Sporting goods retailer Dick’s Sporting Goods (NYSE:DKS) announced better-than-expected revenue in Q3 CY2024, but sales were flat year on year at $3.06 billion. The company expects the full year’s revenue to be around $13.25 billion, close to analysts’ estimates. Its GAAP profit of $2.75 per share was 2.2% above analysts’ consensus estimates.

Is now the time to buy Dick's? Find out by accessing our full research report, it’s free.

Dick's (DKS) Q3 CY2024 Highlights:

- Revenue: $3.06 billion vs analyst estimates of $3.03 billion (flat year on year, 0.9% beat)

- Adjusted EPS: $2.75 vs analyst estimates of $2.69 (2.2% beat)

- Adjusted EBITDA: $387.2 million vs analyst estimates of $394.1 million (12.7% margin, 1.8% miss)

- The company slightly lifted its revenue guidance for the full year to $13.25 billion at the midpoint from $13.15 billion

- EPS (GAAP) guidance for the full year is $13.80 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 9.4%, down from 10.7% in the same quarter last year

- Free Cash Flow was -$139.3 million compared to -$89.75 million in the same quarter last year

- Locations: 864 at quarter end, down from 869 in the same quarter last year

- Same-Store Sales rose 4.2% year on year (1.9% in the same quarter last year)

- Market Capitalization: $17.52 billion

Company Overview

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

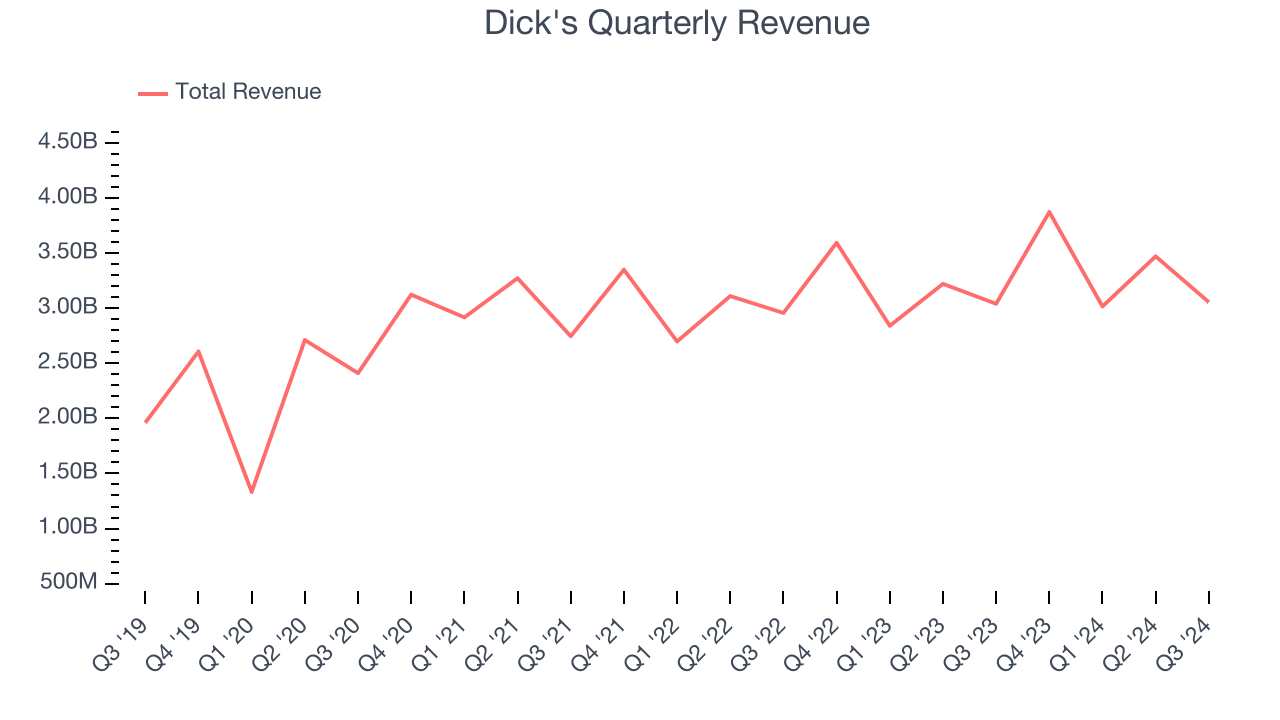

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Dick's is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Dick’s 9.2% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre as its store footprint remained unchanged.

This quarter, Dick’s $3.06 billion of revenue was flat year on year but beat Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months, a deceleration versus the last five years. This projection is underwhelming and indicates its products will see some demand headwinds. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Store Performance

