The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how beverages, alcohol and tobacco stocks fared in Q3, starting with Monster (NASDAQ:MNST).

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 14 beverages, alcohol and tobacco stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was 2.7% below.

In light of this news, share prices of the companies have held steady as they are up 4.2% on average since the latest earnings results.

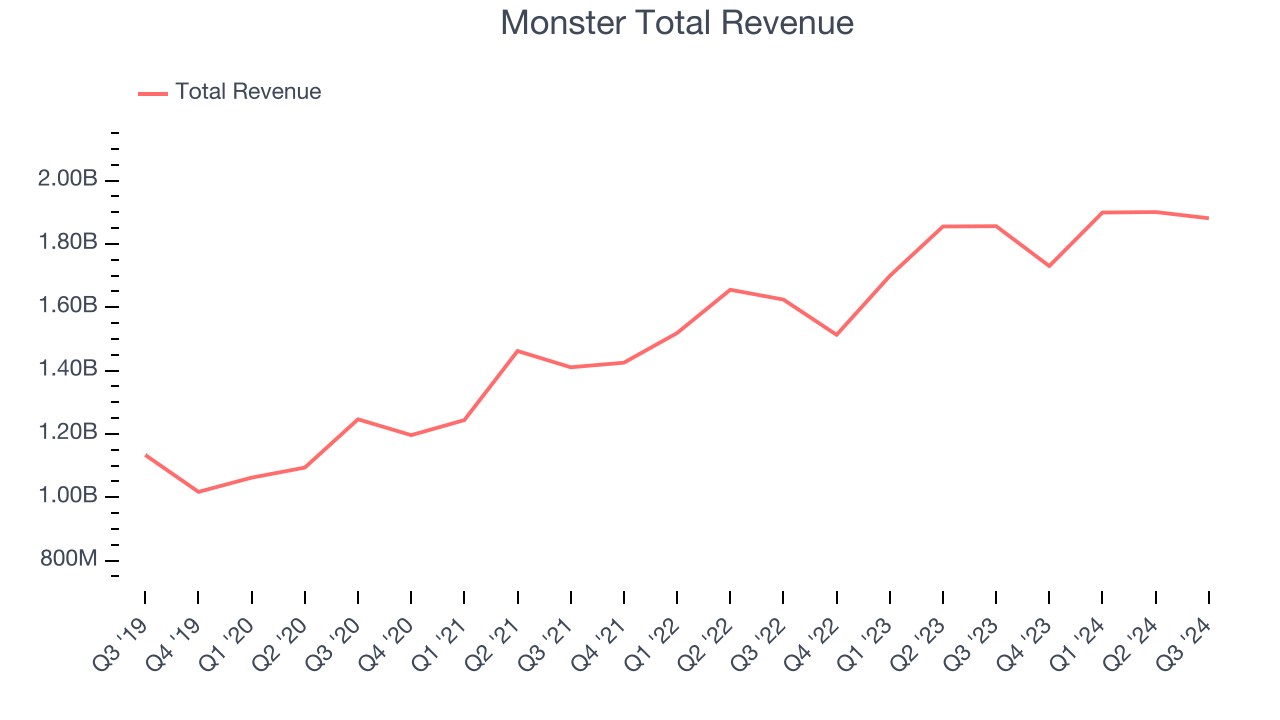

Monster (NASDAQ:MNST)

Founded in 2002 as a natural soda and juice company, Monster Beverage (NASDAQ:MNST) is a pioneer of the energy drink category, and its Monster Energy brand targets a young, active demographic.

Monster reported revenues of $1.88 billion, up 1.3% year on year. This print fell short of analysts’ expectations by 1.6%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

Hilton H. Schlosberg, Vice Chairman and Co-Chief Executive Officer, said, "The energy drink category continues to grow globally and has demonstrated resilience. In the United States, the energy drink category continued to experience slower growth rates. However, in all measured channels excluding convenience, the energy drink category is growing at a faster rate. In the United States, the energy drink category in the convenience channel is beginning to show some improvement in October. A number of other consumer packaged goods companies have also seen a tighter consumer spending environment for certain income groups and weaker demand in the quarter."

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $54.43.

Is now the time to buy Monster? Access our full analysis of the earnings results here, it’s free.

