U-Haul currently trades at $67.07 per share and has shown little upside over the past six months, posting a small loss of 0.7%. The stock also fell short of the S&P 500’s 11.6% gain during that period.

Is there a buying opportunity in U-Haul, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We're sitting this one out for now. Here are three reasons why UHAL doesn't excite us and a stock we'd rather own.

Why Do We Think U-Haul Will Underperform?

Founded by a husband and wife duo, U-Haul (NYSE:UHAL) is a provider of rental trucks and storage facilities.

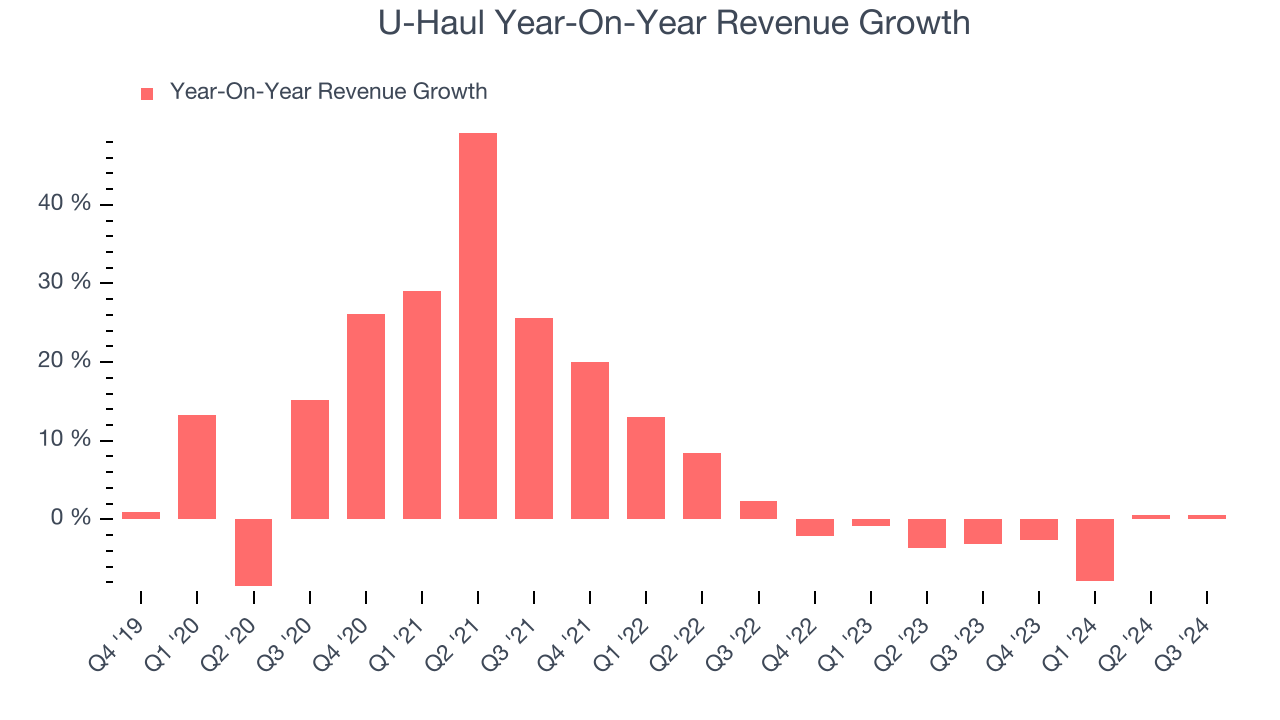

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or product line. U-Haul’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.2% over the last two years. U-Haul isn’t alone in its struggles as the Ground Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

