and currently trades at $55.29.

Is now the time to buy General Motors? Access our full analysis of the earnings results here, it’s free.

Tesla (NASDAQ:TSLA)

Originally founded by Martin Eberhard and Marc Tarpenning in 2003, Tesla (NASDAQ:TSLA) is an electric vehicle company accelerating the world’s transition to sustainable energy.

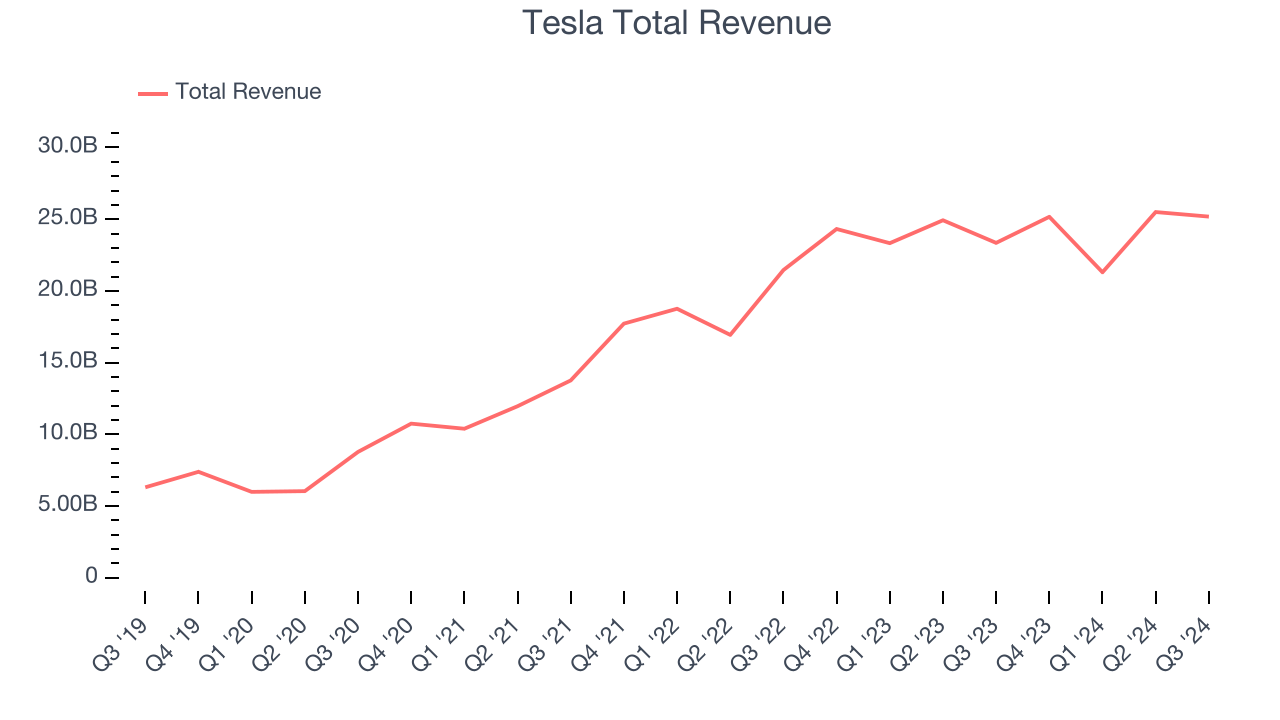

Tesla reported revenues of $25.18 billion, up 7.8% year on year, falling short of analysts’ expectations by 1%. Overall, it was an impressive quarter. Tesla beat analysts’ gross margin expectations (19.8% vs 16.9%). That helped it beat on adjusted earnings per share, Adjusted EBITDA, and Free Cash Flow. Additionally, Tesla saw vehicle delivery growth of 6.4% quarter on quarter, the first time this year the company has seen quarter on quarter delivery growth.

The market seems happy with the results as the stock is up 60.9% since reporting. It currently trades at $343.60.

Is now the time to buy Tesla? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Winnebago (NYSE:WGO)

Created to provide high-quality, affordable RVs to the post-war American family, Winnebago (NYSE:WGO) is a manufacturer of recreational vehicles, providing a range of motorhomes, travel trailers, and fifth-wheel products for outdoor and adventure lifestyles.

Winnebago reported revenues of $720.9 million, down 6.5% year on year, falling short of analysts’ expectations by 1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

As expected, the stock is down 1.7% since the results and currently trades at $57.11.

Read our full analysis of Winnebago’s results here.

Nikola (NASDAQ:NKLA)

Named after Nikola Tesla, Nikola (NASDAQ:NKLA) manufactures zero-emission vehicles, focusing on battery-electric and hydrogen fuel cell electric trucks.

Nikola reported revenues of $25.18 million, up 1,554% year on year. This print came in 31.3% below analysts' expectations. It was a softer quarter as it also logged a significant miss of analysts’ adjusted operating income estimates.

Nikola pulled off the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is down 55% since reporting and currently trades at $1.90.

Read our full, actionable report on Nikola here, it’s free.

Lucid (NASDAQ:LCID)

Lucid (NASDAQ:LCID) produces luxury electric vehicles that combine high-end design with electric technology.

Lucid reported revenues of $200 million, up 45.2% year on year. This print surpassed analysts’ expectations by 1%. Taking a step back, it was a mixed quarter as it also logged an impressive beat of analysts’ sales volume estimates.

The stock is down 5% since reporting and currently trades at $2.11.

Read our full, actionable report on Lucid here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.