Custom Truck One Source trades at $5.18 per share and has stayed right on track with the overall market, gaining 11.4% over the last six months while the S&P 500 has returned 10.9%.

Is now the time to buy Custom Truck One Source, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We don't have much confidence in Custom Truck One Source. Here are three reasons why you should be careful with CTOS and one stock we like more.

Why Is Custom Truck One Source Not Exciting?

Inspired by a family gas station, Custom Truck One Source (NYSE:CTOS) is a distributor of trucks and heavy equipment.

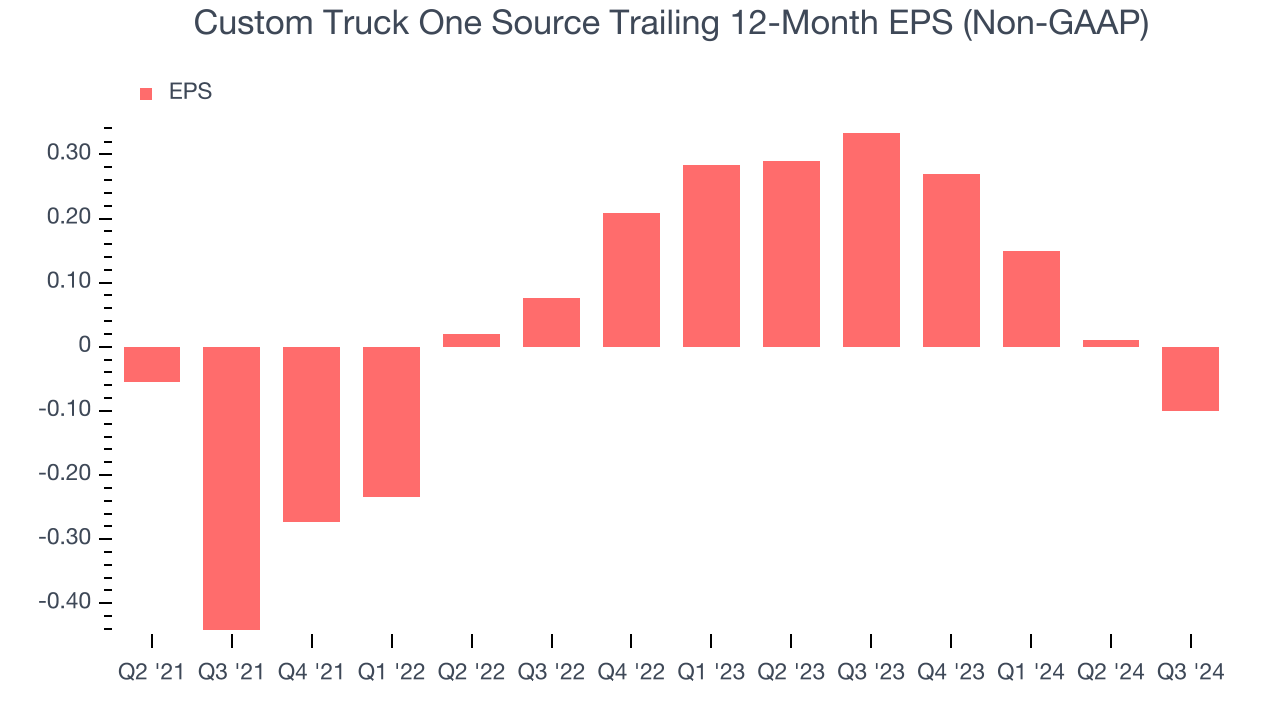

1. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Custom Truck One Source, its EPS declined by 82.4% annually over the last two years while its revenue grew by 11.8%. This tells us the company became less profitable on a per-share basis as it expanded.

