Over the last six months, Keurig Dr Pepper’s shares have sunk to $32.08, producing a disappointing 5.5% loss - a stark contrast to the S&P 500’s 11.1% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Keurig Dr Pepper, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Even though the stock has become cheaper, we don't have much confidence in Keurig Dr Pepper. Here are three reasons why KDP doesn't excite us and one stock we'd rather own today.

Why Is Keurig Dr Pepper Not Exciting?

Born out of a 2018 merger between Keurig Green Mountain and Dr Pepper Snapple, Keurig Dr Pepper (NASDAQ:KDP) is a consumer staples powerhouse boasting a portfolio of beverages including sodas, coffees, and juices.

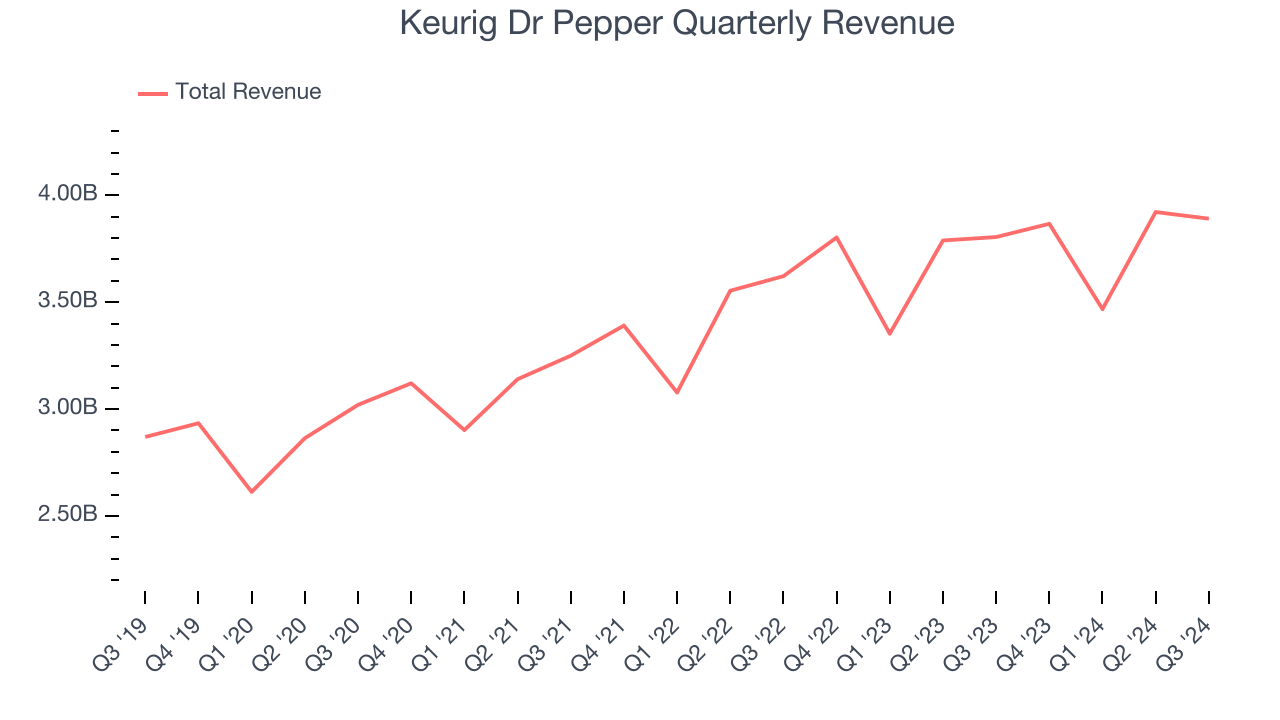

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one sustains growth for years. Unfortunately, Keurig Dr Pepper’s 6.9% annualized revenue growth over the last three years was mediocre. This was below our standard for the consumer staples sector.