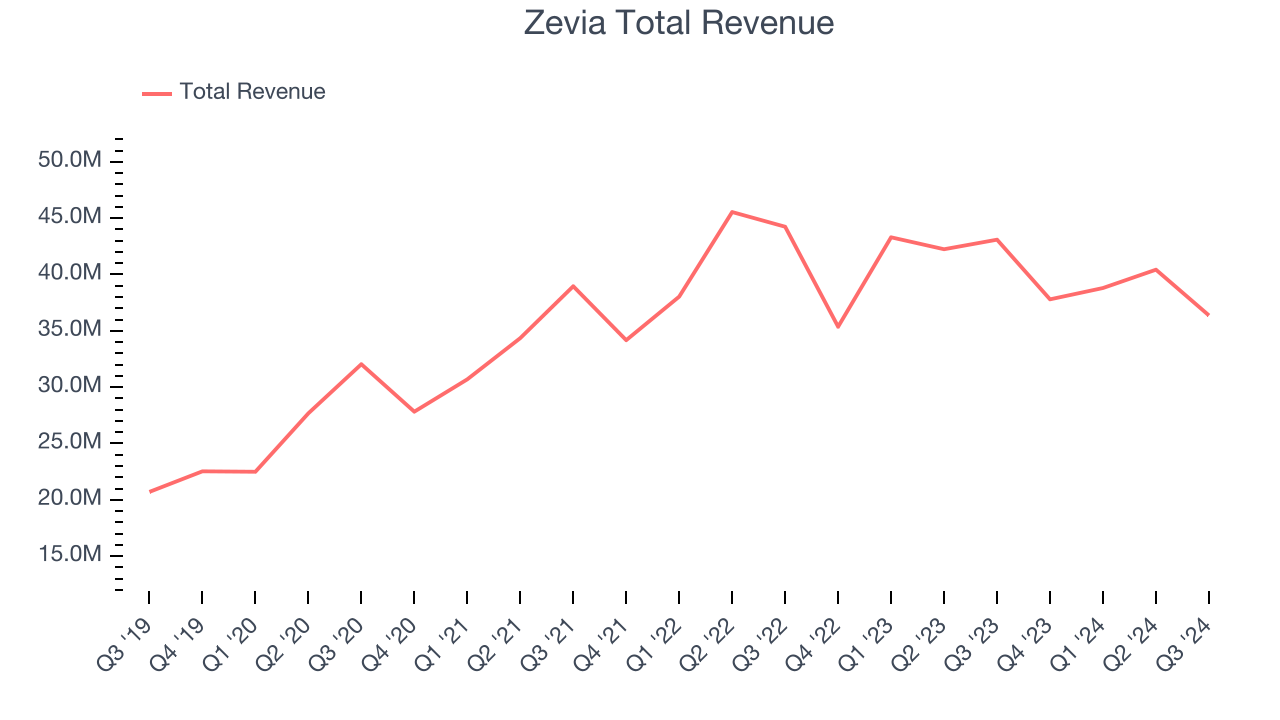

Best Q3: Zevia (NYSE:ZVIA)

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE:ZVIA) is a better-for-you beverage company.

Zevia reported revenues of $36.37 million, down 15.6% year on year, falling short of analysts’ expectations by 6.8%. Overall, it was a mixed quarter with EBITDA guidance for the next quarter exceeding analysts’ expectations and a solid beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 106% since reporting. It currently trades at $2.23.

Is now the time to buy Zevia? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Celsius (NASDAQ:CELH)

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ:CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Celsius reported revenues of $265.7 million, down 30.9% year on year, falling short of analysts’ expectations by 0.7%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Celsius delivered the slowest revenue growth in the group. As expected, the stock is down 5.8% since the results and currently trades at $29.91.

Read our full analysis of Celsius’s results here.

Coca-Cola (NYSE:KO)

A pioneer and behemoth in carbonated soft drinks, The Coca-Cola Company (NYSE:KO) is a storied beverage company best known for its flagship soda of the same name.

Coca-Cola reported revenues of $11.95 billion, flat year on year. This print surpassed analysts’ expectations by 2.9%. More broadly, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ organic revenue estimates but a slight miss of analysts’ gross margin estimates.

Coca-Cola scored the biggest analyst estimates beat among its peers. The stock is down 7.6% since reporting and currently trades at $64.15.

Read our full, actionable report on Coca-Cola here, it’s free.

Boston Beer (NYSE:SAM)

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

Boston Beer reported revenues of $605.5 million, flat year on year. This print beat analysts’ expectations by 0.7%. Zooming out, it was a mixed quarter as it also logged a solid beat of analysts’ EBITDA estimates but full-year EPS guidance missing analysts’ expectations.

The stock is up 1.2% since reporting and currently trades at $305.52.

Read our full, actionable report on Boston Beer here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.