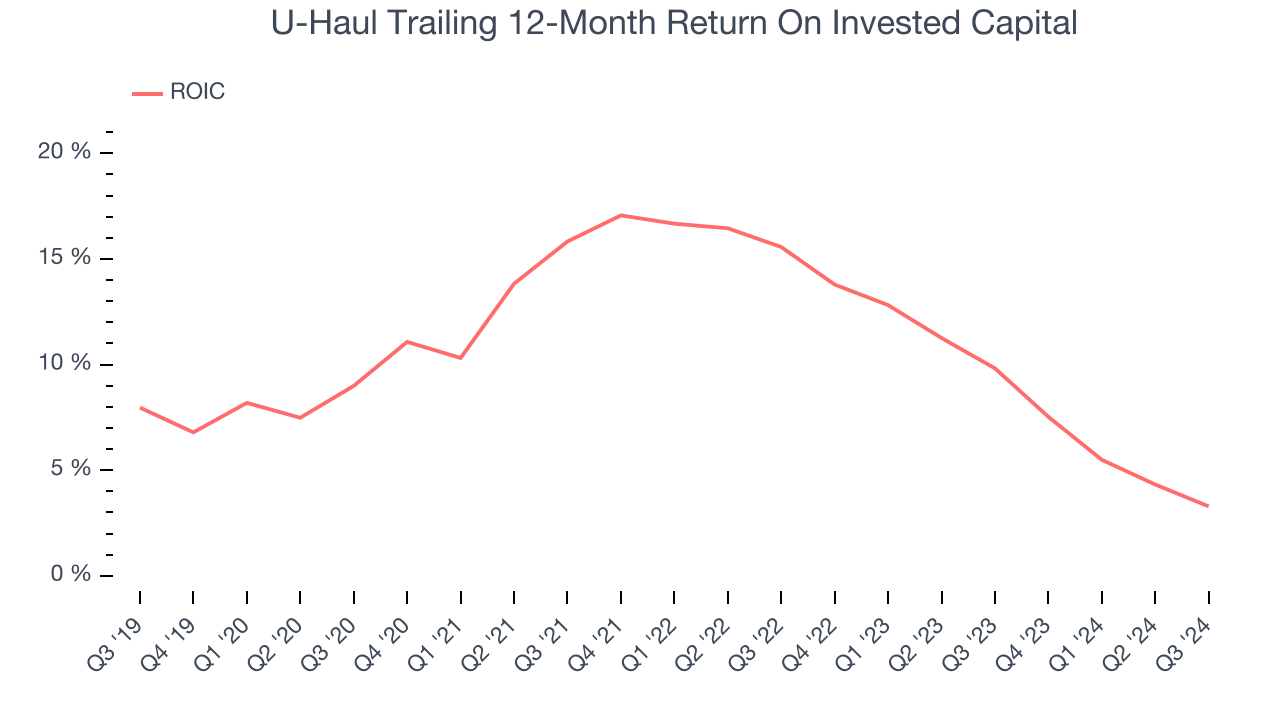

2. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, U-Haul’s ROIC has decreased over the last few years. We like what management has done in the past but are concerned its ROIC is declining, perhaps a symptom of fewer profitable growth opportunities.

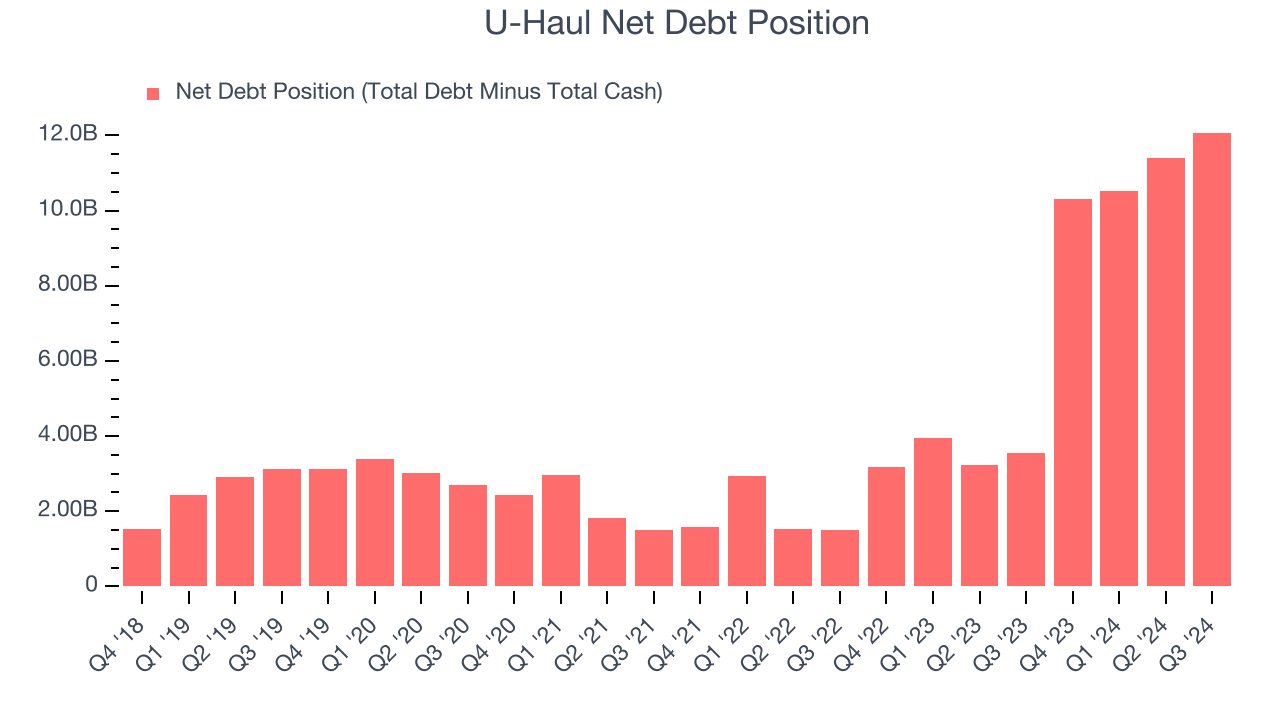

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

U-Haul’s $13.51 billion of debt exceeds the $1.44 billion of cash on its balance sheet. Furthermore, its 7x net-debt-to-EBITDA ratio (based on its EBITDA of $1.69 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. U-Haul could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope U-Haul can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

U-Haul doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at $67.07 per share. At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. We’d suggest taking a look at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of U-Haul

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.