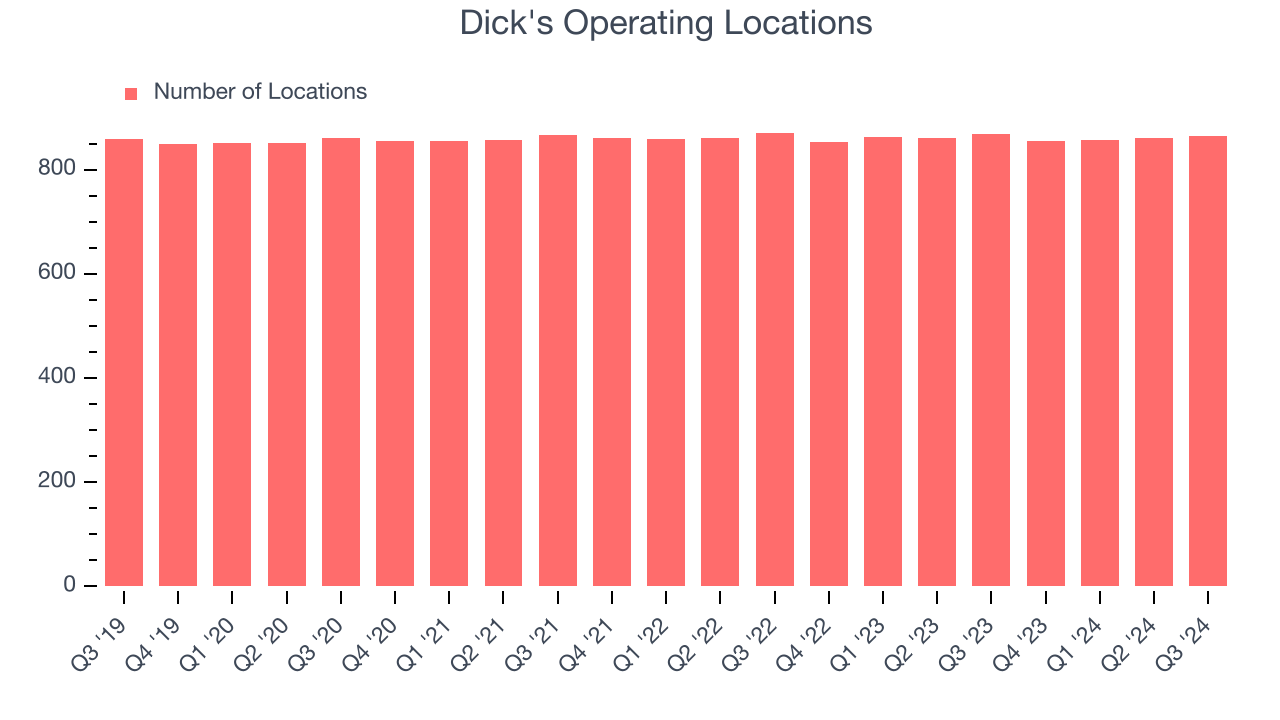

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Dick's listed 864 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

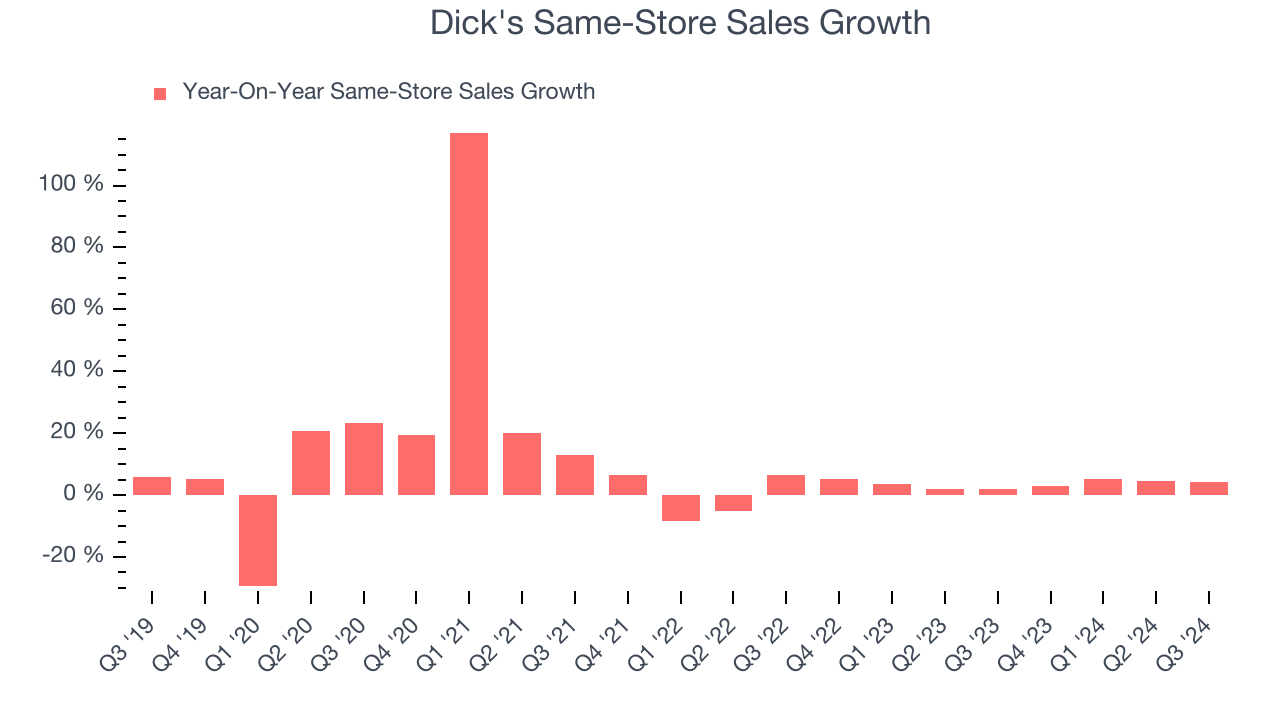

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Dick’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.7% per year. Given its flat store base over the same period, this performance stems from not only increased foot traffic at existing locations but also higher e-commerce sales as demand shifts from in-store to online.

In the latest quarter, Dick’s same-store sales rose 4.2% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Dick’s Q3 Results

It was encouraging to see Dick's beat analysts’ gross margin expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. That the company lifted full year revenue guidance was a positive. Zooming out, we think this was a decent quarter featuring some areas of strength. The stock traded up 4.6% to $225.22 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.