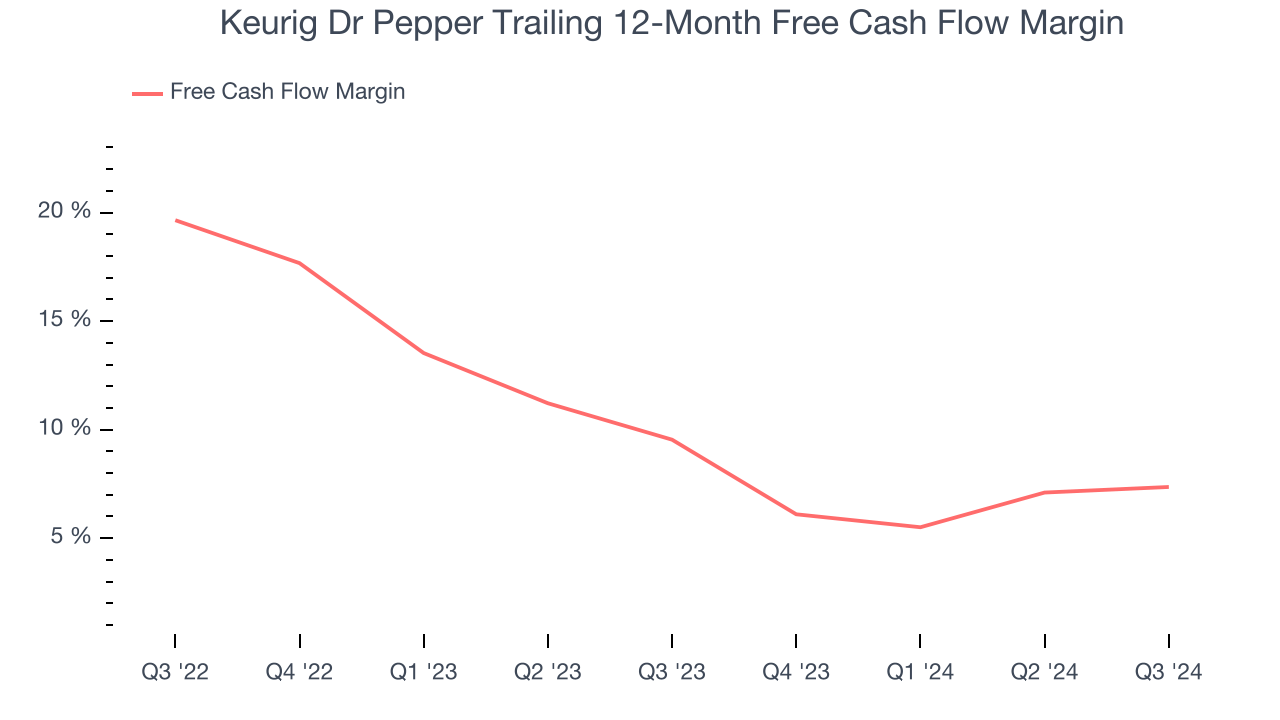

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Keurig Dr Pepper’s margin dropped by 2.2 percentage points over the last year. Keurig Dr Pepper’s two-year free cash flow profile was compelling, but shareholders are surely hoping for its trend to reverse. Continued declines could signal that the business is becoming more capital-intensive. Its free cash flow margin for the trailing 12 months was 7.4%.

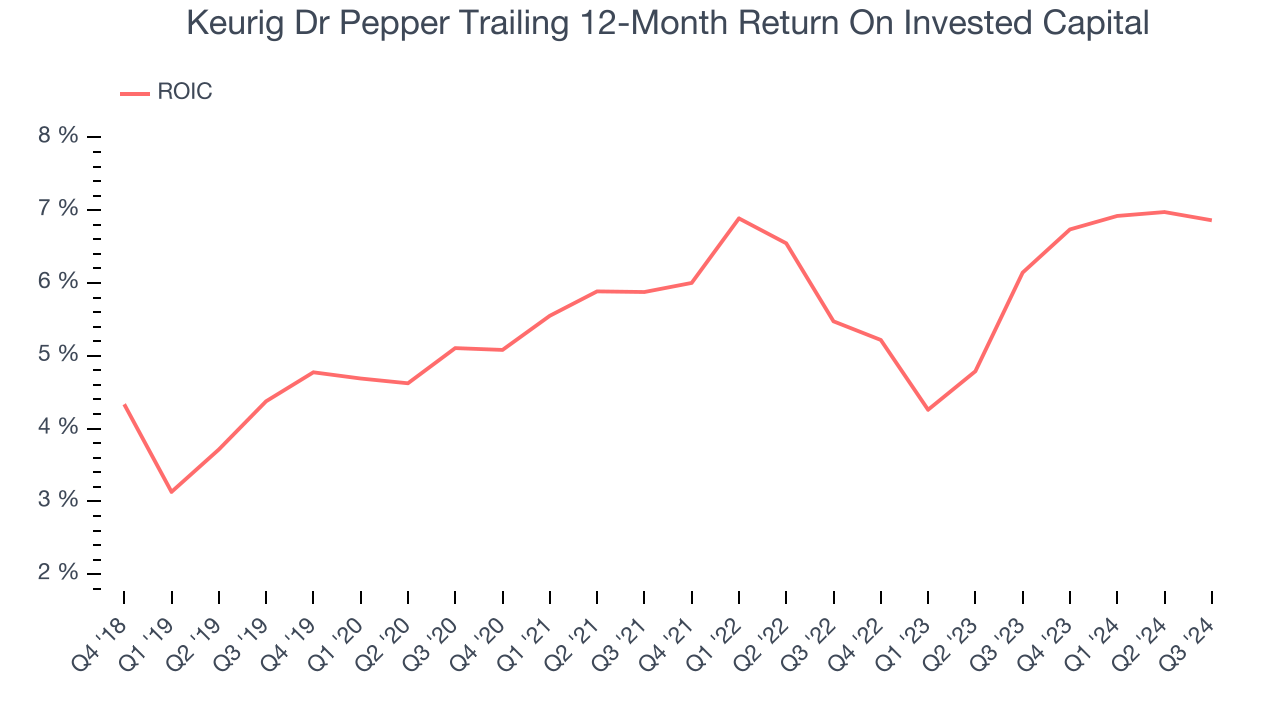

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Keurig Dr Pepper’s five-year average ROIC was 5.9%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a mediocre job investing in profitable growth initiatives.

Final Judgment

Keurig Dr Pepper isn’t a terrible business, but it isn’t one of our top picks. After the recent drawdown, the stock trades at 15.8x forward price-to-earnings (or $32.08 per share). While this valuation could be reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend taking a look at ServiceNow, one of our all-time favorite software stocks with a durable competitive moat.

Stocks We Like More Than Keurig Dr Pepper

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.