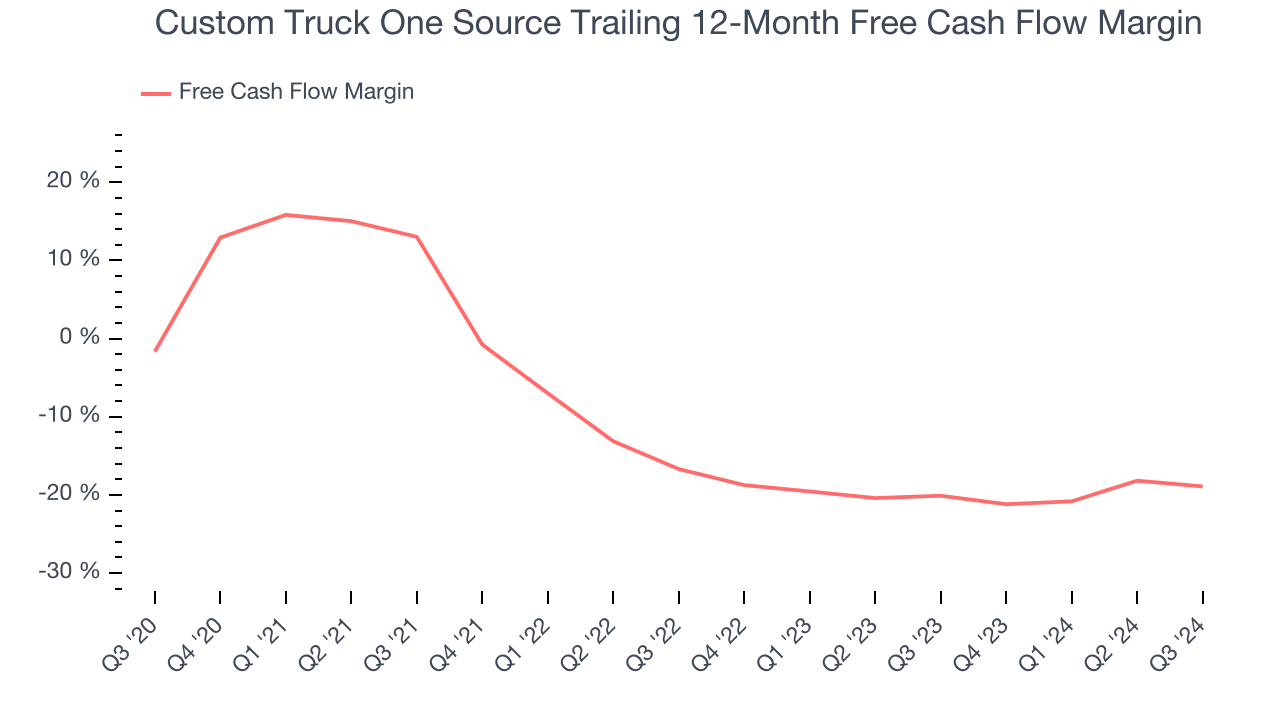

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Custom Truck One Source’s margin dropped by 17.3 percentage points over the last five years. If this trend continues, it could signal it’s becoming a more capital-intensive business. Custom Truck One Source’s free cash flow margin for the trailing 12 months was negative 18.9%.

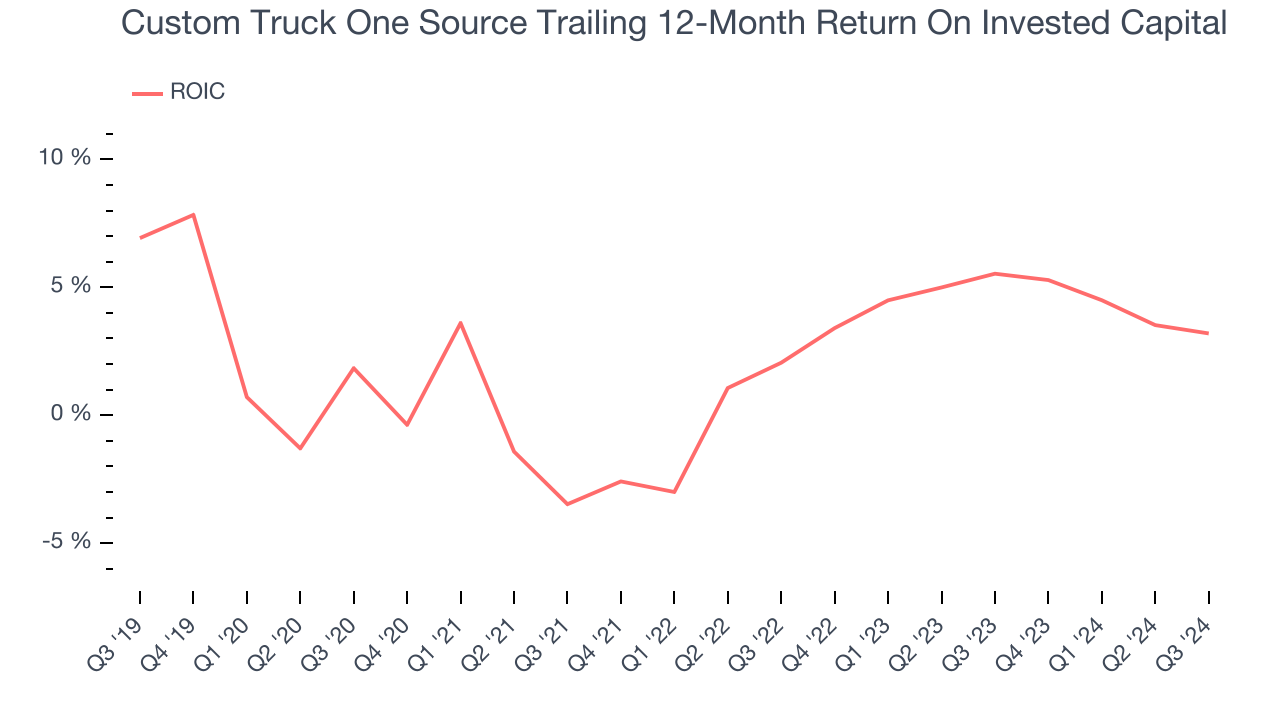

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Custom Truck One Source’s five-year average ROIC was 1.8%, somewhat low compared to the best industrials companies that consistently pump out 20%+. Its returns suggest it historically did a mediocre job investing in profitable growth initiatives.

Final Judgment

Custom Truck One Source isn’t a terrible business, but it isn’t one of our top picks. That said, the stock currently trades at 74x forward price-to-earnings (or $5.18 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere in the market. We’d recommend taking a look at Uber, whose profitability just reached an inflection point.

Stocks We Like More Than Custom Truck One Source

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.